The Covid-19 pandemic brought an unimaginable and unpredictable first half. How long can the disconnect between the economy and the performance of the main stock and bond markets persist, while there are still no reliable public health solutions?

Index

Executive summary

This scenario favours a more defensive stand than the central allocation of each investor in relation to the different subclasses of assets of the financial markets, via increased liquidity, and with a preferential allocation to the US equities market versus Rest of the World.

Financial markets performance 2Q20

The activity shutdown resulting from the pandemic shock initially caused sharp devaluations of the equities and corporate bond markets, between 10% and 40%, but its containment and subsequent reopening of economies resulted in a rapid and strong recovery of those financial markets segments

Financial markets had an unimaginable and unpredictable first half, with abrupt and violent declines followed by rapid and strong recoveries

Aggravating the situation, the oil market imbalance caused a price drop of 50% in the year, even after the OECD+ production cut agreement in mid-April.

Corporate bonds and equities markets fell between 10% and 40% from peak levels by March 23, and in the second quarter they regained much of their value with a concerted and bold response of economic policies and the latest positive signs of pandemic containment and reopening of economies.

Covid-19 status

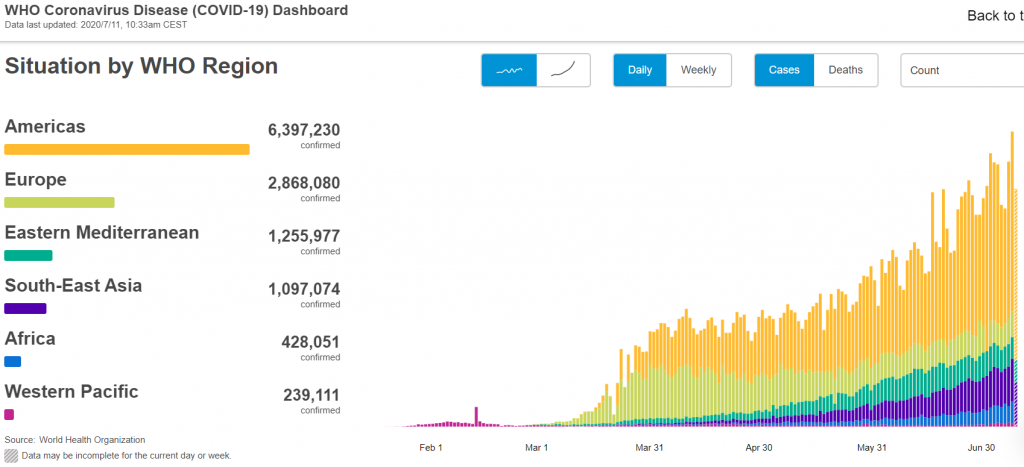

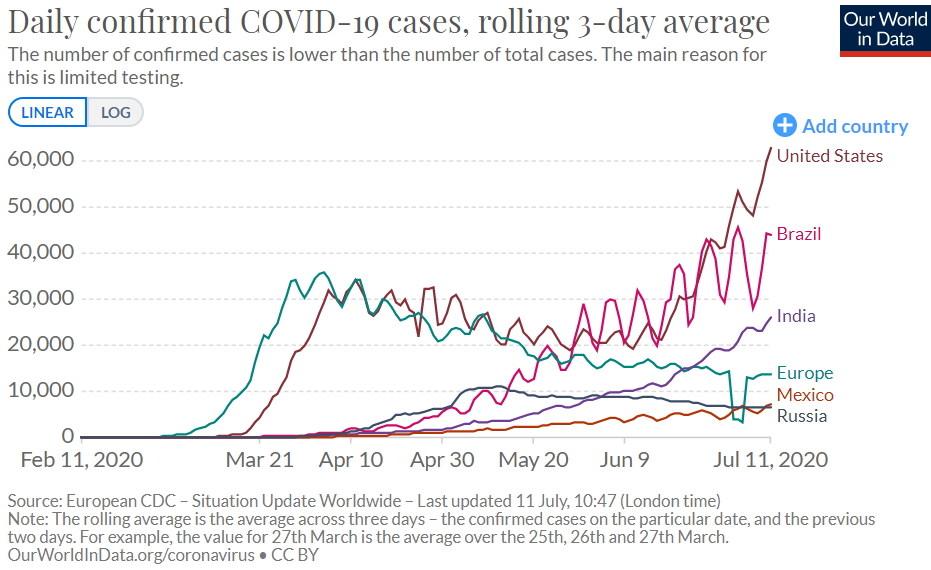

The pandemic continues to spread throughout the world with greater severity in underdeveloped regions such as South America, India and Africa, but also with some outbreaks in the developed world, particularly in some US states, and there are still no effective and reliable public health solutions

