Good performance, absolute and relative, of the US stock market, and of the investment quality bonds of developed countries, as a result of global and regional growth levels, lower inflation and interest rates, tariffs and “deglobalization”, the framework of geopolitical risks, and changes of government in Europe

The outlook for 2025

Economic growth: global 3.3% in 2025 and 2026, up from 3.2% in 2024, with inflation of 3.8% in 2025 and 3.0% in 2026 (5.4% in 2024)

Economic policies: continued decline in official interest rates and increase in trade tariffs by the US

Equity markets: US outperforms than the rest of the world, due to a more favourable economic environment and despite excessive valuations

Bond markets: lower interest rates value medium and long-term bonds with good risk quality

Opportunities: Rising U.S. Consumption and Resolving Global Conflicts

Risks: Rising trade tensions, tight inflation, and worsening deficits and debt in the U.S. and Europe

The outlook for 2025

We recently published the Outlook of the financial markets of the world’s leading investment banks.

In this article, we present our vision and ideas, which contain opinions and recommendations regarding investments.

Global economic growth of 3.3% in 2025 and 2026, up from 3.2% in 2024, with inflation of 3.8% in 2025 and 3.0% in 2026 (5.4% in 2024)

The OECD forecasts global GDP growth of 3.3% in 2025, versus 3.2% in 2024 and 3.3% in 2026.

Inflation in the OECD is expected to slow further, from 5.4% in 2024 to 3.8% in 2025 and 3.0% in 2026, supported by the still restrictive monetary policy stance in most countries.

Growth prospects vary significantly from region to region.

GDP growth in the United States is projected to be 2.8% in 2025, before slowing to 2.4% in 2026.

In the euro area, GDP is expected to grow by 1.3% in 2025 and 1.5% in 2026.

Growth in Japan is forecast to expand by 1.5% in 2025, but then slow to 0.6% in 2026.

China is expected to continue to slow, with GDP growth of 4.7% in 2025 and 4.4% in 2026.

Economic policies: continued decline in official interest rates and increase in trade tariffs by the US

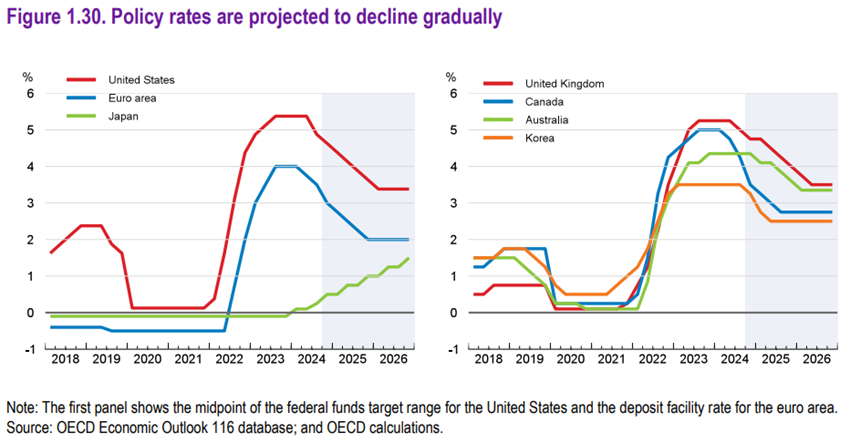

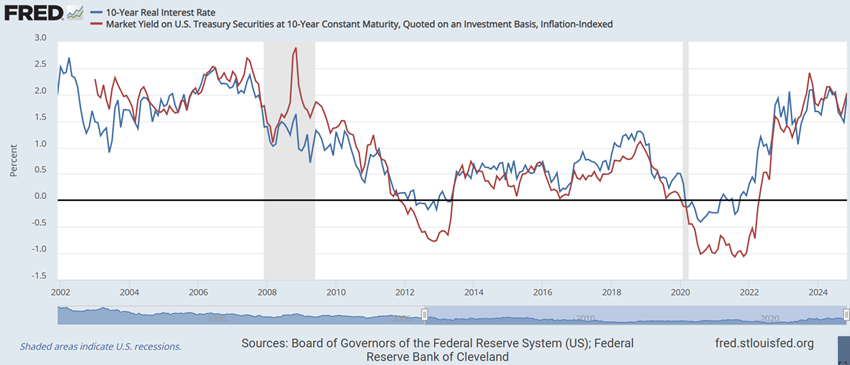

The central banks of the US and Europe will continue to reduce the key interest rates in line with the continued decline in inflation in those countries, at least during the first half of the year.

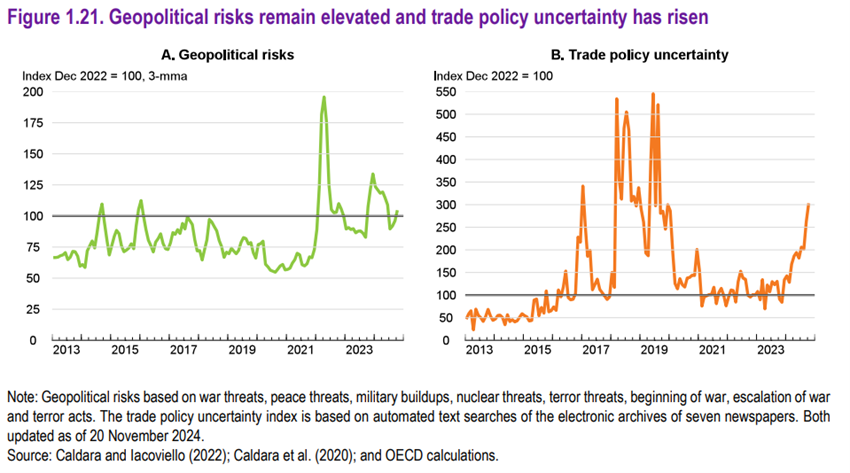

In the second half of the year, prevê.se that inflation will stop falling and interest rates will stabilize due to the inflationary effect of the introduction of trade tariffs by Trump’s agenda.

Trump’s fiscal policy, based on tax cuts and spending reductions (subsidies and the public administration efficiency program), will have effects that are still uncertain.

Two of the main countries in the eurozone have the challenge of containing the worsening of the deficit and public debt, at a time of political change and social contestation.

Equity markets: US outperforms than the rest of the world, due to a more favourable economic environment and despite excessive valuations

The US will continue to be a better option for equity markets, compared to the rest of the world, despite the overly stretched valuations of the former compared to the others.

The main reason is the better expected performance at the macro and micro level, including higher economic growth, positive effects of trade and fiscal policies, and higher growth in corporate results.

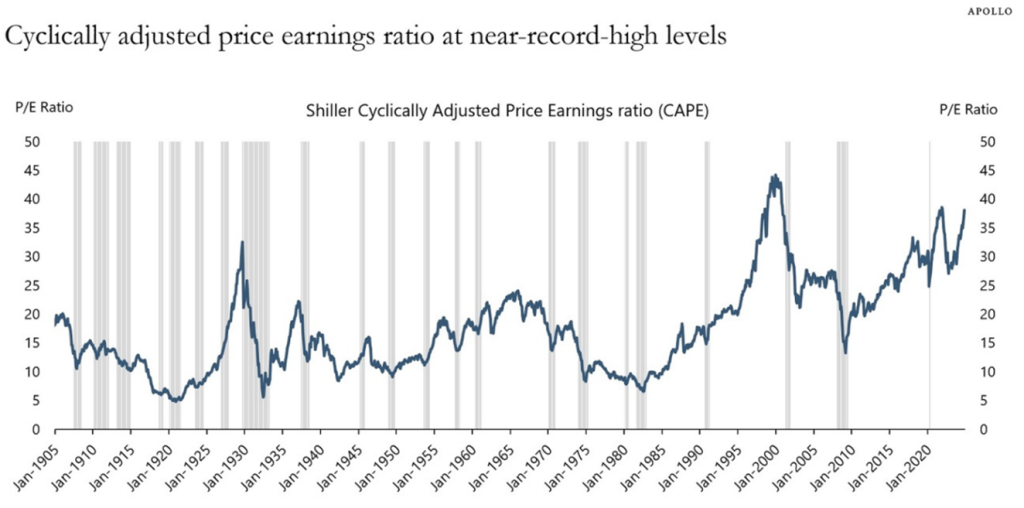

Although the valuations of the stock markets in the US are excessive, by any of the metrics used, the economic context remains very favourable.

The S&P 500 Shiller CAPE is at 38x, significantly above its long-term average of 17x and close to the all-time high of 44x.

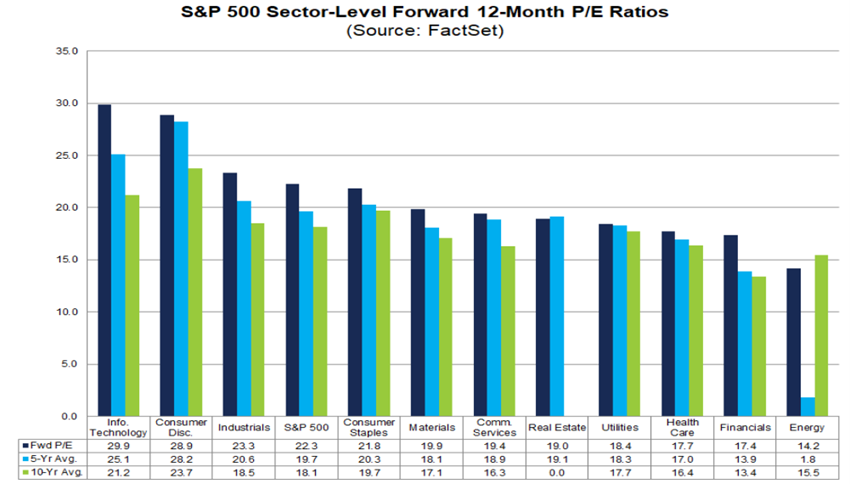

The S&P 500’s 12-month forward PER of 22.2x is well above the five most recent historical averages for the S&P 500: 5 years (19.6x), 10 years (18.1x), 15 years (16.4x), 20 years (15.8x), and 25 years (16.4x). The maximum that this indicator has reached in the last 25 years was 24.4x in March 2000.

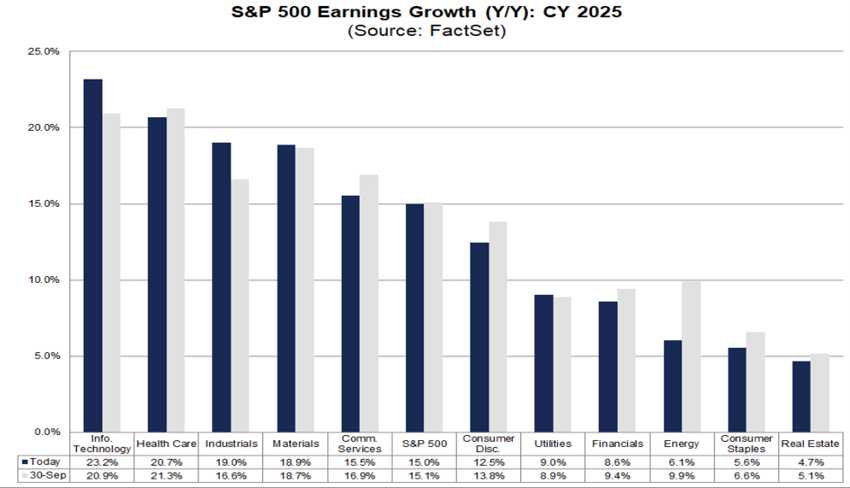

At the sectoral level, ten sectors had the 12-month forward PER well above the averages of the last 25 years, led by the information technology (30.3x vs. 20.9x), materials (20.7x vs. 14.8x), industrials (23.5x vs. 16.9x) and consumer discretionary (27.1x vs. 19.9x) sectors.

Analysts project record EPS for the S&P 500 of $240 in 2024 and $275 in 2025 on November 7 (13% growth).

Volatility will be higher and corrections will be more frequent and larger, but the strong increase in wealth in the last two years due to real estate and stock market valuations is an important cushion for sustaining markets and will maintain a positive effect on consumption.

European stock market assessments are in line with the historical average, but their performance will be constrained by low levels of economic growth and expected corporate earnings, Trump’s increase in tariffs, fiscal restraint, and political changes in Germany and France.

The Chinese stock market will continue to face the challenges of the property crisis and growth based more on public spending and investment than on boosting consumption.

Japan, India and Taiwan are other interesting equity markets, benefiting from continued positive secular conditions.

Bond markets: lower interest rates value medium and long-term bonds with good risk quality

The decline in interest rates in the US and Europe that will accompany the continued decline in inflation will have a positive impact on the valuation of sovereign bonds and good credit quality companies.

Credit spreads are expected to remain as default levels are low and stable.

Opportunities: Rising U.S. Consumption and Resolving Global Conflicts

Trump’s economic agenda, centered on tax cuts, increased tariffs and deregulation, is favorable for American stock markets.

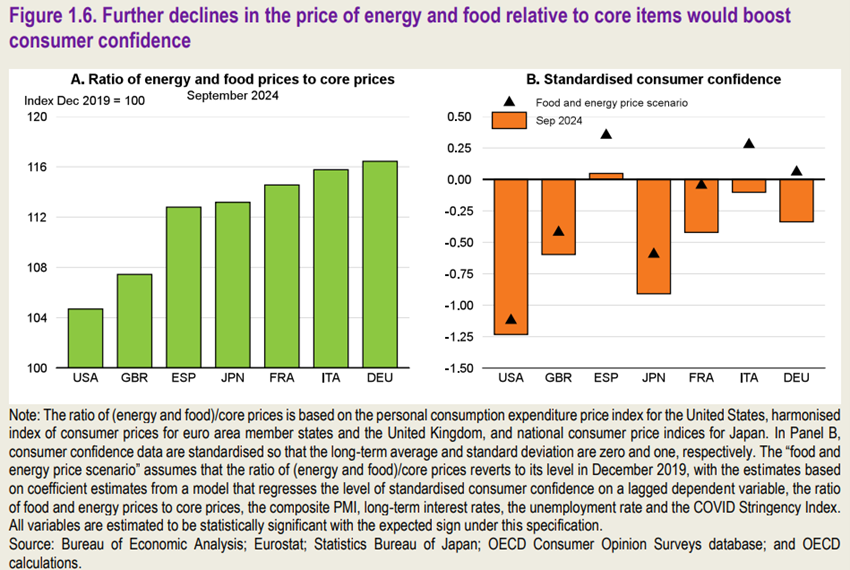

The resolution of the war in Ukraine could increase the level of consumer confidence and lower energy prices.

Risks: Rising trade tensions, tight inflation, and worsening deficits and debt in the U.S. and Europe

An intensification of ongoing conflicts in the Middle East could disrupt energy markets and affect confidence and growth.

Rising trade tensions could hurt trade growth and jeopardize the path of disinflation, which could trigger rate hikes and disruptive corrections in financial markets.