The market of money market funds

The US money market has substantial differences from the European market and is much more developed

The current yields of money market funds

This is the third article that addresses investing in money market funds.

In this article we will look at the size of the money market funds and the main variables for the valuation of these funds.

The money fund market

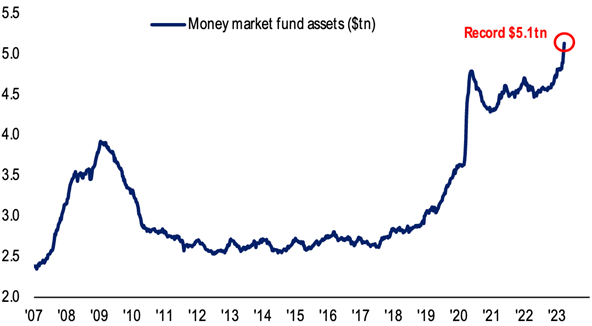

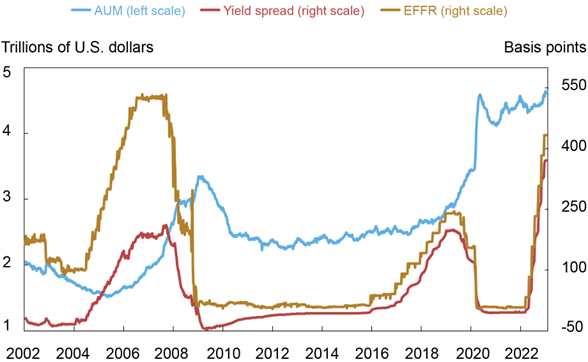

The assets under management of money market investment funds reach $5.2 trillion in the U.S., more than double the $2.5 trillion in 2014:

The money market market in Europe is much smaller than in the US, currently worth €1.5 trillion:

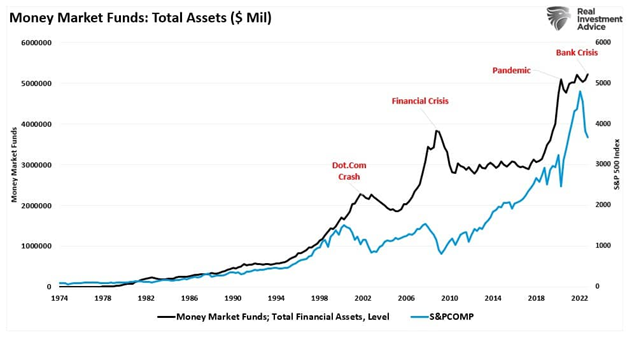

The growth of these funds has been going on for a long time, at least since 1974, and is often linked to the rotation between safe and risky investments, especially in the aftermath of crisis events, but not as much as one might believe:

During the stock market crises of the tech bubble in 1999-2001 and the sub-prime crisis of 2007-08, these funds experienced sharp growth, movements that reversed the recoveries.

However, since 2018, the growth of these funds has been significant, especially during the pandemic, which may be linked to the monetary stimulus injected into the US economy.

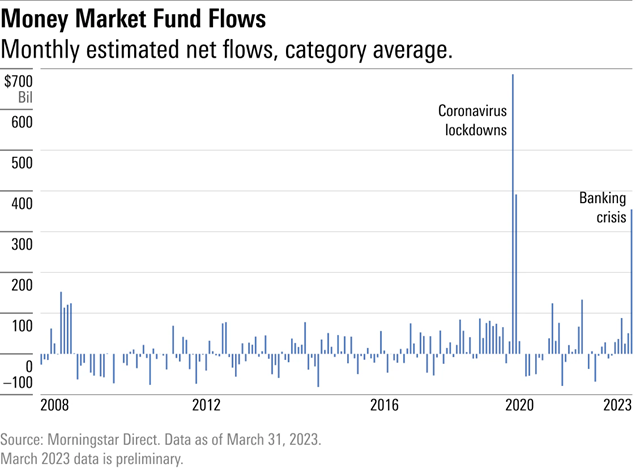

More recently, in 2022 and especially in March 2023, the flow of investment in these funds increased due to the combination of higher rates of return and the crisis in the US banking sector (failure of Silicon Valley Bank and Signature Bank):

At the start of the pandemic in March 2020, $686 billion was allocated in money market funds, and a further $392 billion the following month.

During this period, the stock market fell sharply and trading was frozen in many segments of the bond market (e.g., high-yield).

Today it’s a different story.

What is attracting savers to money market funds is higher yields.

While investors are worried about the economic outlook and the U.S. regional banking crisis has caused jitters, markets have been orderly.

In fact, the stock market managed to rise despite pressures on regional banks.

The US money market has substantial differences from the European market and is much more developed

The substantial differences between the amounts invested in money market investment funds in the US and Europe stem from the different degree of development of capital markets.

The North American capital market is much more developed than the European one. In both financing and investment, the European market is much more dependent on banks than on the capital markets.

Moreover, also because of the different development of the capital markets, money market funds and European funds differ greatly in terms of their composition.

While more than 80% of money market funds in the U.S. are public or government funds, which invest in treasury bills or operations with an equivalent degree of risk, very safe, in Europe almost 90% of money funds are prime funds, which typically invest in bank debt.

In addition, in Europe, treasury debt does not have the same rating as the US, with the exception of Germany, and the public debt markets are not of the same size, so they do not offer the same depth as the US.

Currently, ESMA (European Securities and Markets Authority) has put forward suggestions to make the money market safer funds, including the potential elimination of two types of funds that are considered less stable and increasing the amount of highly liquid assets that funds should hold.

The current remuneration of money market funds

Money market investment funds are growing in popularity as investors opt for safer bets in times of heightened market volatility.

Some of the advantages of money market funds are that they can offer diversification and high liquidity with a relatively low risk profile.

However, historically, these funds have had low returns due to their relative safety.

Over the past decade, record low interest rates have depressed the returns of money market funds and boosted riskier assets such as small-cap and technology stocks.

In the U.S., the best money market funds have had annual returns of about 0.75% over the past ten years, compared with the S&P 500’s return of 9.5% per year.

However, the central bank’s interest rate hikes are turning the tides in favor of money markets.

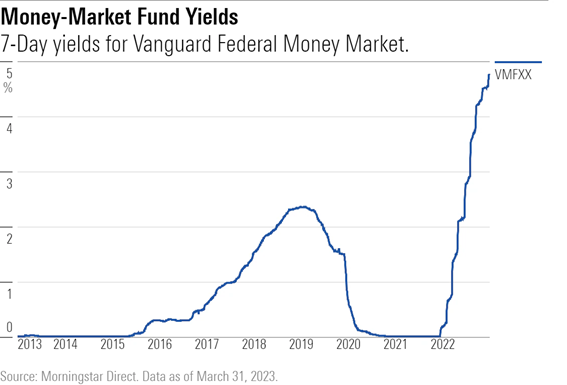

Currently, U.S. money market funds provide yields of 5% per year, while stocks have seen big swings during the Fed’s monetary tightening.

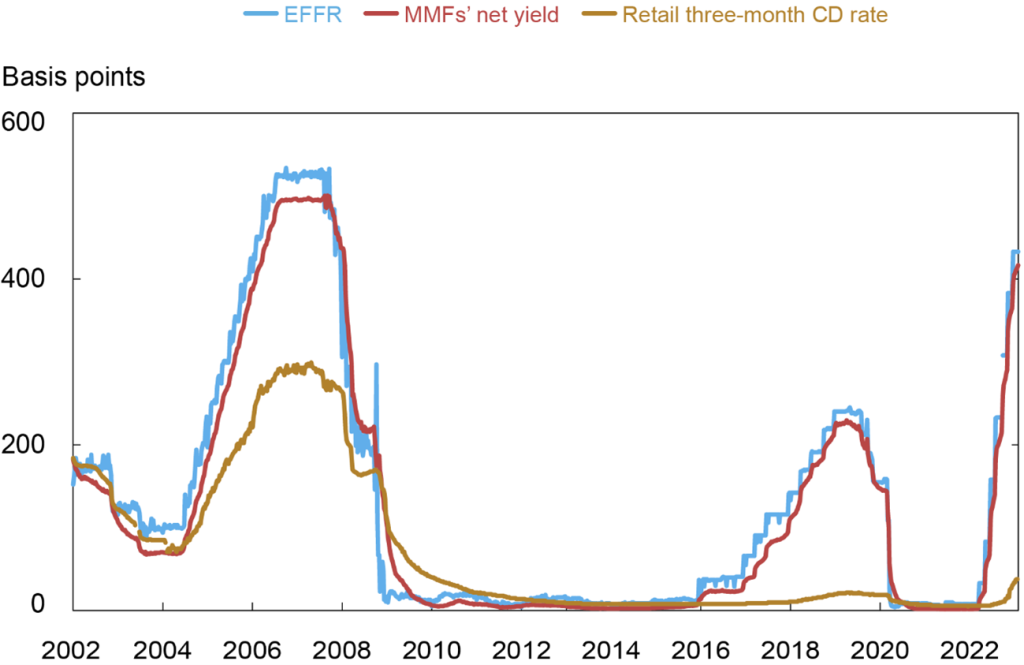

It is savers’ demand for higher yields that has fuelled the shift to monetary funds in the US:

This increase is also due to the low fees paid on certificates of deposit:

Unfortunately, there is no reliable data on the profitability of money market funds in Europe.

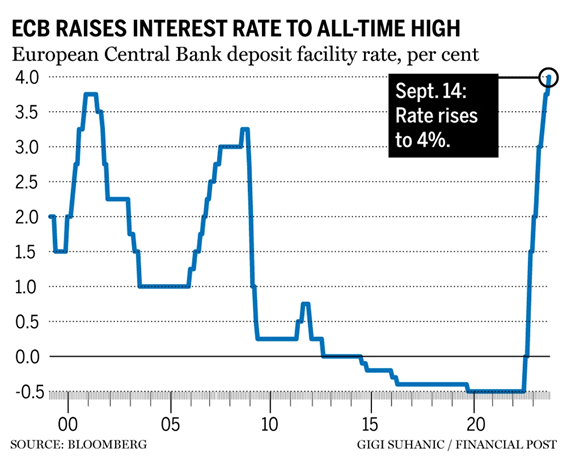

However, and despite the structural differences between US and European funds, it is to be expected that the returns of European funds will also rise in line with the movement of rates by the European Central Bank: