Women think they are less confident than men in investments

The results of women’s investments are the same, and in some cases better than those of men

Women have a different mode and style of investment management than men

Women are more focused on planning and setting investment objectives

Women are more conservative and invest more in the long run

The selection of investments by women and men shows some differences

Women attach more importance to sustainable investments than men

In the series “How they invest” we discuss the characteristics of the main classes of private and institutional investors, which we consider useful to guide the investments of the generality of individual investors.

For individual investors we present the characteristics and differences of investors from various regions or countries, from the various wealth levels, and above all from different generations and women.

In the initial article in this series on women’s investment we saw that the control of financial assets by women in the Western world is already very significant and growing and that women invest more and more, but even less than men.

In this article we will analyze the main differences in investments between women and men.

Women think they are less confident than men in investments

In the various surveys conducted women show less confidence than men in investment management.

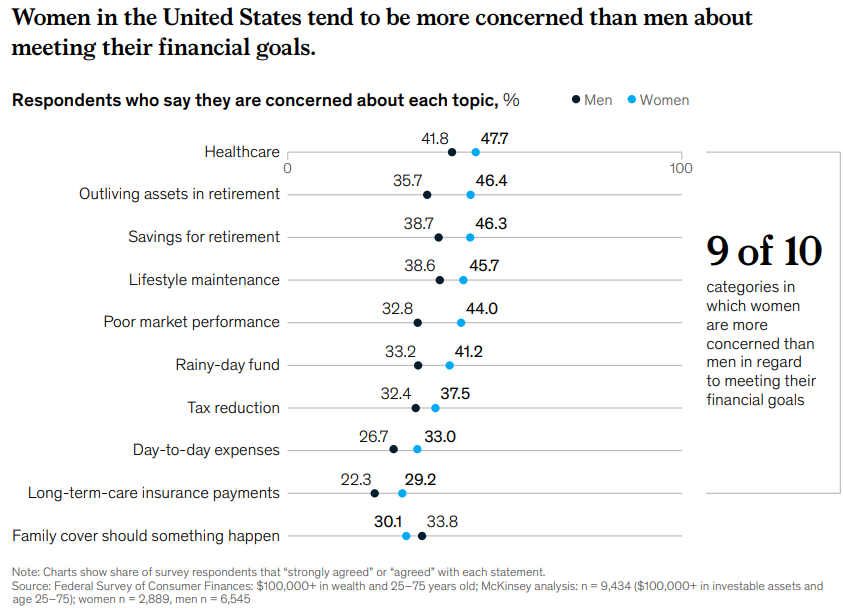

In McKinsey’s Study “Women as the next wave of growth in US wealth management” in the U.S., published in July 2020, many women say they have less confidence in their own financial decision-making and investment acumen.

Only a quarter of affluent women say they feel comfortable making individual decisions related to investment and savings – 15 percentage points lower than their male counterparts.

In the study by the same company in the European market, “Wake up and see the women: Wealth management’s underserved segment”, published in June 2022, few investors reported feeling uncomfortable when they made financial decisions in their portfolio, but women were twice as likely as men to say so, 18% versus 9%.

In the “2021 Women and Investing Study” survey conducted by Fidelity in the USA, only 33% of women see themselves as investors:

And only 9% of women think they make better investors than men, despite research showing that they consistently get better returns.

Women’s confidence increases with age. 46% of Millennial women feel able to handle investments, compared to 60% of women in the Silent Generation.

The results of women’s investments are the same, and in some cases higher, those of men

In general, the results of women’s and men’s investments are equivalent, and in some cases, better.

According to Fidelity’s analysis of 5 million customers, U.S. women earn better investment returns than men, at about 0.4% a year over the past ten years.

Women are less impulsive investors than men. Reports show that women make fewer transactions and even look at their investment accounts less often than men.

McKinsey’s study in the European market estimates that women achieved an average annual return of 5% in their investment portfolios, compared to 6% of men.

This difference is due to a more conservative asset allocation.

Mercer’s 2021 “Women experience a retirement savings gap of 30%” study at 600,000 accounts participating in group retirement plans in Canada over a five-year period also found that the performance of female investment equaled – or exceeded – that of men.