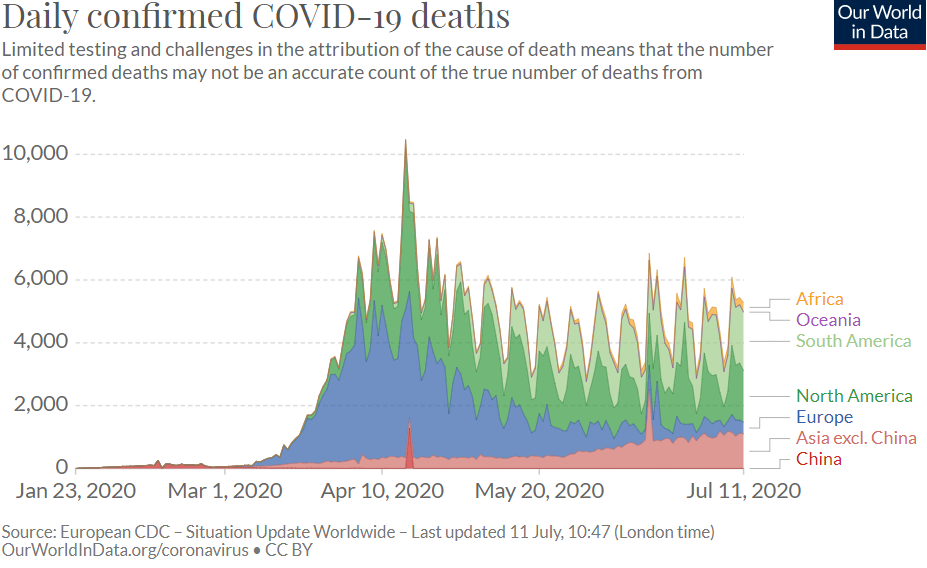

The Covid-19 virus starts in China and spreads to Southeast Asia, and then to around the world, with greater severity in Western Europe (in particular Italy, Spain, France and the United Kingdom) and the US, turning into a pandemic that has already exceeded 10 million infected and 500,000 deaths.

It has high rates of spread, contagion and lethality and there is no effective treatment or vaccine available, being fought with social distancing, ready detection (tests) and hospitalization of critical cases.

Although the Western world is being able to contain the spread in general, the pandemic is still growing globally due to the growth of cases in several Latin American countries, India, Russia, and in some US states.

There are some treatments that are being used around the world and have been shown to be useful to reduce the lethality of critically ill cases, but are of moderate efficacy

Many dozens of pharmaceutical and research laboratories around the world are testing vaccines and treatments, and public health experts say that vaccine availability is estimated for 12 to 18 months from now (best case scenario, spring 2021).

Economic outlook

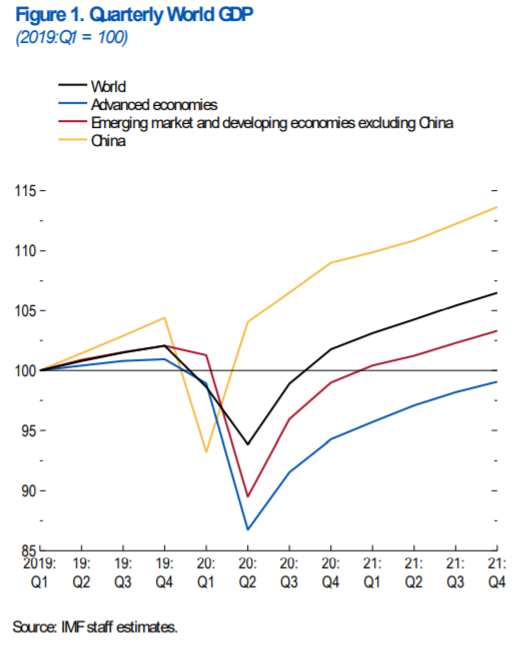

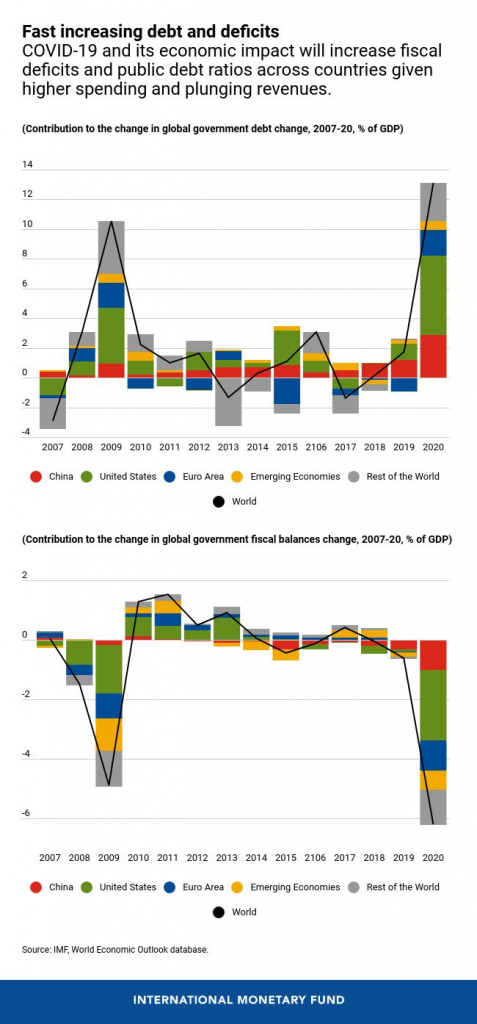

It is expected an economic contraction of world GDP of -4.9% in 2020 followed by +5.4% growth in 2021, -8% and +4.8% in advanced economies, and -3% and +5.9% in emerging economies, respectively, according to the latest IMF forecasts of June, in a scenario where pandemic containment will be contained throughout the year.

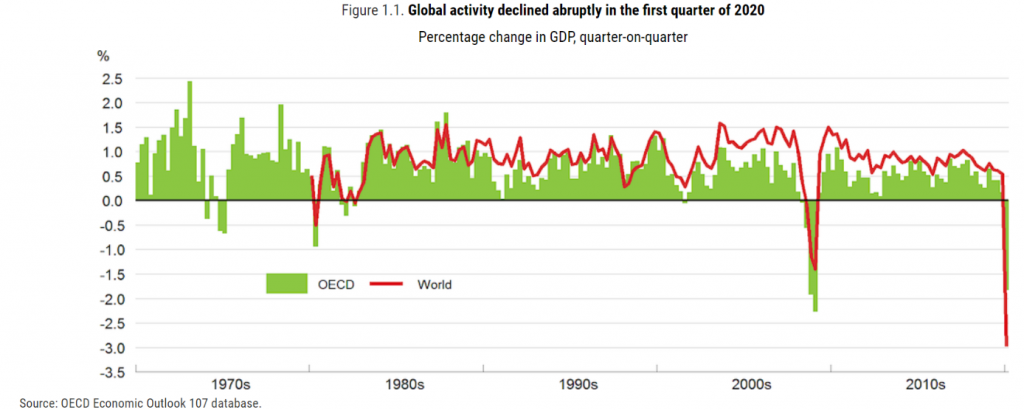

As a result of the shutdown of much of the economic activity to contain the pandemic, the global economy is expected to contract sharply by -4.9% in 2020, much worse than during the 2008/09 financial crisis (GDP contraction is estimated to be 2% to 3% for each month of shutdown).

