Central banks have extended stimulus too much, letting inflation rise to very high levels, which have worsened further with the war in Ukraine, creating a price bubble that burst in 2022

Biases such as loss aversion and recent memory betray us, making us forget the gains of the recent past

We are experiencing a new disconnect between the economy and markets, opposite to the previous one of the pandic period, which is being corrected by the ongoing adjustment process of valuations that when it ends will give way to a new bull market

Is “cash” king – even emperor – or is it still dead?

This is the first of a set of articles on which it takes stock of 2022, gives an overview of the present and projects the year 2023 and beyond.

This article contains the general presentation of the theme, as well as a quick indication for the analyses and conclusions that will be developed in more detail in the following articles.

2022 was difficult for equity and bond market investments, as we saw in the latest quarterly outlook.

Overall, the losses were large, higher than 20%, in the main indices of any of these two major classes of assets, stocks and bonds, entering the so-called bear markets.

The year 2023 could also be not very good, especially for the stock markets and in the first half of the year.

The economic challenges are immense, the main one being the decrease in inflation.

We urgently need to reduce inflation, driven by monetary policy to reduce demand, which can cause stout ing or even recession.

At the origin of inflation and bear market of 2022 was the monetary policy of recent years that caused cheap money, and which generated excesses of asset price valuations

In previous articles we looked at the quantitative easing of monetary policy in recent years which was one of the causes of inflation, as well as the need for its term and reversal to “quantitatite tightening” in order to quickly halt inflation and avoid more permanent negative effects on the economy.

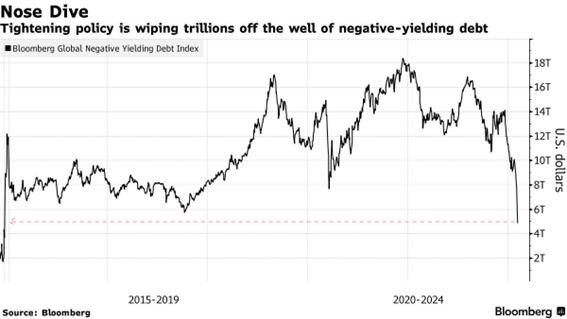

We have also seen that these long years of monetary stimulus have brought interest rates to near zero levels, even negative, creating valuation excesses in the markets.

Source: Market Briefing: European Interest Rates, Yardeni Research, 30/01/23

This was further amplified by the fiscal stimulus for the recovery of the economy from the pandemic.

For a long time there was a lot of cheap or virtually no-cost money, which generated excess savings and capital available for investment that resulted in market excesses.

There have been periods when large amounts of treasury bonds have recorded negative interest rates, which is an economic and financial abnormality or irrationality, as we said at the time.

It invested in everything and all the assets in which it was invested valued a lot.

It happened with the stocks of large companies, bonds, and real estate prices.

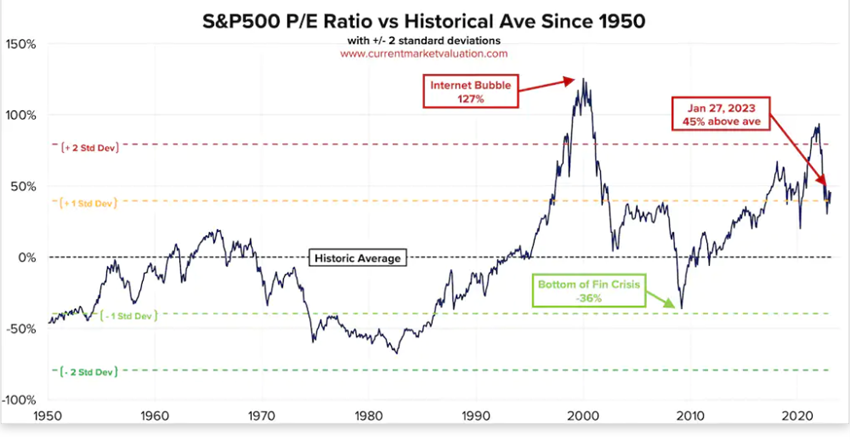

These stocks of large companies have reached valuation multiples well above the historical average, and have surpassed bands of values that usually only occur in situations of market bubbles.

