We are witnessing a change of regime or structural paradigm, to a situation that is new and that many have never lived.

In the initial article we made the introduction and presentation of the approach to the theme.

In the second article we showed what happened in 2022, from a more global perspective of the development and performance of economic cycles and financial markets.

In the third article we analyzed the year 2022 in more detail, to identify the factors and consequences of this paradigm shift, at the conjuncture and structural level.

In the fourth article we said that market valuations are very important in this cycle change and that a process of adjusting excessive valuations of the recent past is underway, earlier in bond markets than in the stock markets.

The goal is to understand what works in this cycle change, so that we can better design the future.

The process of adjusting financial markets, especially in the stock market, has resistance, lags and set-up of expectations

We saw the market adjustment process in the previous article.

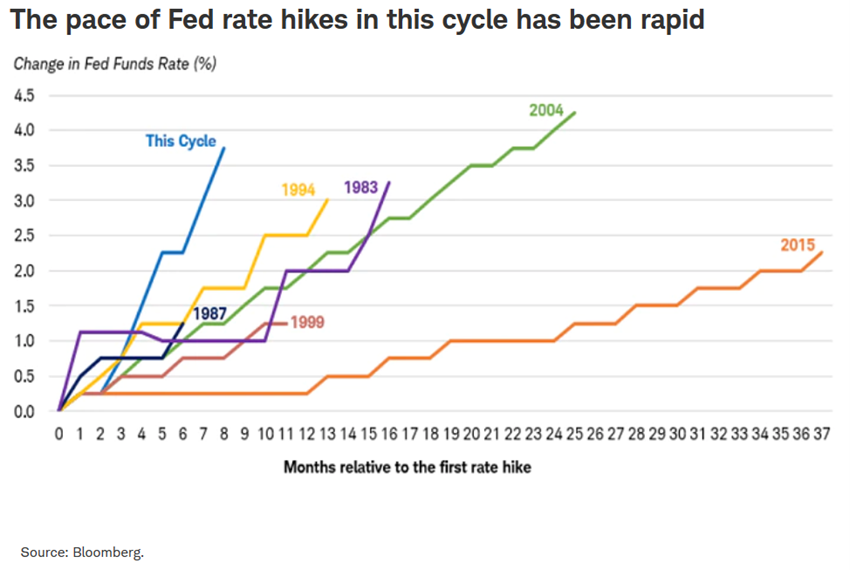

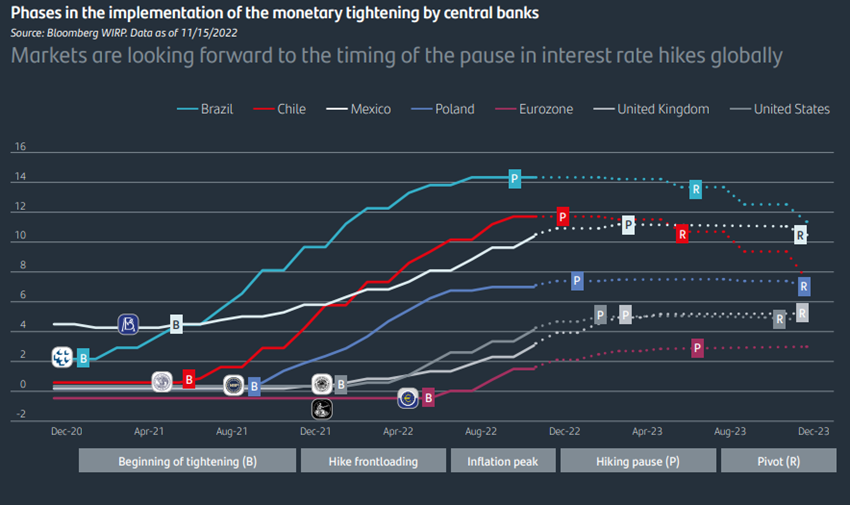

The pace of interest rate hikes by the FED has been rapid compared to what has happened in the past:

However, the ongoing process faces resistance from the markets, suffers from economic effects and is subject to the set-up of expectations by investors who cause a disconnect between the economy and markets and that it is important to be present.

