The S&P 500 is the unavoidable benchmark of the global stock market and should be part of any and all investment portfolios

What is the S&P 500 Equal-Weight Index?

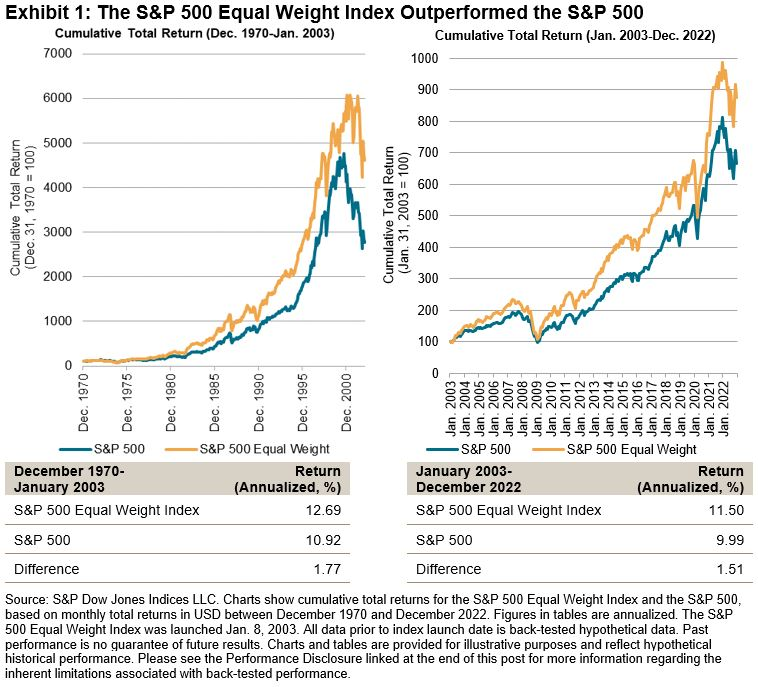

S&P 500 Equal-Weight Index’s long and recent historical performance

Comparison of the S&P 500 Equal-Weight with the S&P 500 (cap-weighted)

We have been developing articles on the main indices of the market.

In this context, in another article we developed the S&P 500, the main index of the world’s stock markets, as it is the main benchmark index of the world’s largest stock market, the USA.

Now we will develop a variant of the S&P 500 index, which is the S&P 500 Equal-weight.

While the former is weighted by market capitalization, the latter assigns equal weight to all constituent companies.

In a recent article, we addressed the positioning and investment interest of the S&P EWI versus the S&P 500, focused on greater breadth and lower exposure at the individual and sector level.

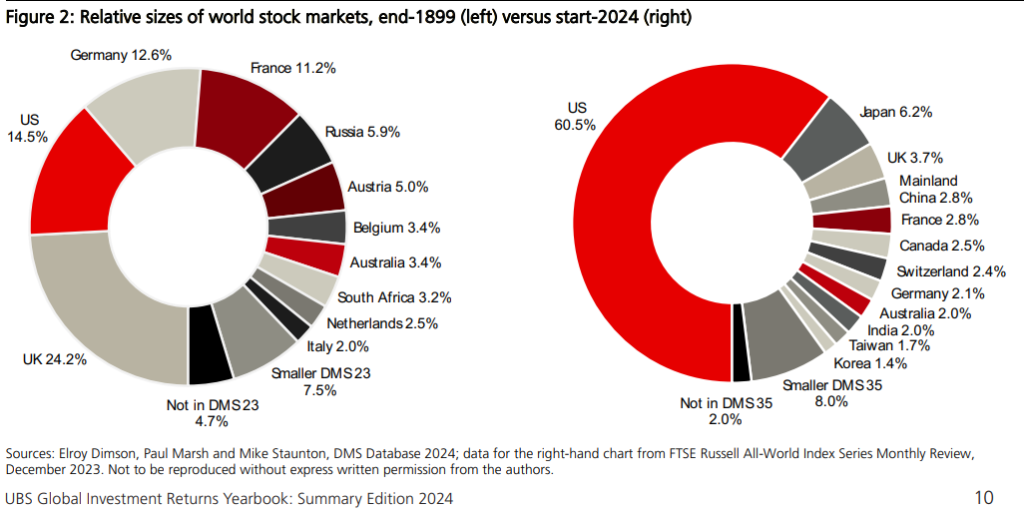

The S&P is the unavoidable benchmark of the global stock market and should be part of any and all investment portfolios

The U.S. accounts for more than 50% of the world’s stock markets:

The growing importance of the S&P 500 index (created in 1957) caused it to replace the original DJIA 30 (Dow Jones Industrial Average) (created in 1896) as the main U.S. market index.

The S&P 500 is more comprehensive, as it is based on a larger sample of total U.S. stocks, and is market-cap-weighted, while the Dow Jones is price-weighted.

The S&P 500 covers approximately 80% of the available market cap in the U.S., with a focus on the large-cap segment of the market.

Today, it is the basis of many listed and unlisted investment instruments.

To this extent, it is the unavoidable reference of the world’s stock markets and should be part of any and all investment portfolios of investors, whether institutional or private.

It is the most widely used, followed and analyzed index in the capital market.

Its movements are studied and monitored in the smallest detail by all investors, private and institutional, of various natures, as its evolution determines the behavior of other indices around the world.

That’s why we use this index in many of our articles.

What is the S&P 500 Equal-Weight Index?

The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely used S&P 500.

The S&P 500 EWI was designed to be a dimension-neutral version of the S&P 500.

It includes the same components as the capitalization-weighted S&P 500, but each company in the S&P 500 EWI is given equal weight at each quarterly rebalance.

The S&P Equal Weight Index series includes equally weighted versions of the S&P 500, S&P MidCap 400 and S&P SmallCap 600.

Similarly weighted indices have greater exposure to smaller companies than their parent indices.

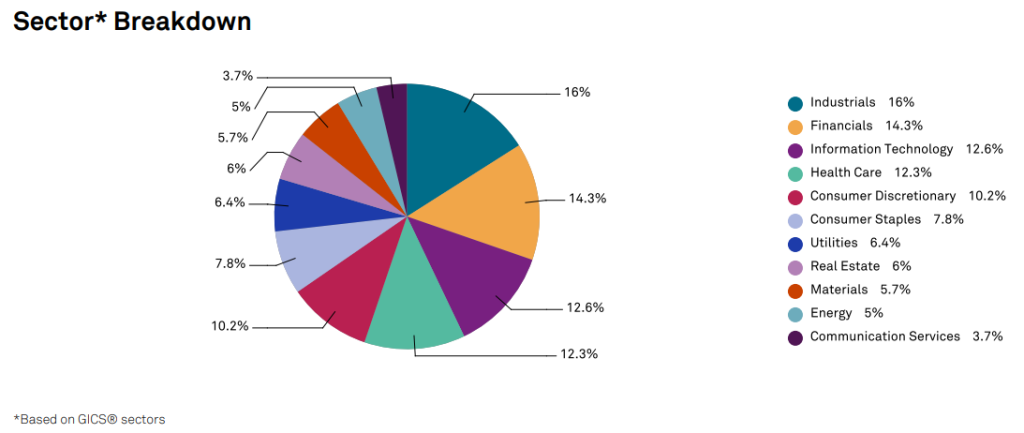

Its sectoral composition is as follows:

The largest sector is industry with 16%, followed by finance with 14%, technology and healthcare with %-13%%, durable consumption with 10%, and subsequently, current consumption, public goods, real estate, energy and raw materials, and telecommunications.

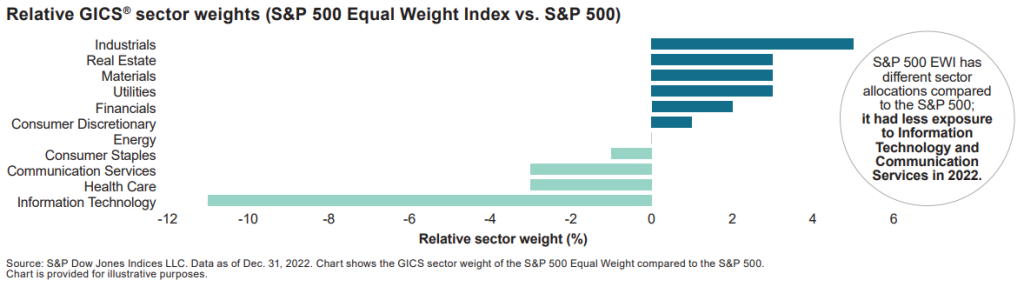

These weights are quite different from those of the S&P 500 index:

In the following link we have a brief characterization of this index:

https://www.spglobal.com/spdji/en/indices/equity/sp-500-equal-weight-index/#overview

