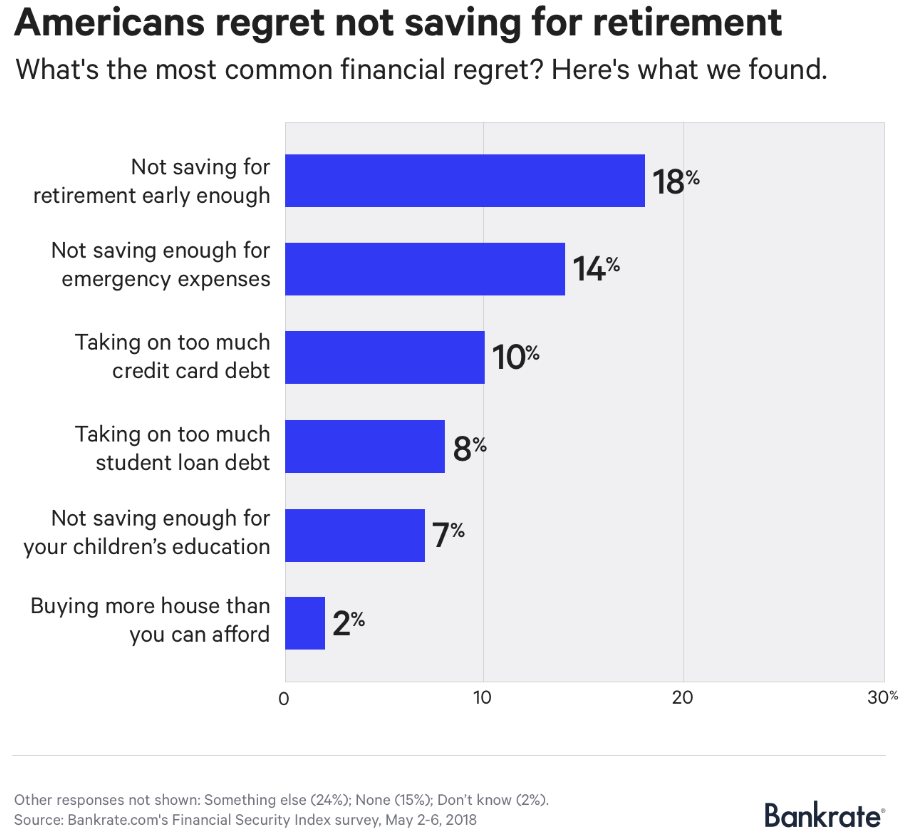

Not setting up a retirement fund is one of the biggest and most common financial regrets

Poor investments selection, not making risky financial investments, and not investing in the medium and long term are the main regrets in making investments

What is regret?

Regret consists in giving much more weight to the errors of acting than the errors of doing nothing.

In decision theory about decision-making in a context of uncertainty, if information about the best course of action arrives after making a fixed decision, the human emotional response of regret is experienced many times, and can be measured as the value of the difference between the decision made and the ideal decision.

The theory of aversion to regret or anticipated regret proposes that when facing a decision, individuals can anticipate regret and thus incorporate in their choice their desire to eliminate or reduce that possibility.

Regret is a negative emotion with a powerful social and reputational component, being central to how humans learn from experience and in human psychology from risk aversion.

Conscious anticipation of regret creates a feedback loop that elevates regret from the emotional realm—often modelled as mere human behaviour—to the field of rational choice behaviour that is modelled on decision theory.

Regret in investments

Fear of regret can play a significant role in deterring someone from acting or motivating a person to act.

When it comes to investments, the theory of regret can make investors risk-averse, or it can motivate them to take higher risks.

Investors can minimize the anticipation of regret that influence their investment decisions if they have an understanding and an awareness of the psychology of regret theory. Investors need to understand how regret has affected their investment decisions in the past and take that into account when considering a new opportunity.

Not setting up a retirement fund is one of the biggest and most common financial regrets

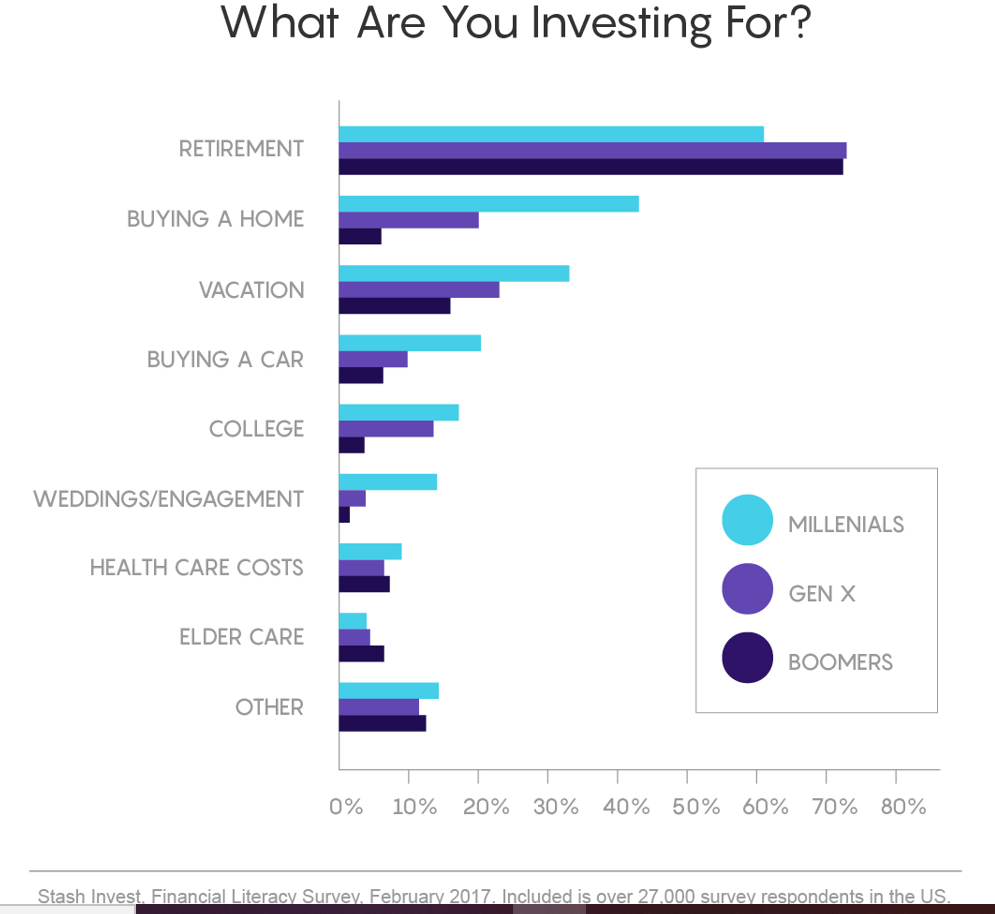

Retirement is the main investment objective, and at the same time, the biggest concern of investors and their greatest regret.

Several studies on finance and personal investment show that retirement is the main financial objective, as we have seen in other posts:

We have also seen that it is the biggest concern of investors, as most consider that they are lagging behind in retirement savings, in addition to the fact that some are aware that Social Security or other public protection schemes will have less financial capacity to ensure the current conditions of pensions in the future.

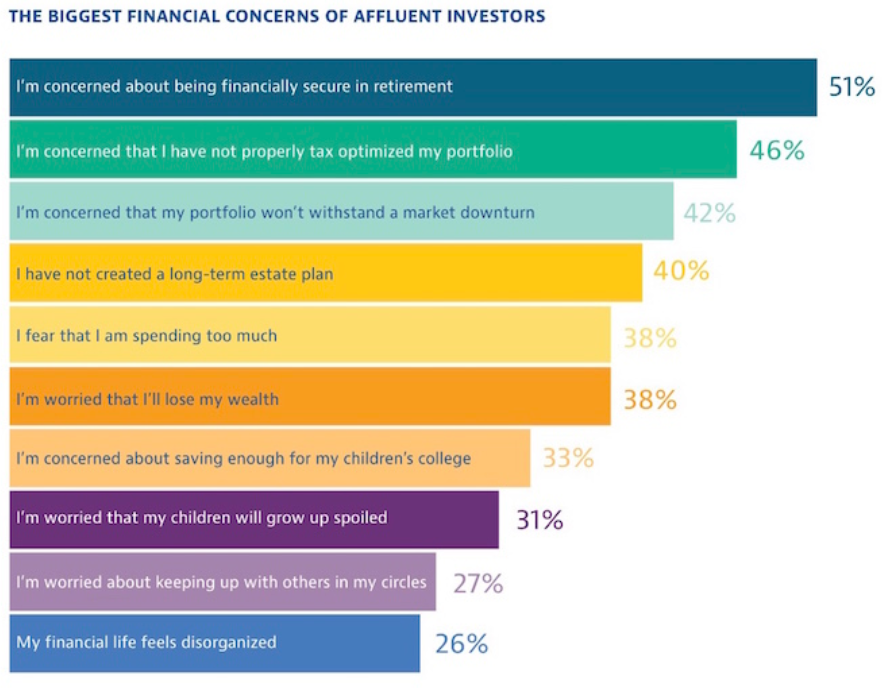

For example, the study conducted by Personal Capital in the US in 2017 with a sample of its affluent investors placed retirement as the top concern:

This main objective and concern becomes the main regret of the majority when retired people are questioned or those close to retirement, since they consider that their accumulated savings are insufficient to maintain the standard of living, considering the increase in longevity, and also the low rates of returns for low-risk assets.

How can we overcome this regret?

We have two ways to do that. Saving more and investing more capital throughout our working life. And above all, investing in assets with higher returns but also more risk.

In many cases it is difficult to save more, as the surveys show.

So why don’t we invest more in risky financial assets, especially for a goal that has such a long term?

The truth is that we invest very little in risky assets and without realizing it costs us a lot.

Most people attach great importance to financial or market risk and very little value to the risk of inflation or living standards.

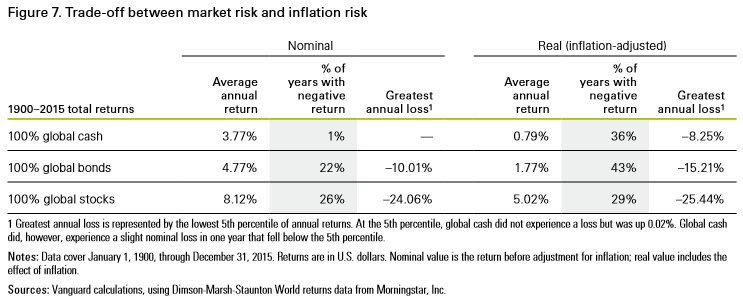

The findings of a study by Vanguard presented in the following table show annual rates of return for 100% cash investments such as deposits or savings accounts, 100% in Treasury bonds and 100% on a diversified set of stocks, such as in S&P 500 index funds or products in the US between 1900 and 2015 :

This table shows that investment security is illusory. What we avoid at market risk we pay in double, or in good truth and as we will see sevenfold at risk of loss of purchasing power.

Investment in cash generated an average annual nominal rate of return of 3.77% in the period and only had 1% years of negative returns, which seems good and safe. However, if we see the average annual real returns were 0.79% and there were 36% of the years in which this rate was negative.

Investment in S&P 500 index products generated an average annual nominal rate of return of 8.12% in the period and negative returns in 26% of the years, reflecting higher returns alongside by more risk or volatility. However, the average annual real rate of return was 5.02% and with 29% of negative years, i.e. a 7-fold higher rate of return and with a percentage of returns with lower loss of purchasing power.

Investment in Treasury bonds produced average nominal to annual yields of 4.77% and with 22% of the years with negative rates. The average annual real rate of return was 1.77% with 43% of negative years. Returns are much more interesting than in cash investments, more than double, but less than half of shareholder investment.

In these terms, it is worth investing in more profitable assets, especially in the first 2/3 or 3/4 of our working life, especially since the time ahead, that is, the investment time is long enough to be able to face and withstand any negative fluctuations in the short-term market.

Therefore, we say that what seems safe is not, we must be truly aware of the risks and change the way we invest our savings.

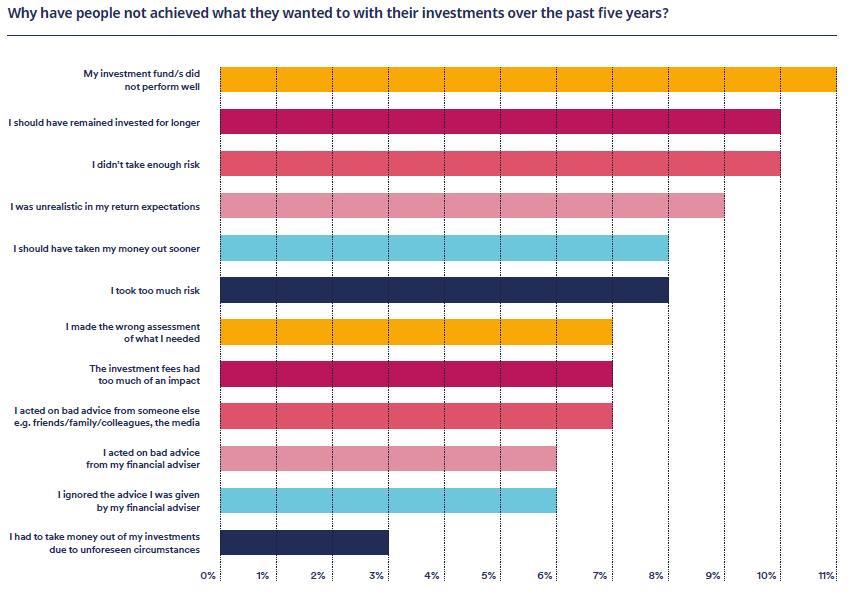

Poor investments selection, not making risky financial investments, and not investing in the medium and long term are the main regrets in making investments

The Schroders’ annual survey of investors worldwide for 2019 covering more than 25,000 concluded the following reasons for not achieving the estimated profitability:

The 3 main regrets in making investments are poor investment selection, reacting to normal market fluctuations and not keeping investments for a medium and long-term horizon, and not making risky financial investments, particularly in stocks.

These situations are easily overcome with more financial literacy, better assessment, planning and implementation of investments, and with the support of expert financial advisors.