#1 The resistances of the wealth generated

The resistance of the markets is the huge cushion of financial wealth created in recent years.

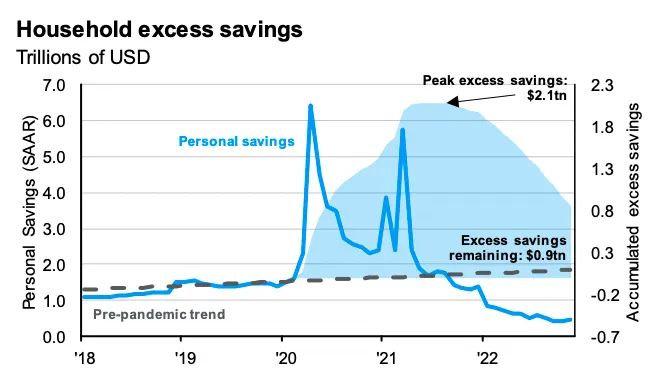

During the pandemic, tax incentives were granted to support families that generated huge amounts of excess savings.

These savings were given between 2020 and 2021 and are estimated to be about $2.4 trillion in the US and nearly $1 trillion in the Eurozone.

Since then, much of this excess savings have been spent due to the reopening of the economy, recovery of consumption, and the increase in inflation, especially that of the lower and middle classes.

This excess is expected to be fully consumed this year.

These stimuli generate a cushion of resistance to the containment of aggregate demand, keeping consumption at a high level and the rate of participation in the labor market and unemployment at low levels.

On the other hand, the very positive performance of the financial and real estate markets in the three-year period of 2019 and 2021 generated an additional wealth of almost $14 trillion in American households.

The main beneficiaries were the highest income and asset households, and investors (in 2021 alone, the richest 1% increased their wealth by $6.5 trillion).

This wealth makes investors better resist market declines by maintaining and not selling their investments, or even reinforcing investments when declines occur.

#2 Lags of monetary policy

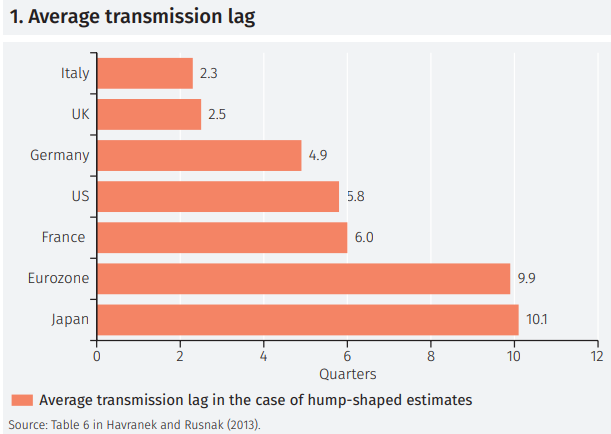

The lags in the effects of the policy change are known.

Between the time when the change in monetary policy occurs and all its effects on the real economy are realized, there is a lag, usually 12 to 18 months for the American economy.

A recent study estimated the following lags in the transmission of monetary policy in the various countries:

The lag period is about 5.8 quarters (almost 18 months) for the US, similar to that of Germany and France, being almost half for Italy and the United Kingdom, and almost double for the Eurozone and Japan.

Central banks, in particular the FED, started quantitative tightening in early 2022, and it is therefore assumed that the effects on the economy will not feel fully until mid-2023.

For example, the impact of rising interest rates is only felt when new contracts are made or only when financing contracts for households and businesses are reviewed.

Large American and European companies only began to feel the impact of the economic slowdown in the last quarter of 2022, starting some redundancies.

Another example is the effects on budget spending.

With higher interest rates the cost of refinancing public debt is higher.

Many of the largest economies have seen a growth in public debt in recent years due to stimulus to combat the pandemic and also to the framework of cheap money.

As the rising cost of debt refinancing is felt, governments will have to contract public spending.

#3 Expectations on changes of FED actions

Expectations are important because they contribute to the formation of asset prices by investors at present.

Market investors are used to an accommodative economic policy regime that lasted nearly four decades.