In the baseline scenario, which assumes that the pandemic will disappear in the second half of 2020 and that containment efforts can be largely mitigated, the global economy is expected to grow by 5.4% in 2021 as economic activity normalizes, supported by the actions of fiscal and monetary policy authorities.

The stoppage of activity has a cross-cutting economic and financial impact, but very differentiated in sectoral terms, strongly affecting the tourism, leisure, discretionary consumer, and banking sectors, and to a lesser extent food, public goods, telecommunications, and technology.

Being very difficult to estimate the impact of this economic crisis by its own nature (health), extent (global), size (stoppage) and duration (time), the current forecasts are of a contraction of GDP in the US and global higher than that of the Great Depression, but with a faster recovery (from 1 to 2 years instead of 4 to 5 years).

Inflation is controlled all over the world.

Source: OECD Economic Outlook, June 2020

Source: World Economic Outlook Update, IMF, June, 24

Macroeconomic context

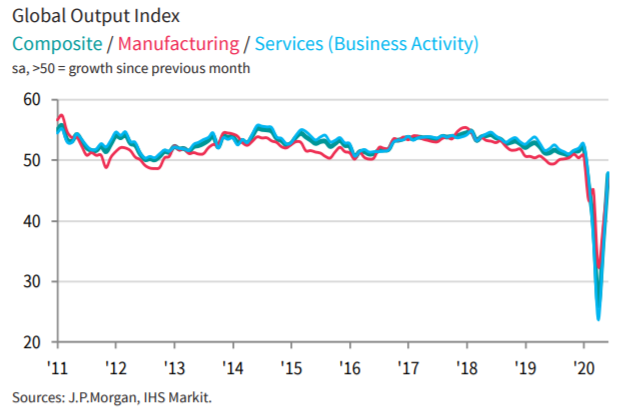

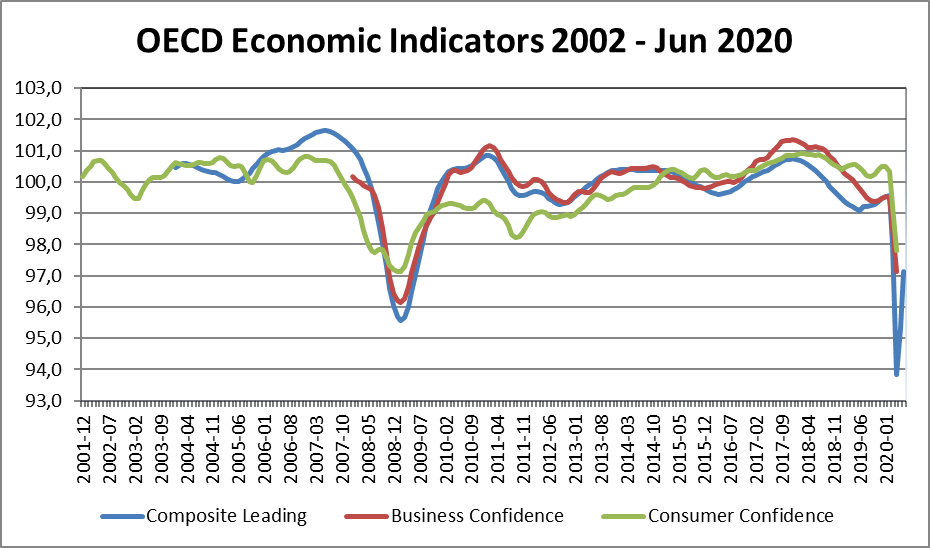

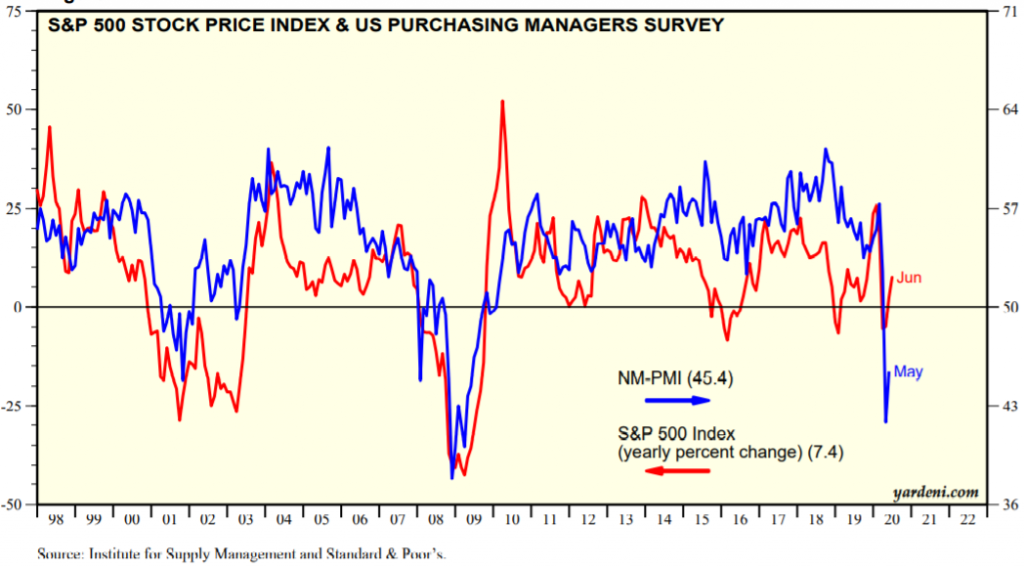

After the sharp contraction of the leading economic indicators from March to May associated with the stoppage of activity, a general improvement begins to be noticed at the end of June, although distant from previous levels:

The Global Composite PMI for early July has been improving from lows of 36.3 reached in May to 47.7 in June, although still at contraction levels.

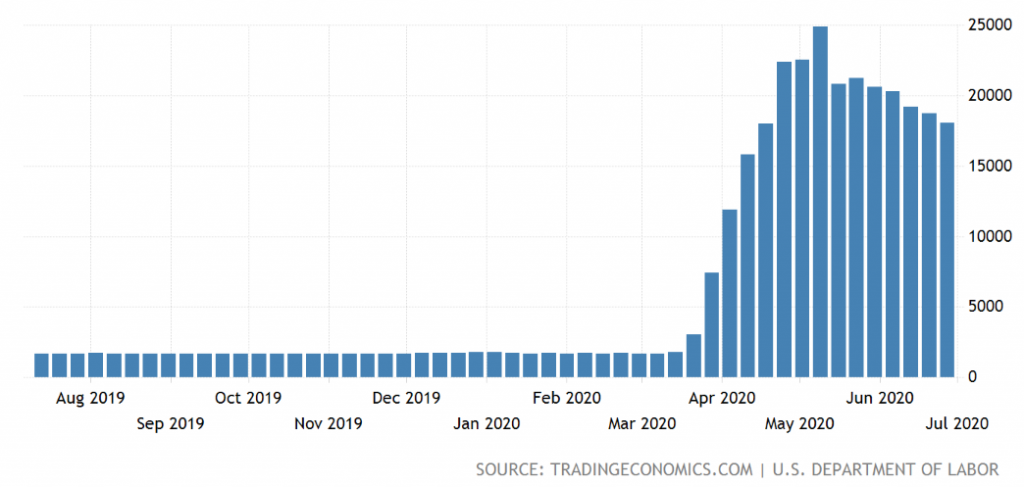

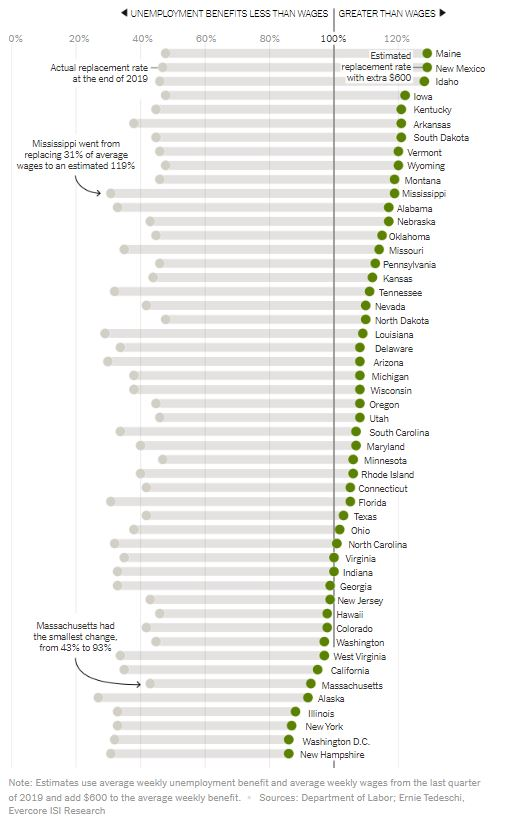

Unemployment indicators, notably US Jobless Claims in the US, improved from a maximum of almost 25 million accumulated in five consecutive weeks (which exceeded the total job creation in the 11 years following the GCF) to values slightly below 20 million, a situation mitigated by the substantial increase in unemployment benefits.

In the US, Retail Sales rose 17.7 percent in June after declines of -8.2% and -14.7% in March and May, and Empire Manufacturing recovered 48 percentage points to -0.2% in June.

The latest OECD leading, business and consumer confidence indicators are reflecting the crisis evolution.

Source: US Jobless Claims 1Y, US Department of Labor, 09/07/20

Economic Policies

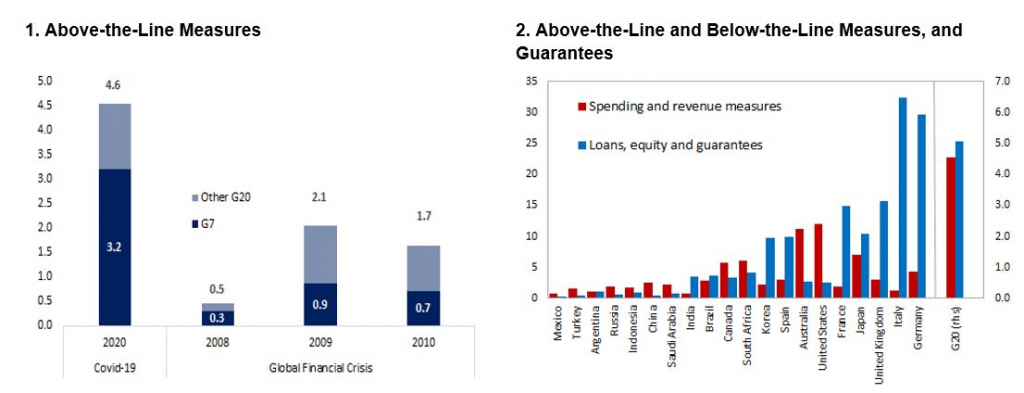

Economic policy makers around the world have implemented substantial fiscal and monetary measures to support affected households and businesses to maintain income and employment and bridge the gap in activity until it gradually normalizes with the reopening of economies:

