We choose the financial advisor for reasons of trust, good performance and cost/benefit ratio of the service and integrity, and replace him by lack of performance, communication, and confidentiality

What we want from financial advisors are transparent costs aligned with the value of the service provided, the protection of our data, ethical behaviours, simple communications, and respected professionals

What services do we want from financial advisors?

We choose the financial advisor for reasons of trust, good performance and cost/benefit ratio of the service and integrity, and replace him by lack of performance, communication and confidentiality

Let’s look at two recent studies that looked at the main reasons for choosing the financial advisor and the replacement.

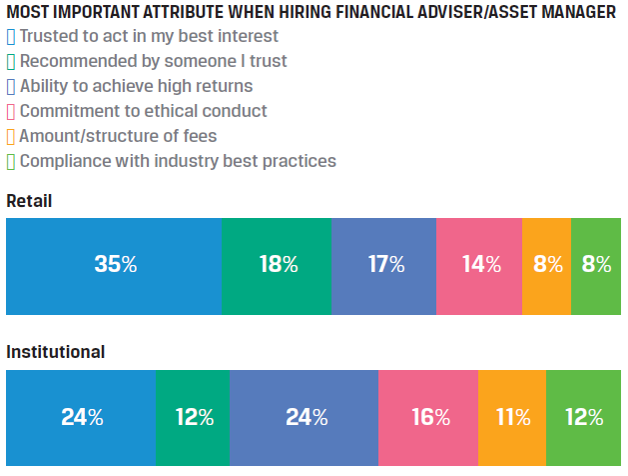

The first was conducted by the CFA Institute in 2018 and was based on a survey of 3,127 individual investors over 25 years with $100,000 of assets from 12 countries (and 829 institutional investors with assets under management exceeding $50 million):

Source: The Next Generation of Trust: A Global Survey on the State of Investor Trust, CFA Institute, 2018

It concluded that the main reasons for choosing the financial advisor by individual investors are the confidence that it acts according to our interests, the referral by trusted people, the ability to achieve higher returns and the ethical conduct. These reasons are more or less the same as those pointed out by institutional investors.

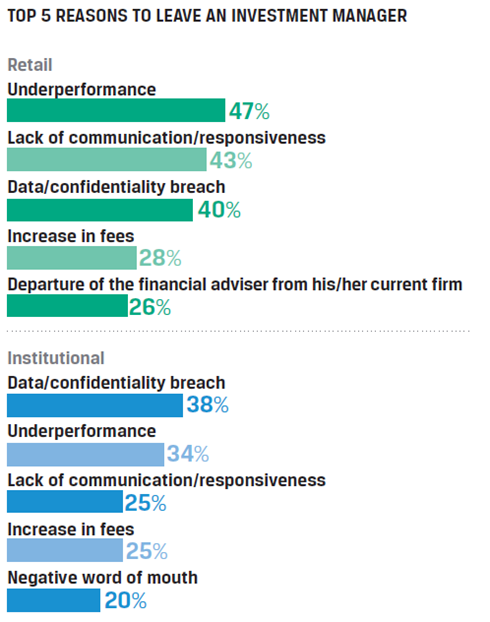

In the same study, the 5 main reasons for replacing financial advisers were also asked:

The main reasons indicated by private investors to replace the investment advisor, are poor performance, lack of communication or response, breach of confidentiality, increased costs and the departure of the company by the consultant. In this case too, the reasons given by institutional investors are not very different.

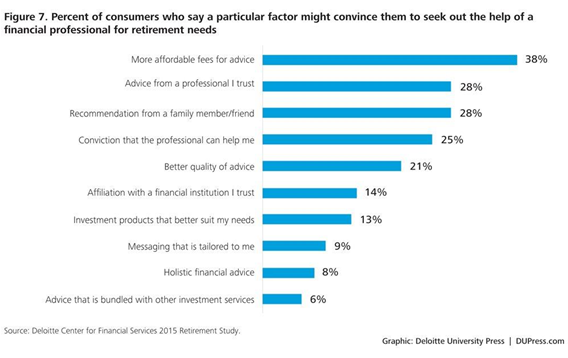

Another study was conducted by Deloitte in 2015 on the criteria for choosing financial advisors for the needs of the retirement:

It concludes that the main factors for the choice of financial advisors for retirement are the costs charged, the trust and professionalism, the referral by respected people, the conviction that the service has value and the quality of the advice.

What we want from financial advisors are transparent costs aligned with the value of the service provided, the protection of our data, ethical behaviours, simple communications, and respected professionals

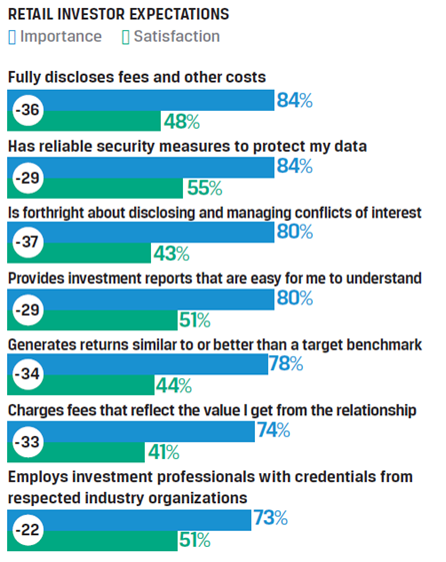

In the same study conducted by the CFA Institute, investors were asked what they want from financial advisors:

Source: The Next Generation of Trust: A Global Survey on the State of Investor Trust, CFA Institute, 2018

The most important aspects required by investors to financial advisors are the transparency of all costs and absence of conflicts of interest, data protection, sending understandable information, obtaining good results in relation to references of market, charging commissions aligned with the service provided and has accredited professionals.

In other words, we want the advisor to put our interests above all (fiduciary duty), provide adequate and simple information and obtain results

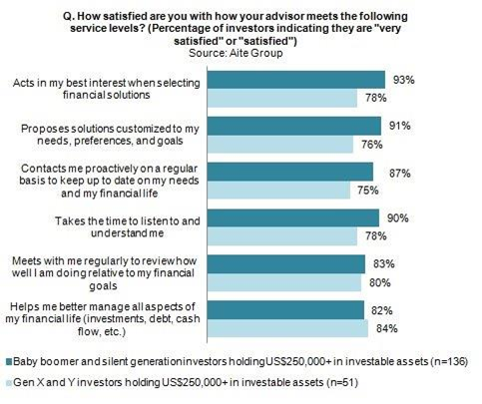

The Aite Group study shows the service levels that matter most:

It concludes that the most important levels of service in the satisfaction of the financial advisors are the work according to our interests, the proposed customized solutions, regular communication, ease of contact and understanding of our case, the existence regular state-of-the-day meetings and support in the management of all finances (investments, debts, income and expenses, etc.).

What role or what services do we want from Financial Advisors?

Some consider that having a financial advisor is like hiring a CFO (Chief Financial Officer) for our family.

If we think that our finances need to be monitored and are not always well we can look at the financial advisor also as a doctor specializing in the health of our finances.

The services we need from the financial advisor are:

- Financial planning, which focuses on all aspects of financial life, from what we save to the insurance we need, going far beyond investments. For investments it includes the definition of financial objectives (such as retirement, reserve fund, home purchase, child education, etc.), knowledge of the financial situation and capacity and the risk profile to ensure that the taking of asset allocation decision is customized, adequate and correct, as well as ensuring alignment in the management of expectations;

- Investment consulting, which focuses on the functions of selection and realization of investments, and their management in time, namely what investments to make and in what accounts.

The selection of concrete investments and their management strategy, well communicated, reasoned and perceived is one of the essential aspects. Another equally important aspect is to support and guide us in times of increased market volatility or where we have changes in personal circumstances that impact on our financial life, which may or may not justify changes to the plan initially

- Planning of the retirement, which seeks to align all relevant issues to ensure life in retirement, namely social security pensions, other pensions, taxes, retirement date, investments, etc.

Since retirement is one of the main financial objectives, because it is a fairly long period, and during which we have a more limited capacity to explore new sources of income, spending can be quite volatile and in which we want to maintain our level of life with a lot of tranquillity, good planning is key.

The financial advisor helps in 3 major subjects:

- Selects financial solutions according to our best interests, proposing customized solutions for our needs, preferences and objectives and helping us to manage all aspects of our financial life;

- Contact us proactively and meet with us on a regular basis to report information, understand us and are available to listen to us;

- It helps us fight our behavioral vulnerabilities.

The issue of rigor, professionalism, conduct and added value of the financial advisor are fundamental because as Warren Buffet said: “Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway.”

https://www.cfainstitute.org/-/media/documents/survey/cfa_investor_trust_global_report.pdf