#R6 We have the crises of energy and agricultural products.

#R7 Europe’s energy dependency.

#R8 We have increased interest rates with countries with high indebtedness.

#R9 We still have a covid crisis.

#R10 The setbacks of globalization or global fragmentation.

#R11 The famine in Africa.

#R12 Supply chains, the “yo-yo” of “start-stock” or “reset” and “lockdowns”.

#R13 Monetary contraction and stress in less liquid markets such as credit and derivatives.

This is the second of three articles on the exercise of building scenarios for assessing the risks and opportunities of financial markets.

We have taken the current market situation for reference and example of this financial year, in which investors, shareholders and bondholders are incurring major losses.

It is a rich and complex situation of multiple events and acting with intense forces and in opposite directions.

In this article we will continue to develop the risks.

In the third and final part we will address the main opportunities and make a careful balance between risks and opportunities, in order to focus on the determining issues that arise on financial markets.

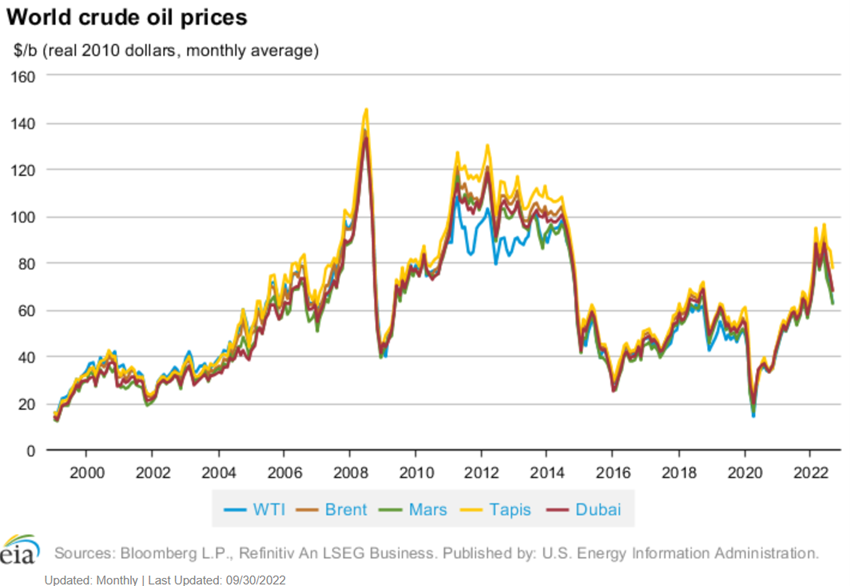

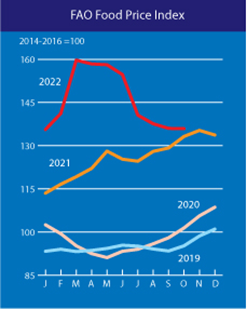

#R6 We have the crises of energy and agricultural products.

Inflation is due to increased prices of raw materials, especially energy and agricultural products, and supply chain problems.

These increases in raw materials were already coming from behind, but they were compounded by the war.

The increase in energy prices brings to our memories the oil crises of 1973 and 1983. The first brought us stout and the second recession.

In previous articles, we developed the theme of the impact of oil on the markets.

The increase in agricultural prices affects mainly the most disadvantaged classes and the poorest countries.

The risks of popular uprisings are greater.

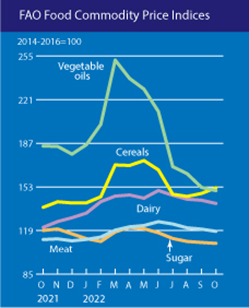

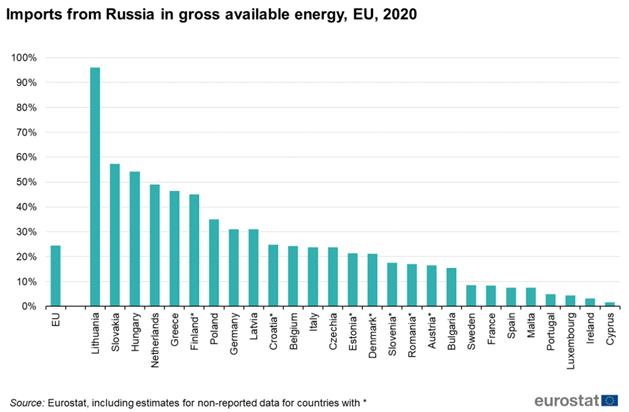

#R7 Europe’s energy dependency.

In the last 20 years Europe has created a great energy dependency on Russia. 40% of its energy needs are met by Russia.

Much of Europe’s oil and gas supply infrastructure is for Russian energy use. Alternatives are not easy.

Oil is controlled by OPEC+, which integrates Russia.

Gas is even more difficult because most European countries are not prepared for more liquefied gas. It depends on the Russian pipeline.

Russia threatens to cut off gas supplies. And winter is at the door.

We have also looked at Europe’s energy dependency in Russia in a previous article.

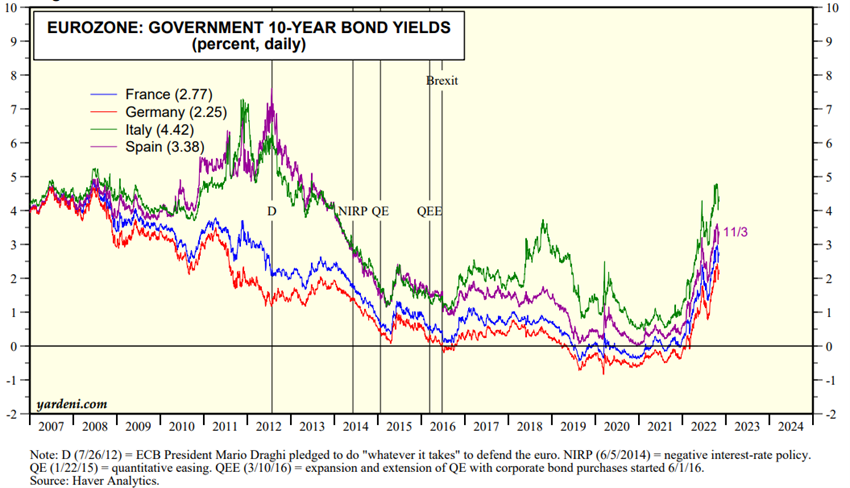

#R8 We have increased interest rates with countries with high indebtedness.

There are European countries with a high level of indebtedness, such as Italy, Greece and Spain.

Less than 10 years ago we had the sovereign debt crisis in the Eurozone.

This has only been surpassed by greater European solidarity and cohesion, and low interest rates. So low they’ve been negative in the last five years.

The increase in interest rekindles this theme. There is talk of European fragmentation.

We have also seen the enormous instability that the UK has experienced, with the unsustained economic mini-programme of Liz Truss and Kwasi Qwarteng.

But it is not only in Europe and in developed countries.

There are emerging countries with a serious financial crisis. Sri Lanka has gone bankrupt. Pakistan, Ghana, Tunisia, Egypt, and Argentina are in serious trouble.

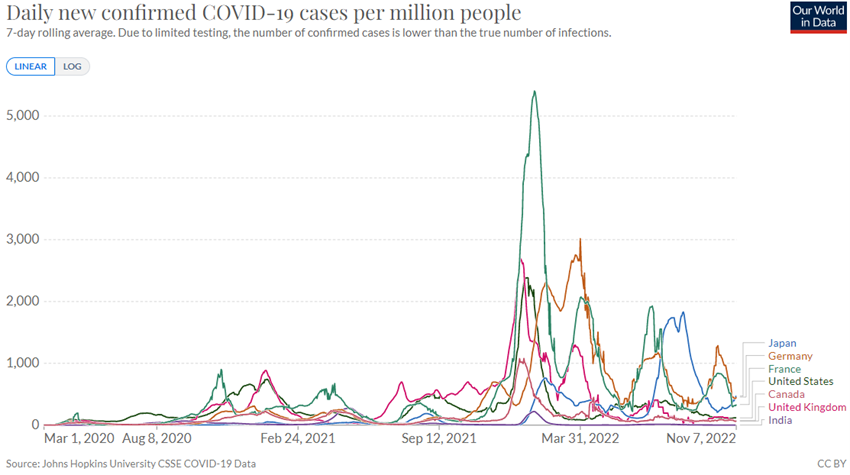

#R9 We still have the covid crisis.

Inflation and war almost made us forget the health crisis. But we still have it.

We may be moving to the state of endemic in developed countries, but in developing countries there is still a long way to go.

Despite improvements and advances, we never know what the future holds.

The risk of more infectious, resistant or more burdensome virus mutations cannot be excluded.

Meanwhile, China’s zero-tolerance policy in China causes successive lockdowns, continuing to undermine the regularization of global supply chains.

#R10 The setbacks of globalization or global fragmentation.

With Donald Trump in the US presidency, a trade war has been unleashed with several countries, notably With China.

The change has brought some unwind.

However, this occurred in the midst of a pandemic.

In addition, the war for technology and cyber nets between the two major world powers, China and the USA, resonated.

There is a common ambition and mutual mistrust that manifests itself from 5G technology to computers.

The war in Ukraine brings new data.

Russia is in the middle of trade with the West. Today is the sanctions, tomorrow will be distrust and the release of energy dependence.

It remains to be heard whether the confrontation between China and the US will not increase global fragmentation.

#R11 The famine in Africa.

Rising prices of agricultural goods and a blockade of Ukrainian exports are adamant of hunger in Africa.

Ukraine is one of the largest producers of cereals and sunflower oil in the world.

Many African countries import more than 50% of these goods from Ukraine. Blocking prevents this trade. They are poor countries and hunger increases.

Not being a direct risk and with strong impact, it is a serious humanitarian problem and can create major geopolitical instability.

#R12 Supply chains, the “yo-yo” of “start-stock” or “reset” and “lockdowns”.

The problem with supply chains is whether the issue boils down to bottlenecks that the pandemic has left or whether it is more serious and structural than that.

The pandemic has brought down activity shutdowns and much economic uncertainty.

The disupposition was strong. Factories stopped, tourism (travel, accommodation and catering) fell sharply, there were many redundancies, and retailers reduced orders as a precaution.

GDP fell by more than 20% in a single quarter and 5% in a year in many Western countries. The recovery was equally abrupt and strong. Now a possible recession is admitted.

Under these conditions, it is difficult to plan and manage orders and inventories well.

The supply chains are global. Returning to normality costs. Reactivating companies for full activity takes time.

The aggravation is also the lockdowns in China and the world fragmentation, previously mentioned.

#R13 Monetary contraction and stress in less liquid markets such as credit and derivatives.

Markets are myth sensitive, so the slightest signs of disruption or instability the movements are very violent.

Examples of the recent performance of Credit Suisse’s stock and the volatility of very long British treasury bond prices are a good example.

The risks are higher in less liquid markets, such as credit and derivatives, which is added to the high leverage that developed during the period when the cost of money was very low.