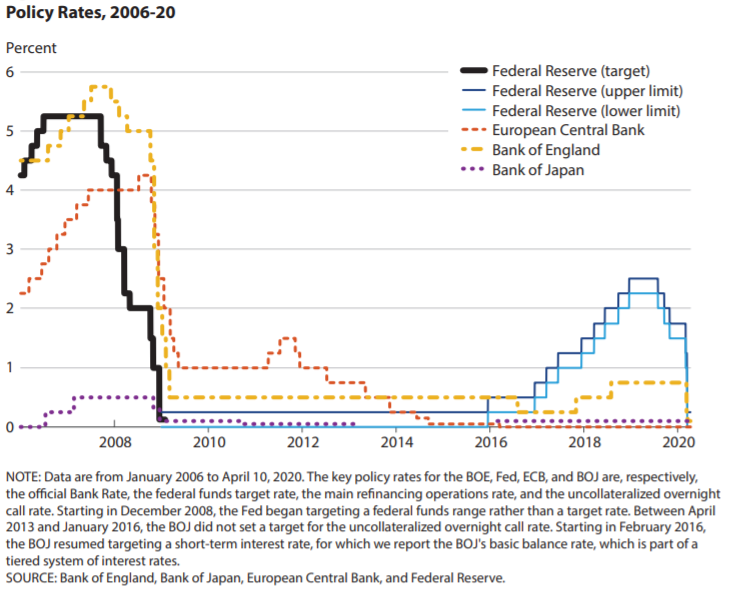

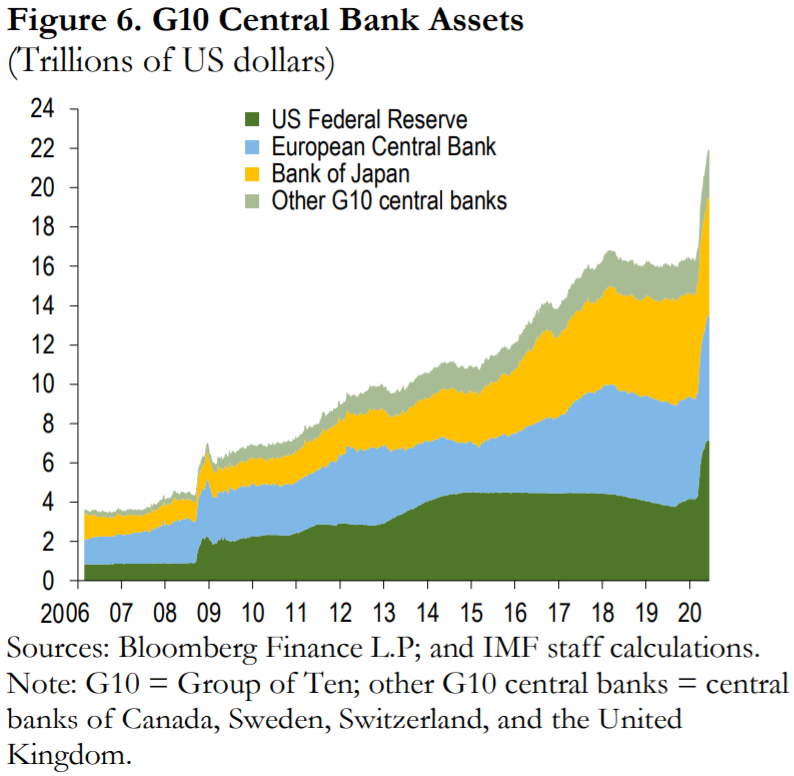

– Reduction of key interest rates and strong strengthening of asset purchase programs by central banks around the world.

– Programs aimed at maintaining income and employment, such as the improvement of unemployment benefits (the Cares Act in the US that grants $600 per week to the federal government in addition to the average $387 of state-level subsidies by July 31, makes that almost two-thirds of the unemployed earn more than if they were working), financial support to companies for maintaining employment by access to the layoff scheme in Europe and the US, and direct aid through donations, grants or loans to companies in the most affected sectors, such as airlines, hospitality and restaurants around the world.

Short-term interest rates are negative in the Eurozone, Japan and Switzerland, and falling in the US. Interest rates on 10-year treasury bonds are near zero in the Eurozone, Japan, and Switzerland, and falling in the US and UK to historic lows. Central bank benchmark interest rates are expected to remain negative in the Eurozone for an extended period and could run until 2024/2025, and those in the US will remain below 2%.

Fonte: World Economic Outlook Update, IMF, June, 24

Source: Global Financial Stability Update, IMF, June 2020

Source: OECD Economic Outlook, June 2020

Source: OECD Economic Outlook, June 2020

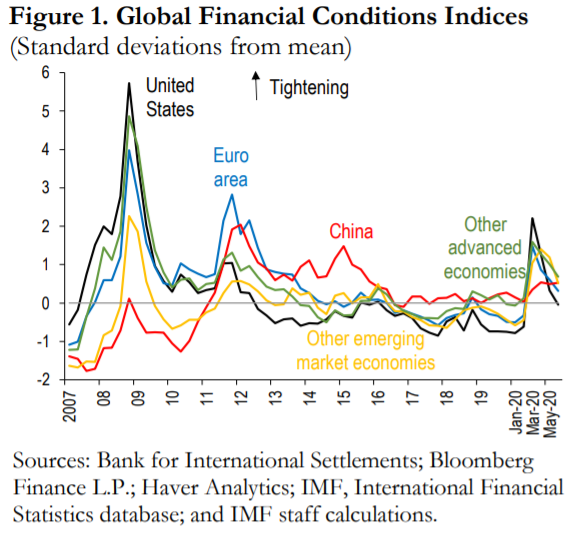

The recovery in risk asset prices following the fall and the decline in benchmark interest rates have led to an overall improvement in financial conditions.

The prompt and bold response of central banks around the world has also improved financial conditions.

Source: Global Financial Stability Update, IMF, June 2020

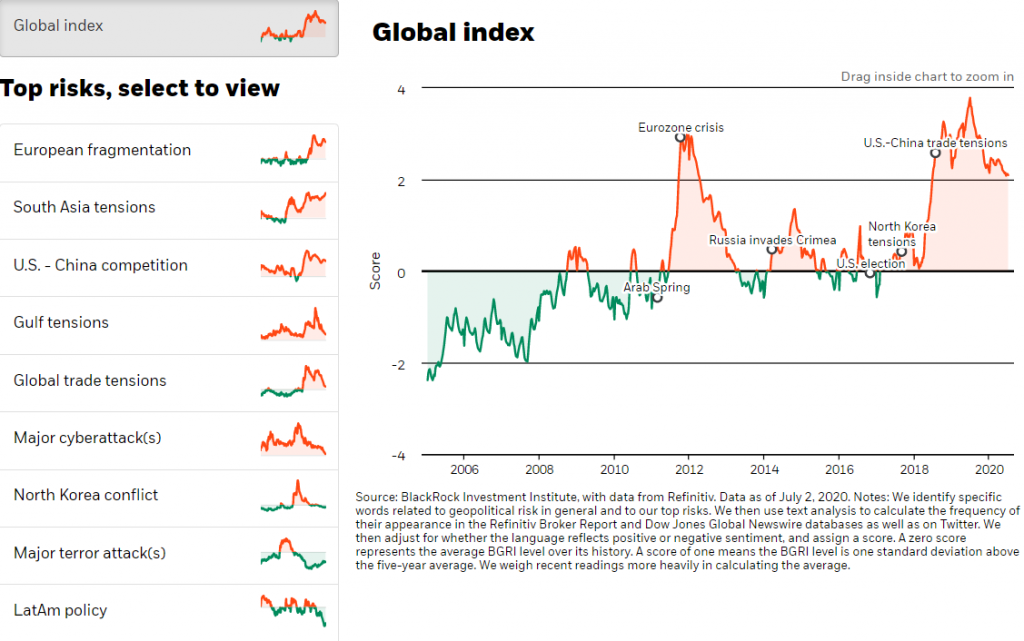

Source: Main Geopolitical Risks, Blackrock Institute, July,2, 2020

Markets valuation

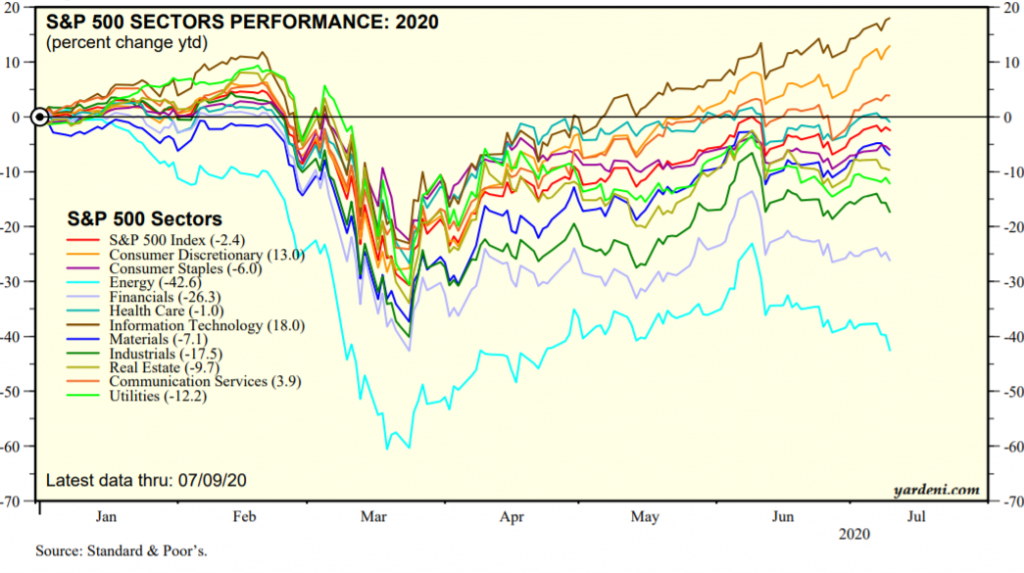

Equities markets fell 30 percent or more from the start of the pandemic to the lows of March 23, having recovered most of that decline in the US and Europe, particularly in line with the strong global asset purchase program and ahead of economic data.

This movement is facilitated by the rotation of assets associated with low interest rates (there is no alternative), the reopening of economies, the support of economic policies to households and companies, the strong appreciation of companies in the technology sector, or Work From Home (WFH) companies.

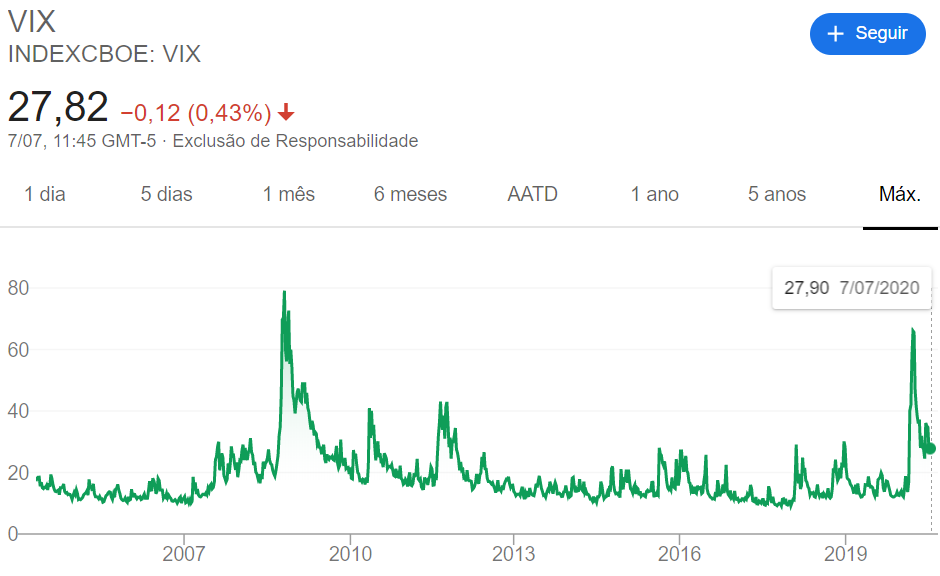

Volatility indicators such as the VIX in the US have reached extreme levels or 80 points, levels equal to those of the GFC at the peak of the crisis in the last week of March, and have dropped and stabilized around 30 points.

The uncertainty of the impact on business earnings is very high, with the majority abandoning their guidance. The second quarter earnings season in the US is about to start and will continue over the next 3 weeks (in Europe it starts at the end of the month), which will bring important indications.

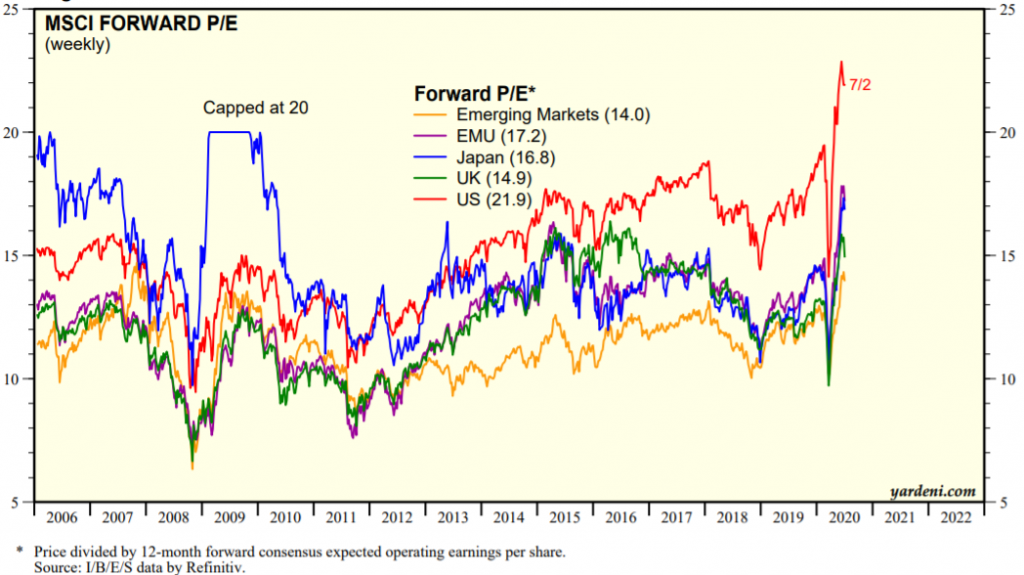

The global and multi-region equity markets is above the long-term average. The PER of 21.9x for the US is well above average and close to highs, which is compounded by the fact that earnings consensus is still high and constantly being revised downwards. The PER of 17.2x in the Eurozone, 16.8x in Japan and 14x in Emerging Markets are also above average and have the same bias in consensus outcome estimates.

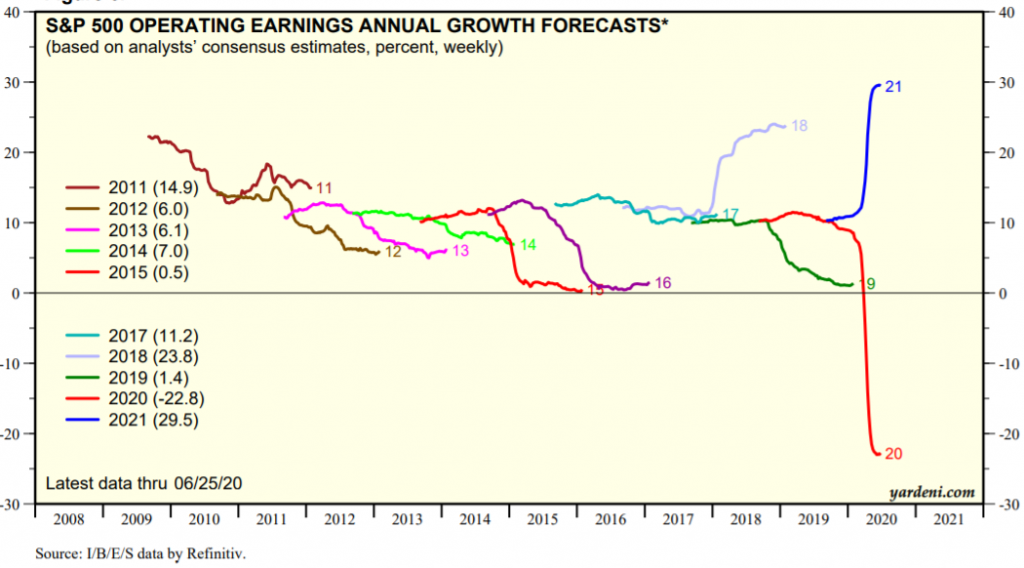

The consensus predicts negative growth rates of earnings and value of -20.0% for the global stock market in 2020, and +21% for 2021, based on a rapid recovery from the second half of this year.

