The main developed stock market regional indices: Eurostoxx 50 and Stoxx 600, Nikkei 225 and Topix, Footsie 100 and DAX 30

Long and recent year’s performance of developed stock market regional indices

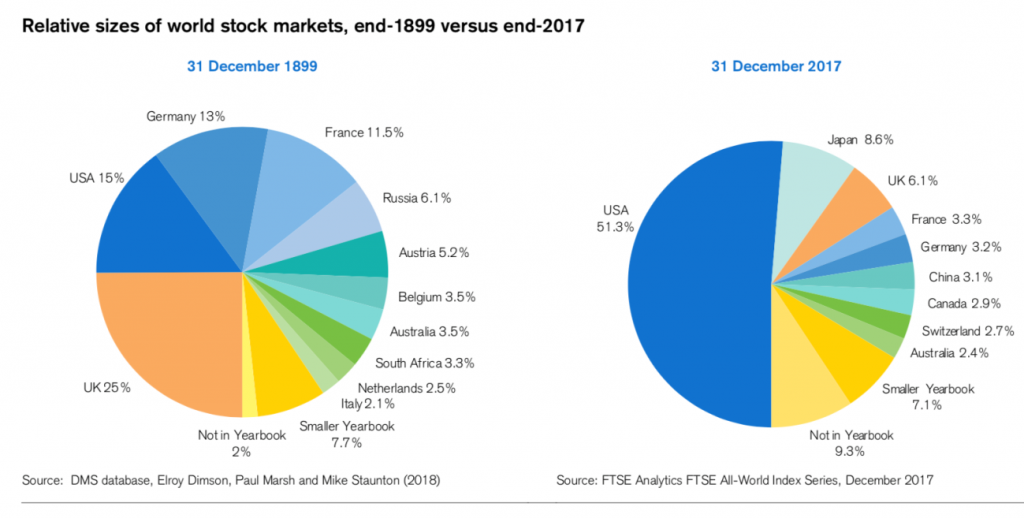

The weight of each country stock markets worldwide is the following:

Currently, the US accounts for 51% of the world stock market, Japan 9%, the UK 6%, the Eurozone about 12%, the other developed markets 8% and emerging markets 14%.

In a previous article we described the S&P 500, the main index in the U.S. and even the world.

In this article we will see the other major developed market regional indices: Eurozone, Japan, UK, and Germany.

The main regional stock market indices

Euro Zone and European stock markets: Eurostoxx 50 and Stoxx 600

The european indices most used by professional investors are the Euro Stoxx 50 and the Stoxx 600.

The Euro Stoxx 50 Index is the euro zone’s benchmark index and should be included in the investment portfolio of all private investors, mainly from the countries of this area.

It represents the performance of the 50 largest companies in the top 19 sectors in terms of market capitalization in 11 Euro zone countries. These countries include Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, The Netherlands, Portugal and Spain.

The index captures about 60% of the euro zone’s total negotiable stock market capitalization, and about 95% of the negotiable stock market capitalization of all countries that make up it.

It covers a global stock market capitalisation of almost €2 trillion. The average capitalisation of the constituent companies is almost €50 billion.

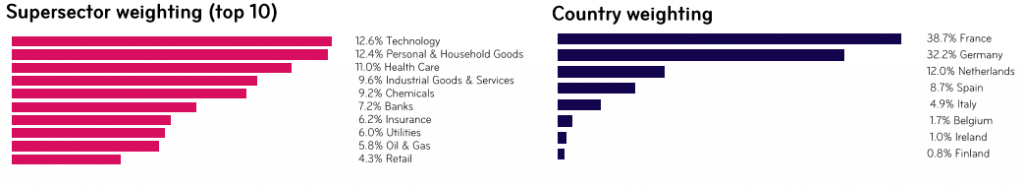

Its composition is as follows:

The countries with the most weight is France with 39%, Germany with 32%, the Netherlands with 12%, Spain with 9%, Italy with 5%, and then Belgium, Ireland and Finland.

The most important sectors are technology, personal and household goods and health care with 11% to 13% each, industrials, banks and chemicals with about 8% to 10% each, followed by insurance, utilities, oil and gas and retail.

