The extraordinarily expansive monetary policy of recent years

The extent of the impact of Quantitative Easing on the price of financial assets

Quantitative Easing increases public indebtedness

Quantitative Easing generates inflation

Official interest rates will continue to rise and quantitative tightening will continue

In the first part of this article we saw the importance of monetary policy in investments, as well as its objectives and main instruments.

We said that considering the ongoing policy change it is helpful to relate this article to others recently published, in view of a broader view.

We refer to the previous articles in which we addressed the question of how to act in an inflationary and interest-raising context such as the present.

We referred to another one in which we saw the effect of changes in economic cycles on investments, and how we can position ourselves in those moments.

And finally we pointed out those articles in which we had already deepened the themes of how we can live the frequent corrections of the stock market

and the history and patterns of the various crises in this market.

In this article we will see how monetary policy has been developed in recent times and the course and challenges of the current policy.

The extraordinarily expansive monetary policy of recent years

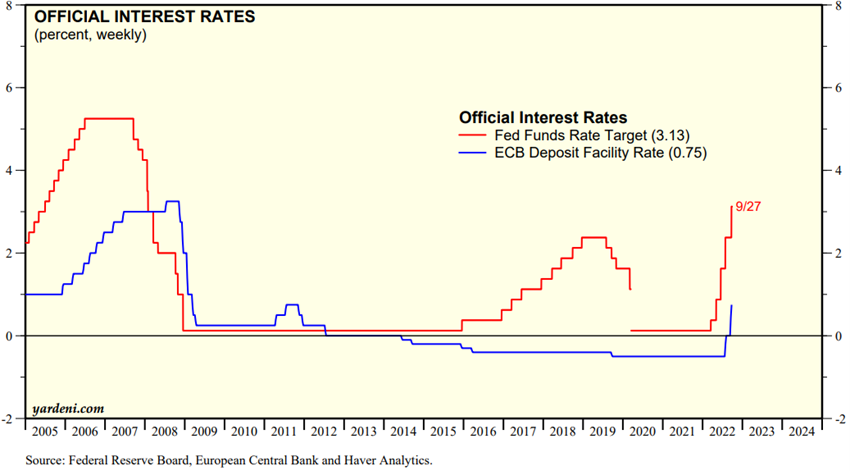

Since the Great Financial Crisis, several monetary stimulus programmes have been developed around the world, most recently reinforced by the response to the pandemic.

Central bank interest rates approached zero and even entered negative ground:

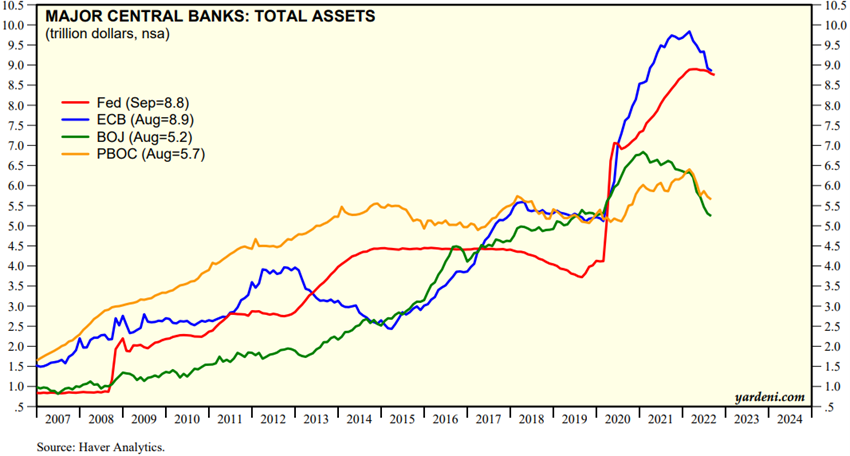

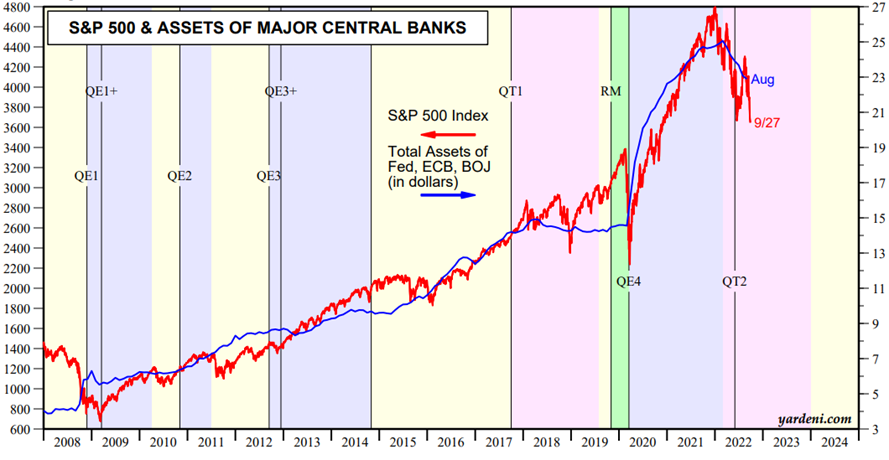

Asset purchase programs intensified between 2008 and 2016, and with even stronger strength in 2020-21:

Source: Central Banks:Monthly Balance Sheets, September,29th, Yardeni Research

In this period, the balance sheets of euro central banks have gone from just over 1Tn to more than 9Tn in the US and eurozone, and those of the Bank of Japan and the Bank of China to more than 7Tn.

