The allocation of assets by economic cycles as a variant of tactics or dynamics

Age is a simple factor in modeling the objectives, and even the investor’s profile, in order to define the asset allocation

In other articles we had already elaborated on some aspects related to asset allocation.

In fact, we presented the development of the financial planning process itself, the definition of objectives, the consideration of constraints, including the financial situation and capabilities, and the investor’s risk profile.

We have also focused on the importance of portfolio diversification, directly linked to expected returns, as well as the expected risks of the main assets.

We have also seen the importance of the correct allocation of assets in the construction of the investment portfolio, as it largely determines the expected profitability and risk profile.

In a recent article we comprehensively covered asset allocation, from the conception and design phases of the allocation process to the 4 main strategies used by investors.

Now we will develop the asset allocation by economic cycles, one of the main variants of tactical or dynamic asset allocation, and then the influence of the age factor in the definition of asset allocation.

The allocation of assets by economic cycles as a variant of tactics or dynamics

We have seen that dynamic and tactical strategies adjust the allocation of investors’ portfolios to the situation and context of the markets.

The basis of these strategies lies in the understanding that the profitability and expected risks of different asset classes vary throughout economic cycles.

In previous articles, we have already addressed the influence of economic cycles on the behavior of various assets, namely inflation, growth and monetary policy.

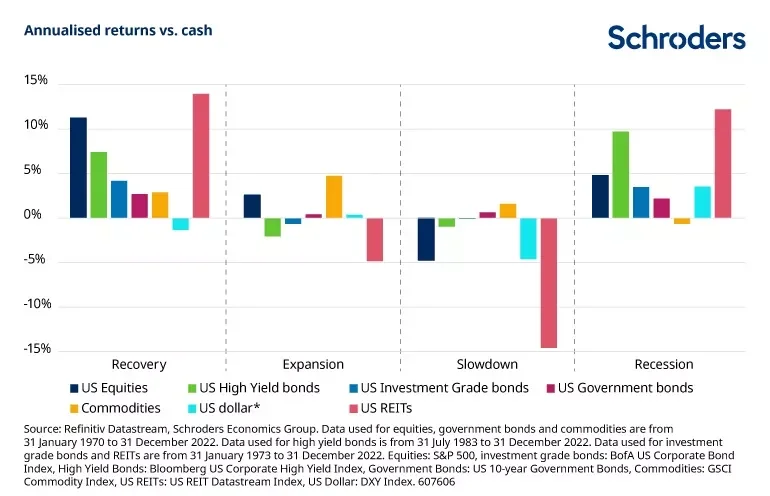

The following chart shows the differentiated behaviour of the main assets according to the various stages of the economic growth cycle:

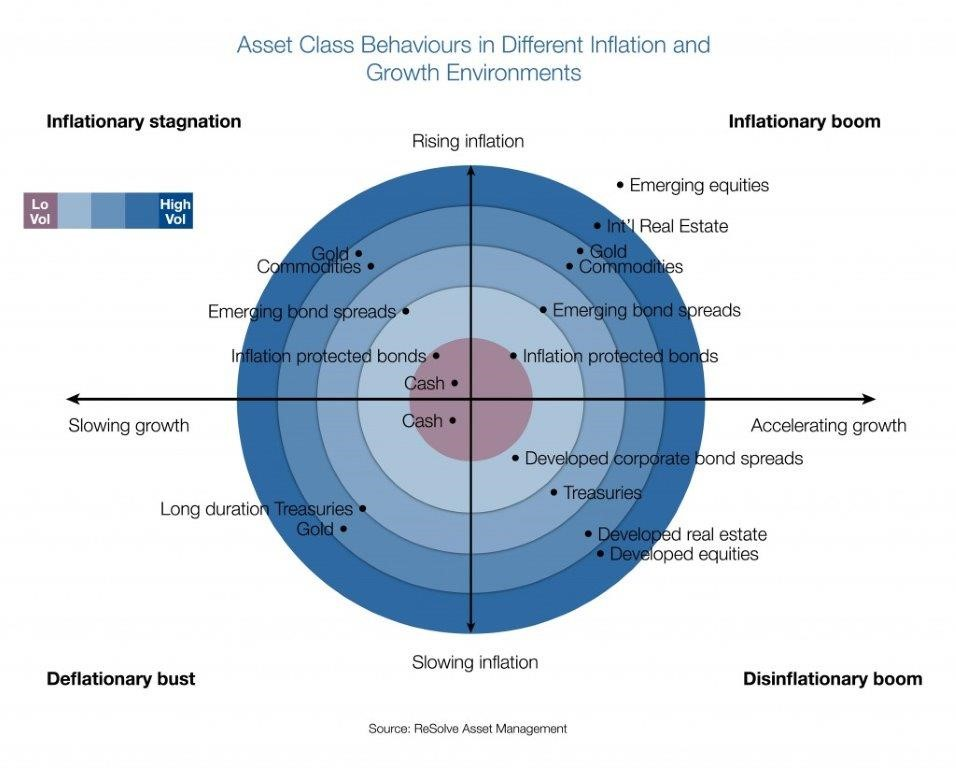

This performance can be more precise when analysed in two dimensions, economic growth and inflation:

Age is a simple factor in modeling the objectives, and even the investor’s profile, in order to define the asset allocation

The age of the investor is a simple and concrete factor that helps determine asset allocation.

The underlying logic is that the younger we are, the longer the investment term, which means that the more time we have to recover from any adverse market fluctuations in the short term.

To that extent, the younger we are, the smaller we are, the allocations to equities relative to bonds will be higher, given that the band and risk of short-term fluctuations in equities are higher than those of bonds.

Additionally, the younger we are, the more common the objectives and even profile of investors.

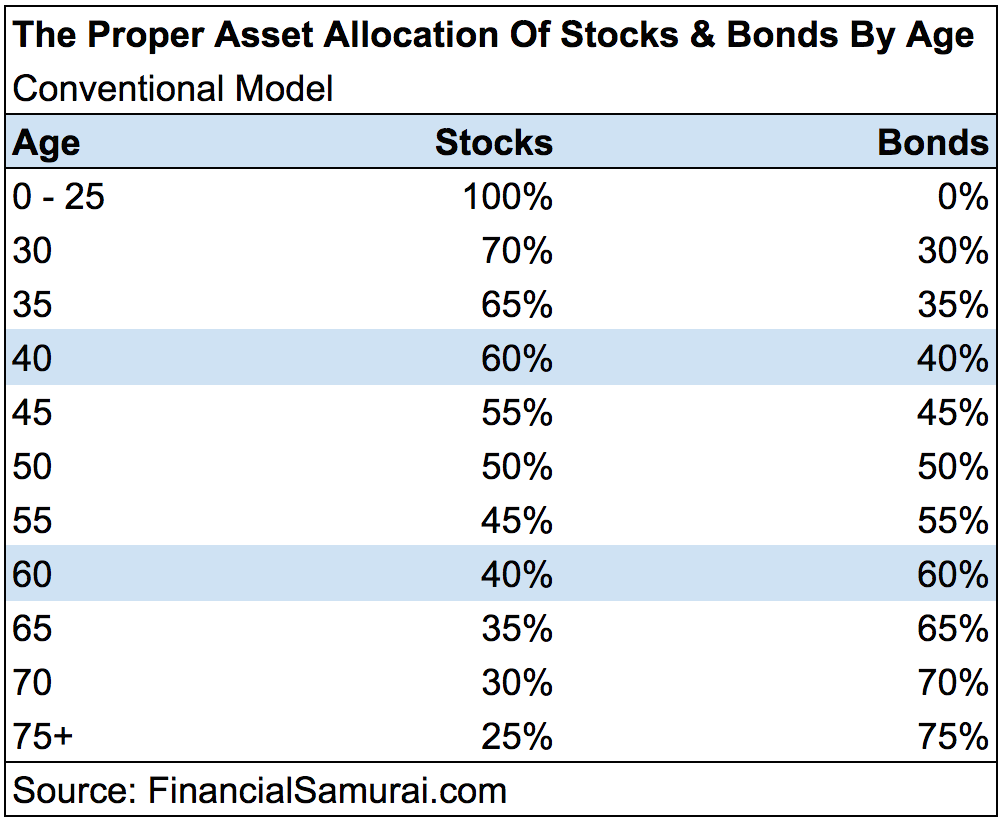

The traditional model of allocation by age was as follows:

An easy mnemonic to retain this model is to take the difference between 100 and the age to obtain the allocation to stocks, with the remainder to bonds.

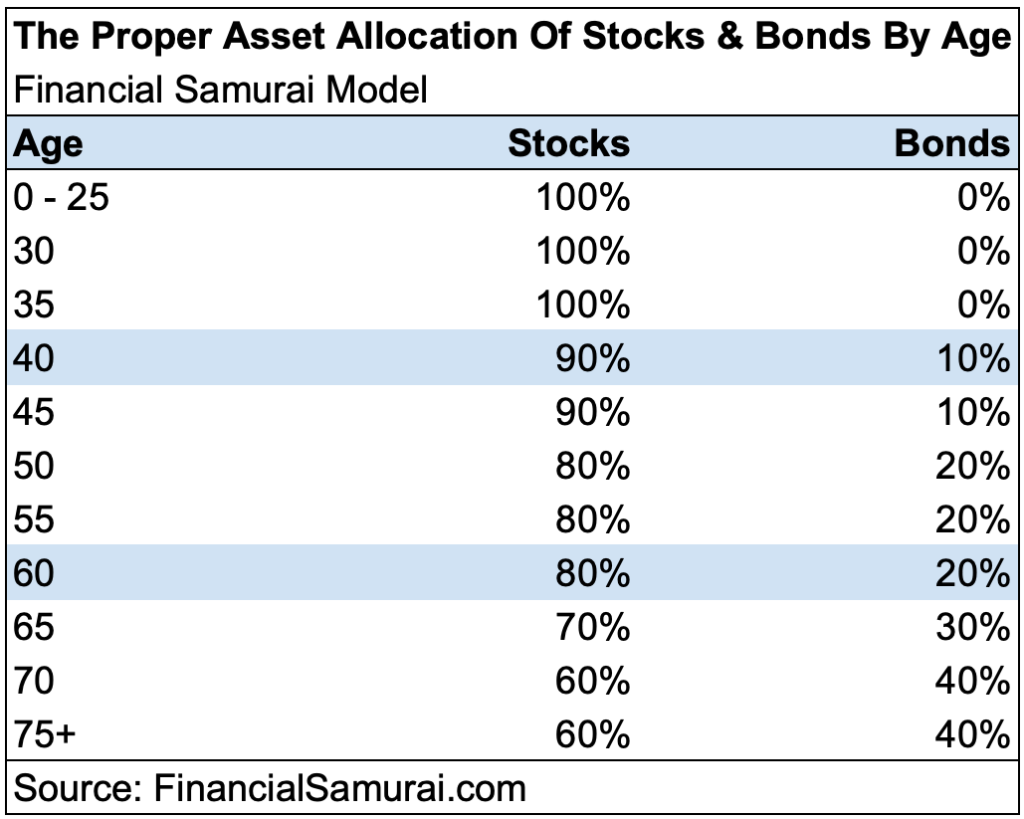

Considering the increase in longevity in recent years, the following model is more appropriate to current times:

This allocation maintains a high share weight for all ages, especially up to retirement age.

It is enough to recall the comparative returns and recovery time of shares and bonds to conclude that this model is fair.