Women control about 1/3 of the financial wealth in developed countries and in the next decade this percentage will be much higher

Women invest more, but still less than men, with a gender investment gap enduring

Main motivations and blockages of investment by women

We developed a series of articles with the title “How they invest” to show the characteristics of the investments of some groups of reference investors, individual and institutional.

We consider that these characteristics provide useful knowledge for the investment of individual investors.

With regard to private investments, we address the differences in investment in regions or countries, incomes and wealth of households, and give particular relevance to the differences between generations and between women and men.

This is the first in this series dedicated to investing in financial markets by women.

It is conducted on the basis of recent studies and surveys on women’s investment in the US and Europe.

We will see that women still invest less than men, the so-called investment gap, due to a number of financial disadvantages and other aspects that limit their influence as investors.

However, the importance of women’s investment has been increasing and will increase in the coming years.

In fact, women already control a third of the wealth in Western countries and it is estimated that it could exceed 50% in the next decade.

Women invest differently than men and achieve equivalent or even higher results.

They focus more on the objectives, focus on family security, are more conservative and invest more with greater stability.

The investment gap poses a critical challenge to life in retirement.

They earn less, have more career interruptions, accumulate less wealth, have lower pensions and live longer than men.

This reality requires a different investment perspective from that of men.

They state that they need greater financial literacy and access to expert consultants who understand their specificities in terms of their objectives, financial situation and investor profile.

The world of personal finance and investment management and consulting is still very much male-dominated, with the presence of women being very little significant

Women control about 1/3 of the financial wealth in developed countries and in the next decade this percentage will be much higher

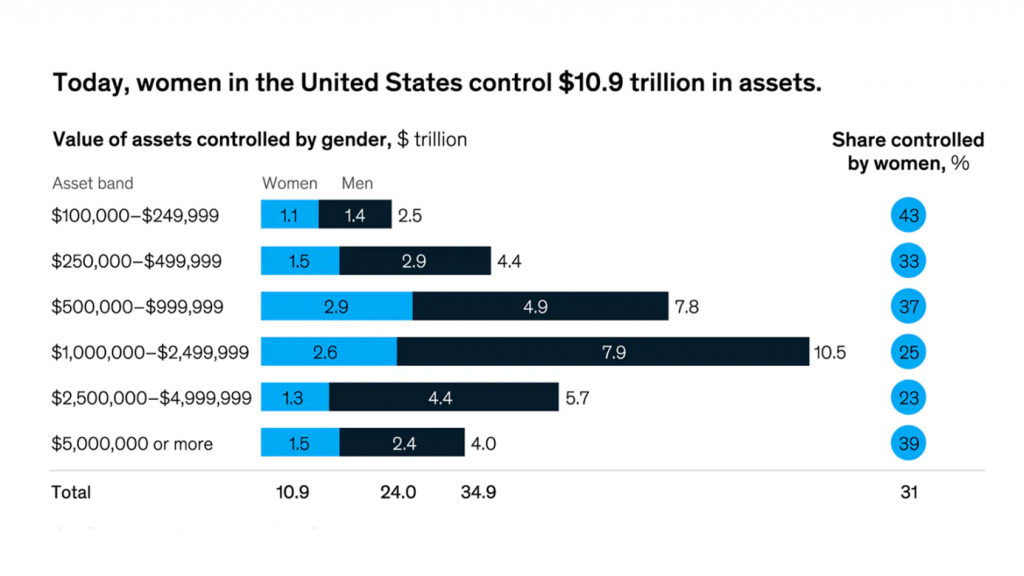

According to the study “Women as the next wave of growth in US wealth management”, conducted by McKinsey and published in July 2020, affluent women already control about a third of U.S. financial assets corresponding to $10.9 trillion:

But these figures will increase significantly over the next decade due to demographic factors.

It is estimated that by 2030, U.S. women control about 30 trillion financial assets as a result of a massive transfer of wealth from Baby Boomers (almost equivalent to U.S. annual GDP) and greater equalisation of women’s labor income.

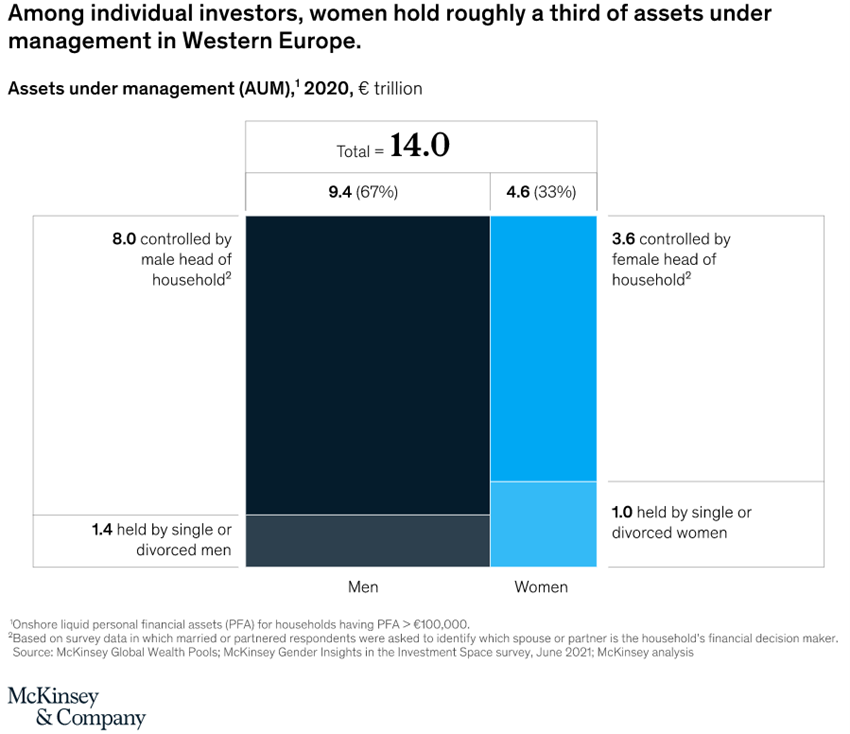

In another similar study, McKinsey’s “Wake up and see the women: Wealth management’s underserved segment”, published in June 2022 and conducted on 3,000 women and 2,000 affluent men in Western Europe, found that affluent European women also control about a third of their financial assets, corresponding to €4.6 trillion:

European women are estimated to control around 45% of their financial assets for the same reasons as in the US by 2030. Women’s assets will grow at 8.1% per year and men’s assets will grow at 2.7% per year.

Women invest more and more, but even less than men, with a gender investment gap enduring

Several recent studies in Western countries show that women still invest less than men, but have significantly increased investment in recent years, reducing the gender gap.

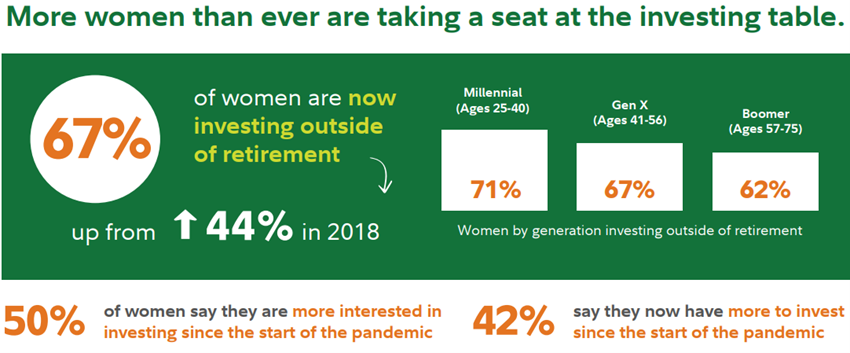

According to a 2021 Women and Investing Study by Fidelity in the US, 67% of women currently make investments beyond retirement, compared to 44% in 2018:

It should be noted that the highest percentages of younger generations, the 71% of Millennials and the 67% of Gen X.