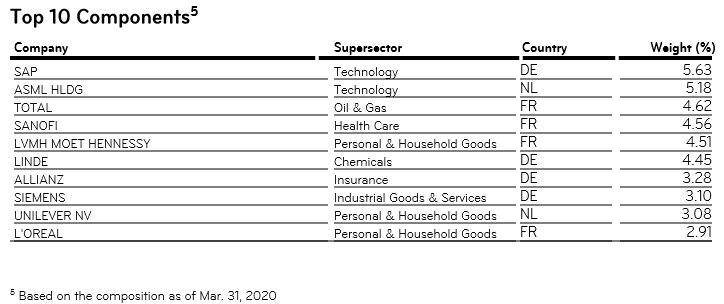

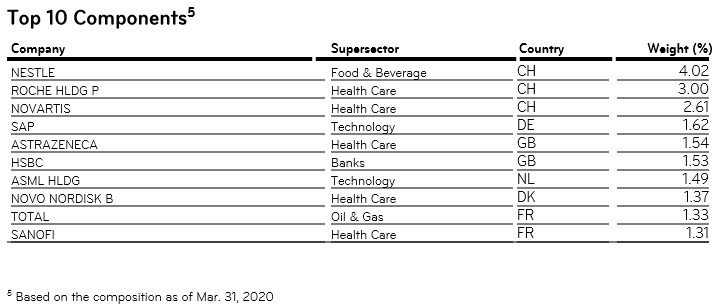

Its top 10 companies are as follows:

.

The following chart shows the Euro Stoxx 50 companies in 2018:

In the following link we have a brief feature of this index:

https://www.stoxx.com/document/Bookmarks/CurrentFactsheets/SX5GT.pdf

Stoxx Europe 600

The STOXX Europe 600 represents the 600 largest exchange-traded companies in developed European markets.

This index includes large, medium and small enterprises from 18 European countries.

The countries that are part of the index are Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, Netherlands, Norway, Portugal, Spain, Switzerland, Sweden and the United Kingdom.

It captures about 92% of the total negotiable stock market capitalization of developed Europe.

It covers a global negotiable stock capitalization of €8.6 trillion.

Its composition is as follows:

The countries with the highest weight are the United Kingdom with 24%, Switzerland and France with 17% each, Germany with 14%, the Netherlands with 6%, Spain, Sweden and Italy with 4% each, and then Denmark and Belgium.

The most important sectors are health care with 17%, industrials with 11%, personal and household goods, food and beverages and banks with 8% each, followed by technology, insurance, oil and gas, utilities, and chemicals.

Its top 10 constituents are as follows:

The average capitalisation of the constituent companies is around €15 billion.

In the following link we have a brief feature of this index:

https://www.stoxx.com/index-details?symbol=SXXP

Japan: Nikkei 225 and Topix

The Nikkei 225, short for Japan’s Nikkei 225 Stock Average, is Japan’s leading and most respected stock index. It is a price-weighted index composed of Japan’s 225 largest companies traded on the Tokyo Stock Exchange. The Nikkei is equivalent to the Dow Jones Industrial Average in the United States.

The constituent shares are weighted by the stock price, and not by the market capitalization, as is common in most indices. The ratings are denominated in Japanese yen.

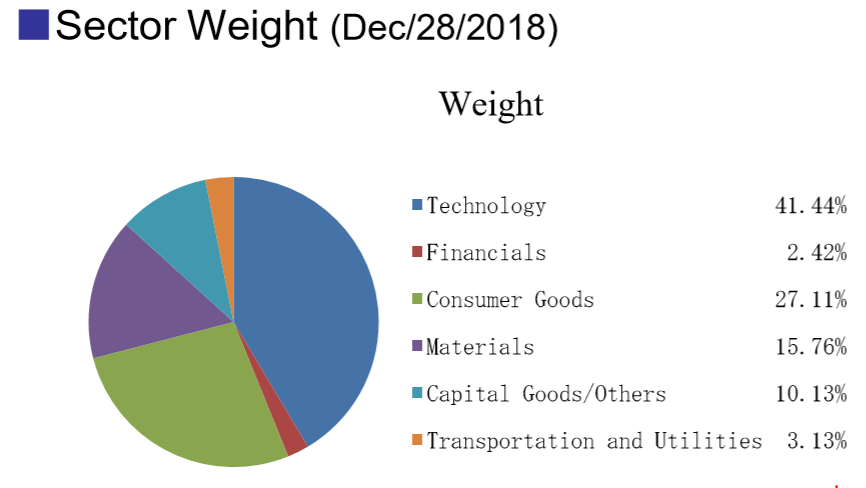

Its sectoral composition is as follows:

The most important sectors are technology with 41%, consumer goods with 27%, materials with 16%, and capital goods with 10%.

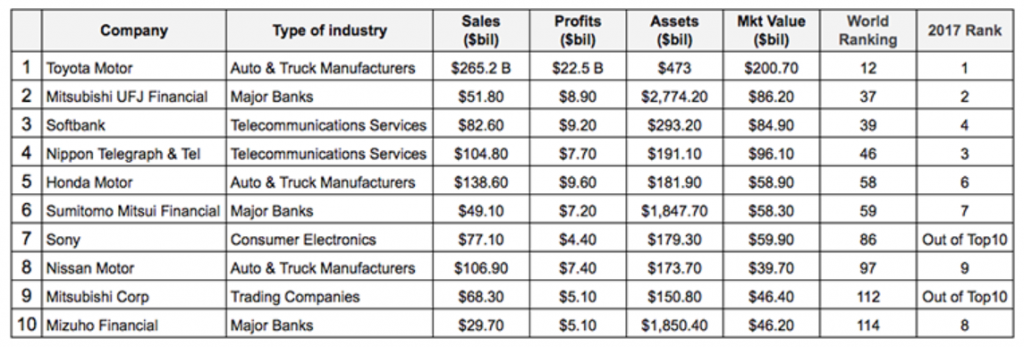

Its top 10 companies are as follows:

The following image shows some of the most relevant companies in the Nikkei 225:

In the following links we have a brief feature of this index:

https://indexes.nikkei.co.jp/en/nkave/index/profile?idx=nk225

https://indexes.nikkei.co.jp/nkave/archives/file/nikkei_stock_average_factsheet_en.pdf

Compared to the Nikkei 225, the TOPIX is considered a more appropriate representation of the entire Japanese stock market because it is weighted by capitalization (reflecting a fairer representation of price changes) and includes the largest companies traded on the Tokyo stock exchange.

In comparison, as we’ve seen, the Nikkei is price-weighted and consists of only the top 225 blue-chip companies listed on the TSE. However, the Nikkei 225 is still the most widely used reference by professionals.

United Kingdom: Footsie 100

The FTSE 100 is by far the most widely used stock market index in the UK.

The FTSE 100 100 index, also called the Financial Times Stock Exchange 100, or, informally, the “Footsie”, is a stock index of the 100 companies listed on the London Stock Exchange with the largest market capitalization.

The 100 companies account for about 81% of the entire market capitalisation of the London Stock Exchange.

It covers a global negotiable stock market capitalisation of £1.8 trillion.

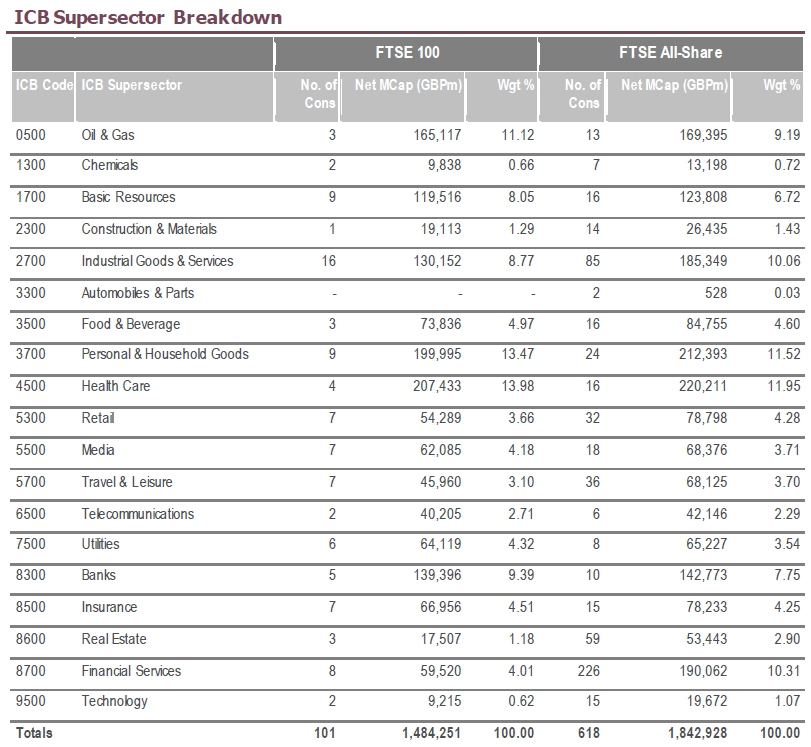

Its sectoral composition is as follows:

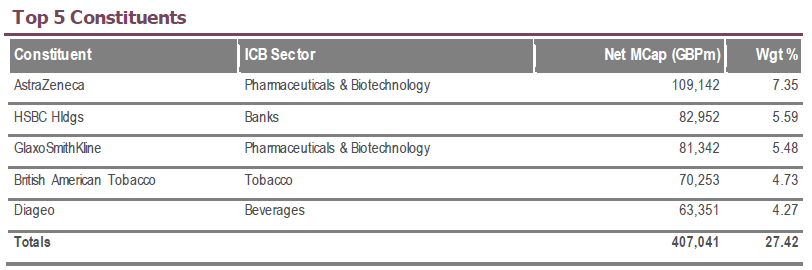

Its 5 largest companies are as follows:

In the following link we have a brief description of this index:

https://research.ftserussell.com/Analytics/FactSheets/temp/24667a90-f30a-46fe-9f45-097c67caab50.pdf

Germany: DAX 30

The DAX index tracks the segment of the largest and most important companies – known as blue chips – in the German stock market, being the main index of this country.

It is the European index most exposed to the global economy and most cyclical due to Germany’s strong export nature.

It contains the shares of the 30 largest and most liquid companies admitted to the Frankfurt Stock Exchange.

The DAX represents about 80% of the capitalization of the German main market.

The Dax is calculated primarily as a performance index. It is one of the few major indices of countries that also considers dividend yields, thus fully reflecting the real performance of an investment in the index portfolio.

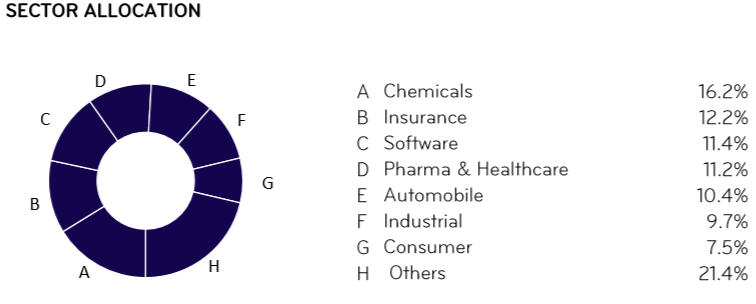

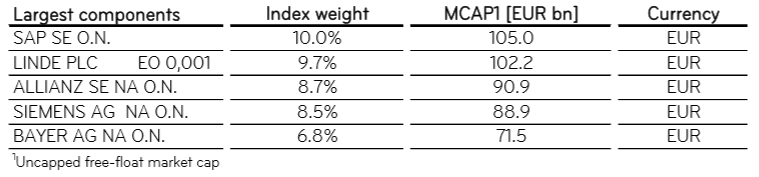

Its sectoral composition is as follows:

Its 5 largest companies are as follows:

In the following link we have a brief description of this index:

https://www.dax-indices.com/document/Resources/Guides/Factsheet_DAX%20EUR_NR.pdf

Long and recent year’s performance of developed stock market regional indices

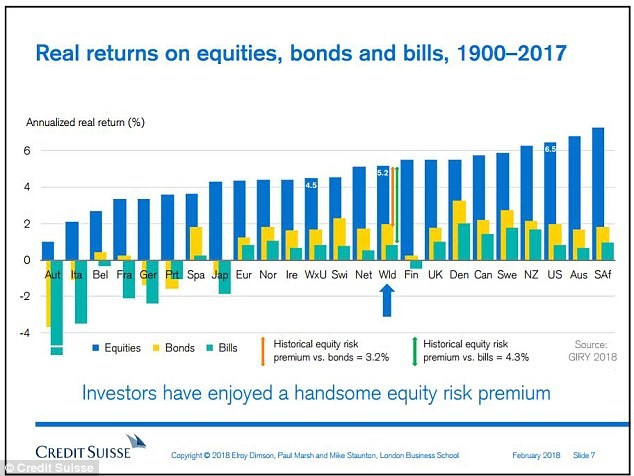

The following graph shows us the average annual returns in real terms of the developed markets at the level of each country between 1900 and 2017:

Europe recorded an average annual real return slightly above 4%, well below the US 6.5%. The countries that lost the two major wars, Germany and Japan, had lower returns, while the UK had returns of almost 6% a year.

The following graph shows the evolution of the main indices of developed markets (including dividends reinvested at 100%) between 1998 and 2018:

In these 20 years, the S&P 500 increased by 250%, the FTSE and DAX about 150%, and the Euro Stoxx 50 and Topix with about 125%.