The S&P 500 reached per multiples of 27x and the Nasdaq of more than 30x, levels of more than 2 standard deviations from the average.

Some of the stocks that make up these indices had PE ratios of more than 100x or 200x.

But these extraordinary valuations have extended to other segments and fringes of the market.

In fact, the more peripheral, or less liquid, the segments, assets or securities, the higher the valuations.

The stocks of small and medium-sized, and growth companies, which are the most sensitive to interest rates, rose more than the largest and reached even higher valuation multiples.

The number and the values of stock exchange entries exploded, either through initial public offerings (IPO), or by the fashion of SPAC, which are a “fast track” of IPO, so much was the rush of the founders to want to take advantage of the very rich valuations of the market.

The stock prices of companies in financial difficulties, the so-called “meme” stocks, skyrocketed, benefiting from this euphoria and the entry into the field of a new generation of investors, young people, influenced and moved by social networks.

Cryptocurrency prices have flown, also taking advantage of the wave of a new investment trend.

These valuations fed themselves into a spiral that seemed endless.

The assets that rose the most were preferred by investors.

They were the most talked about and followed by investors, and attracted more capital, which made their prices go even higher.

In other words, market excesses have resulted primarily in overvaluation.

The financial wealth created in this period was very high.

In the U.S. alone, there were $2.3 trilion of surplus savings associated with fiscal stimulus and $14 trillion in real and financial assets valuations (primarily real estate, stocks and bonds).

Central banks have extended stimulus too much, letting inflation rise to very high levels, which have worsened further with the war in Ukraine, creating a price bubble that burst in 2022

With inflation rising to high levels, compounded by the effects of the war in Ukraine, central banks had to drastically change their direction, replacing expansive monetary policy with a restrictive one.

In a set of articles published a year ago, we said what the implications of this cycle change were, we looked at the behaviour of investments at various stages of economic cycles and presented the investments that behave better in these inflationary and interest-raising contexts.

When Russia was invasion of Ukraine, we also showed the effect of geopolitical risks on financial markets.

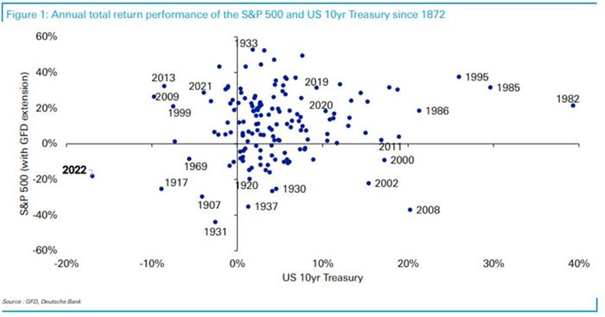

Since just over a year ago, the stock and bond markets have begun to correct and have both entered the bear market, with corrections in excess of 20%, which is an unprecedented case.

This, caused by the rapid rise in official interest rates and their transmission to longer interest rates, is unprecedented in the history of US investment rating bonds, and has meant that many investors felt very sharp losses for the first time.

The many investors who adopt the traditional 60/40 portfolio, of 60% in stocks and 40% in bonds, had losses of 20%.

The same has happened with more conservative risk-profile investors, who invest the largest part in bonds

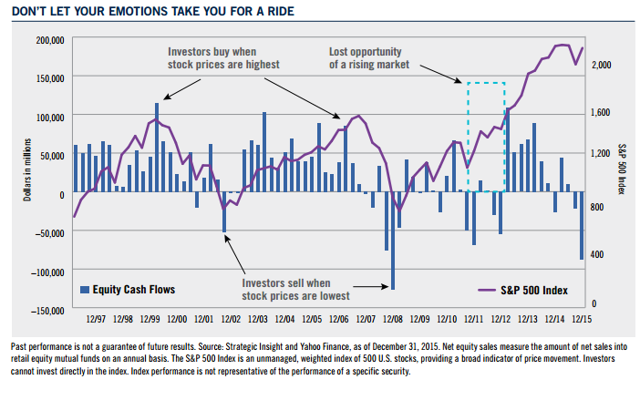

Biases such as loss aversion and recent memory betray us, making us forget the gains of the recent past

Faced with this extraordinary and surprising situation, some investors begin to put the option of giving up investments and opt for their sale and replacement for cash.

