What are high-yield bonds?

The performance of investments in high-yield bonds is similar to that of stocks

Investing in bonds makes sense in a diversified investment portfolio. But in what kind of bonds?

Bonds provide preservation of invested capital, income stability and diversification from equity investment and are particularly suitable for investors with more conservative risk profiles or for pension supplement investment portfolios.

We have published several articles on bond investing in general.

Recently we published two articles, the first on the benefits of investing in bonds, and the second, on how we should allocate our equity and invest in bonds.

However, all of these articles have given more focus to investment grade obligations.

In this article, the first in a series of three published in succession, we will cover investing in the asset subclass of high-yield bonds.

What are high-yield bonds?

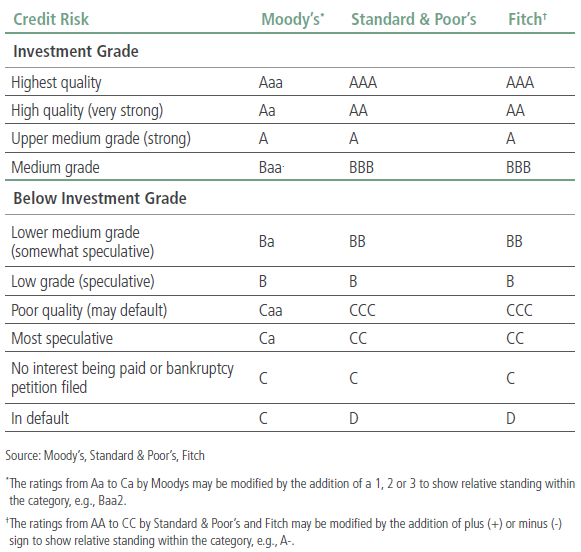

High-yield bonds, also known as junk bonds, are bonds issued by companies that pay higher interest rates because they have lower credit ratings than investment-grade bonds.

In other words, high-yield bonds are more likely to default and therefore pay a higher yield than investment-grade bonds to compensate investors.

High-yield bonds are defined as corporate bonds rated below BBB− or Baa3 by established credit rating agencies, and can play an important role in some portfolios.

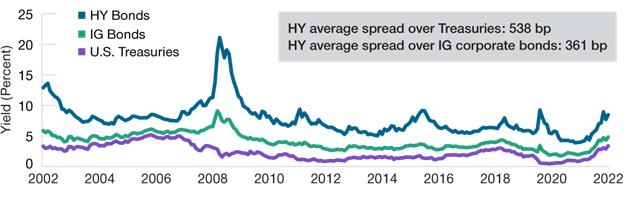

They typically offer higher coupons than government bonds or high-quality corporate bonds (or corporate bonds) and have the potential to increase prices in the event of an improvement in the economy or performance of the issuing company (of course, if these conditions worsen, prices may also fall).

High-yield debt issuers tend to be start-ups or capital-intensive companies with high debt ratios. However, some high-yield bonds are “falling angels,” bonds that have lost good credit ratings.

The performance of investments in high-yield bonds is similar to that of stocks

It is worth noting that the following information and analysis focuses on the subclass of high-yield bonds as a whole, through their main benchmarks, rather than on a specific bond.

In addition, we do not recommend investing in a specific high-yield bond, but rather in a diversified basket or set of these bonds, given the risk of default, which we will see below.

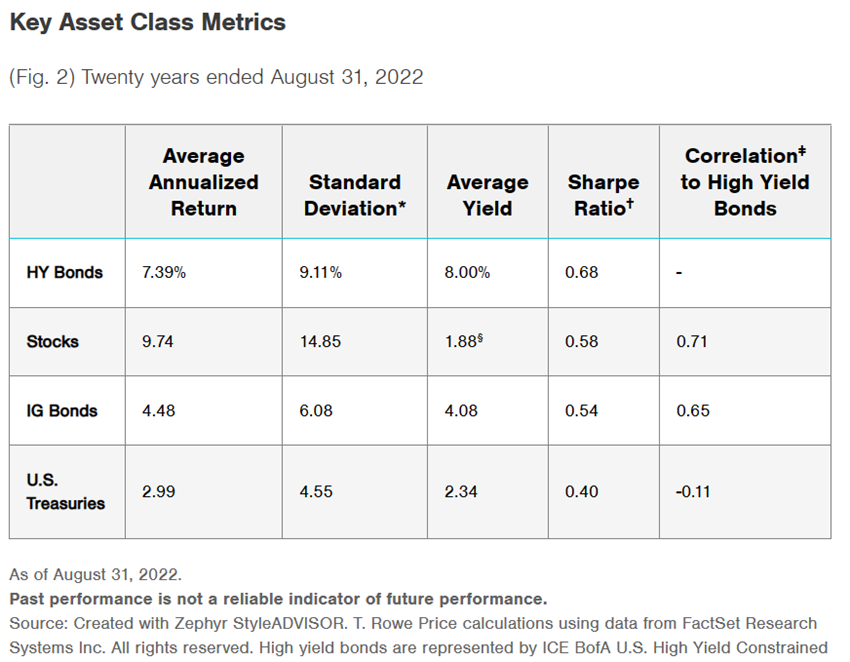

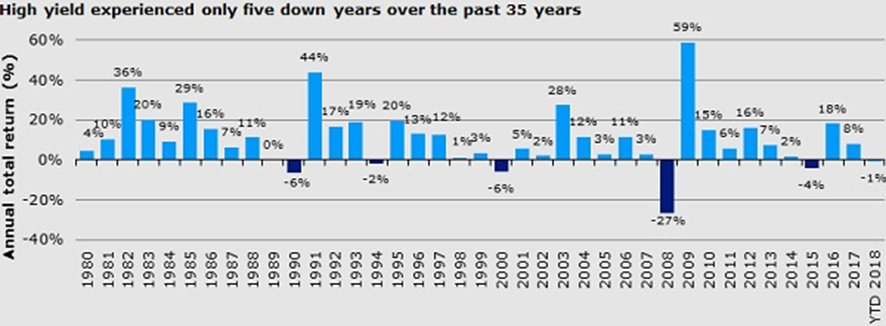

Over the past 40 years, high-yield U.S. bonds have generated an annualized return of 7% to 8%:

There have only been 6 years of negative returns in the last 40 years, which have been immediately recovered in the following years.

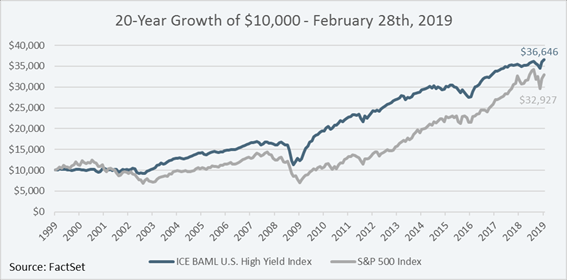

In the current millennium, the valuation of capital invested in high-yield bonds has been equivalent to that of stocks:

Global high-yield dollar bonds present a similar reality.

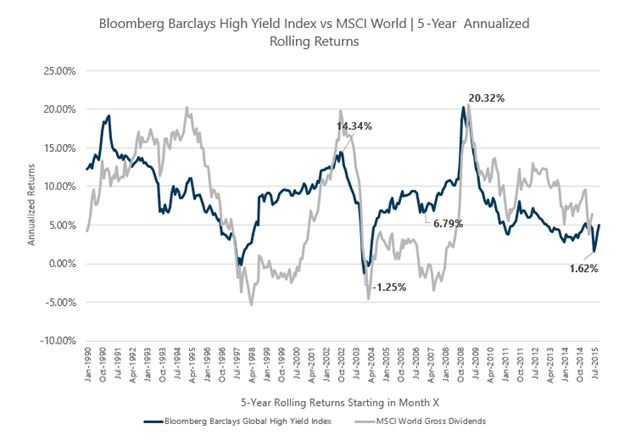

Since 1990 (33 years), the annualized return on high-yield dollar bonds (given by the Bloomberg Barclays Global High Yield Total Reurn Index) has been 8%, and the 5-year annual moving returns have been as follows (compared to global stocks):

The following chart shows the maximum potential losses or “drawdowns” in this period:

Typically, high-yield bonds are considered a hybrid asset subclass because they tend to exhibit characteristics of stocks and bonds.

However, a deeper analysis allows us to conclude that the return profile of high-yield bonds is more similar to that of stocks, with a slightly lower profitability and risk, given the influence of credit risk.

Despite this, unlike stocks, high-yield bond returns are more associated with coupons than with capital gains.