The main emerging stock market indices: MSCI Emerging Markets and Hang Seng

Long and recent years performance of emerging stock market indices

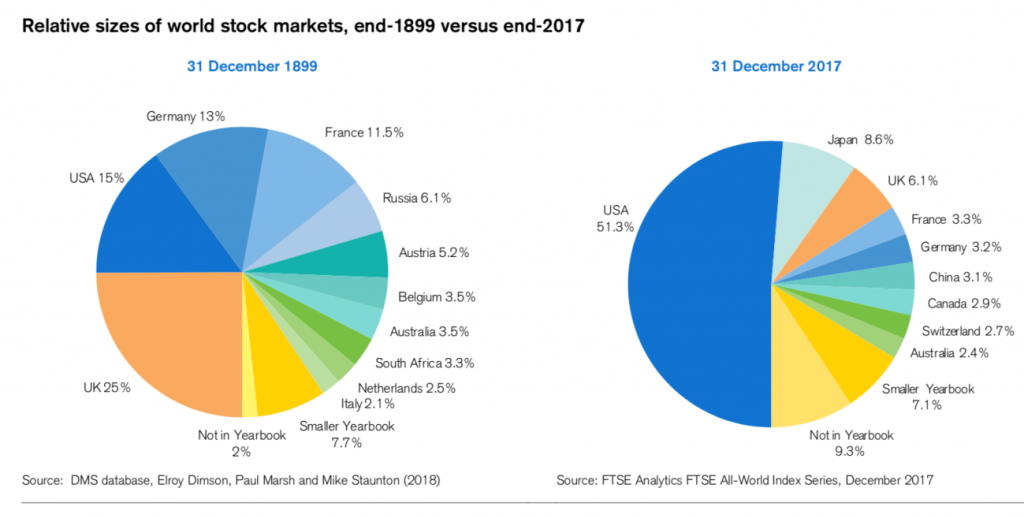

The weight of each country stock markets worldwide is the following:

Currently, the US accounts for 51% of the world stock market, Japan 9%, the UK 6%, the Eurozone about 12%, the other developed markets 8% and emerging markets 14%.

In previous posts we described the main developed stock market indices, from the US, Europe, and Japan.

In this post we will see the major emerging market indices: MSCI Emerging markets and Hang Seng.

The main emerging stock market indices

MSCI Emerging Markets

The MSCI Emerging Markets index captures the representation of large and medium-sized capitals in 26 Emerging Market countries, including: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and the United Arab Emirates.

With 1,404 constituents, the index weighs the stock market capitalization of countries and covers approximately 85% of each country’s capitalization.

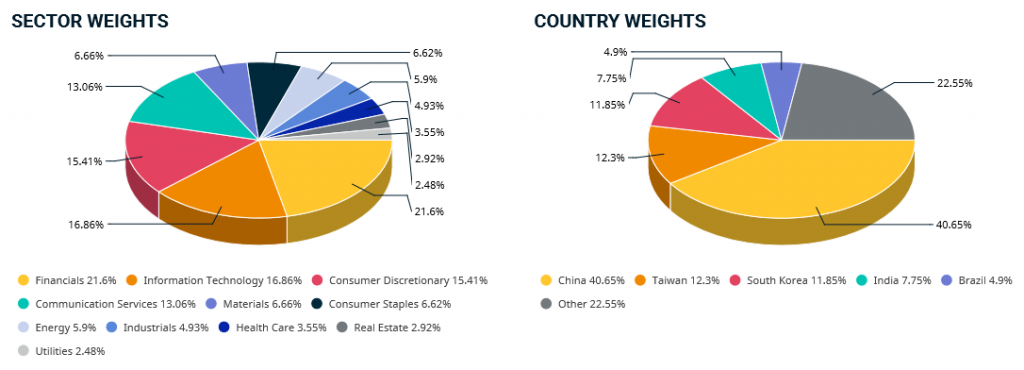

Its composition is as follows:

The countries with the highest weight are China with 41%, Taiwan and South Korea with 12% each, India with 8%, Brazil with 5%, and the rest with 23%.

The most important sectors are the financial with 22%, information technology with 17%, consumer discretionary with 15%, communication services with 13%, and then materials, consumer staples, energy, industrials, health care, real estate and utilities.

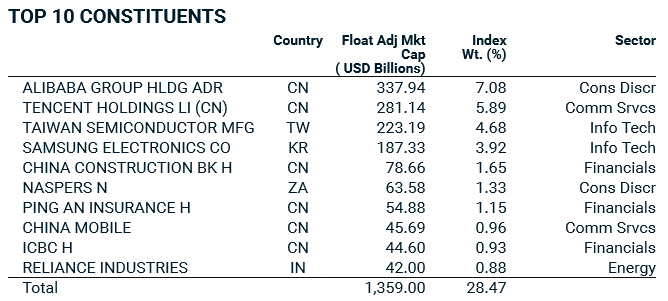

Its top 10 companies are as follows:

In the following link we have a brief description of this index:

https://www.msci.com/documents/10199/c0db0a48-01f2-4ba9-ad01-226fd5678111

China: Hang Seng

The Hang Seng Index (“HSI”), is the most widely cited index of the Hong Kong stock market and includes the largest and most liquid stocks listed on the main market of the Hong Kong Stock Exchange.

It is the main reference of the Chinese stock market for international investors.

The index includes the largest and most liquid shares traded in Hong Kong. The shares are adjusted to liquidity to represent trading capacity.

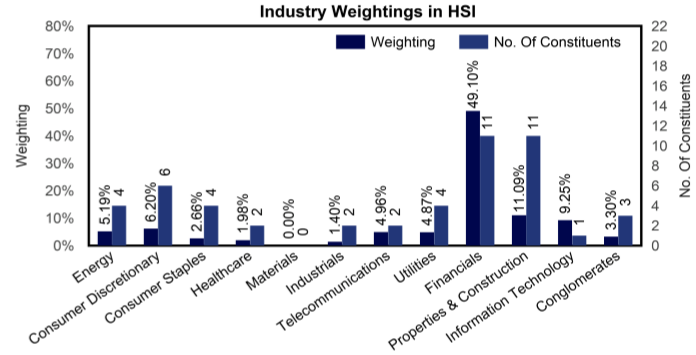

Its sectoral composition is as follows:

The most important sectors are the financial with 49%, construction with 11%, technology with 9%, consumer goods with 6%, and energy, telecommunications and public goods with 5% each.

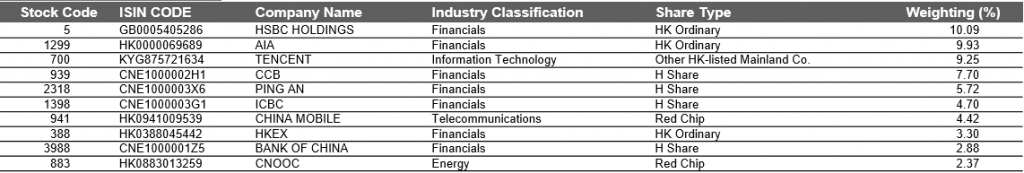

Its top 10 companies are as follows:

The following chart shows some of the most relevant Hang Seng companies:

In the following link we have a brief description of this index:

https://www.hsi.com.hk/static/uploads/contents/en/dl_centre/factsheets/hsie.pdf

Long and recent years performance of emerging stock market indices

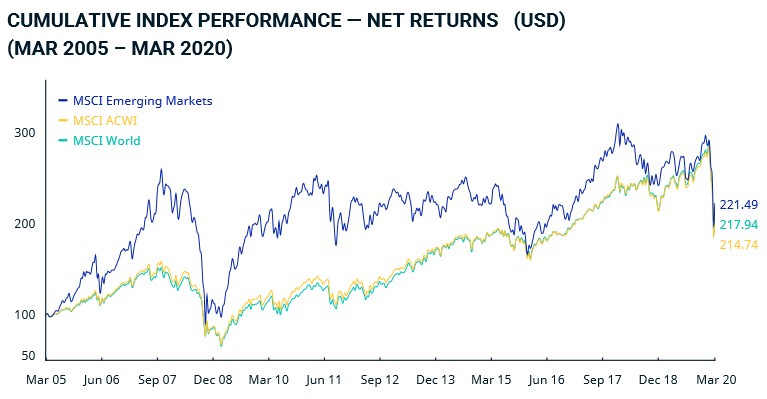

The following graph shows the evolution of the MSCI Emerging Markets index of this 2005:

The emerging markets index had a global appreciation in the period very similar to that of the global indices MSCI ACWI (whole world) and World (developed world), but showing greater cyclical oscillations.