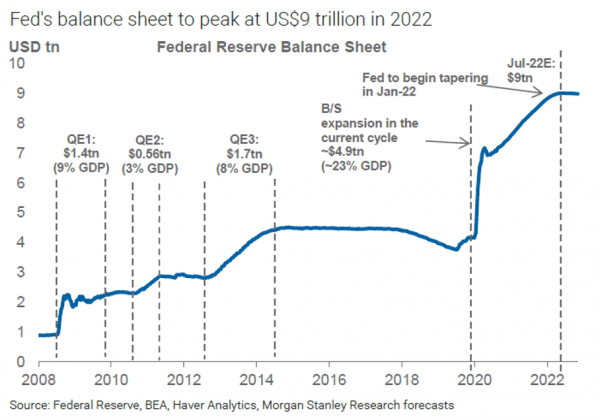

The Quantitative Easing program in the USA had three phases plus the pandemic:

In the first three phases, purchases totaled 4Tn, and in the seismic phase of the last two years, there were more than 5Tn.

The extent of the impact of Quantitative Easing on the price of financial assets

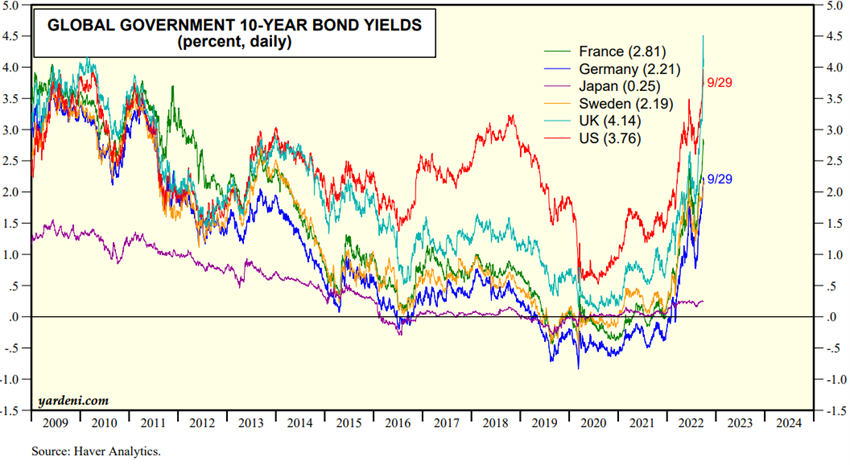

Long-term treasury interest rates followed the evolution of official rates and reflected the facilities of asset purchases:

Source: Market Briefing:Global Interest Rates, September30th, Yardeni Research

Interest rates on 10-year debt rose from 3% per year in 2009 to between 0% and 1% by the end of 2021, and resulted in very positive bond yields.

Then they began to rise abruptly, approaching the levels of the beginning of this period.

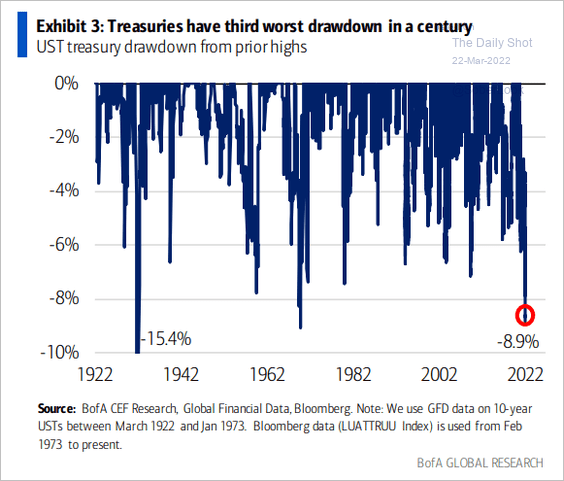

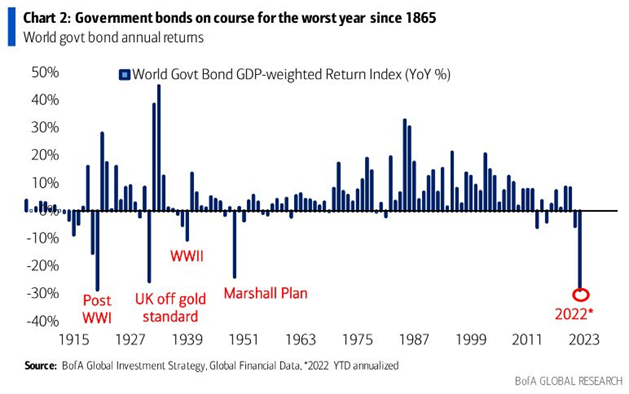

As a result, U.S. and global treasury bonds are having the biggest devaluation of the last century:

The remaining bonds are also recording the same performance, notable gains followed by high losses.

The Quantitative Easing program also inflated the stock price, as we saw at the beginning:

The index of the main U.S. stock market, the S&P 500, shows a significant correlation with expansion of the FED’s balance sheet.

This evidence was at the origin of the expression “don’t fight the FED”.

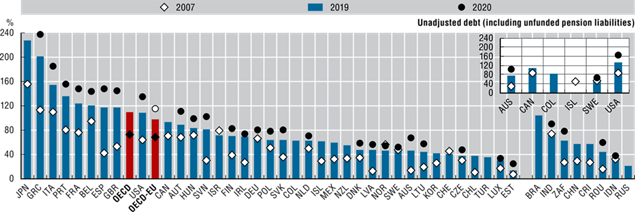

Quantitative Easing increases public indebtedness

Low interest rates have allowed for a significant increase in public indebtedness by most governments:

Source: Sovereign Borrowing Outlook for OECD Countries 2021, OECD

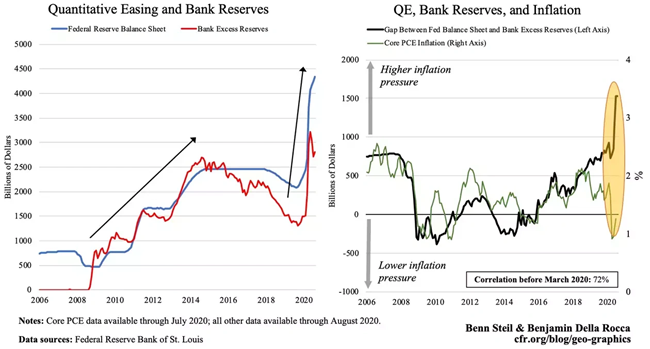

Quantitative Easing generates inflation

These programmes and supply chain problems began to generate inflationary pressures from the beginning of 2021, which worsened with the war in Ukraine that began in February 2022:

Inflation rates in the US and Europe have already exceeded 9% a year.

Inflation is being cross-cutting to various components of the price mix, with emphasis on energy, agricultural products, housing and health care.

The additional problem is that inflation, especially in the US, is passing on to wages, which have increased significantly due to low unemployment and the imbalance in the labour market.

The risk is that this will lead to an inflationary spiral, in which rising prices cause increases in labour costs, which in turn causes a further increase in prices.

Another complication is that inflation is also showing to be quite rigid.

Despite the recent fall in energy prices, the moderation of prices of other goods including agricultural products and materials, inflation does not fall.

One of the main components for this resistance are housing and health costs.

In the first case, even with interest rates on mortgages around 6%, the impact on the market exists, but is moderate.

The main issue is that monetary and fiscal stimulus programs provided extraordinarily benevolent financial conditions, reflected in labor income (including subsidies), capital income and real estate appreciation.

There was widespread inflation in the price of financial assets that allowed a great growth in household wealth.

Families still have a good wealth cushion, as do businesses. So they resist returning to work and real estate gives way little.

Now, in order to combat inflation, liquidity must be extracted.

Some of the more than 6Tn injected into the US, have to be removed.

To reduce inflation, the FED and other central banks want to reduce demand with the least impact on unemployment.

Inflation of 9%, well above the target level of 2%, which is associated with price stability, destroys purchasing power and puts pressure on companies’ margins.

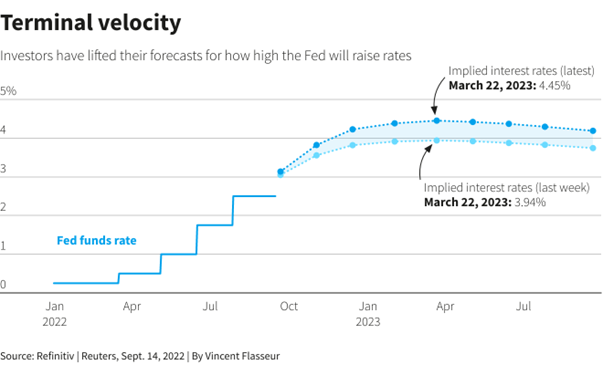

Official interest rates will continue to rise and quantitative tightening will continue

The indication of FED officials and the expectation of market analysts is that official interest rates will continue to rise:

It is also expected to maintain the programs for the sale of assets, reduction of the balance sheet of the FED, or “Quantitative Tightenig”.

This FED program is currently on sale at $95Bn per month.

In the case of the Bank of England it was expected to sell €8.9Bn per month from October, but the change of government recently reversed the decision.

The ECB is not expected to start this programme until the first quarter of 2023.

This relative delay is not alien to the difficult economic and financial situation aggravated by the war in Ukraine, the high indebtedness of some countries, and the fear of European fragmentation.