This is especially the case when there is no medium- and long-term perspective that should preside over successful investments.

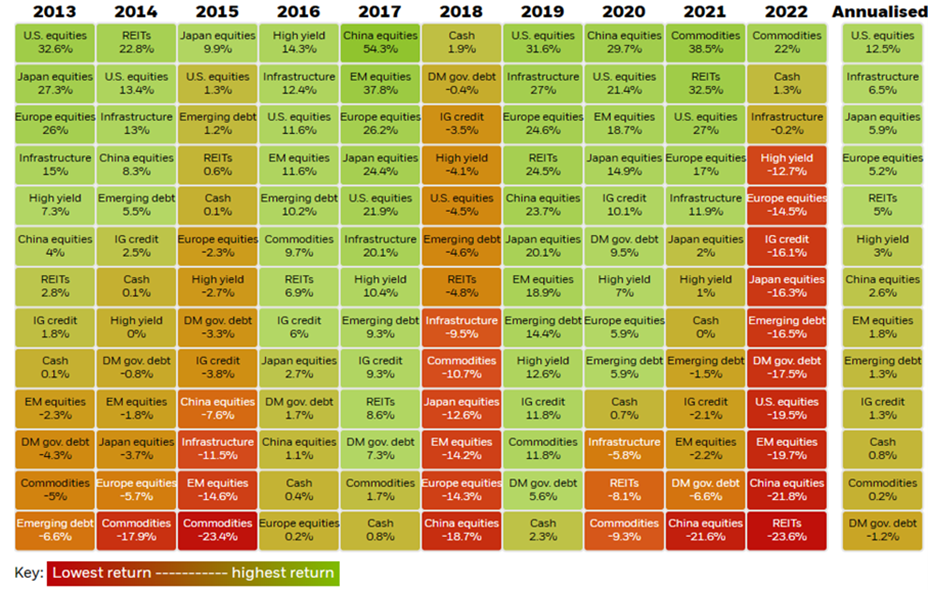

There are many who forget the performances in previous years, which were exceptionally good, both in the stock markets and in bond markets.

Therefore, and in this context, the current corrections are normal.

More importantly , these corrections follow years of very considerable positive performances that we tend to forget.

The skew ed by recent memory or current affairs only reminds us of the losses of the recent past, forgetting the years of previous gains.

This bias is amplified when we lose due to loss aversion.

If we allow ourselves to be guided by these emotions we can have even more significant losses:

The three years between 2019 and 2021 were superb.

The years from the end of the GFC until 2021 were also very good.

The expectation of medium and long-term returns has improved substantially.

What is happening is nothing more than the market reversion to the mean.

Or rather, what is ongoing is the correction of excessive valuations.

This process is tense and intense because there is a lot of resistance and barriers left by the last few years to break down to achieve the reduction of high inflation.

The labour market is very narrow, with many people leaving the workforce.

The sharp valuations of financial markets have generated a lot of wealth in investor households which provides greater capacity to withstand losses and availability of investment capital as soon as the first signs emerge that the adjustment process is ending.

That is why the market falls have not been deeper so far, that the stock market has risen in the last quarter, but that also inflation is still very high.

