Risk is the possibility of loss derived from the fluctuation and uncertainty of the investment returns

For the investor, what matters more than the risk is the effective and realized loss, which emerges only when he sells in a situation of devaluation of the investment

The range of fluctuation of returns of the major asset classes, and the possible maximum loss (“drawdown”) in a given period are the most important concepts to evaluate the investor risk tolerance

An investment in stocks is for the medium and long term and an investment in bonds is for shorter investment time horizons

Risk is the possibility of loss derived from the fluctuation and uncertainty of the investment returns

Regarding investment decisions, the risk is as important as expected return or profitability.

In general terms, the risk is the uncertainty of the outcome. It is an integral part of all aspects of our lives.

The financial risk is the variability of investment results and of its returns.

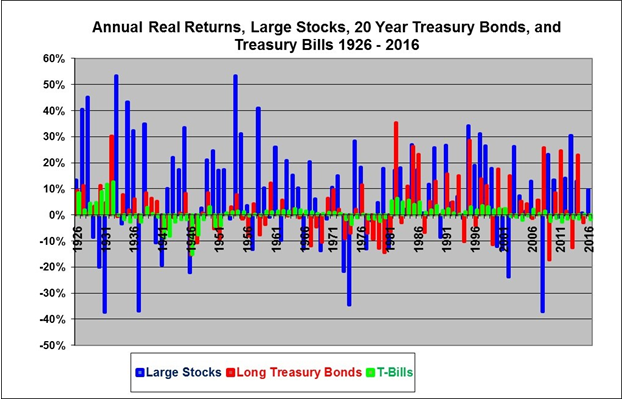

The observed returns on investments, or the ones we get, are different from the average historical return, or expected. The following graph shows the annual returns observed for 3 asset classes of 1926 until 2016 in the US. It shows that the variation or volatility is greater for stocks (in blue) than for bonds (in red), and that this one is greater than the one for cash (in green, given treasury bills to 3 months)

Source: Are Stocks Really Riskier Than Bonds? InvestorsFriend.com

For the investor, what matters more than the risk is the effective or realised loss, which emerges only when he sells the investment at a value below the one bought

But not all the risk (as uncertainty or volatility) is bad. The positive outcomes and returns are good. These are welcome and we like. On the other hand, the negative temporary and observed returns are not necessarily a loss.

To be losing and make a loss are two different things. We could be losing and come to have a gain (as well as lose even more). The loss only occurs when we realize it. There is a loss when we sell an asset at a lower price (plus income however obtained) than the one we purchase it. So, what matters is the loss and not the risk. And the loss is a function not only of the fluctuation in prices, but also of the need for liquidity of the asset at any given time.

The range of fluctuation of returns of the major asset classes, and their possible maximum loss (“drawdown”), in a given period, are the most important concepts to evaluate the risk tolerance

The loss occurs when we sell the invested capital in devaluation in relation to the amount initially invested, at the end of the term, or in advance due to liquidity needs. The concept that better captures the possibility of loss is the maximum loss (“drawdown”), which is regarded as the largest devaluation of assets and investments within a given period or time horizon.

In this sense, the “drawdown” is perhaps one of the most important data for us to evaluate our risk tolerance for investments in financial markets, stocks and bonds.

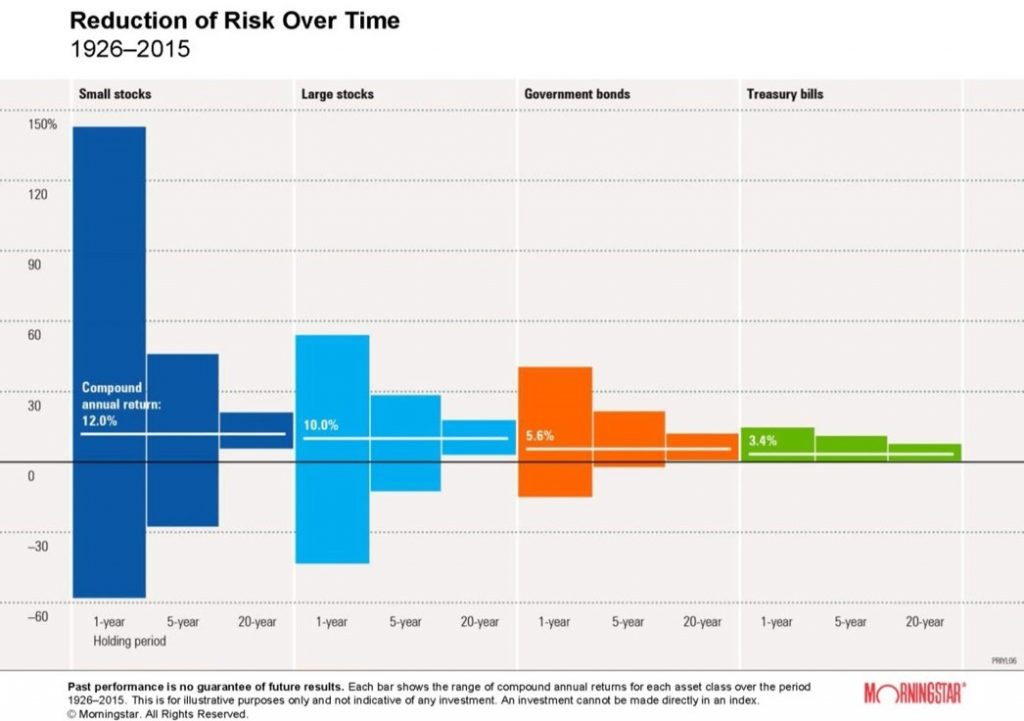

The following graph shows the maximum and minimum fluctuation values of nominal or monetary returns for 4 asset classes – stocks of small companies, big companies, Treasury bonds and Treasury bills – for periods of 1, 5 and 20 years, in the US between 1926-2015:

We can draw the following conclusions:

- There is a risk or fluctuation of returns for any asset and any time horizon;

- For any asset, the risk or the fluctuation of annual returns decreases with the increase of the time period;

- From horizons of 20 years, there are no negative returns for any asset, and the range of annual return makes it much more interesting the investment in stocks than in any other asset class.

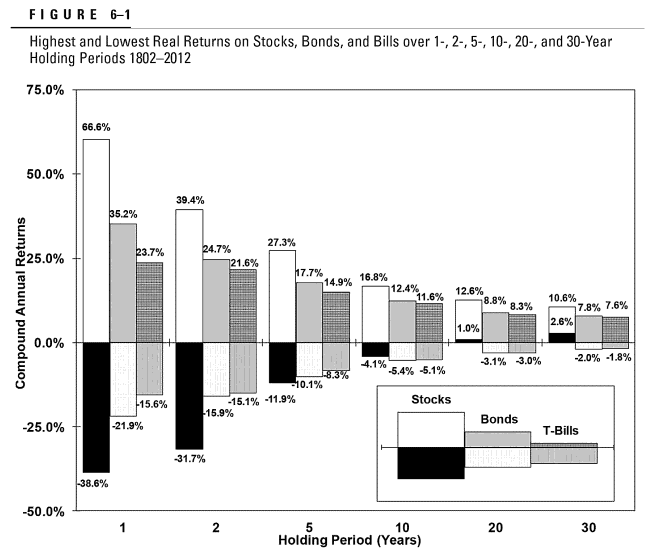

The following graph shows the intervals of maximum and minimum fluctuations for 3 classes of assets – shares of large companies, treasury bonds and treasury bills, for periods of 1, 2, 5, 10, 20 and 30 years, but now in terms of actual returns, i.e. , corrected for inflation, in the US between 1802-2012:

Source: Stocks for the Long Run, Jeremy Siegel

The main conclusions are as follows:

- For time horizons up to 2 years, the maximum loss of investment in stocks is much higher than that of bonds and treasury bills;

- For horizons of at least 5 years, the investment in stocks is better than in bonds or treasury bills, because the maximum loss is not much different and the maximum gain is clearly superior, as well as the average profitability, as shown earlier;

- For horizons of 10 years or more, the investment in stocks is unbeatable because most the favourable ranges of returns reinforce the higher annual average profitability.

Investment in stocks is for the medium and long term and investment in bonds is for shorter investment time horizons

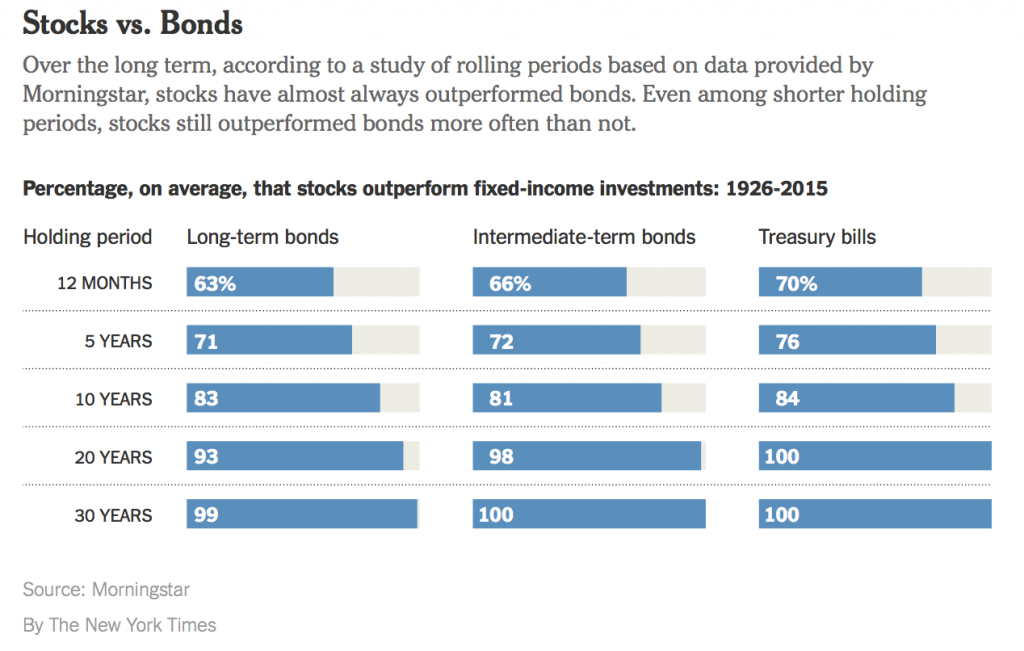

Beyond the ranges of variation of the maximum and minimum returns, it is also relevant to know the frequency of occurrence of the returns. In the period between 1926 and 2015, in the U.S., stocks had annual returns exceeding the obligations ones in 63% of the years, 71% in periods of 5 years, 83% in 10 years, 93% in 20 years and 99% in 30 years periods.

In short: Stocks are the best investment for the medium and long term, bonds are for shorter periods, and cash, like savings in deposit accounts, are better for day by day living or time horizons up to 2 years.