The high-yield bond market

Business cycles determine the performance of high-yield bonds

Advantages and disadvantages of investing in high yield bonds

From time to time we discuss investing in bonds.

This discussion becomes more heated when there is instability or anomalies in the market.

In recent years, this situation has happened when long-term investment-grade bonds have reached negative implied rates of return in the Eurozone and close to zero in the US, and last year, when bonds suffered unprecedented devaluations, by almost 20%.

In the short time in which these situations occurred, there were those who defended extreme and diametrically opposed positions, between the accentuation of investment in bonds due to the fear of losing the security they provide, and the giving up of this investment in the face of the devaluations verified.

That is why we recently republished a set of articles on bond investing.

Then we decided to publish some articles about a little-talked about bond segment, the “high-yield” bonds.

In the first part of this article we saw what “high-yield” bonds are and their historical performance.

In this second part we will see the performance cycles of these bonds, as well as the advantages and disadvantages of investing in these securities.

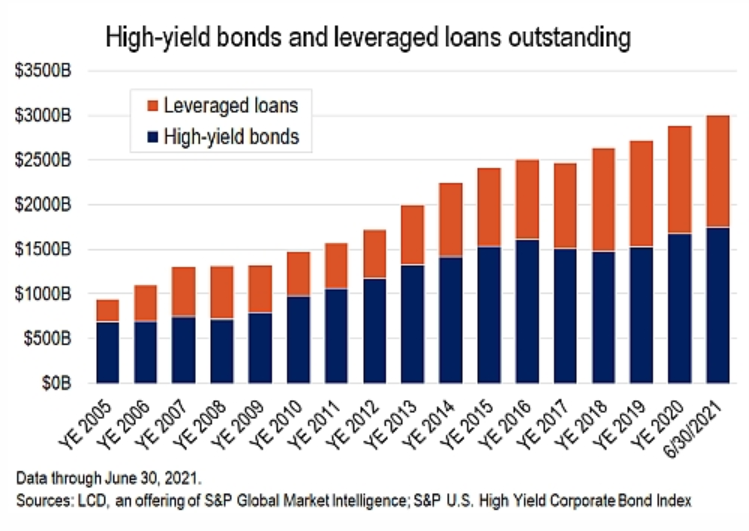

The high-yield bond market

The global high-yield bond market is valued at more than $1.5 trillion outstanding, with more than 1,500 issuing companies ranging from large multinationals to small and medium-sized enterprises.

Business cycles determine the performance of high-yield bonds

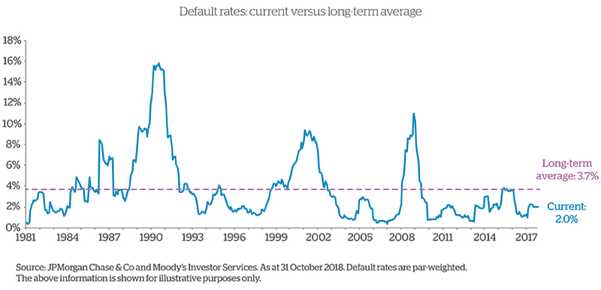

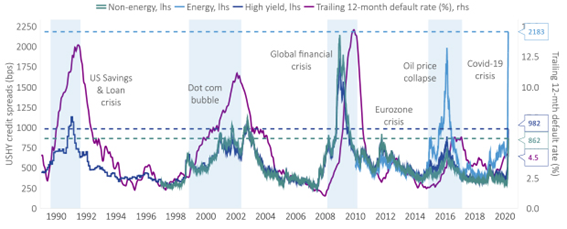

What determines the performance of high-yield bonds are the cycles of the credit market, more than any other factor such as the level of risk-free interest rates, and an understanding of the growth phases of the business cycles (recession, recovery and expansion) is critical.

The following chart shows the evolution of spreads and default rates on high-yield bonds since 1990 (“spread to worst” is the lowest implied rate of return, considering early repayment)

Recessions

High-yield bonds tend to be susceptible to recessionary environments, as economic downturns typically result in lower economic activity and make it more difficult for bond issuers to service their debt.

Credit spreads also tend to widen in these environments in anticipation of increased defaults.

In recessionary environments, high-yield bonds tend to outperform stocks, but generally underperform “safer” fixed-income asset classes such as government debt or investment-grade companies as investors migrate to safety.

Recoveries

During the recovery phase of the economic cycle, companies generally seek to improve their balance sheets by reducing non-performing assets and repaying or restructuring debt.

The risk of default during these periods tends to decrease as economic activity grows and it becomes easier for companies to repay their debt.

High-yield bonds tend to outperform in these environments as default rates fall, credit spreads narrow, and higher coupons contribute to higher returns than other higher-rated bonds.

Expansions

During economic expansions, economic and credit conditions typically improve.

Generally speaking, companies are able to make more profits, which makes it easier for them to service their debt. Spreads tend to narrow. High-yield bonds tend to outperform.

As the cycle matures, interest rates rise as central banks contract monetary policy to slow the economy.

High-yield bonds tend to be more resilient to rising interest rates than other fixed-income asset classes due to their shorter duration and higher coupons.

Advantages and disadvantages of investing in high yield bonds

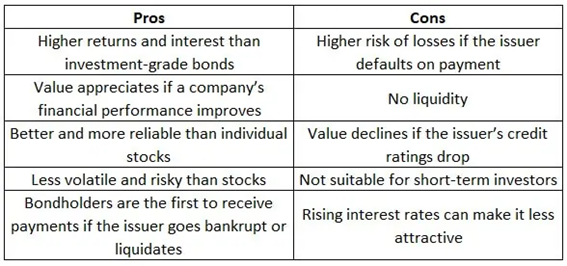

With the subclass of high-yield bonds having a low correlation with other segments of the fixed income market, as well as a lower sensitivity to interest rate risk, an allocation to high-yield bonds can provide portfolio diversification benefits.

Moreover, historically, investments in high-yield bonds have offered similar returns to equity markets, but with lower volatility.

The benefits are diversification, higher current yields and shorter duration

High-yield bonds can offer investors a number of potential benefits associated with specific risks.

#1 Diversification

High-yield bonds typically have a low correlation with investment-grade fixed income segments such as government debt and corporate debt of that rating, meaning that adding these bonds to a broad fixed-income portfolio can improve portfolio diversification.

#2 Higher current yields (interest rates)

High-yield bonds typically offer significantly higher yields than government bonds and many investment-grade corporate bonds.

In addition, the average yields on these bonds vary depending on the economic environment, generally increasing during periods of recession, when the risk of default also increases (high-yielding companies may be more adversely affected by adverse market conditions than investment-grade companies).

#3 Stock-like long-term return potential

High-yield bonds and stocks tend to respond similarly to the overall market environment, which can lead to similar return profiles over a full market cycle.

However, returns on high-yield bonds tend to be less volatile because the yield component in the total return is typically higher, providing an additional measure of stability.

In addition, the combination of higher yields and the potential for capital appreciation (albeit lower than for stocks) means that high-yield bonds can offer total returns close to those of stocks over the long term, with less risk.

#4 Duration (medium term) relatively low

High-yield bonds usually have a shorter average investment term than investment rating bonds, as they are issued at shorter terms and have the possibility of exercising early repayment.

Risk is the highest probability of default against investment-grade bonds

Compared to corporate bonds and investment-grade government bonds, high-yield bonds are more volatile, with a higher risk of default.

In times of economic stress, defaults can increase, making the asset class more sensitive to the economic outlook than other sectors of the bond market.