The horizon for individual investors between 1 and 4 years is too short

In addition, investors have terrible results when trying to make the “market timing”, always arriving late

This investment in the financial market at very short terms comes at a high cost for individual investors

The horizon of the world’s best investors is the very long term (over 20 years)

Warren Buffett: “If we’re not willing to own a stock for ten years, there’s no point in thinking about owning it for ten minutes.”

To be more successful in our investments, we must adopt a set of simple and easy-to-follow rules, which we call golden rules.

In previous articles we have already developed some of these rules.

These rules start with financial planning, namely investment by objectives, that is, with an end, a purpose, a goal, and considering our situation and financial capacity.

They also include the diversification of investments, either by asset classes or by the financial instruments or values themselves, as the only way to mitigate risks.

This is followed by the decision to allocate by asset classes, which determines the results and a large part, and must be aligned with our interests and our investor profile, or degree of risk tolerance.

Then you set off to the selection of investments, which should focus mainly on mutual funds, carefully chosen, taking into account the class and subclass of the desired assets, the investment strategy, the costs, the expected returns, the quality and experience of the investment manager, the size of the fund management company, among others.

In addition, it is necessary to monitor and monitor the evolution of investments, seeking to periodically rebalance, strengthen and adjust the portfolio in stages when necessary, and stay the course in the face of normal and current market fluctuations.

Within the scope of investment rules, the time horizon of investments is one of the main ones, as it is precisely at the heart of maintaining the course of investments.

In general, as we shall see, we invest for too short a long term.

We should not do that.

Investment in the financial markets must be made in the medium and long term, i.e. at least 5 years.

The horizon for individual investors between 1 and 4 years is too short

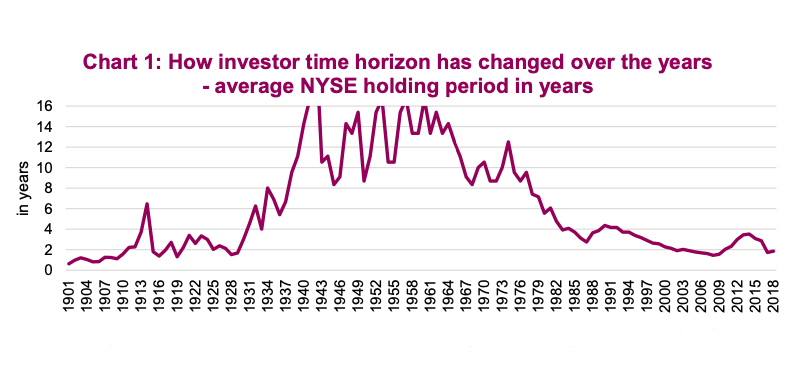

The following chart shows the average holding period of shares listed on the New York Stock Exchange, showing a major change in investor behavior:

In the early 1900s, investors only held one stock for a year or two, similar to what happens today.

However, between the 1930s and 1970s, investors clearly opted for a more buy-and-hold approach, for periods that exceeded 10 years.

Many things have contributed to this change in behavior, from technology, market composition, and available strategies.

What is a fact is that the time horizon of the average investor is much shorter.

And this time horizon trend is unlikely to reverse anytime soon.

There are too many factors that contribute to shorter detention periods.

Technology and lower trading costs have reduced trading friction.

Investment fund managers and discretionary managed account managers are forced to transact their portfolio a lot to justify the fees charged.

Quantitative investment strategies contribute to shorter time horizons.

And even exchange-traded funds (ETFs) themselves have also shortened time horizons, to the extent that if trading a given ETF is not working, even for a short period, investors quickly sell them and buy another.

Gone are the days when the effectiveness of a strategy is measured over an entire economic cycle.

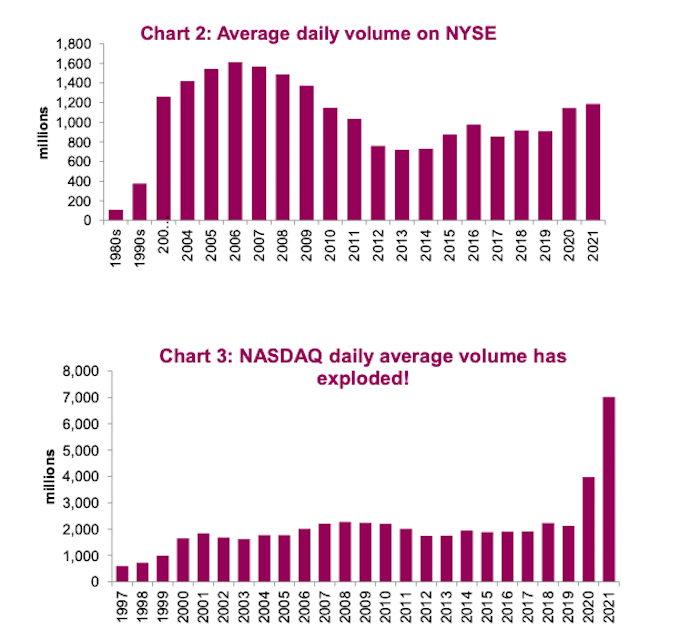

Trading volumes are increasing in the NYSE mega-caps, but the rise is much more pronounced in the more speculative markets or exchanges such as the Nasdaq:

Values traded as a percentage of market capitalization are at levels not seen since the bubble of the late 1990s, and volumes on the Nasdaq have more than tripled.