In all age groups analyzed, despite the lower savings rates, accounts held by women had slightly higher average returns (0.1%). This is probably due to women’s greater affinity for diversified solutions within workplace retirement benefit programmes – again observed in all age groups.

Women have a different mode and style of investment management than men

Although there are also variations within the groups, studies reveal differences between women and men, on average, in their attitude towards financial advice, approach to investment, decision-making style and risk profile.

As a group, women are more likely to seek professional advice and less likely to feel confident about their own competence in making financial decisions.

Female decision-makers tend to be less risk tolerant and more focused on life goals.

Women are more focused on planning and setting investment objectives

McKinsey’s study in the U.S. concluded that women focus more on real-life goals than men:

For most women the main goal is not to overcome the stock market.

Retirement is the big theme. Women have about ten percentage points more than their male counterparts saying they are concerned about surviving their retirement assets and having enough savings for retirement.

Health is also at the top of its priorities. Women are more likely than men to worry about health care costs, pay for long-term health insurance, and be a burden to others later in life.

In addition to these long-term objectives, women also want more help in managing their bank accounts and other day-to-day financial needs.

The JP Morgan study concluded that European women have the same main objectives:

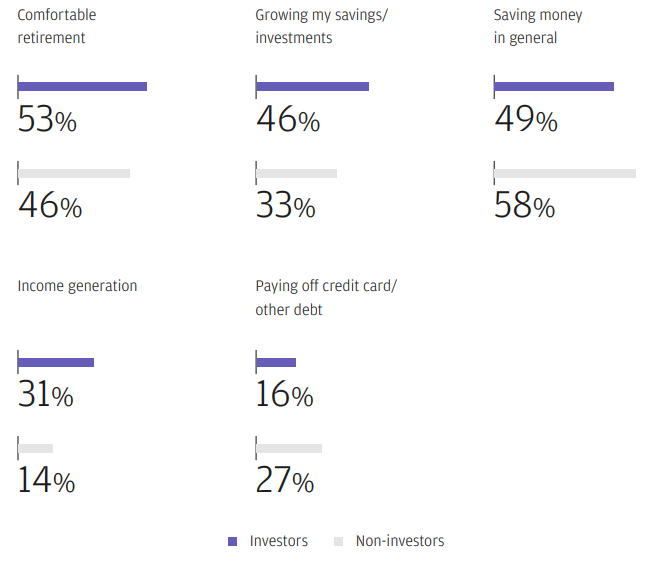

Its priority is to increase savings and investments with a clear focus on a more comfortable life in retirement.

Women who invest have more specific, wealth-increasing priorities, while those who do not invest have a less well-defined and shorter-term purpose.

N26 found that 43% of European women rate financial security and wealth in the long term as their top priorities.

In reverse, only 23% say that growing their money quickly is a primary goal.

.

Women are more conservative and invest more in the long run

In the U.S. McKinsey study, women show lower risk tolerance. Women are almost ten percentage points less likely than men to say they would run great investment risks for the potential for higher returns.

Fidelity also concludes that women tend to invest more conservatively. Women maintain, on average, 68% of their portfolio in cash and cash equivalents, against 59% of the average portfolio of men.