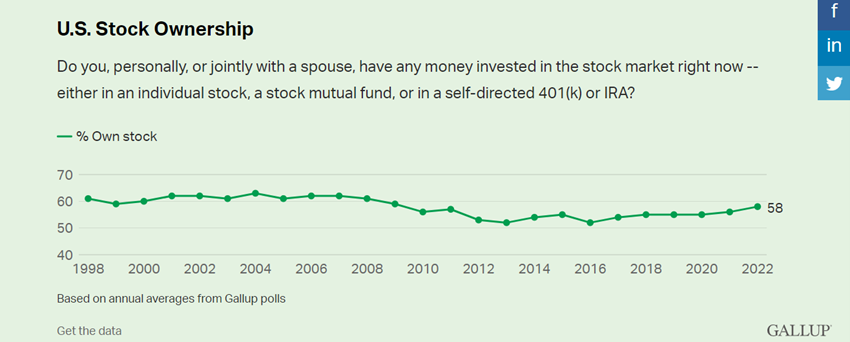

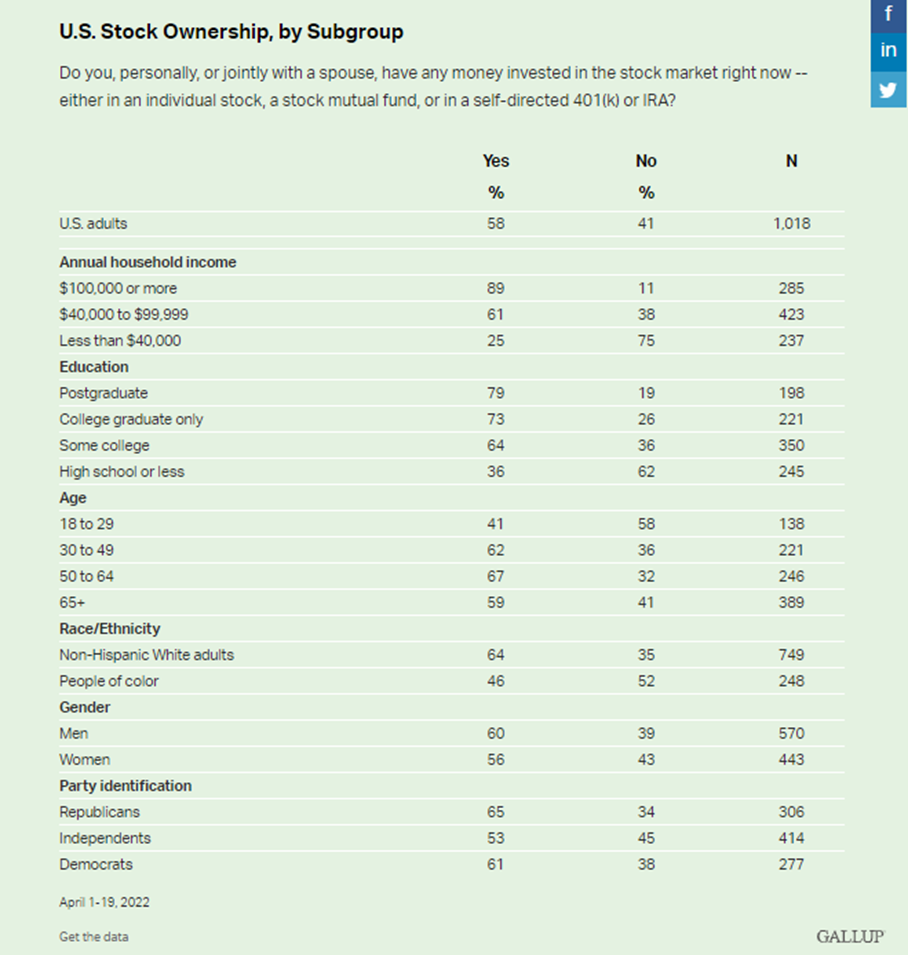

Gallup conducts annual studies on the ownership of U.S. stocks by households (including individual shares, mutual funds or self managed retirement savings accounts), the evolution of which has been as follows:

This most recent survey showed that 56% of women have equity investments versus 60% of men in the US:

This gap has been narrowing over time, of more than 6% at the time of the Great Financial Crisis.

JP Morgan’s survey of 4,000 women from 10 European countries (Austria, Germany, Spain, Finland, France,Italy, Portugal, the United Kingdom, Sweden and Switzerland) in 2021 revealed that two-thirds of respondents identified as investors, compared to three-quarters of men.

And less than one in five women invest regularly, compared to three in 10 men.

The study by N26 in 2022 of 16,000 affluent women and men from 5 major European countries (Germany, Austria, France, Spain and Italy) found that women invest 29% less than men.

However, more than two-thirds of women want to invest more.

Affluent European women invest an average of €857.52 of their monthly income, with the majority investing between €100 and €499 per month.

Affluent men invest an average of €1,184.49 per month.

The main reason for this investment gap is clearly the difference in wages, and consequently the lower accumulation of wealth, because studies show that women save more.

We will analyze this investment gap in more detail in a later article.

However, studies show that there are significant differences in how women and men see, plan and manage investments. We will also see this in another subsequent article.

The Bank of New York Mellon survey of 16,000 women in 16 countries, as well as 100 asset managers managing a total of more than $60 trillion – “The Pathway to Inclusive Investment: How Increasing Women’s Participation Can Change the World” – concluded that increasing women’s investment would have a major positive impact on women’s lives, investment industry and the planet.

If women invested at the same level as men, there would be at least another $3.22 trillion of assets under management.

Perhaps more importantly, as women are more likely to make investments that have positive social and environmental impacts, there would be an influx of $1.87 triillion of additional capital into sustainable investment.

Main motivations and blockages of investment by women

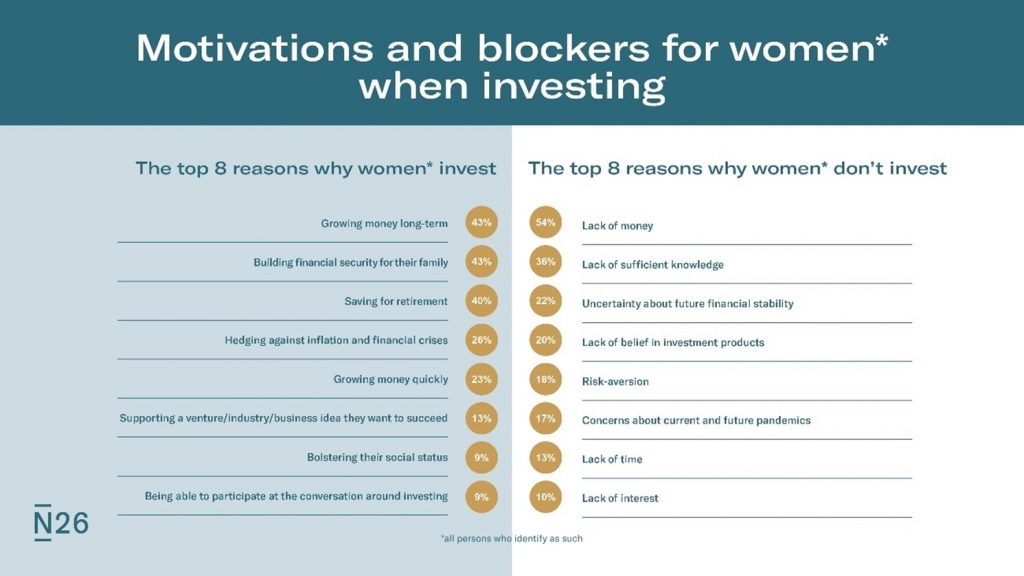

According to N26, the main motivations and blockages of investment by European women are as follows:

At the top of motivations is the growth of long-term capital, the financial security of the family and the savings for retirement.

The main blockages are the lack of money and the lack of knowledge.

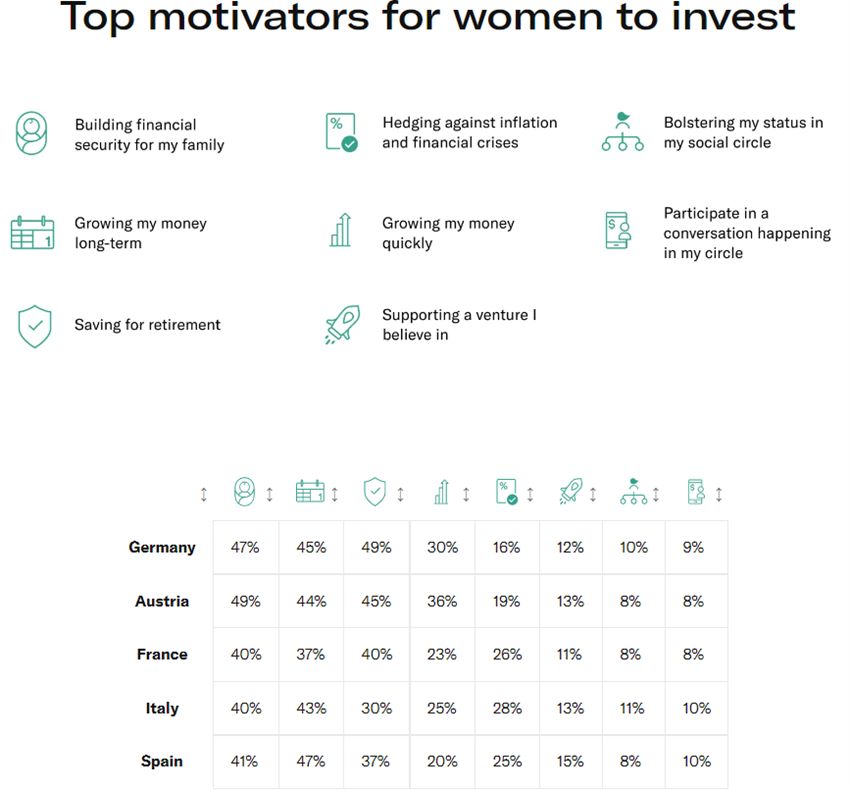

With regard to motivations, there are slight differences between countries:

In southern Europe there is a greater concern about protecting inflation and crises.