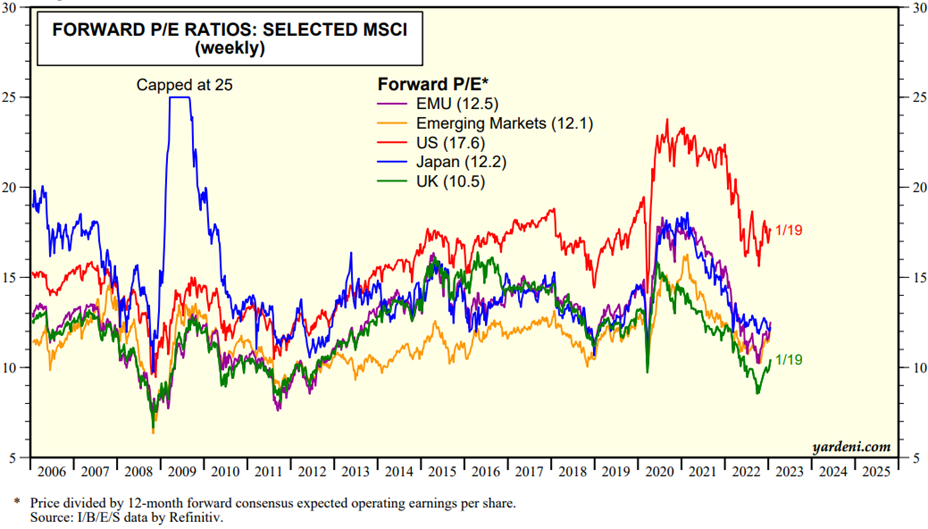

We are experiencing a new disconnect between the economy and markets, opposite to the previous one of the pandic period, which is being corrected by the ongoing adjustment process of valuations and which when it ends will give way to a new bull market

There is a new disconnect between the economy and the markets, again provoked by monetary and fiscal stimulus policies, but now in reverse.

Previously the economy was falling and markets were going up.

Now markets fall and the economy resists.

The adjustment process will end just not known is when.

The drop in valuations already indicates that the end of this process will be closer.

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, 24/01/23

In fact, after a long bull market in stocks and bonds, we live a bear market in these assets, which will end with the start of a new bull market in both.

We know that bull markets provide valuations much higher than bear market corrections and usually last much longer.

Therefore, it is best to prepare for the next positive cycle of markets, analyzing the opportunities that markets provide us with the end of these corrections.

These investment opportunities in which we can invest at prices much lower than the fair value of assets are very exceptional, in some unique cases, for the establishment of a long-term investment portfolio.

The most recent studies of the prospects for long-term returns show that they are already at the most interesting levels of the last decade and just below those of the exit from the Great Financial Crisis of 2008.

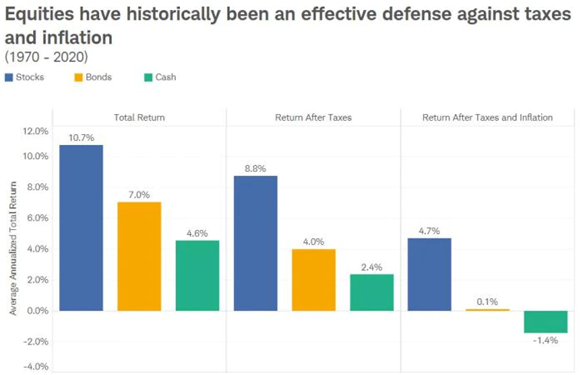

Is cash king – even emperor – or is it still dead?

In corporate finance there is a saying that “cash is king”, to the extent that the real measure of wealth creation of companies is the generation of cash-flows and not just profits.

In contrast, in personal finance it is said that “cash is dead”, since its medium and long-term yields are much lower than those provided by investments in financial assets, stocks and bonds, and in many cases do not even compensate for average inflation.

Last year’s cycle change made cash not the king, but the emperor, for personal finances and investments.

But this would only be true if we had been able to anticipate the movements and even better… to return to the markets in time to catch the subsequent recovery.

Since most of them cannot do so, what was recommended was a more defensive attitude, from adjustments to allocations to less volatile investments.

2022 was a difficult year for the investment of stocks and bonds, but we forget that previous years provided above average returns due to biases such as aversion to loss and recent memory.

Just look back at the first image we presented.

We know that in the medium and long term, cash is a bad investment.

Only investment in stocks and bonds have very attractive returns that outweigh inflation.

Source: Stocks, Bonds and Cash: The building blocks, Schwab Moneywise, Charles Schwab

We also know that the capital market operates for cycles and that in the medium and long term it provides interesting returns.

And with inflation at these high levels, now more than ever, we need to find investments that can compensate the devaluation of the purchasing power of our assets

These are the themes that we will develop next in more detail, in order to understand where we are and where we are going.