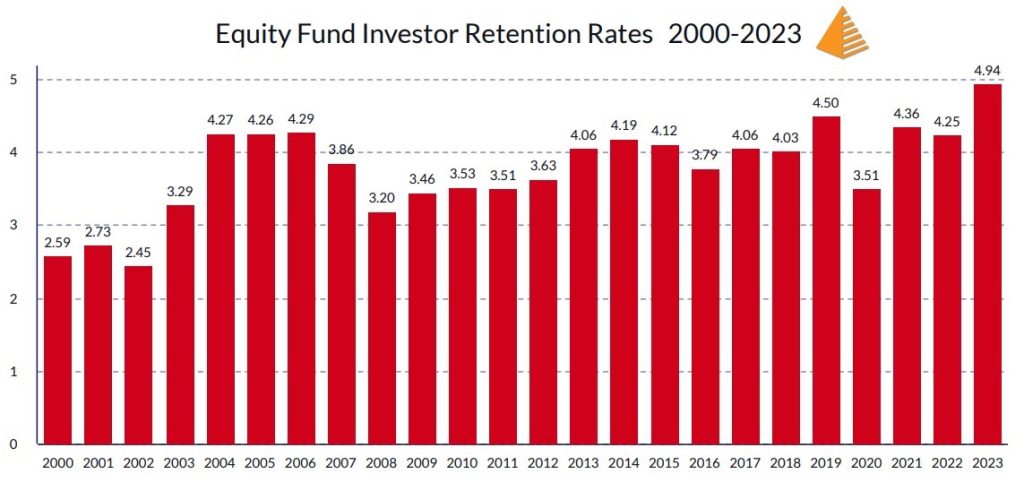

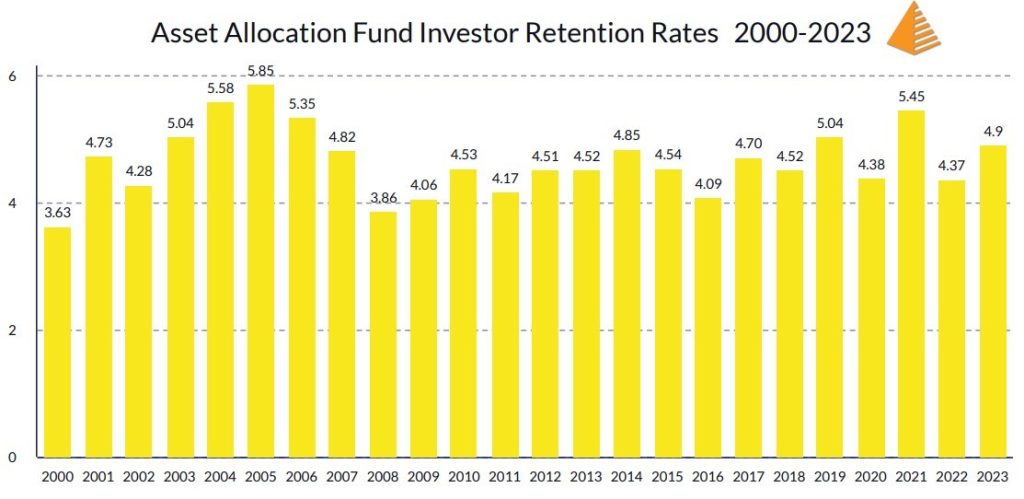

Investors hold the various types of mutual funds longer than individual stocks, but the time frames are also short

The average holding period of investors in equity investment funds is less than 5 years:

Source: Dalbar Quantitative Analysis of Investor Behaviour 2023

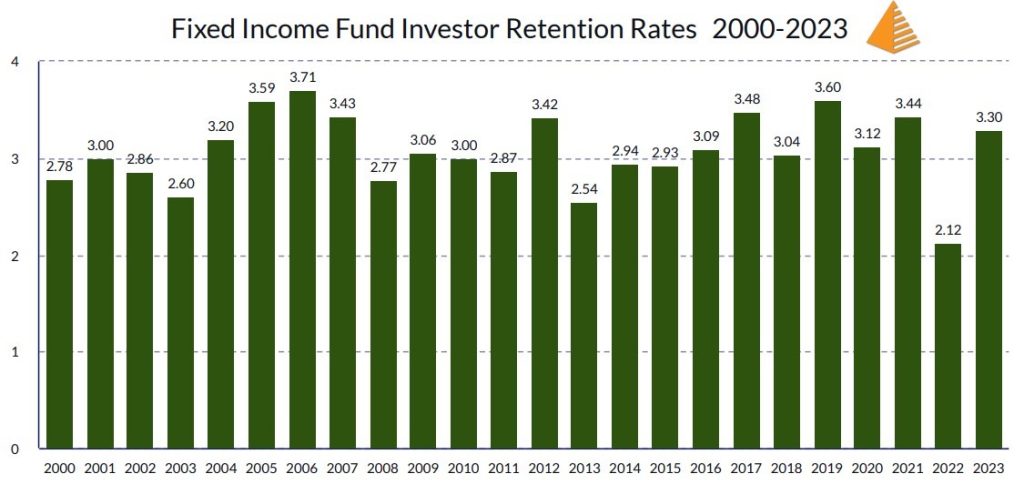

The average holding period of investors in bond investment funds is 3.3 years:

Source: Dalbar Quantitative Analysis of Investor Behaviour 2023

And the average holding period of investors in mixed investment funds is 4.9 years:

Source: Dalbar Quantitative Analysis of Investor Behaviour 2023

These are longer than two years for individual actions, but they are excessively short.

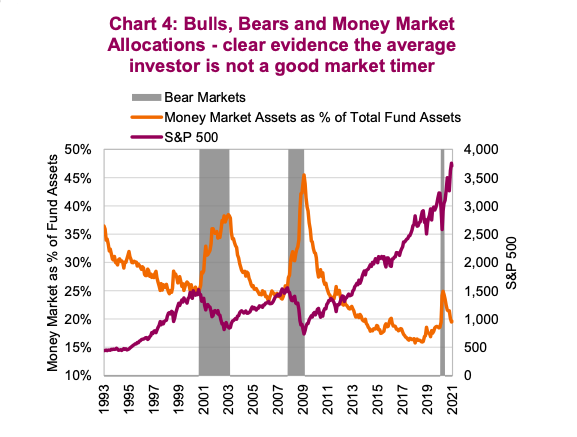

In addition, many investors try to make the “market timing”, with terrible results, because they run after the market and always arrive late

Investors chase the valuations of the financial markets and are always late.

In fact, we can confirm that the allocations between equity and liquidity investments are opposite to the valuation cycles of the former.

The following chart shows the percentage of fund assets parked in money market funds over time and the evolution of the S&P 500 stock index:

This percentage is higher when the market is down and is very low when it is at its peaks, which is literally the opposite of buying low and selling high.

The returns obtained by private investors in investments for medium and long-term periods are much lower than those provided by investment in the market:

Source: Dalbar Quantitative Analysis of Investor Behaviour 2023

On average, the annualized returns obtained by investors in equity investment funds were 6%, 3%, and between 1% and 3% lower than those of the market, for investment periods of 3, 5 and between 10 years and 30 years.

For bond investment funds, the annualised returns obtained by investors were between 1% and 3% lower than those of the market, for investment periods between 3 and 30 years.

In the case of mixed funds held by investors, annualized returns were between 2% and 6% lower, depending on the terms considered.

Although these values may seem small, they are not so when analyzed in absolute terms, since they are losses for one year, are repeated for many years, represent 20% to 33% of annual returns, and aggravate losses due to the effect of the capitalization factor of long-term incomes.

Usually, the main explanation given to justify this difference in performance or loss vis-à-vis the market is the investor’s behavioural biases.

In previous articles we have already covered many of the main biases of investors, starting with an overview in which we showed that these biases are the worst enemies of the investor himself.

Among these biases, which it is important to know and keep in mind when investing, we presented loss aversion, herd effect, topicality, familiarity, recent memory, media noise, excess optimism, confirmation, and mental calculation.

Experts in behavioral economics have already identified more than 50 behavioral biases to which we are subject, which condition our actions, harm our results, and as such, must be perceived and managed.

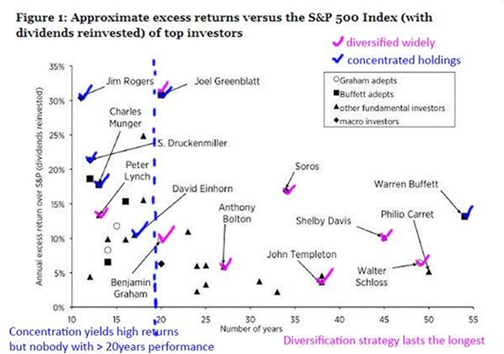

The horizon of the world’s best investors is the very long term (over 20 years)

In stark contrast to individual investors, the world’s largest and most successful institutional and professional investors have investment terms of several decades:

For example, Warren Buffett, also called the Oracle of Ohama, has had investments for more than 50 years in his “core” portfolio of the top 5 stocks (which represent 70% to 80% of the total), such as Coca-Cola and American Express.

But it’s not the only one.

Peter Lynch, the great manager of Fidelity in the 1980s, Benjamin Graham, Warren’s mentor, Charles Munger, his partner of decades, Jim Rogers, Druckunmiller and George Soros of the Quantum Fund in 1988 and 2000, John Templeton of the funds of the same name since the 1950s, among others, managed and invested with a time horizon of several decades.

All of these investors achieved annualized returns that consistently outperformed those of the S&P 500 index, consistently between 5% and 30%.

Whereas the returns on the S&P 500 were 8% to 10% per year, what these investors achieved was 15% to 35% per year, consistently and over a long period of more than 15 years.