Whenever financial markets were slightly more correction, central banks came to rescue the economy and markets with their quantitative easing programmes.

This is where the expression of the FED “put” was born, or the FED’s action to support the markets.

Many investors also think that the FED and other central banks will come back to bail out the markets if there is a sharper correction.

This belief results in them not selling, or until they buy in the small corrections. As a result, the market does not fall.

In our opinion, this will not happen.

The FED and the other central banks are determined to fight inflation, aware of its very negative economic effects.

On the other hand, even if they wanted to do so, there is no way to do so.

The balance sheet of central banks is huge due to the accumulation of assets of quantitative easing programs.

This calls into question the credibility and sustainability of the value of fiat currencies.

On the other hand, several analysts believe that inflation will fall faster in its approach to 2% levels which would limit the rise in interest rates and the time of its permanence to a high level.

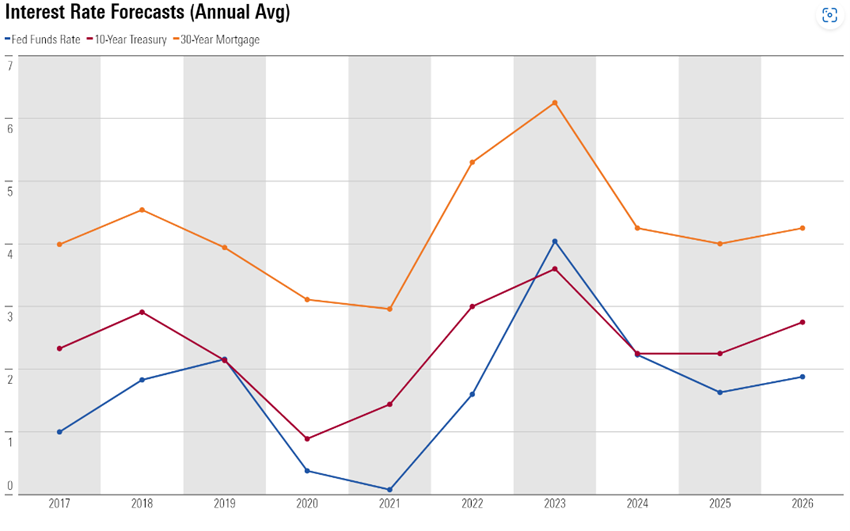

For example, Morningstar predicted last October that inflation would approach 2% by the end of 2023, and that, consequently, the FED would lower the official interest rate later this year:

In contrast, a few days ago, the official FED interest rate implied in the markets for the end of 2023 rose from 4.5% at the beginning of the year to more than 5% today, according to Bloomberg data published in the Financial Times:

The turning point will be when the market sees what the deadline and its level of interest rates central banks will need to bring inflation down to the 2% target

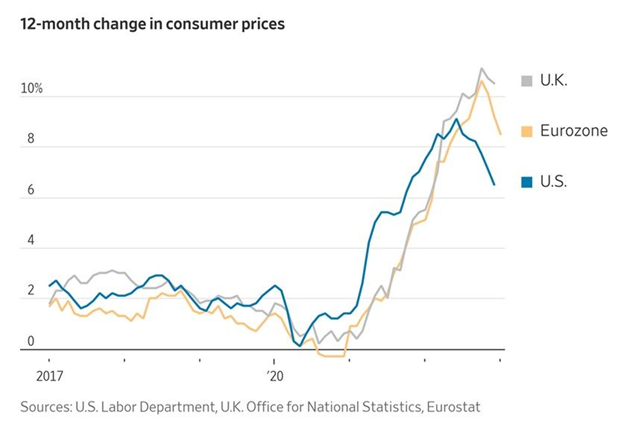

In January 2023, the annual U.S. inflation rate was 6.4% (an increase of 0.4% in the month), and core inflation (without food and energy) was 5.6% (same monthly increase of 0.4%).

These rates compared to 6.5% and 5.7% respectively in December.

The latest FED forecasts for annual inflation are 2.9% in 2023 and 2.4% in 2024.

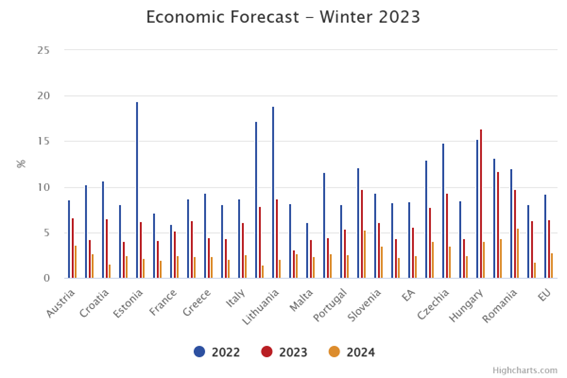

In the European Union, the annual inflation rate will have been 8.5% in January, after 9.2% in December.

Source: Winter 2023 Economic Forecast: EU Economy set to avoid recession, but headwinds persist; European Commission, February,13th, 2023

The European Commission’s annual inflation rate forecasts are 6.4% in 2023 and 2.8% in 2024 for the European Union, and 5.6% in 2023 and 2.5% in 2024 for the Euro area.

Economists, politicians and investors believe that inflation could drop sharply in 2023 with normalization of supply chains and stabilization of energy and food prices.

However, inflation is showing to be stiffer than expected, especially after the first falls.

In addition, China’s reopening due to the new rules to combat the pandemic will drive increased demand.

The level of inflation and its downward trajectory determine the actions of the FED and the other central banks in terms of the evolution of the level of official interest rates, which are immediately transmitted to longer-term interest rates in the market.

In the first half of 2023, it is expected a fall of the stock markets

Stock market valuations in the U.S. are still very high for current market conditions, as we saw in the previous article.

Therefore, in the first half of 2023 it is expected that the adjustment process of valuations and a fall of the stock markets are expected to continue.

In this period, there will be better knowledge and predictability of the overall economic situation and the earnings of companies, the development of resistance, lags and the revision of investor expectations mentioned above.

We will also have a better perception of the risks of stagflation or economic recession and the evolution of the war in Ukraine.

These factors will provide greater clarity for the estimates of the evolution of company results and for the evaluation of markets.

In the second half of 2023, when the path of inflation is controlled, a recovery of the stock markets will begin

When the market has a better prospect of the economic conditions needed for inflation to continue towards 2% levels – notably the level and term of higher interest rates, and their effects on economic growth, business results and unemployment – the adjustment process will be complete.

From that moment on, and at a lower valuation level than the current one, the stock market will begin a recovery that will be a great opportunity for investors.

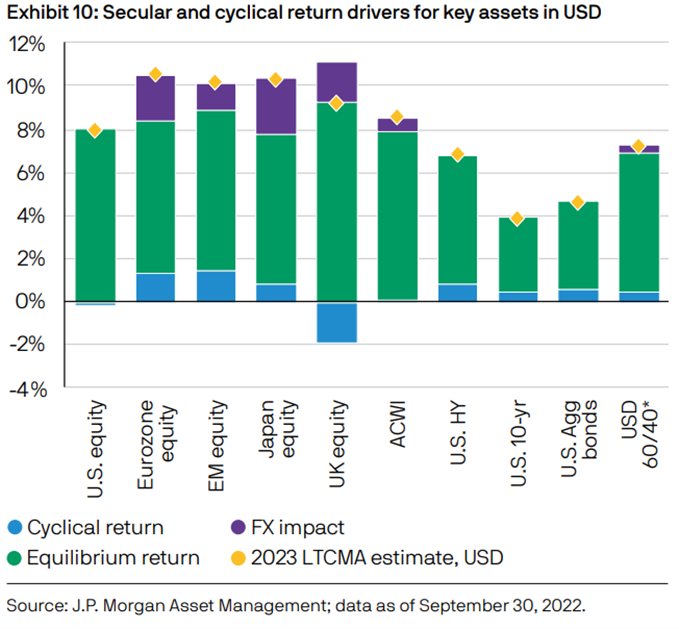

The medium- and long-term return on investments will be in terms of historical average yields, as shown by recent studies by JP Morgan and Vanguard, among others, which we have seen in other articles: