Asset allocation is one of the main determinants of investments returns, being much more important than securities selection and the investment timing… contrary to what most people think: 90%, 40% or 100%!

However, most people think that it is a selection of securities and market timing, and not the asset allocation that determines the investments performances, and act in accordance with this understanding

Asset allocation should be determined by the investment period and the risk profile of each situation

Studies published since 1986 showed that asset allocation is the main determinant of variations of returns among funds, representing 90%, 40% or 100% of long-term performance

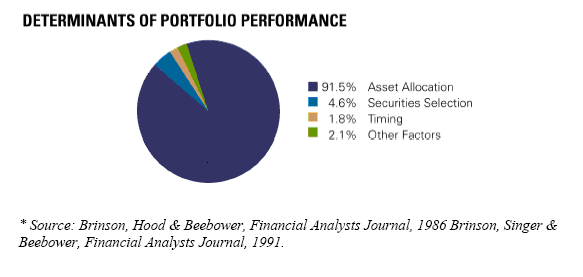

The first published studies on the subject in 1986 and 1991 for balanced pension funds in the US by Brinson and other authors showed that asset allocation determines more than 90% of each fund’s returns variation, more precisely 91,5%. Next, with a minor role, come the selection of securities with 4.6% and the selection of timing of the investment, with only 1.8%.

A study conducted by Ibbotson and Kaplan on pension funds and balanced mutual funds in 2000 clarified that strategic asset allocation determines 90% of the variation in the returns of a typical fund over the long term, but only 40% of the returns variations among the various funds (the other factors are asset class timing, style within asset classes, security selection, and fees); however, those 90% were largely due to the fund’s exposure to the capital markets in general.

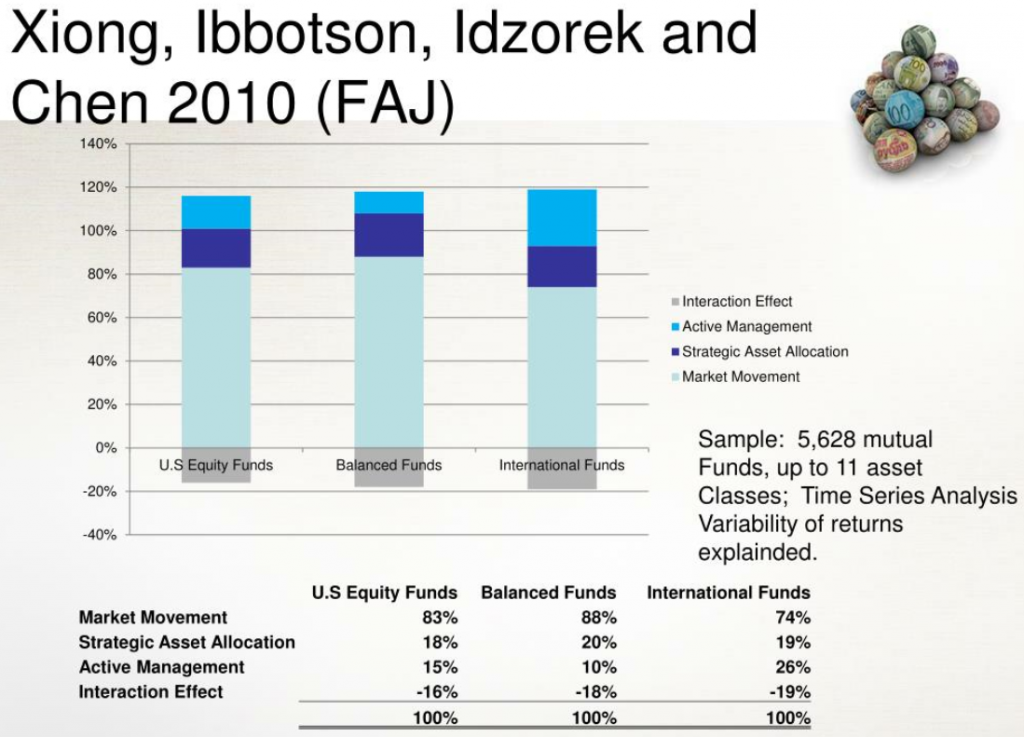

Finally, the study by Ibbotson and other authors in 2010 on more than 5,000 mutual funds found that 75% of the typical fund’s variation in time-series returns comes from general market movement, with the remaining 25% split roughly evenly between the specific asset allocation and active management.

The studies collectively demonstrate the importance of:

- Being in the market;

- Doing a strategic asset allocation.

In other words, asset allocation is a key factor for investment portfolio’s performance.

However, most people think that it is a selection of securities and market timing, and not the asset allocation that determines the investments performances, and act in accordance with this understanding

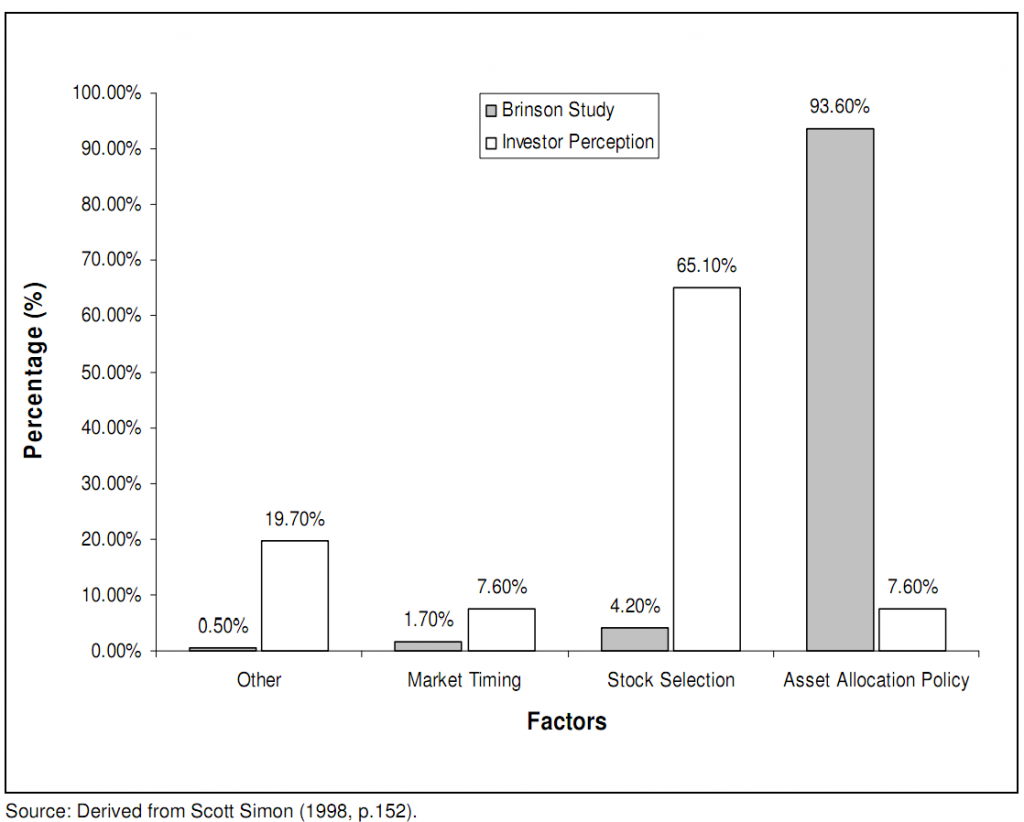

This is not what people think. The more recent studies show that investors think that the most important thing is securities selection with 65%, and that asset allocation is only responsible for 7.6%, the same level as market timing.

As a result, most people invest in a set of securities selected by them and choose the moments they consider right to be invested, without any positive results, or worse, with bad results.

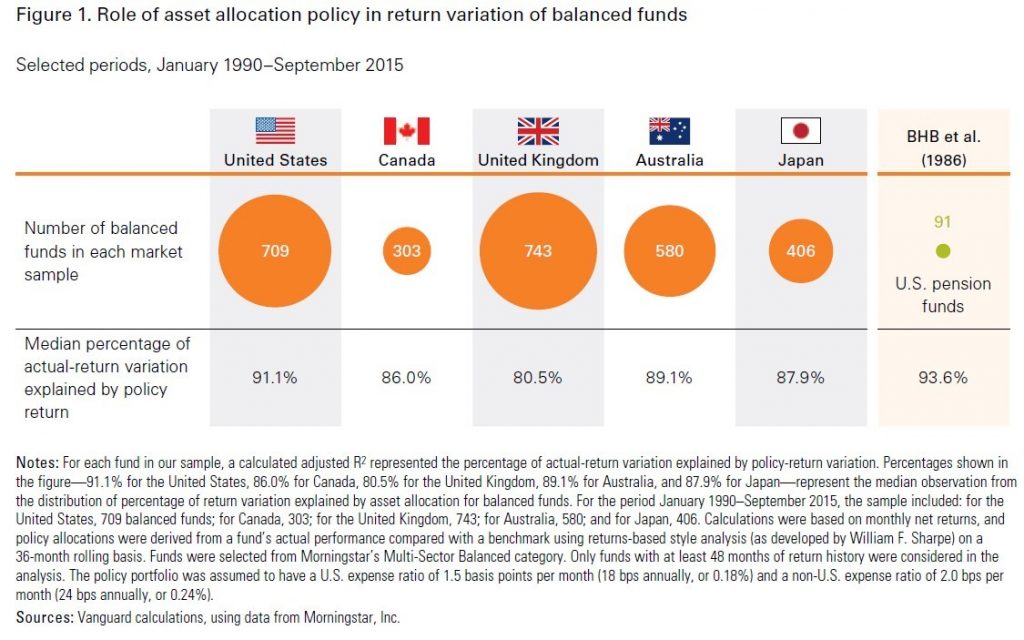

The most recent studies continue to prove not only that asset allocation accounts for more than 90% of the result, but also that this conclusion is valid for any country

More recent studies show that this conclusion is true for any geography when analysing balanced funds. Whether for the US, Canada, UK, Australia or Japan, asset allocation accounts for about 90% of the variation of returns of investments.

The main consequence of the conclusions of these studies is that in order to invest well we must decide well on our appropriate personal asset allocation (financial objectives and risk tolerance) and stay invested in the market.

Asset allocation is determined by the investment time horizon and the risk profile of each person

Efficient and correct diversification must consider the returns and risk we want for the investment time horizon, knowing that the higher the profitability the higher the risk and vice versa.

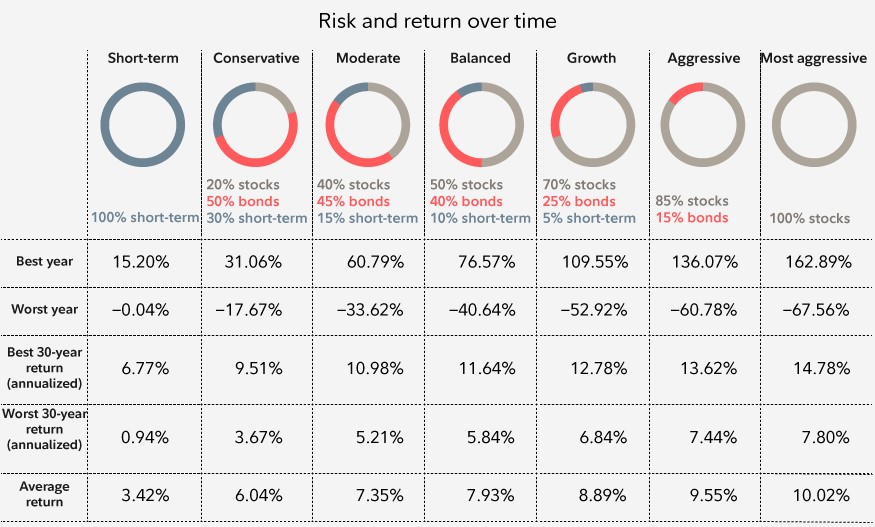

The following chart shows the returns over time of different combinations of the 2 main asset classes during the period 1926 and 2018:

Source: How to start investing, Fidelity

We know that the longer the investment horizon the greater risk we can assume because risk is diluted over time.

On the other hand, not all of us have the same risk profile, that is, we support and react differently to adverse markets events especially those of greater intensity.

Thus, in order to live well with our investments, we must select the allocation of assets that best suits our financial objective and personal situation (time horizon of financial objective, financial capacity and risk tolerance).

In short, asset allocation is the key part for successful investments because:

- It determines the diversification or combination of assets most appropriate for the financial objective we intend to achieve, considering the investment time horizon and our risk profile (capacity and risk tolerance);

- It is proven that it is the assets allocation that determines more than 90% of the result of the investment portfolios performances, at any time and in any country, contrary to what the average investor thinks.

In other posts we will see how we should decide our asset allocation in order to: 1) define the classes and subclasses of assets that are justified (efficient diversification); 2) adjust it to our personal case (correct diversification).