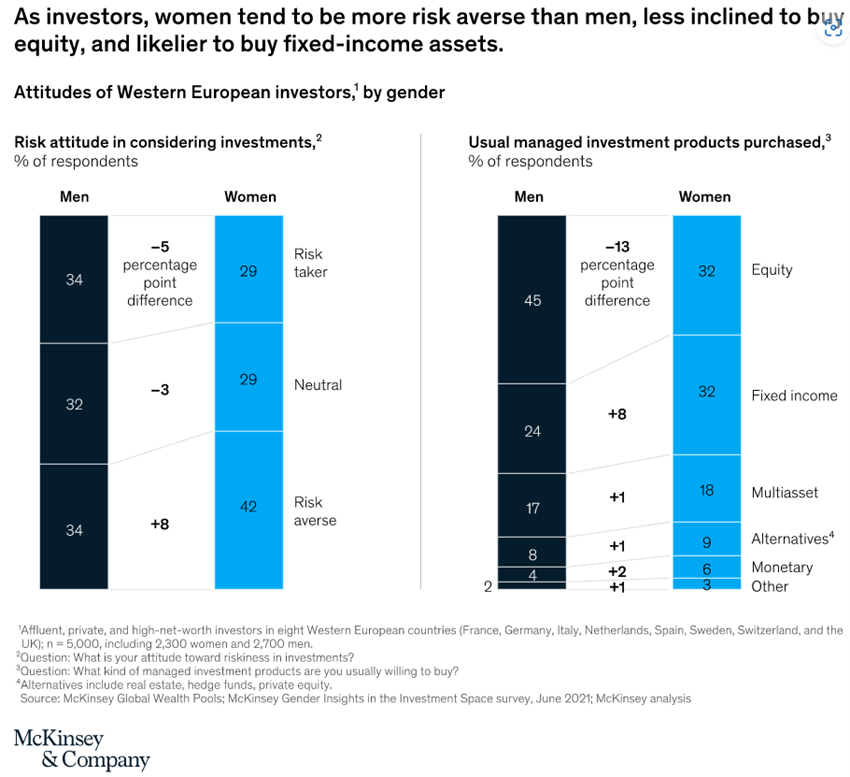

McKinsey’s European study reveals a higher percentage of women than men (42 percent versus 34 percent) compared to taking a risk-averse approach to asset allocation:

Women’s allocation to fixed income investments is eight percentage points higher than men’s (32% versus 24%), while their allocation to shares is 13 percentage points lower (45% versus 32%).

In addition, more men than women held a large portion of their portfolio in assets under discretionary management, such as investment funds, mandates, insurance, among others.

This study also found that women were less likely to modify their investment portfolio more than once a month (36 percent did, compared to 45 percent of men) — but more likely to make changes if their adviser proposed a new investment (32 percent did, versus 24 percent of men).

The N26 study in Europe also indicates that women seem to favour long-term stability over riskier short-term investments.

The selection of investments by women and men shows some differences

According to McKinsey, U.S. women tend to prioritize capital protection over the generation of market-return excesses.

They are also more likely to manage their money through passive investment strategies rather than active investment strategies – preferring low-cost exchange-traded investment funds (ETFs) to most investment funds, for example.

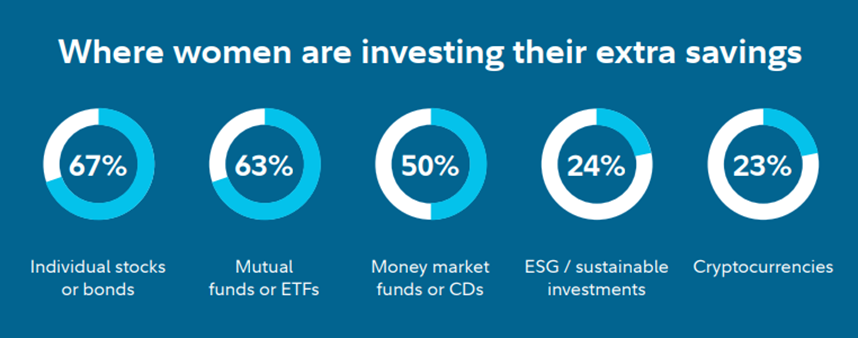

Fidelity’s study points to the following savings investment choices by U.S. women:

More than 2/3 prefer investing in stocks or bonds, either directly or through funds, half make monetary investments and more than 20% make sustainable investments and invest in cryptocurrencies.

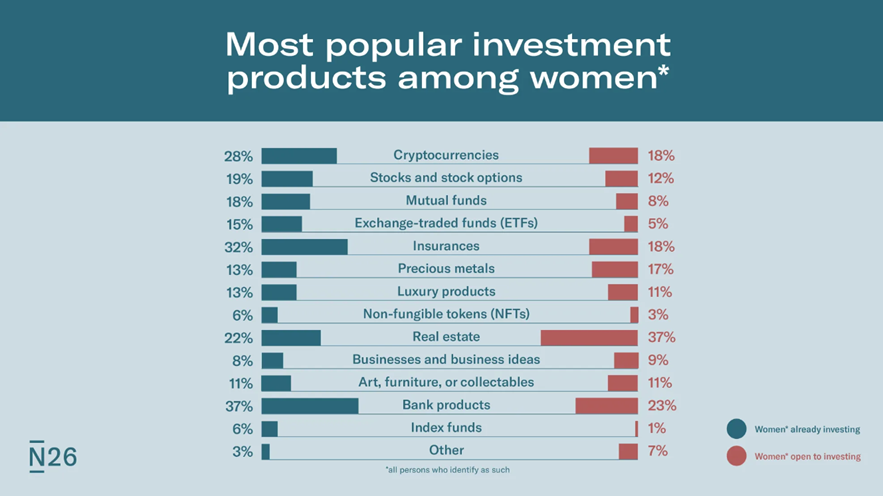

The N26 study concluded that the most popular investment products of European women are as follows:

These data are somewhat surprising, and contrast with the results obtained by McKinsey (which may result from errors in the sample of the population surveyed).

The popularity of traditional, common and current investment products, such as investment funds and EFT, seems too low.

At the opposite end, the popularity of riskier and fashion products, such as cryptocurrencies, seems to be too high.

The strong preference for real estate, banking and insurance products is more predictable, taking into account the family’s protection and security priorities and the more conservative investment profile.

Women attach more importance to sustainable investments than men

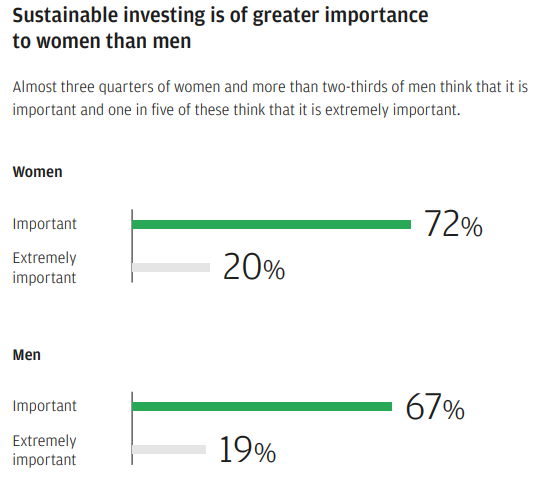

According to the JP Morgan survey, almost three quarters of women and more than two-thirds of European men think sustainable investment is important, and one in five thinkit is extremely important:

And sustainable investment is seen as the most important in Portugal and Spain (85%), and in Switzerland and Italy (82%).

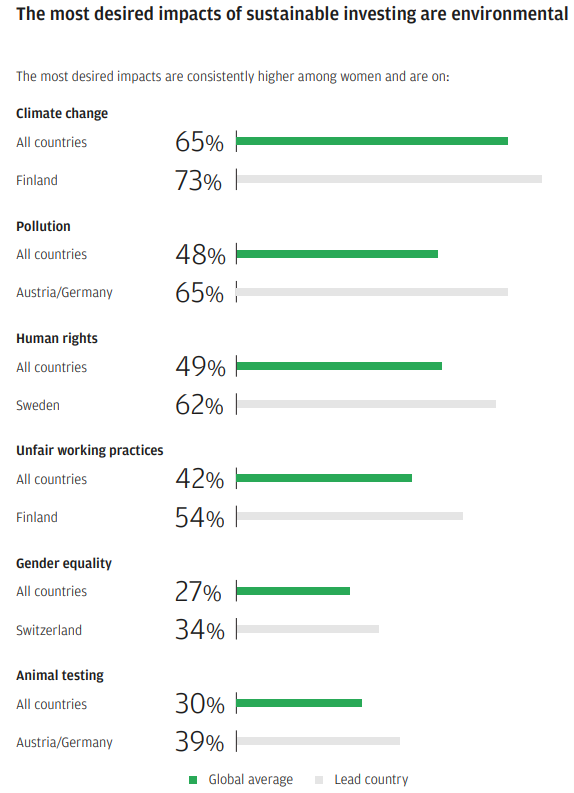

The most desired impacts of sustainable investment are environmental:

In the next article we will deepen the women’s investment gap.

.