Index

Executive sumary

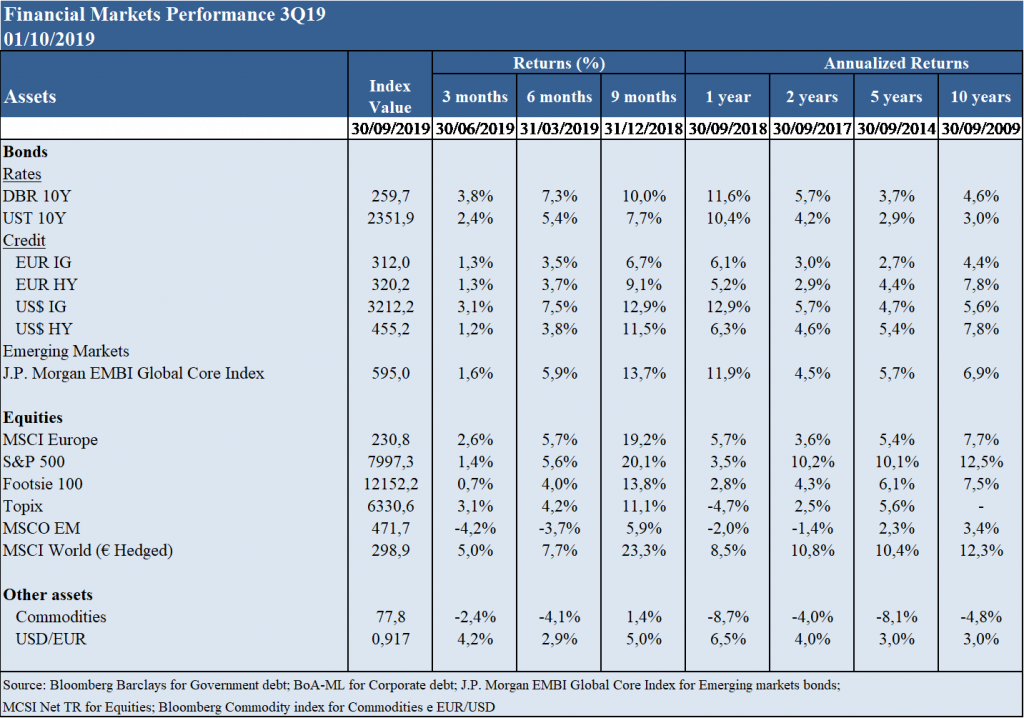

- The equities markets had a very positive performance in the developed world in the first three quarters of the year, mainly with the appreciation of 20% in the US and the Eurozone, and with very low volatility. The bonds markets also had a positive performance in this period, albeit with less expressive returns, between 7% and 13%. Raw materials had a slight appreciation and the dollar gained 5% against the euro.

- This financial markets positive developments, in general, throughout the year, was mainly due to the change in U.S. monetary policy, which not only interrupted the expected rising cycle in interest rates, but also reduced them, and some alleviating geopolitical risks (trade war, Italy, Spain, Brexit and Hong Kong).

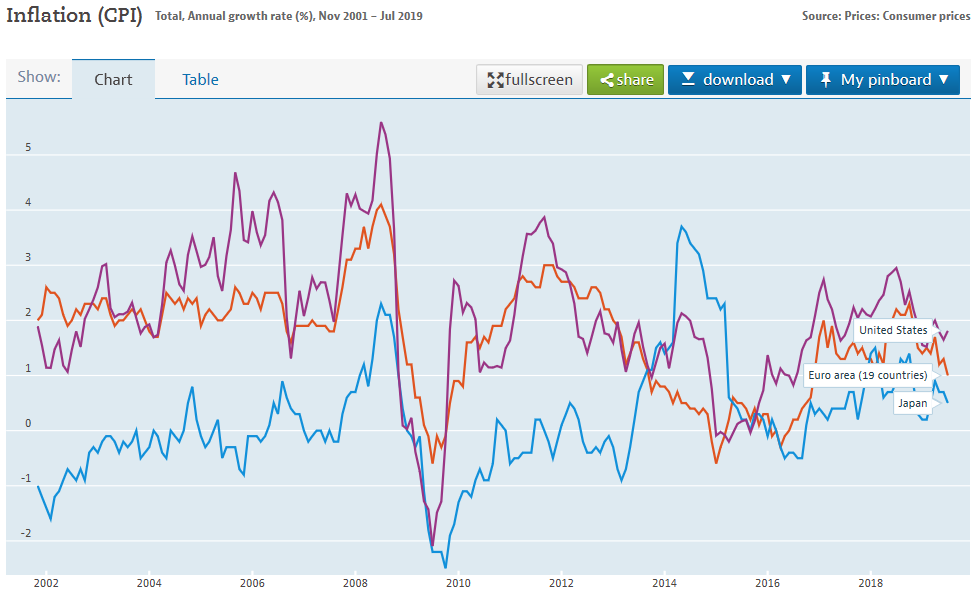

- Virtually all macro and micro data indicators worldwide have deteriorated in recent times with the escalation of protectionism accelerating the Japanisation threat: economic slowdown, low inflation, zero or negative interest rates are threatening stagflation, deflation or recession.