Source: Central Banks:Monthly Balance Sheets, Yardeni Research, July, 10, 2020

Source: Performance 2020:S&P 500/400/600 Sectors, Yardeni Research, July, 10, 2020

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, July, 8, 2020

Source: Global Index Briefing: All Country World MSCI, Yardeni Research, July, 6, 2020

Source: Corporate Finance Briefing: S&P 500 Revenues and Earnings Growth Rate, Yardeni Research, July, 1, 2020

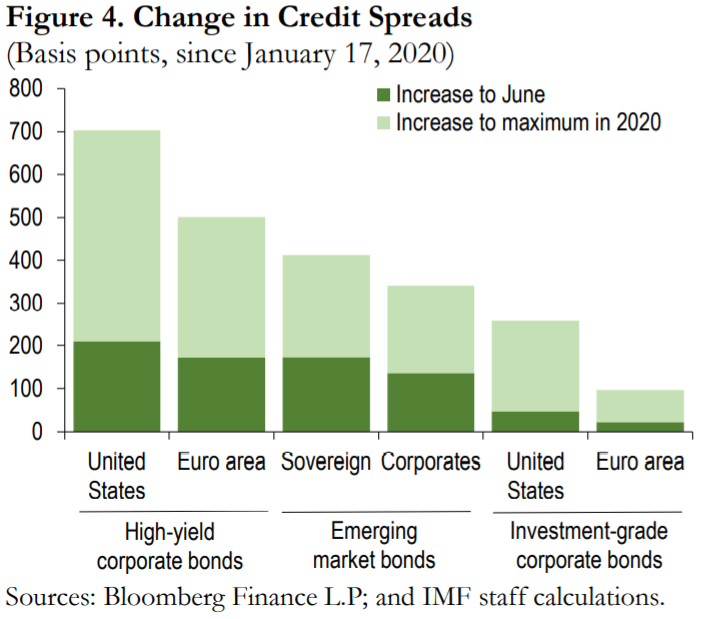

The pandemic initially had a huge impact on credit markets with implicit risk spreads more than doubling to values never seen after GCF in the investment quality segment and with greater preponderance in speculative, and then improved with the intervention of the authorities, in particular the FED.

Medium- and long-term interest rates on US treasury bonds are at historic lows due to demand for refuge assets (such as rising gold prices).

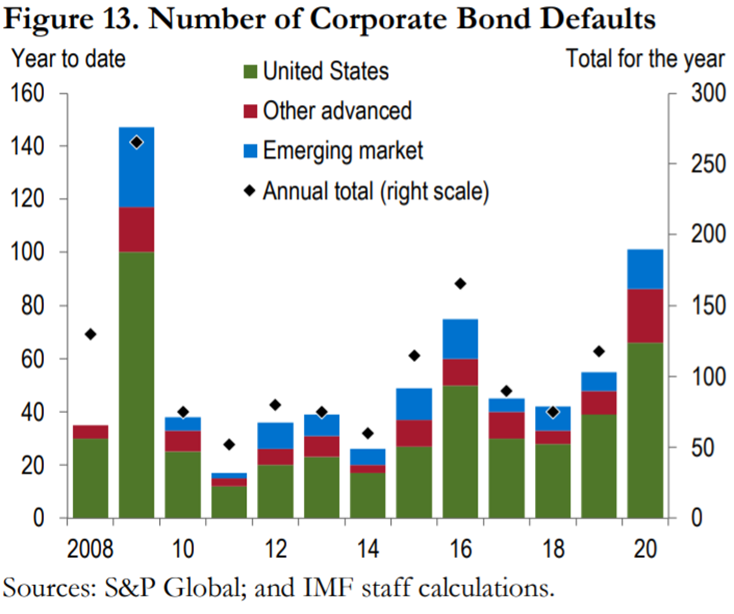

There has been a deterioration in credit ratings by the various agencies at the level of countries and companies, with a particular focus on the most unbalanced, more dependent on oil and tourism. Fitch downgraded 33 countries (including Canada, the UK and Hong Kong) in the first half (a number that had never been reached in a full year) and put 40 in a negative outlook.

Source: Global Financial Stability Report, June 2020

Source: Global Financial Stability Report, June 2020

Source: Global Financial Stability Report Update, IMF, June 2020

Main opportunities

Anticipation of medical solutions (effective treatment and/or vaccine) from the expected 12 to 18 months, which allow for a faster economic recovery in developed countries. According to the WHO, at the end of June there were more than 140 vaccines at various stages of development worldwide, with 13 in clinical trials with humans.

Intensification of economic policies, including fiscal ones, with the adoption of a new Cares Act in the USA and the European Recovery Fund in the European Union.

Source: Exploring the Drug Development Process, Laura Elizabeth Lansdowne, Senior Science Writer, Technology Networks, Mar 13, 2020

Main risks

A deception of economic growth rates and above all lower-than-expected employment in the developed world as a result of pandemic adjustment, a possible European crisis due to North-South disagreement over economic and financial solidarity measures, worsening macro imbalances in some major emerging countries, hoarding by households around the world and some geopolitical risks linked to President Trump’s US election agenda

A shift in investors sentiment, in reaction to possible news and/or data on the deterioration of the situation and which lead them to consider that the valuations are excessive in relation to the economic recovery prospects.

Worsening or prolonging the pandemic beyond 2020 forcing a setback in the reopening of economies, as is happening in some US states, and increased complexity of clinical management if it coincides with the flu period of autumn and winter in the northern hemisphere.

A new European sovereign crisis, but now not confined to peripheral countries and also affecting Spain and Italy, with the possible increase in the risk of European fragmentation.

Worsening external imbalances and public accounts in large emerging economies such as India, Brazil, Mexico, and South Africa, doubly dependent on oil and other natural resources and international trade (increased protectionism).

Increased hoarding effect by households and businesses with the consequent brake on the normalisation of economic activity.

Source: S&P 500 Revenues & PMIs, Yardeni Research, July, 6, 2020

Source: OECD Economic Outlook, June 2020

Source: World Economic Outlook Update, IMF, June, 24