S&P 500 Index’s long and recent historical performance

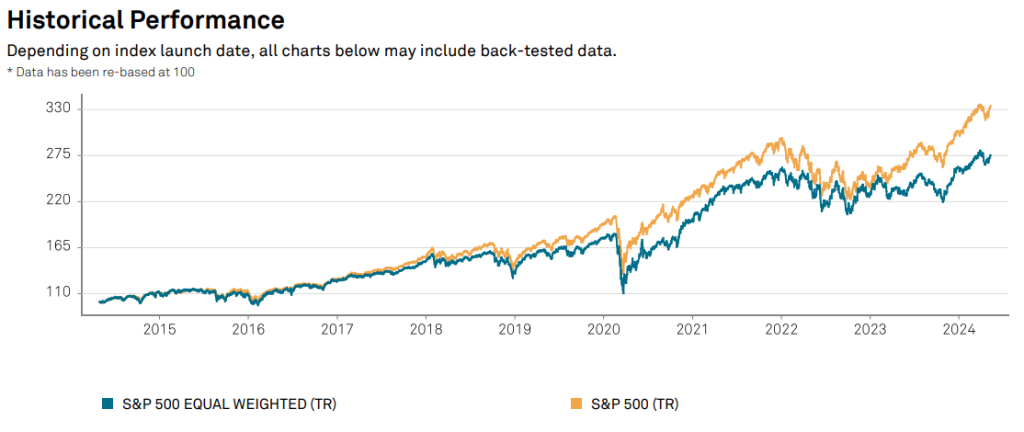

The following chart shows the return on investment in the S&P 500 EWI, compared to that of the S&P 500, since 2014:

The S&P 500 index posted an average annual nominal return of 10.3%.

This yield was much higher than the 5.5% per annum provided by 10-year treasury bonds and the 3.3% per annum obtained by 3-month treasury bills, and only surpassed by small company stocks of 11.8% per annum.

The index has appreciated in more than 70% of the years.

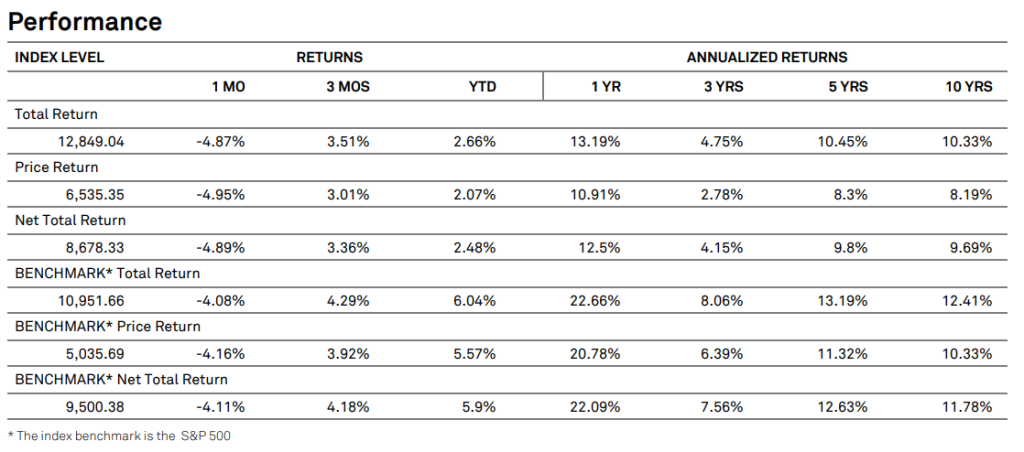

The following table shows the annualized return over the last 10 years:

The annualized yield on the S&P 500 EWI was +13%, +4.75%, +10.5% and 10.3% on investments made in the most recent 1, 3, 5 and 10 years.

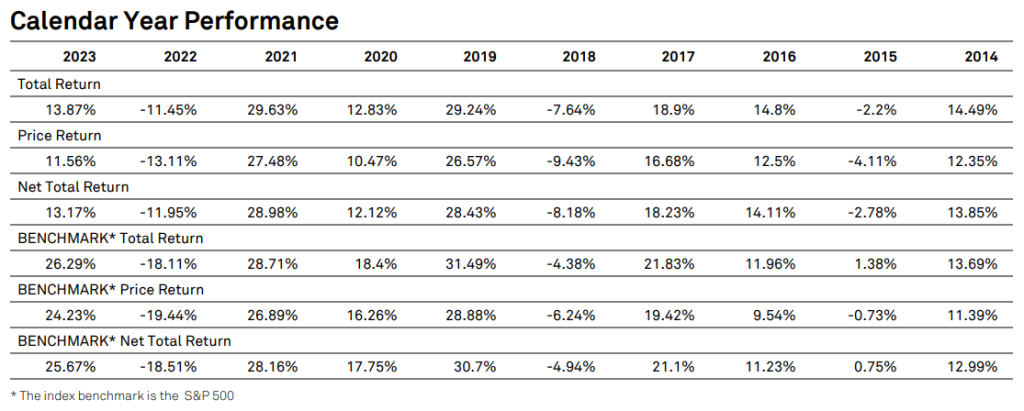

The following table shows the returns in each year of the last 10 years:

Comparison of the S&P 500 Equal-Weight and the S&P 500 (cap-weighted )

The S&P 500 Equal Weight Index has outperformed the S&P 500, both since January 2003, when it was created, and even since the 1970s, when we look at its history of “backtesting”: