The Cost of Financial Life Insurance

The use, applications and interest of financial life insurance

The advantages and disadvantages of financial life insurance

This article is part of a series on personal insurance.

Insurance is a basic and priority element of our personal finance plan that defines our needs and financial goals, as it gives us a protection from risk and guarantees us a safety net in the face of unforeseen adversities.

In the initial article of this series we looked at the penetration, densities and expenses of insurance in the world and presented the general program of this series.

We have also seen that we must buy protection insurance against financial shocks of low probability and high impact (loss amount).

In the second article, we addressed life insurance that is exclusively risk, that is, without a financial component, presenting its characteristics and costs.

In this third article, which we have divided into two parts, we address capitalization insurance, a financial and investment insurance product, which associates life insurance.

In the first part we presented its description and main characteristics and now we will analyze the costs, advantages and limitations.

The Cost of Financial Life Insurance

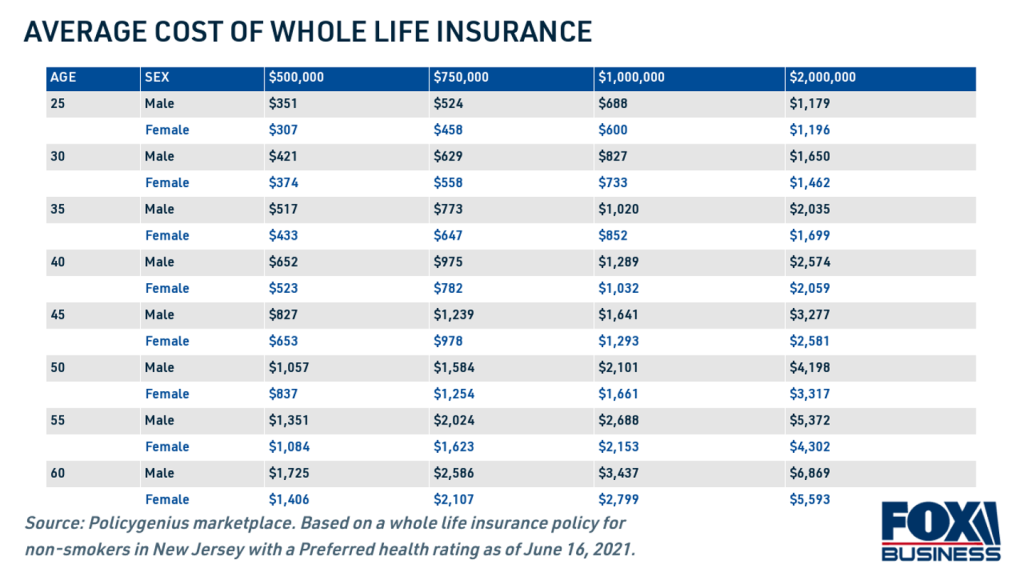

Full life insurance premiums vary widely, costing anywhere from around $300 to $7,000 per month.

Full or full life insurance has much higher premiums than term or term life insurance. While term life insurance expires after a certain term, full-time life insurance lasts for life.

Full life insurance can cost up to 15 times more than term life insurance.

Full life insurance is seen more as an investment than insurance because the cost of the investment is much higher than that of insurance.

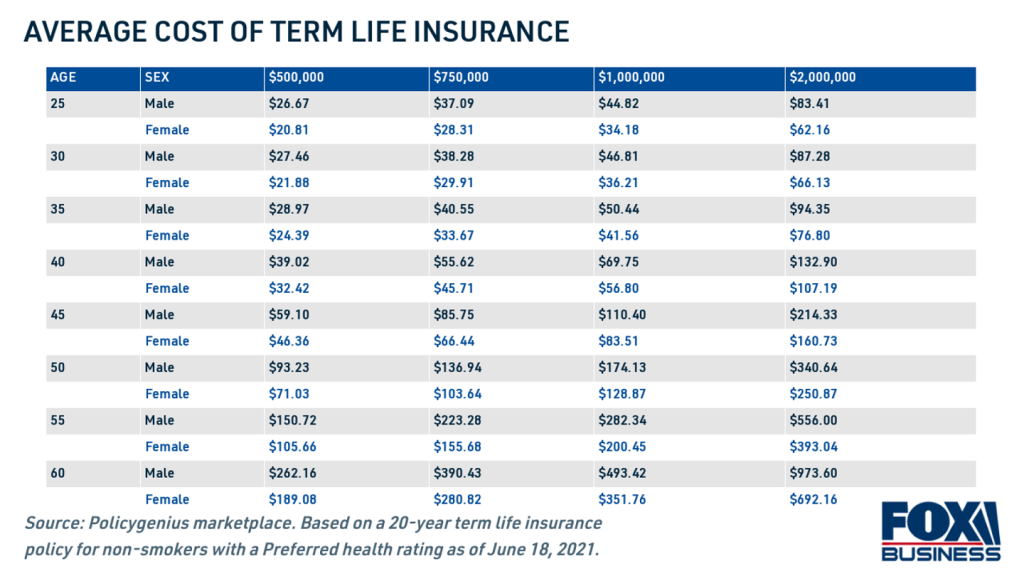

For comparison, the table below illustrates the average monthly cost of a life insurance policy for a 20-year term by age, gender, and the policy capital in the US:

The average premium for a $500,000 life insurance policy and 20-year term for a young, healthy insured can be around $25 to $35 per month.

As you get older, life insurance rates increase by up to 9% each year.

These costs vary from insurer to insurer and over time.

https://www.nerdwallet.com/article/insurance/average-life-insurance-rates

The use, applications and interest of financial life insurance

Unit-linked life insurance can be used to complement other popular estate planning solutions.

This insurance can be tailored to meet the specific needs of individuals and their families, with the potential to improve financial planning.

The advantages and disadvantages of financial life insurance

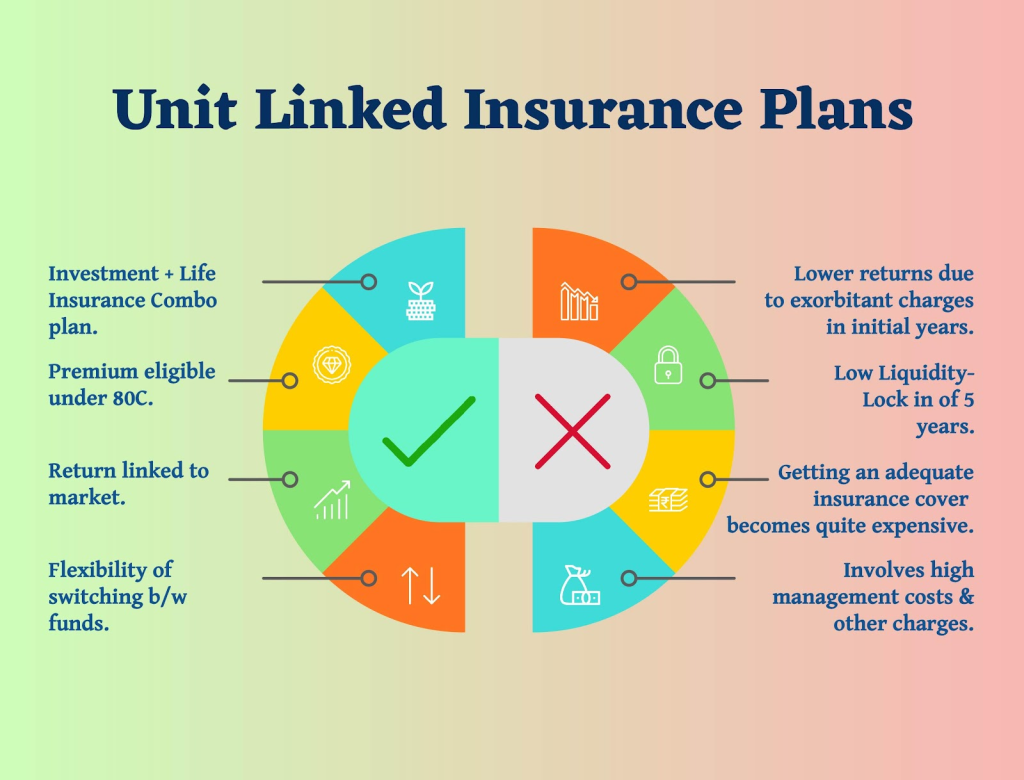

These financial insurances aim to provide a combined solution for insurance needs and investment needs:

However, because both needs are different in nature, one being an expense (insurance) and the other an investment (investment needs), these financial insurance plans are not able to offer efficient returns for a number of reasons, especially because of the high charges levied on these plans in the initial years.

Getting adequate coverage to meet the needs of the family from unit-link insurance plans becomes quite expensive as the premiums are high.

In addition, the portion of the premium that is actually invested to generate capital returns is reduced with the high management charges and other costs, which means lower returns on investments.

Another major disadvantage of unit-link financial insurance is its demobilization period, usually 5 years.

In addition, in the event of redemption, the redemption value is much lower than the value of the units held, which means giving up a very substantial amount.

Investors should consider making separate purchases to meet their insurance and investment needs.

A great option would be to purchase a term insurance policy with adequate coverage according to the family’s needs. Regarding investments, it would be better to invest in more conventional investment products such as investment funds – equity funds, debt, mixed, equities, bonds, etc.

The choice of instrument depends on investors’ risk appetite, investment horizon, and financial objectives. It also depends on the knowledge and experience of investors in each of these products.

For most investors, investment funds are the most suitable product.

By choosing these alternatives in place of combined unit-link financial insurance plans (insurance + investment), investors are better off in terms of costs and returns.