Benjamin Graham and Warren Buffet, and value investing versus growth investing

But after all what are value stocks and growth stocks?

Historically, contrary to it is thought, the best investing strategy was value compared to growth

Is it possible to identify value and growth cycles and/or patterns or sets of factors that favour one strategy over the other?

We live in a market cycle with very significant valuations, in which the growth strategy far exceeded that of value.

So many think it was and will always be so.

From now on, only the future will tell. As for the past, nothing could be more wrong.

There were cycles of alternation of strategies, but in the very long term the value strategy was clearly dominant.

Benjamin Graham and Warren Buffet, and value investing versus growth investing

The value investing strategy is followed by major references from the investment world, including one of its pioneers, Benjamin Graham, and one of his most respected disciples, Warren Buffett.

The value investing strategy seeks to invest in companies that are undervalued in relation to the market. The valuation can be measured in several ways, including the P/E ratio, the price earnings per share, or the P/B ratio, of the price book value per share.

In contrast, growth investing aims to invest in companies that are rapidly growing revenues, profits and cash flows. As a result, these companies often seem to be overvalued based on those assessment metrics.

But after all what are value stocks and growth stocks?

Growth stocks are those of companies that are considered to have the potential to outperform the general market over time due to their higher potential for future growth.

Value stocks are classified as companies that are currently trading below the value they are actually worth, thus providing greater profitability.

Value stocks are generally those of larger, better-established companies, which are trading below the price that analysts consider the shares are worth, depending on the ratio or financial multiple or the benchmark with which it is being compared.

Value stocks typically trade at a discount in terms of the P/E ratio, or the price on the results per share, or the P/B, the price on the book value per share, or the P/CF, of the price on the unit cash flow.

In theory, value stocks are considered to have associated a lower level of risk and volatility, since they are usually larger and more established companies. And even if these stocks do not reach the target price or objective that analysts or investors predict, these stocks pay reasonable dividends and may still offer some capital growth.

In turn, growth stocks generally refrain from paying dividends, and instead companies reinvest retained earnings to expand. Thus, the probability of loss of growth stocks to investors may also be higher, especially if the company cannot keep up with growth expectations.

Historically, contrary to it is thought, the best investment strategy was value compared to growth

Many people think that the growth investing strategy is the one that has performed the most over the years.

Some understand that this could only be the case given that growth stocks typically have more volatility and risk, being associated with smaller companies.

Nothing could be more wrong, as evidenced by the historical facts.

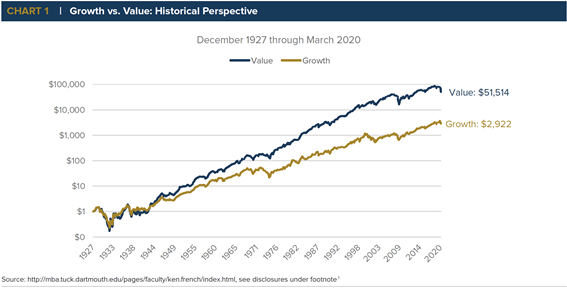

In the following chart we see the performance of the investment strategy in value and growth between 1927 and 2020 in the US:

Adopting a value investing strategy, the investment of $1 in 1927 would have resulted in a capital of $51,514 in 2020 while following a growth investing strategy the resulting capital would only be $2,922.

Thus, it is unquestionable that value stocks outperform the appreciation of growth stocks in the long-term.

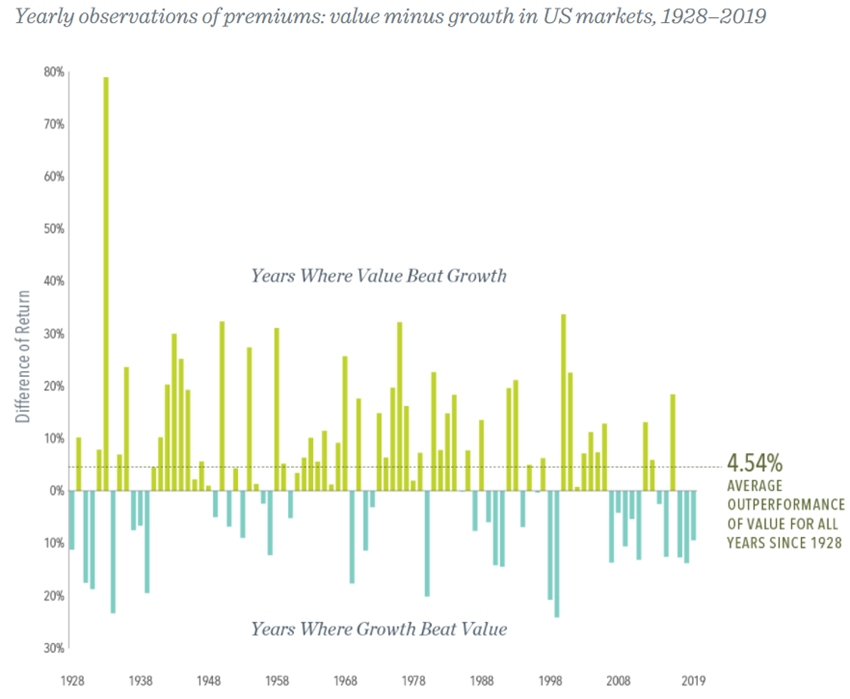

The following graph shows the difference in annual returns between the value strategy and growth strategy in the US between 1928 and 2019:

We see that not only the number of years in which the value investing strategy beats that of growth is higher (green versus blue), but in many cases the difference in profitability in those years is much greater than the situation in which growth is valued the most.

In this period, on average, value investing had a 4.5% per year return higher than that of growth investing.

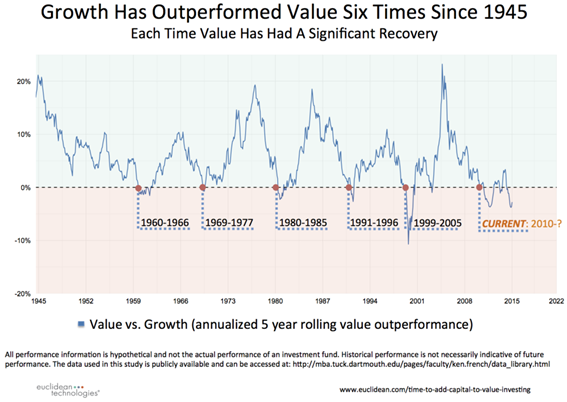

The following graph allows us to analyse the cycles of strategies by showing average annual returns for 5-year periods between 1945 and 2017:

Since 1945 growth investing has only outperformed value investing in 6 periods and all have been short-lived except the most recent. After these brief periods, the investment in value had a very strong recovery.

The difference between the average annual rates of return on value investment against growth over 5-year periods often exceeded 10% while the reverse only occurred in the years leading up to the 2000 technology bubble.

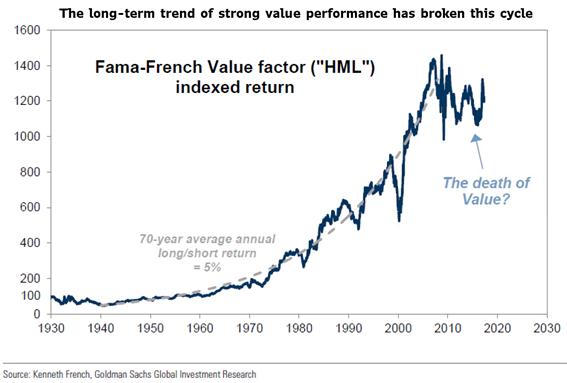

However, the following graph of the evolution of the differences in value and growth investing since 1930, inspired by the original work of Fama-French, shows a different recent situation:

By the end of the Great Financial Crisis in 2009, the value has significantly outperformed growth investing, but since then, in this last very positive cycle for the markets and also quite long, this situation has changed to an extreme of questioning if we are not witnessing the “death of value”.

However, in the last cycle, since 2009, the growth investing strategy has gained and for an impressive score

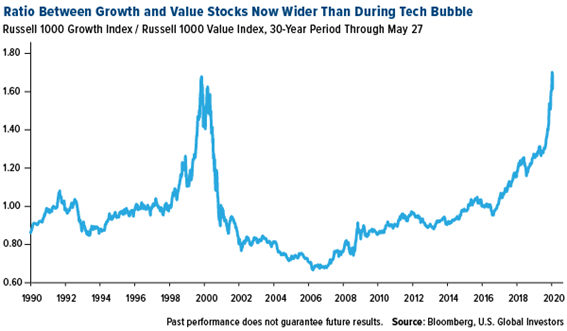

The following graph shows the evolution of the valuation ratio between value and growth investments between 1990 and 2019 in the US:

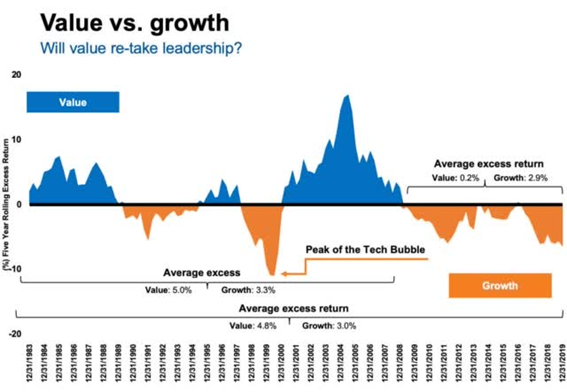

The following graph seeks to analyse the same period, but in terms of cycles, showing average annual returns for 5-year periods:

Value investing was better between 1983 and 1998, and even better in the period from 2001 to 2008, between the last two crises, having been surpassed by growth investing since 2009.

For more than a decade, value investing has performed better than growth:

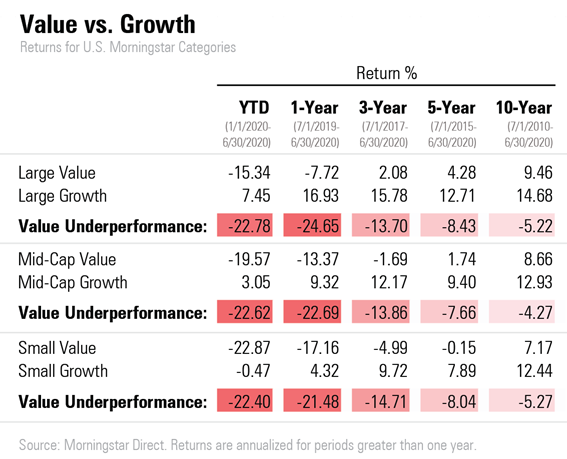

According to Morningstar’s rating between value and growth, the comparative returns in the last 10 years were as follows:

Growth investing has beaten value in all segments, from large, medium to small businesses, and differences have been increasing in recent years.

Over the past 10 years the differences in annual average returns have been 14.7% versus 9.5% for large growth over value, slightly more than the differences in medium and small capitalisations.

Still in relation to large companies, in the last 5 years, the difference was between 12.7% and 4.3%, in the last 3 years between 16% and 2% and in the last year between +17% and -8%.

Overall, the remaining market capitalisations also had the same relative behaviour, although never experiencing growth performance figures as high as in the case of large companies.

We conclude that this most recent cycle of 10 years has clearly been dominated by growth investing, having been accentuated over the years, and very much focused on the largest companies.

The question now is whether we are living a paradigm shift, that is, whether the growth investing recent outperformance is here to stay, or whether on the contrary, we will soon have a reversal of the cycle to the mean, and the coming years will be more favourable to value investing.

We will do this analysis in a subsequent post.

https://www.amazon.com/Intelligent-Investor-Definitive-Investing-Essentials/dp/0060555661