How the familiarity bias occurs in investing in time deposits or structured products

Home Bias in the various countries and investor segments is the most common form of familiarity bias

Why should we fight home bias?

How can we overcome the familiarity bias?

What is the familiarity bias?

We all know people who only shop in a certain place or buy a certain brand, or who only go a certain route to go somewhere because that is the path they’ve taken for years. By doing so they remain in their comfort zone.

These are examples of familiarity bias, which in many cases can prevent a person from acting objectively, even when the information available suggests doing so otherwise.

Prejudice or bias of familiarity is very common in investment. The most frequent versions are when an investor:

- Only buys stocks or bonds of his home country.

- Holds a high percentage of the company’s stock simply because he works there.

- Buy stocks of a company whose product often uses and appreciates. Not only global or multinational companies like Apple, Amazon, Facebook, Spotify, Johnson & Johnson, McDonalds, Nike, LMVH, Inditex, Unilever, BMW, Daimler but also his utility companies (electricity, gas and water), telecommunication company, supermarket or other domestic/regional companies).

The familiarity bias occurs when an investor prefers a familiar investment, although there are several viable options that can be much better in terms of portfolio diversification. We invest only in what is familiar to us, in what we know or in what we think we know more than others.

It follows that we invest excessively in domestic securities or funds, far beyond the weight of the country, the company and the security in global markets terms, and the assessment of their attractiveness in terms of return and risk in a global context, in many cases just because we think we know them better.

An investment that we have already owned in the past and that has provided us with a positive experience may seem less risky to us and therefore often emerges as a new investment choice when we seek to generate returns.

Of course, there are other reasons why investments are held in portfolios. Holding an investment for a long period does not mean that it is subject to familiarity bias. On the contrary, bias occurs when the investment process, or rather its lack, results in the choice of investments that seem easier to us, rather than properly considering those that are in the broadest set of investments possible.

Familiarity bias can lead to sub-optimal choices of assets and/or investments when investors underestimate risk and make investments that lack sufficient diversification and have an over-exposure to risk.

The familiarity bias may also stem from the loss aversion bias. To avoid losses, investors are afraid of diversification and tend to remain confined to their comfort zone.

It can also be caused by the availability bias, when more information is available for familiar stocks and businesses, or by the herding bias effect that prevents investors from making decisions other than the ones others are making.

How the familiarity bias occurs in investing in time deposits or structured products

An example of familiarity bias can be found in the use of time deposits for the exclusion of other assets. Time deposits have a known return, but it is very low when compared to investment in stocks or bonds. Although they provide some income, they do not give access to term or credit risk premiums, so they are not a complete portfolio solution.

Another example can be seen in the investment in structured or hybrid products, whether capital guaranteed or not. People invest funds structured capital guaranteed products to obtain a higher return than the deposit alternative. They also make investments in structured non-guaranteed capital products, of several risk degrees (less or more leveraged), seeking to concentrate on these investments their risk bets or their more aggressive side.

If we combine these two examples of investor bias, it’s easy to see why some investors have the share of investments that exclude stocks from their portfolios overexposed to hybrids and cash, excluding the rest of the global fixed income universe.

Home Bias in the various countries and investor segments is the most common form of familiarity bias

A clear example of the familiarity bias and also of naïve diversification bias is the concentration of investment in the domestic or regional market (“home / regional bias”), especially in terms of equities (not to mention investment in the same set or type of stocks, for example sector, be it technology, health, financial, etc.).

Investors have a bias to buy the stocks they know. This can mean buying several stocks from their own country, their own company or from companies they know or which products that commonly use. Family bias prevents investors from analysing the real potential of lesser-known companies and stocks, which may prove to be more profitable than familiar options.

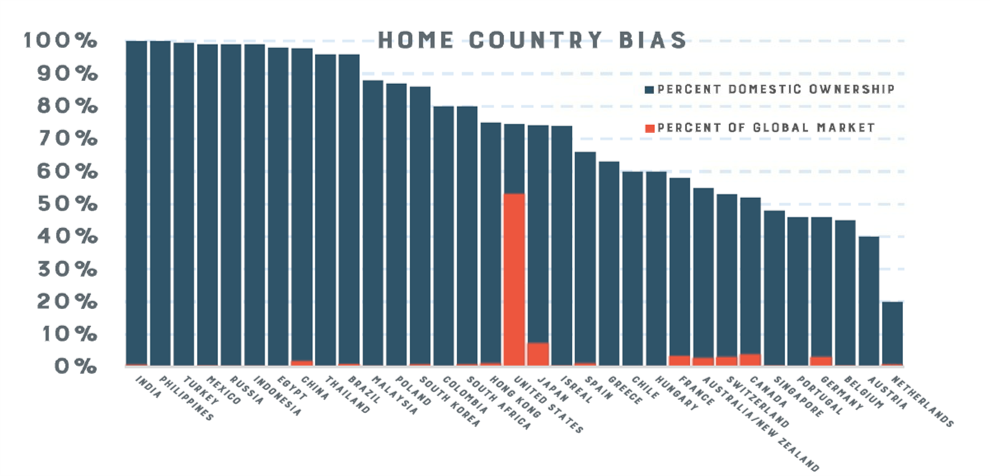

According to a study conducted by the International Monetary Fund in 2014, the bias of investment in domestic market stocks is very high in all countries of the world:

The weight of investments in the average domestic market is around 60% to 70%, with more than 50% in all countries with the exception of the Netherlands and Austria, when the weight of national markets in the global market does not normally exceed 4% (with the exception of the USA and Japan).

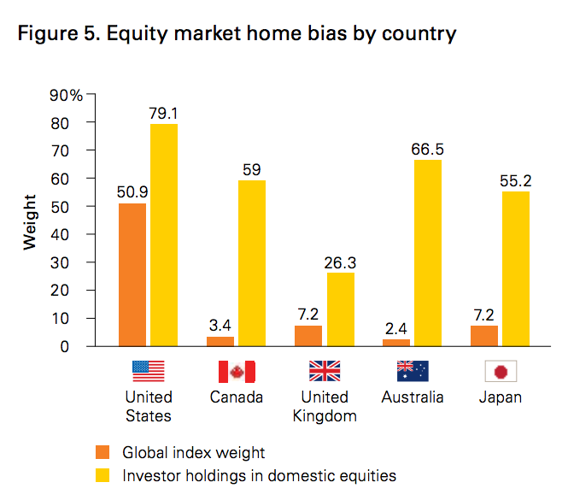

The following chart shows a more recent study by Vanguard in 2016 on this bias in equity investments in five major global markets:

The bias is clearly lower in the US due to the greater weight of this market in global terms and not by the greater international diversification, being the country which invests more domestically, about 80%, but has a high weight, almost 51%. In other countries and except for the United Kingdom, investments in domestic stocks are above 55% when the weight of the markets does not exceed 8%. In the UK alone, the weight of domestic investment is more moderate at 26%, when its weight is 7.2%.

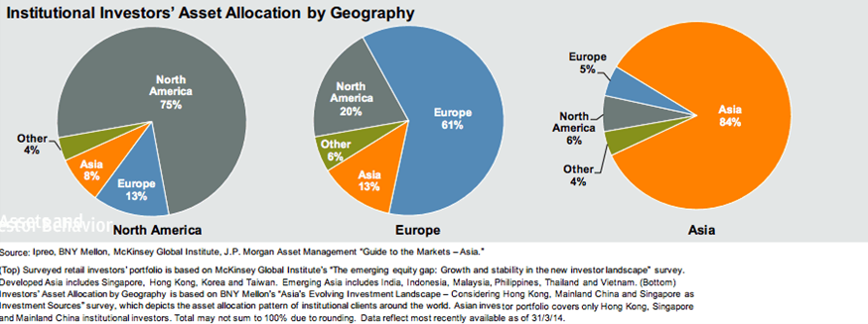

In 2014, McKinsey and JP Morgan Asset Management conducted a study on the geographical allocation of assets by the largest institutional investors in the world’s major regions:

The conclusion was that there is a large domestic bias in asset allocation, ranging from 84% in Asia, 75% in North America and 61% in Europe.

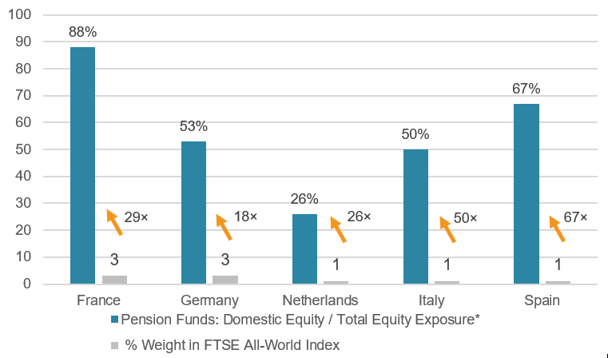

The evolution of geographical equities allocations made by pension funds in some of the largest European countries was as follows according to recent study by FT Russell Pension Funds:

European pension funds also showed a large domestic bias, with allocations of 88% in France, 67% in Spain, about 50% in Italy and Germany and 26% in the Netherlands, when their weight in the world market is only between 1% and 3%.

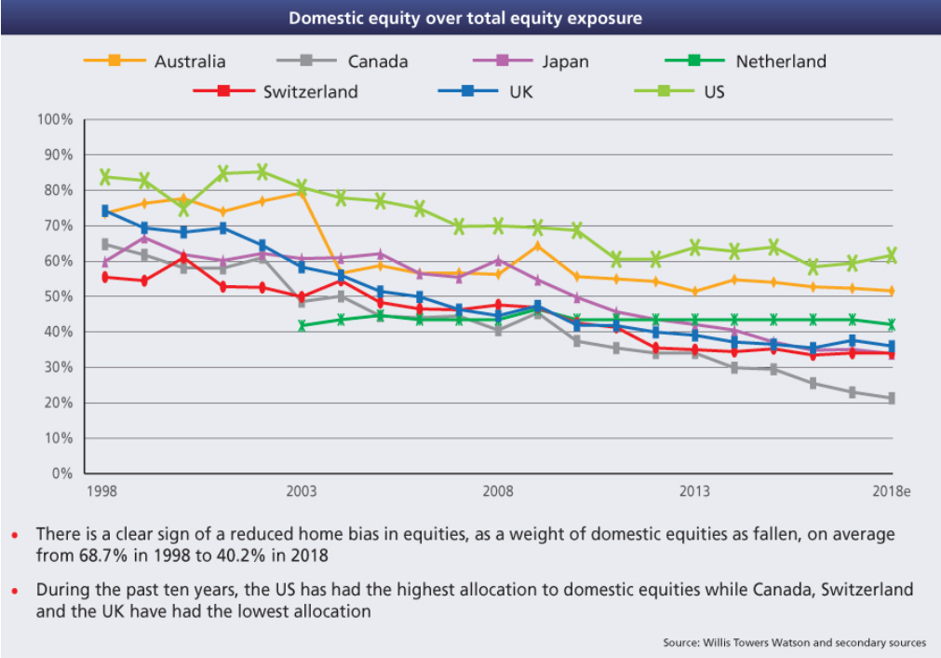

Willis Towers has also analysed the geographical distribution of equity investment of the largest pension funds in each country, with the latest study revealing the following:

Although there is a downward trend in domestic bias in allocations between 1998 and 2018, this bias is still very pronounced in almost all the world except for the US where the weight of its market is significantly higher.

For emerging countries, a survey conducted by Schroders for individual investors in these countries found that between 40% and 50% of respondents prefer funds that invest in the domestic market or in the emerging market region:

The reasons are the preference for investments in family countries and in the country itself, in addition to some international diversification.

Why should we fight home bias?

The main reason is diversification, i.e. once again “do not put all the eggs in the same basket”, in order to improve expected returns and risk by combining investments.

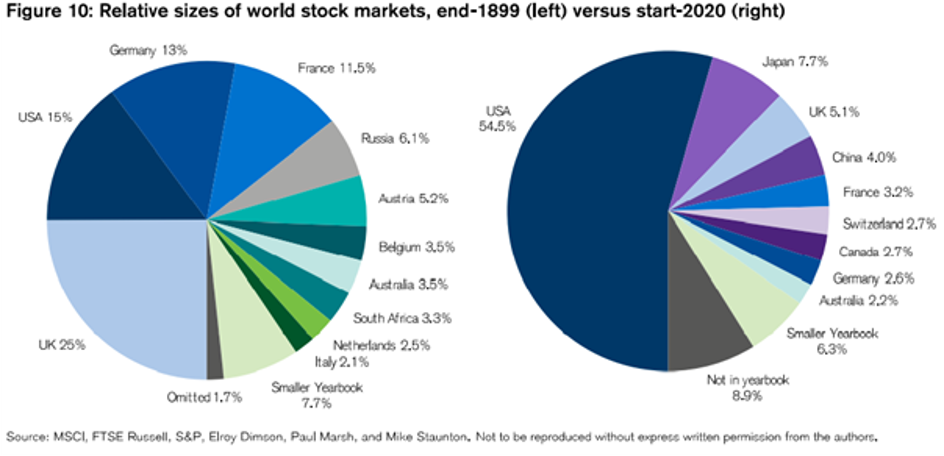

The second reason is the demand for more and better investment options, which provide greater returns for the same level of risk. We have seen and know that there are larger capital markets and companies, and more developed, efficient, dynamic, with greater potential for appreciation and growth, more attractive and more solid. Regarding stock markets, the composition of the global market itself reflects this different efficiency and dynamics and is a good guidance for allocation:

In addition, there are many companies that are not as foreign as we think. They are companies that manufacture products that we buy or that provide us with some services that we use in our daily life. We do it as well as a large universe of families all over the world.

We provide some examples. In US companies we have Apple, Amazon, Microsoft, Google and Facebook in technology. And Visa, Procter and Gamble, Johnson & Johnson, Nike, Disney, Coca-Cola e a Pfizer. In Europe, we have Unilever, Merck, LMVH, Nestlé, Volkswagen, Bayer, and Siemens. In Japan, Toyota, Sony, and Toshiba. In other Asian countries we have Taiwan Semiconductor, Samsung and Kia.

In addition there are many other companies of which we are not consumers, but that are true global giants by the size of their domestic or regional market, such as Alibaba, China Mobile, Tata, Teva, Cemex, Walmart, JP Morgan, among lots of others.

How can we overcome the familiarity bias?

The most important step to overcome the familiarity bias is to accept that familiar is not necessarily safe. In addition, investors should not consider seeking help as a sign of weakness.

Investors should regularly check their investment account. They should evaluate and revaluate options for optimal portfolio management and asset allocation. This will give them awareness of the other opportunities, and help them eliminate familiar stocks and businesses that are not performing as well as they were or thought.

To overcome the familiarity bias, investors should try to reduce investment in the domestic economy, domestic companies, and the companies they work for. Conscious attempts in this direction will help them diversify.

In essence, each stock and each investment opportunity should be analysed individually, without any form of bias. Risks and rewards should be understood in detail and investment decisions should be based solely on the objectivity of the outcome. This will lead to more rational and logical decisions compared to irrational decisions caused by behavioural biases.