- Earnings per share remain high and growing, albeit at low pace and with downward revisions. Equities market valuations in terms of price earnings are in line with the historical average.

- Corporate margins and business and consumer confidence indicators are the exception, staying at a high level.

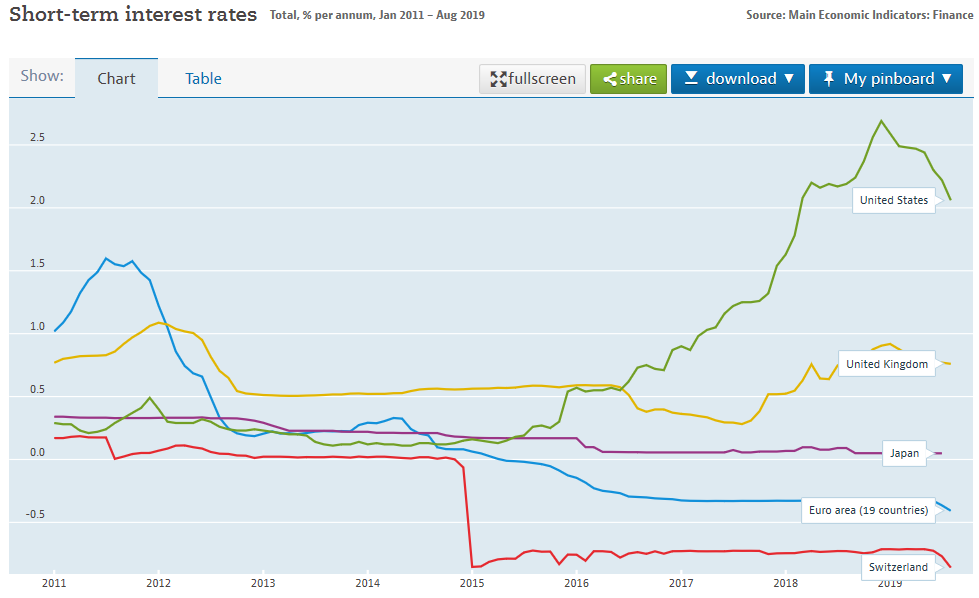

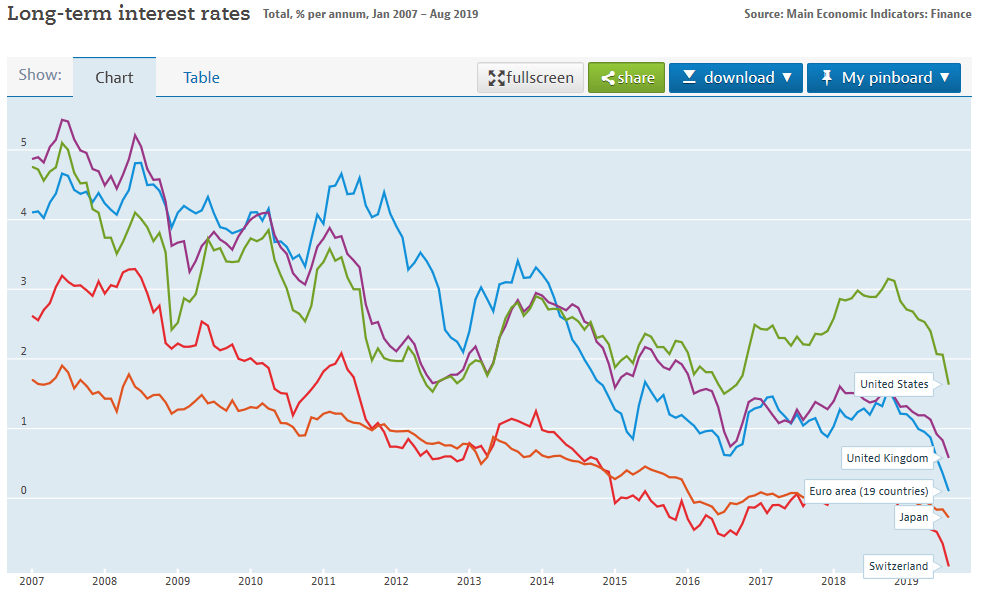

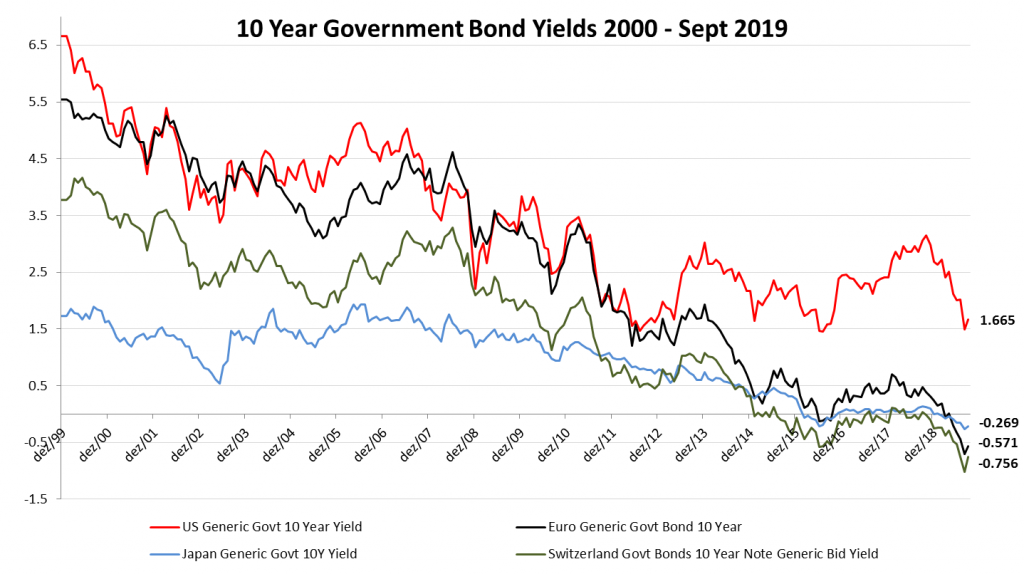

- Interest rates are at all times extremely low levels with more than $16 billion bonds at negative rates or about ¼ of the total market and ½ of the market excluding the US.

- Equities markets slightly overvalued in the US and undervalued in all other regions, especially in the Eurozone.

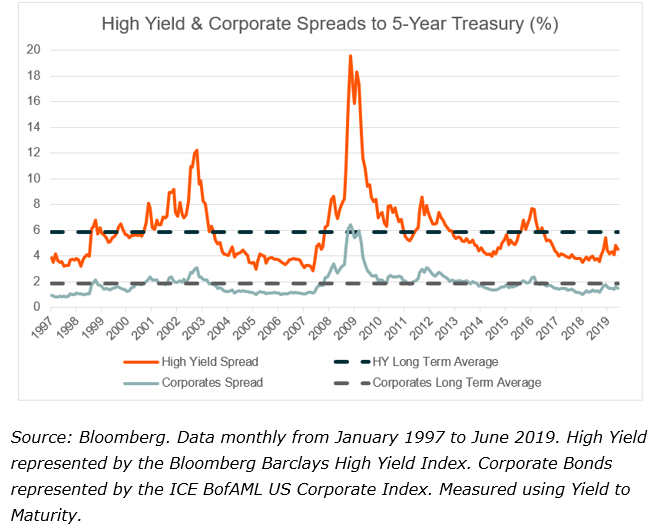

- Bond markets are generically expensive, with negative reference rates in most European developed countries and Japan, and credit spreads are close to historical minimums.

- Search for yield favours investment in equities versus bonds.

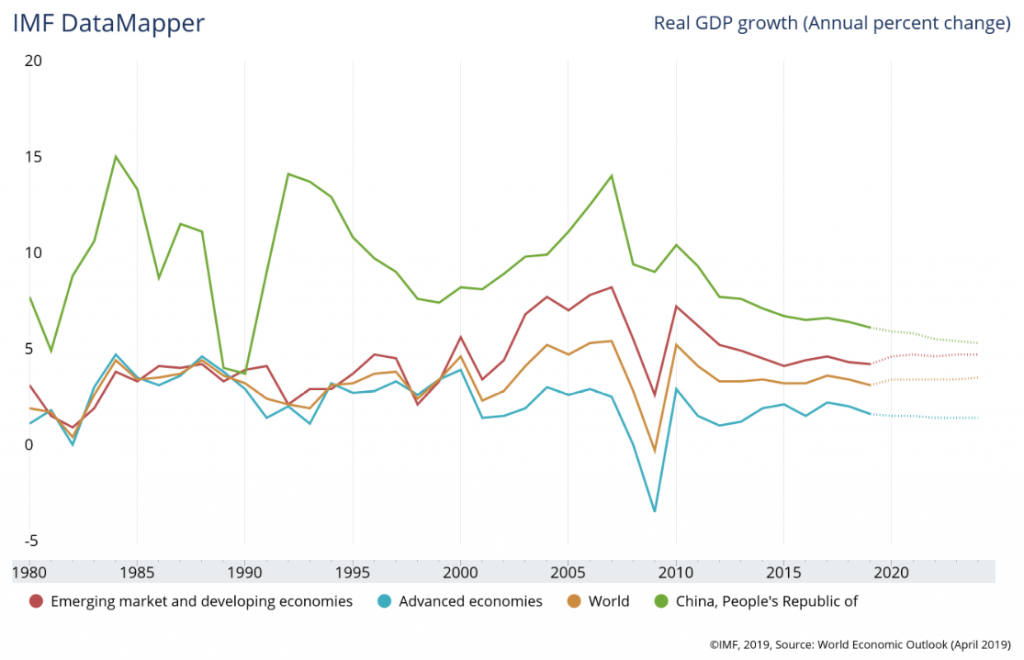

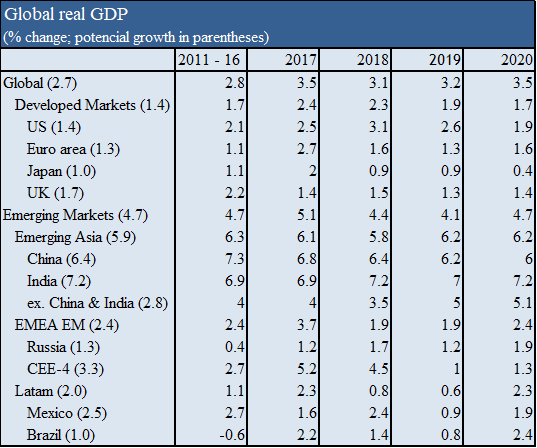

- Despite the growth slowdown and rising stagflation fears and even recession, global real GDP continues to grow at 4% over 3.5% of the long-term average and the potential level.

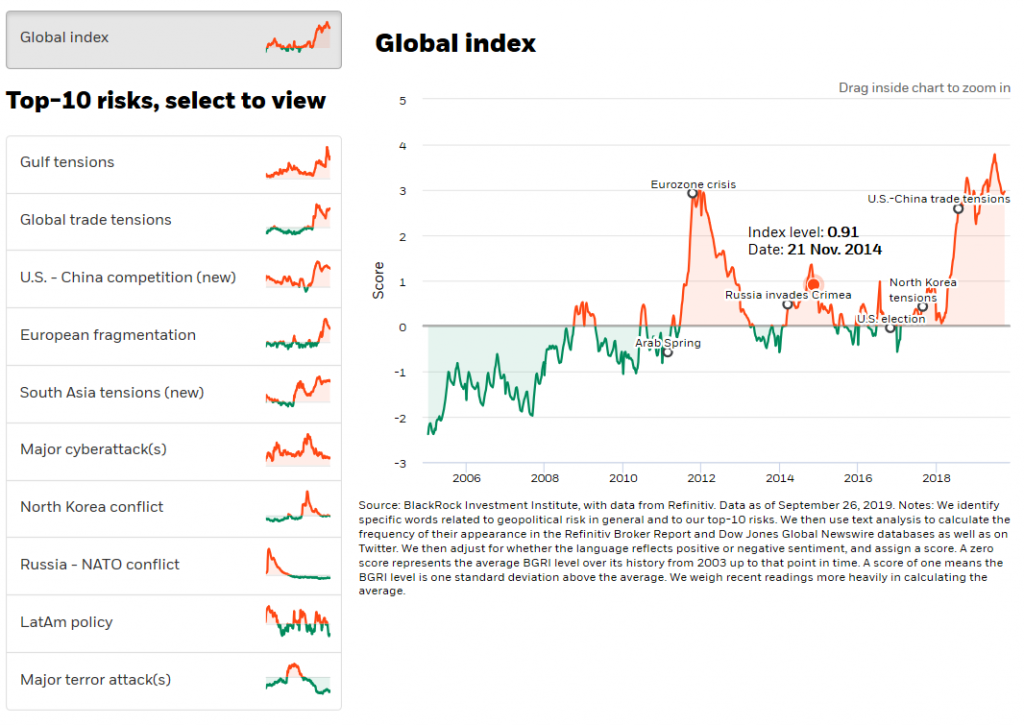

- Geopolitical risks, namely the trade war between China and the USA, Brexit, protests in Hong Kong and tensions in the Persian Gulf, are the major constraints of the performance of investments in the short term, albeit with signs of mitigation by the abandonment of the law of extradition to China by Hong Kong, and the possibility of resumption of trade talks between US and China in October.

- In this context, the central allocation must be maintained for the different subclasses of assets of the financial markets, with some overweighting of equities versus bonds, and of the Eurozone and Japan in relation to the US as regards the equities markets.

Financial markets performance

Macro context: Global economic slowdown but at an above the potential level, and decreasing inflation in developed economies

- Real GDP growth continues the downturn trend while remaining at a level of 4%, higher than the 3.5% long-term average.

- This slowdown is expected both in advanced economies and in emerging countries, mainly in China.

- Inflation rate has been stable in almost all major geographies, around 2% in the US, 1% in the Eurozone and 0.5% in Japan.

- The largest advanced economies are at historically low levels of unemployment.

- The U.S./China trade war intensified during the first half, with an increase in tariffs and na extension to a greater number of goods on both sides, deteriorating international trade levels.

Macro context: Expansionary monetary policies in the largest economies, with declining central banks interest rates

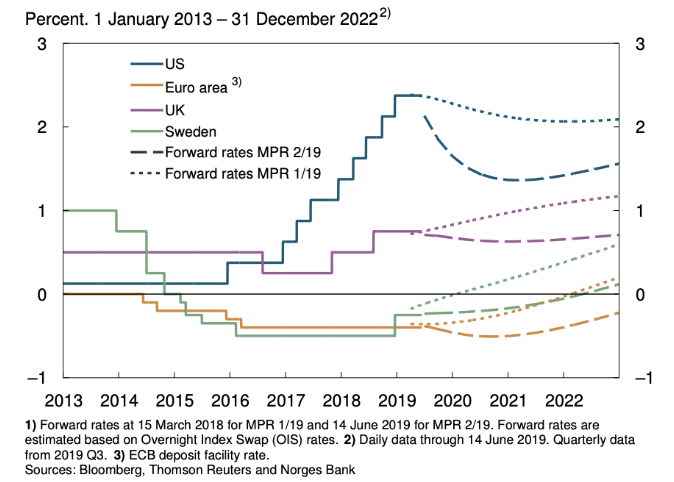

- The recent signs of economic cooling, the threat of recession and the containment of inflation have led the main central banks to develop expansionary monetary policies, including the Fed which reversed the cycle of increasing interest rates of the last 2 years and cut interest rates in June.

- The interest rates of treasury bonds have been sharply descending in all terms.

- The central banks interest rates are expected to remain negative in the Euro area for a prolonged period of up to 2024/2025, and the ones for U.S. will be around 2%.

Macro context: Neutral and limited fiscal policy in the largest economies, and aggravation of geopolitical risks in the US, China and Europe after some mitigation in the first four months of the year

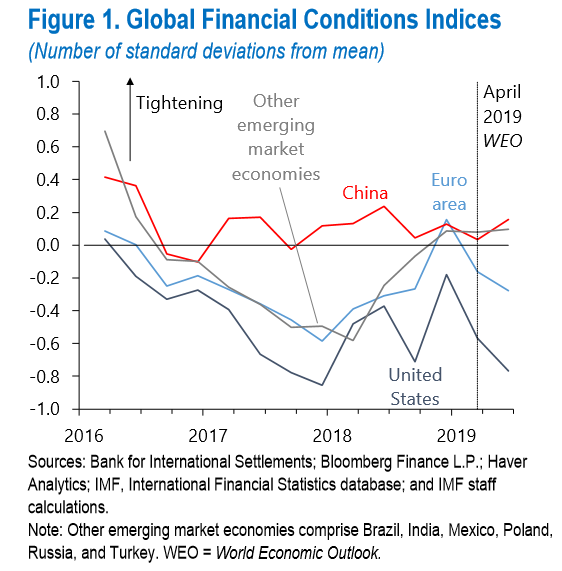

- Fiscal policy has been virtually neutral in recent years and countries have little leeway at the public deficit level (with the exception of Germany and the Netherlands).

- The impact of fiscal policy on stimulating economic growth has been limited.

- Global financial conditions have been more accommodating in the US and Eurozone and neutral in China and other emerging markets.

- After some relief in the first quarter, geopolitical risks subsequently re-emerged with the worsening of the trade war, the spread of protest movements (not only in Europe but also in Hong Kong) and instability in the United Kingdom ( Brexit and government), Italy and Spain; more recently there has been some positive signs on these various fronts but new risks arose, the tension in the Middle East.

Micro context: Deterioration of leading indicators, but maintaining operational margins and confidence levels at high levels

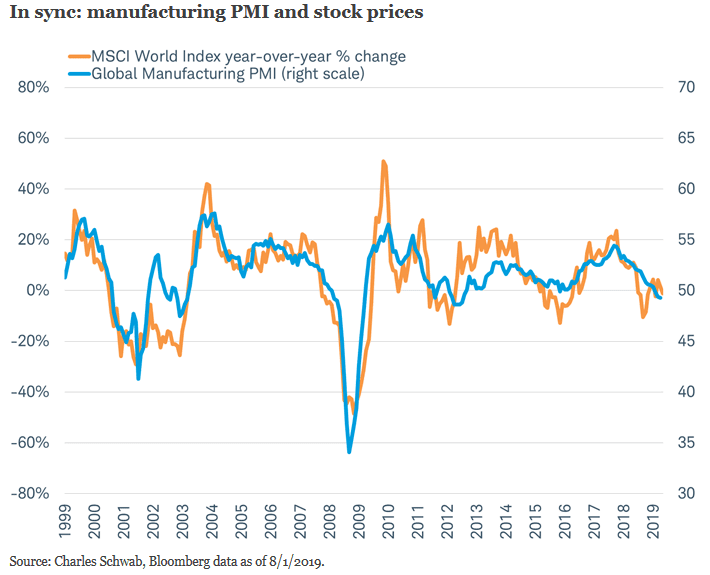

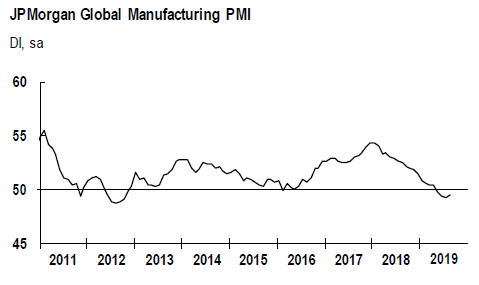

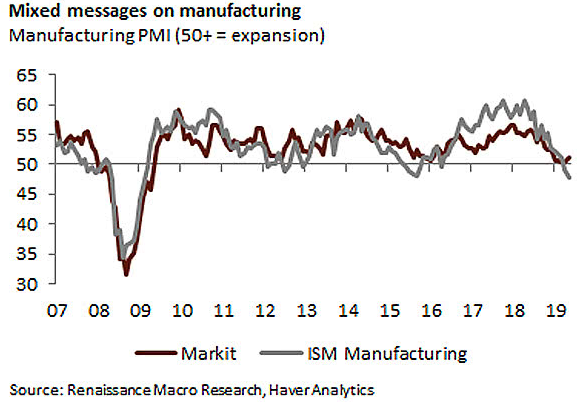

The economic growth leading indicators, in particular the Global Manufacturing PMI (which normally has a performance aligned with that of the MSCI World Market index), are deteriorating since 2018.

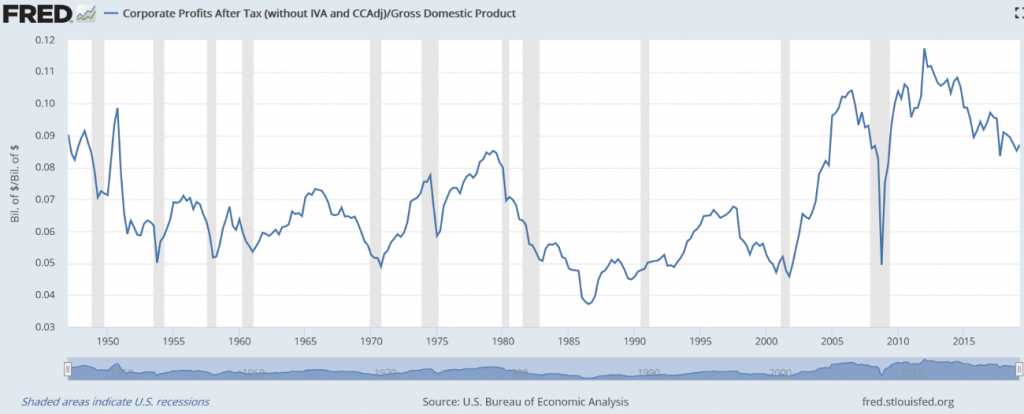

The companies’ profit margins remain at a very high level.

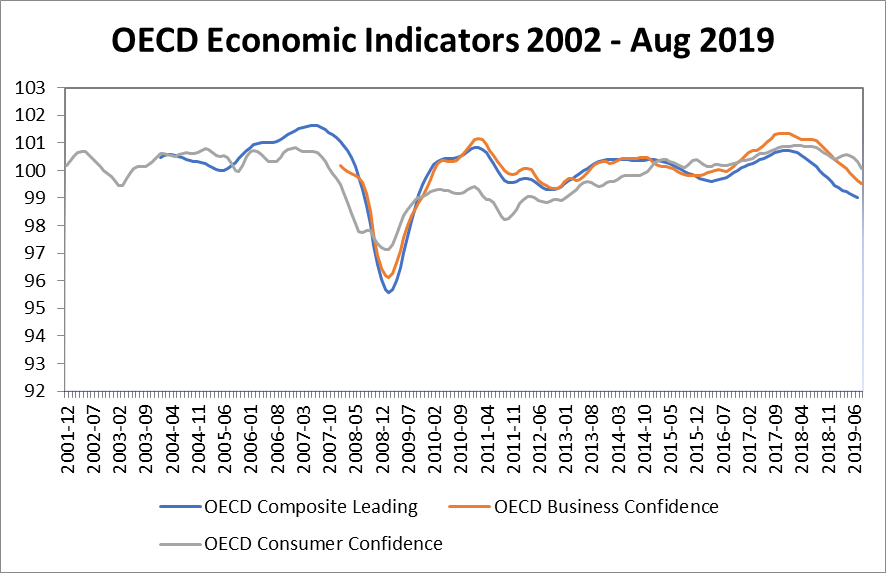

The confidence indicators of entrepreneurs and consumers are also high.

Valuation: Stock markets at fair levels but with revisions of forecasts and decreasing growth of Earnings Per Share

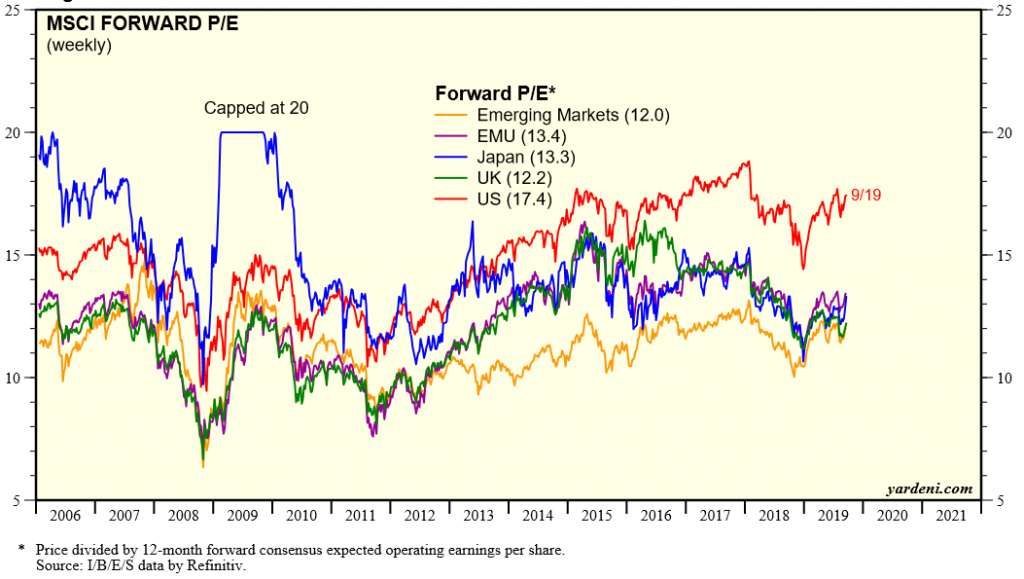

- The world stock market valuation in terms of price earnings multiples is reasonably in line with the long-term average but with differences in the level of major markets. The 17.4 x for the USA is above average, 13.4 x in the Eurozone and 13.3 x in Japan are quite below average and 12x for emerging markets is in line with the average. Relative valuations between the U.S. and the rest of the world are achieving an extreme deviation level.

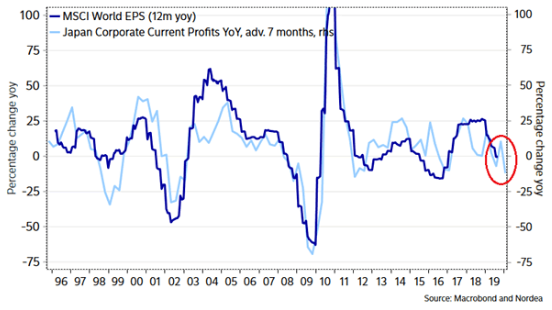

- EPS growth is slowing down in all geographies, and EPS growth revisions are also falling.

Valuation: Bond markets

- More than $16 trillion bonds have negative implied yields, especially in Europe and Japan, representing about 1/4 of the world market and almost 50% of the world ex-US market, as a result of the negative interest rates set by the central banks and asset purchase programs.

- Credit spreads are at very low levels in historical terms throughout the developed world.

- This situation reflects the monetary policy pursued by central banks, the fears of economic recession and the investment policies of the main institutional investors (pension funds, insurance companies, banks and many mutual funds).

Key opportunities

- Economic growth above the long-term average and the level of its potential level.

- Expansionary monetary policies in all geographies.

- Strong sentiment indicators of business and consumers.

- Valuation indicators at reasonable levels.

Key risks

- Recession risks in Germany in 2019, after contraction of GDP in the second quarter, and greater than expected growth slowdown in the US (ISM of October 1 recorded minimum of 9 years) and China (industrial production reached minimum of 17 years).

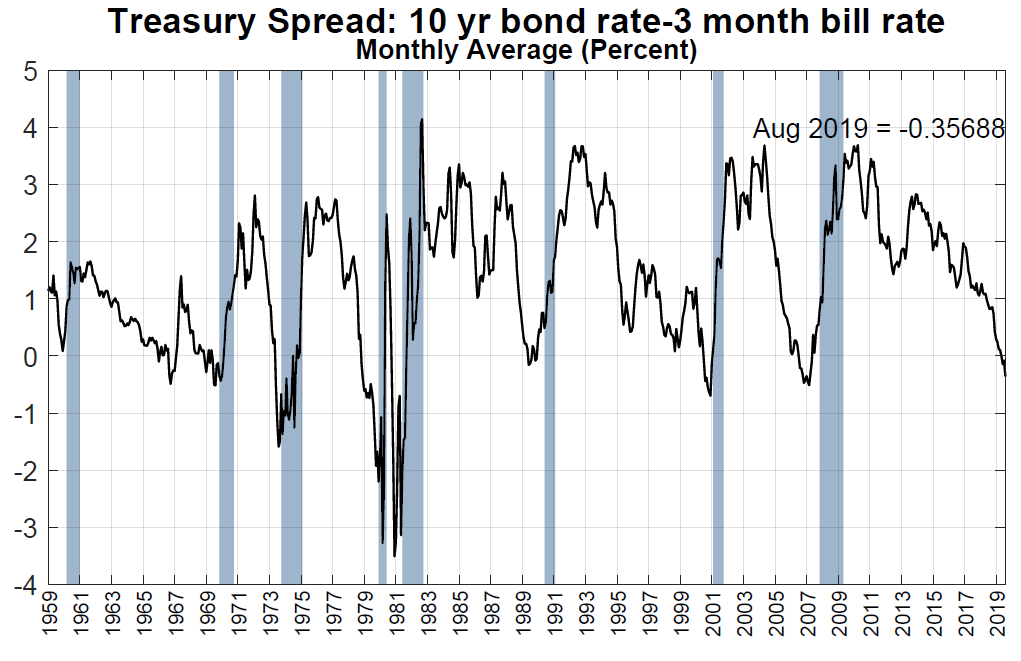

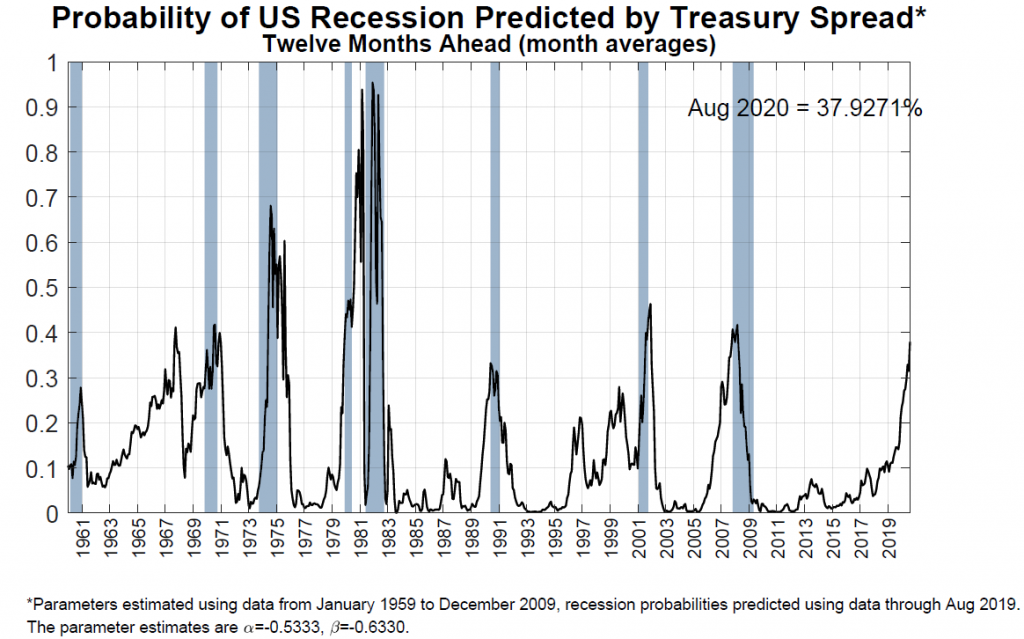

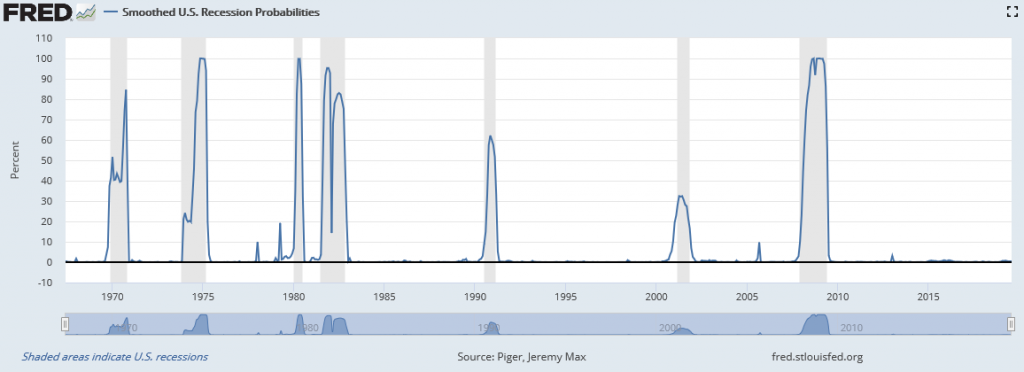

- Increase in the probability of recession to 37% in the next 12 months in the US, according to the New York Fed treasury spread model, without correspondence in the macro-based model of the Fed of St. Louis (less than 0.98%).

- This slowdown is mainly due to the worsening of geopolitical factors, especially the prolongation and escalation of the U.S./China trade war, but also to the social unrest in Hong Kong and the uncertainties of Brexit’s outcome.

The following link accesses a recent article on the development and impact of trade tensions between the U.S. and China: