The rating of mutual funds

The main rating agencies of mutual funds

Benchmarks and rating criteria for funds, by category

Morningstar’s fund ratings

Lipper’s fund rating

Warnings about the limitations of the value of the rating and the past returns of the funds

Illustration of the use of the rating of fund agencies: the rating of US Large Blend funds by Morningstar

In the first article of this series we saw the main characteristics and advantages of mutual funds.

We conclude that these funds are the investment vehicle in the financial markets par excellence for the individual investor.

This makes the selection of funds have a huge importance in the investment decision.

Therefore, in subsequent articles we have been analyzing the various factors that determine this decision to choose funds.

There are tens of thousands of funds, so it is important to have criteria to select those in which we invest.

We started by developing the various types or categories of funds, as the investor’s asset allocation determines the category in which to invest.

Next, we presented the aspects of the returns of the funds, bearing in mind their relevance in the choice by investors.

We then looked at the costs of the funds and their relationship to profitability, realising that, in general, the highest cost funds are those with the lowest net return.

More recently we have addressed the issue of the availability of funds and the choice of investment currency.

In this article we will address another very useful question in deciding the selection of funds, that of the rating agencies or rating of the funds.

So far we have seen a combination of factors that are important for the choice of funds.

Now, the rating of the funds can be seen as a shortcut, a substitute, a reinforcement or a complement to this process.

The rating of mutual funds

There are specialized rating agencies that classify, analyze and evaluate investment funds, according to criteria that we will see later.

This situation greatly facilitates and simplifies our work of selecting investment funds.

As we have seen so far, the selection begins by choosing the fund category, analyzing the profitability, considering the costs and deepening the policy and management of investments when deciding between indexed funds and active funds.

The consideration of the rating of the funds by the specialized agencies is a good complement to this selection work, when they proceed to the grouping and evaluation of the funds, using qualitative and quantitative criteria.

The main rating agencies of mutual funds

The rating agencies of investment funds are several, comprising CRISIL, ICRA, Morningstar, ValueResearch, Lipper and Standard & Poor’s, among others.

These companies cover the world’s largest mutual funds, paying particular attention to those made available in the US.

However, most of these funds are also marketed in other countries, namely in Europe, Asia and America ex-US.

Benchmarks and rating criteria for funds, by categories

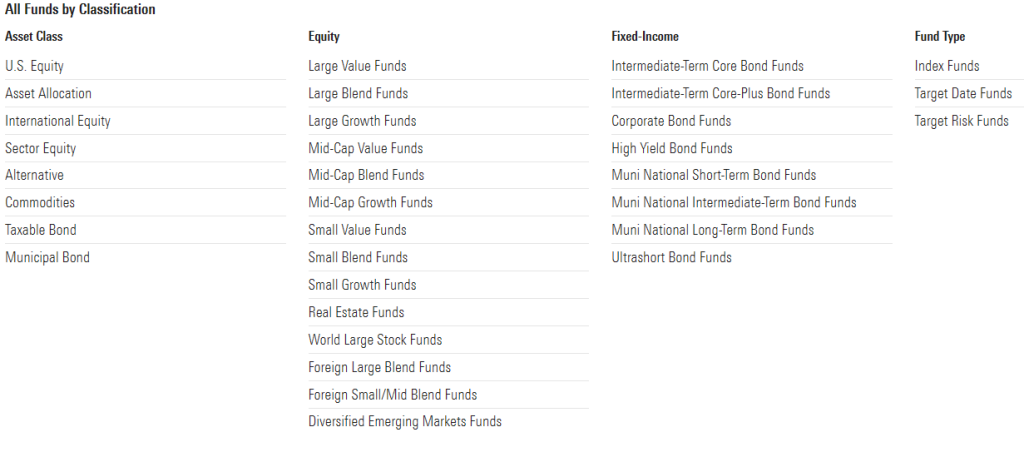

Rating agencies start by grouping funds by categories:

The grouping is done by asset class – stocks, bonds, mixed, etc. -, geography of investment – world, USA, Europe, etc. -, management style -asset or passive, small or large capitalization, value or growth -, type of issuer – government, companies, etc. -, rating – quality or speculative.

This grouping allows us to have coherent sets and to be able to compare what is comparable at the level of the broad lines of investment policy.

Then, agencies typically use two criteria for evaluating and rating the funds within each category, the quantitative and the quality.

The quantitative criterion seeks to assess risk-adjusted profitability.

It uses metrics such as the Sharpe ratio (which we have already seen in a previous article), the Treynor ratio (which also measures the excess return on the risk-free interest rate such as the Sharpe ratio, but dividing by market or beta risk rather than total risk), or the alpha (remuneration of non-systematic risk) of the fund.

The profitability is assessed against the benchmark of the category benchmark defined for each fund.

The main benchmarks used are the main indexes, which we have seen in other articles.

Thus, the main stock benchmarks are the main American indices, the S&P 500, the Nasdaq, and the Dow, the world MSCI ACWI and World, the indices of each region or country, the indices of the main factors, the styles of value and growth, and the capitalization of companies, small, medium and large.

The main bond indices are Barclays Capital or IBoxx, including those by issuer type, “Treasuries”, “Corporate” or “Aggregate”, or rating, “investment grade” and “high yield”.

Each of these indices has a different spectrum of returns and risk.

The following link contains the historical returns of some of the major indices used by Vanguard:

https://personal.vanguard.com/us/funds/tools/benchmarkreturns

Still within the quantitative criterion, it also seeks to measure the liquidity of the fund – the ease or cost of exit or divestment -, the quality of credit in the case of bond funds, and the degree of concentration of the fund’s portfolio.

The qualitative criterion tries to judge the reputation or credibility of the management company, the historical performance (“track record”) of the manager and the robustness of the investment process.

Morningstar’s fund ratings

The methodology is developed in this link:

On the other hand, it prepares the rating of grading funds by medals, which focuses on the analysis of companies, managers, teams and management processes.

In fact, this work is done in two forms or methodologies, one qualitative and the other quantitative (created more recently with the purpose of expanding the coverage universe).

This analysis has a prospective nature.

The two methodologies can be found in the following links:

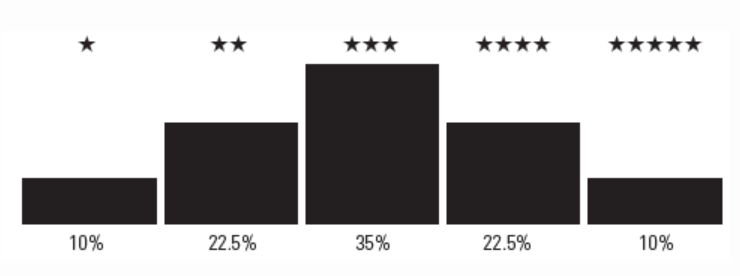

In the star rating, Morningstar rates funds in ascending order from worst to best between 1 to 5 stars.

It adopts a distribution in which the 1 and 5 stars represent the worst and best decil, and the 2 and 3 stars the next 22.5% percentile, so the 3 stars represent the central percentile of 35%.

Morningstar uses a risk-adjusted profitability assessment model, more elaborate than Sharpe’s or others’ ratios we saw earlier, and which is based on the economic theory of expected utility and the preferences of a risk-averse investor.

It makes an assessment of the performance of the funds in the last 3, 5 and 10 years, and an overall rating (in which the 10 years weigh 50%, the 5 years 30%, and the 3 years 20%), using monthly data.

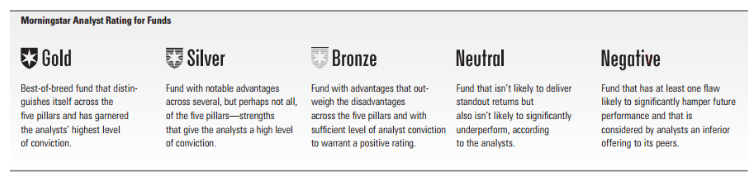

In the medal rating, Morningstar also scores the funds in 5 tiers, of which 3 are medals – gold, silver and bronze – followed by neutral and negative, according to the results obtained in relation to the median of the funds of each category.

The medaled funds are the ones that obtain positive results, being the gold ones corresponding to the 15% percentile, silver the subsequent 35% percentile and bronze to the following 50%.

The neutral rating is given to funds with a null or negative result of the 70% percentile, while the negative rating is given to the remaining 30% percentile.

In the qualitative model of medals, analysts expect medal funds to produce a net positive alpha of term commissions longer than 5 years, while the remaining two levels indicate a null or negative alpha.

Funds are penalized by the amount of commissions charged, incorporating the findings of various studies that prove that costs are predictors of future performance even when assessed on net terms.

Morningstar uses multiple regression statistical analyses of the gross and scoring returns of teams, processes and management companies, with weights of 45%, 45% and 10%, respectively, in active funds, and 10%, 80% and 10% in liabilities.

Lipper’s fund rating

Thomsom Reuters Group (Refinitiv) Lipper is another very influential fund rating agency, and covers a universe of more than 400 funds.

The methodology followed is described in this link:

http://www.lipperleaders.com/documents/LipperLeaders_Methodology_US.pdf

It also adopts grouping by main categories of funds.

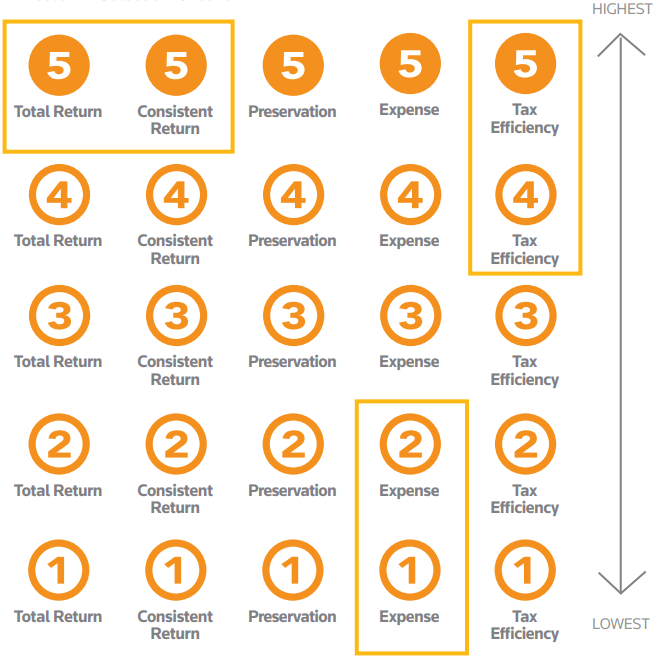

Lipper ranks funds in ascending order from 1 to 5 stars, according to a distribution in which each level comprises a 20% percentile.

The bottoms of the top 20% percentile are called the Lipper leaders.

In the evaluation, it scores separately and individually the factors of total profitability, consistency of profitability, preservation of capital, tax efficiency and the costs of funds, which allows investors to see which factors it considers most important.

For example, for a short-term mutual fund, capital preservation may be the most relevant factor.

Warnings about the limitations of the value of the rating and the past returns of the funds

The various studies on the predictive capacity of the rating of mutual funds, namely those whose methodology focuses on the analysis of the performance of past returns, indicate that it is moderate.

No wonder. In the previous article on profitability we showed that the consistency of fund returns over time is low.

Thus, it cannot be said that the top funds will continue to be top funds.

However, it can be said that the best funds in the past tend to be good in the future, and that the worst ones usually stay bad.

That is, the predictive capability is not excellent or very good, but it is reasonable.

To that extent, the rating is very useful for the investor, especially when it is accompanied by an analysis that goes beyond recent returns.

The conclusions of these studies are important because they indicate some of the limitations and also the best alternatives.

Most studies show that the best predictive factor of funds’ performance is their cost, that is, the lower the cost the better the net return.

The main limitations are the low consistency of fund returns over time.

A very simple study by the Wall Street Journal concluded that of the funds with 5 stars in 2004, 10 years later (in 2014), 37% of the funds had lost one star, 31% two, 14% one and 3% had fallen to only one star.

Only 14% of the funds had managed to keep the 5 stars, but 51% of the funds reached 4 or 5 stars.

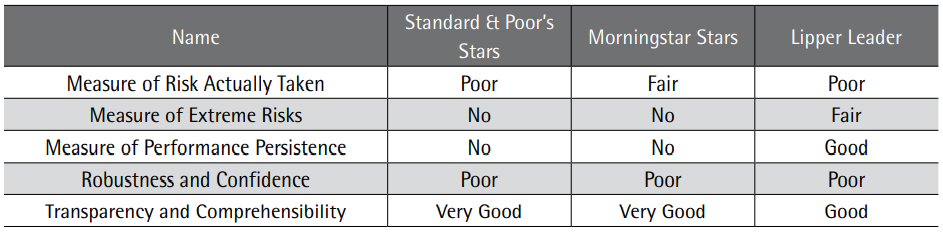

The EDHEC research center did a data analysis study of the 3 fund rating agencies, S&P, Morningstar and Lipper.

It concluded that in order for the rating to be more than an evaluation of past performance and can serve as a criterion for choosing investment for the future, more attention should be paid to risk assessment.

This study highlighted that more attention should be paid to the potential for extreme loss, the dependence on the prior definition of rating categories, and the persistence of performance.

Illustration of the use of the rating of fund agencies: the rating of US Large Blend funds by Morningstar

Let’s exemplify the use of the funds’ rating using Morningstar’s rating for one of the most important categories, American, mixed, large-cap stocks known as the US Large blend.

For this category, there is a rating for investment funds and exchange-traded funds or ETFs, which is organized alphabetically, in the following links: