Women face 5 investment gaps: wage, wealth, retirement needs, retail and institutional

The wage gap

The wealth gap

The retirement needs gap

The retail investment gap

The institutional investment gap

In the series “How they invest” we address the characteristics of the main classes of individual and institutional investors, which we consider useful to guide the investments of most individual investors.

With regard to individual investors, we present the characteristics and differences of investors from various regions or countries, from different levels of wealth, and above all from different generations and women.

In the initial article dedicated to women’s investment we saw that women invest more and more, although still less than men, confirming the existence of an investment “gap”.

In the second article we saw that women get the same results in investments as men, but with important differences in the way they plan and execute investments.

In this article we will look at the reasons behind the gender investment gap.

Women face 5 investment gaps: wage, wealth, retirement needs, retail and institutional

There is not only one investment gap, but rather 5 gaps.

If these gaps are not corrected, inequalities in wealth accumulation will persist.

This issue is all the more important because this investment gap for women makes them much more financially vulnerable to retirement.

Not only are women less able to accumulate the same capital, but they also need more capital, as they live longer than men.

Longevity is a very critical issue for women, probably one of the biggest reasons why women’s needs are so different from men’s in terms of financial savings and investment.

The wage gap

Working women around the world earn less money than men, on average.

This wage gap persists for a variety of reasons, and is slowly narrowing.

Whatever the causes, it means that the average working woman has less money to invest potentially.

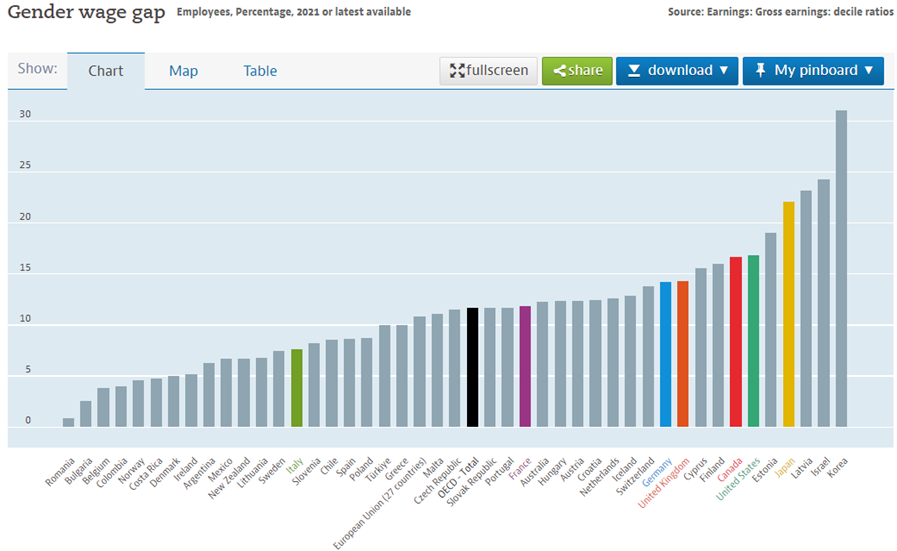

The OECD annually calculates the gender pay gap, which is defined as the difference between the average incomes of women and men.

For employees and full-time workers, the most recent data are:

On average, in OECD countries, women earn 11.6% less than men. In most of these countries the difference is of this order.

However, the differences are greater in countries such as South Korea, Israel, Latvia, Japan and Estonia.

Even in countries like the US, UK, Germany and Switzerland, the difference is almost 15%.

At the opposite extreme, there are countries with differences of less than 5%, such as Romania, Bulgaria, Belgium, Colombia, Norway, Costa Rica, Denmark and Ireland.

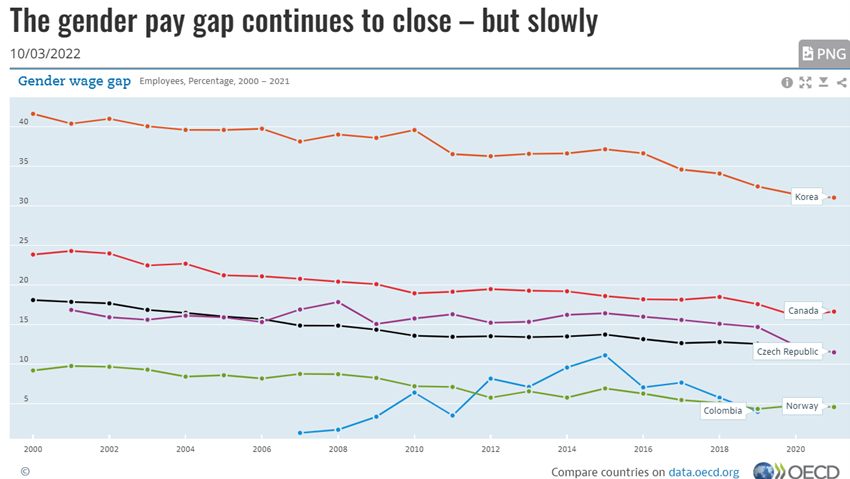

Between 2000 and 2020, the gender pay gap in OECD countries fell from 18.1% to the current 11.6%:

This trend has been observed in most countries, although with different forms and experiences.

The gender pay gap in 2000 in Korea, Canada, the Czech Republic and Norway was 41.7%, 23.9%, 16.9% and 9.2% respectively.

In 2020, they fell to 31.5% (-10.2 pp), 16.1% (-7.8 pp), 11.6% (-5.3 pp) and 4.8% (-4.4 pp), respectively.

The wealth gap

Since, on average, women earn less money than men, they tend to have less wealth.

The wealth gap among the unretired is more than double the wage gap. It’s a lot less money for women to invest.

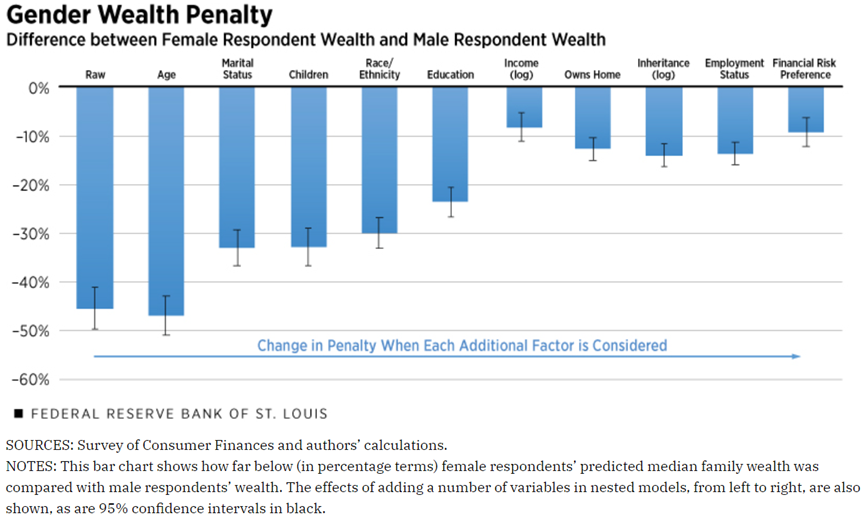

The study “Gender Wealth Gap: Families Headed by Women Have Lower Wealth” by Ana Hernández Kent and Lowell Ricketts, published by the St. Louis Fed in 2021, concluded as follows:

The gross gender wealth gap was the largest among men and women who had never been married.

In this group, women had a “gap” of 34 cents per 1 dollar of men’s wealth, that is, they had 66% of men’s wealth level.

After adjusting for various factors such as age, children, race and ethnicity, education, income, property, inheritance, employment and financial risk-taking, this gap has been significantly reduced – 71 cents per $1 – or 29%, but remains very significant.

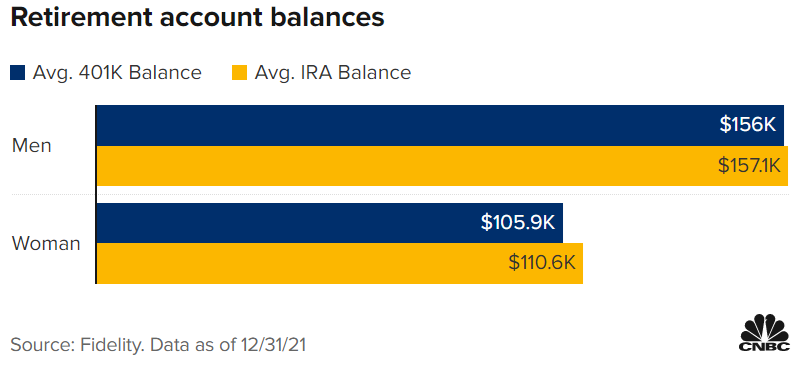

U.S. retirement account balances published by Fidelity for the end of last year show a gap of more than 30%:

According to Mercer’s latest Retirement Readiness Barometer in Canada, based on an assessment of 14,000 of group retirement plan balances, on average, women retire with 30% less than men.

This means that they face a low-income pension and lose the standard of living they need.

The average value of a man’s retirement fund is C$100,000, while a woman’s is $70,000.

This reflects several factors, including the gender pay gap, the savings or contributions gap, and a higher likelihood of career disruption (including the pandemic that also affected women more than men in general).

The Mercer study found that the savings rate or gender contribution gap is 0.81 percent, or nearly 1 percent. Only this “gap” in the savings or contribution rate implies that women need to work two years longer than men to be ready for retirement.

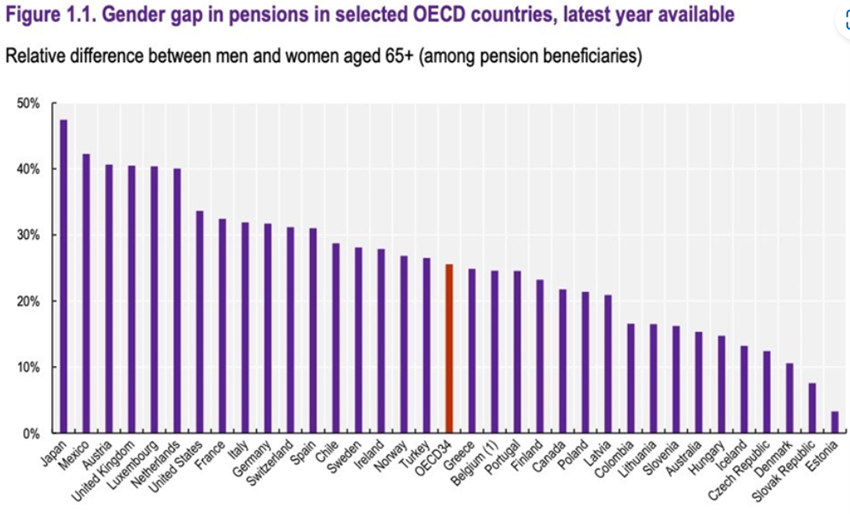

The gender gap in pensions (the difference between the pensions of men and women in receipt of pensions) in OECD countries is as follows:

The gender pension gap exists in virtually all retirement income systems around the world.

The range of realities of the various countries is very significant, with Japan having a difference of almost 50%, while Estonia’s difference is less than 5%.

On average, this pension gap represents $8,400 a year in the US and £6,000 a year in the UK.

There are three causes for the gender pension gap, some related to employment, others to the pension system and still others to socio-cultural roots.

Employment-related careers include shorter careers (later entry, maternity breaks and earlier retirement), more part-time work, lower career progressions, lower wages and a greater presence in lower-income sectors.

Those in the pension system have to do with restrictive eligibility rules, the lower mortality rate and greater longevity (which leads to lower annuities).

The socio-cultural causes include the few supports for the care and education of children that fall more on women, lower literacy, greater risk aversion and higher expenses for the protection and security of the family.

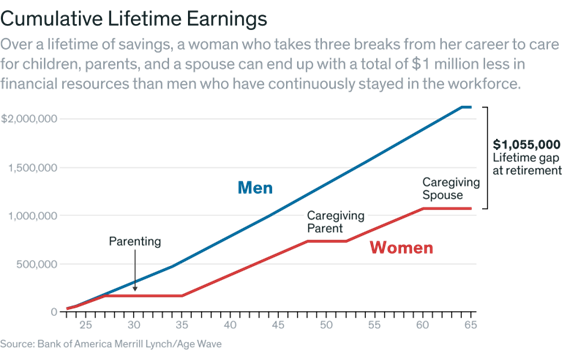

In 2018, Bank of America Merrill Lynch and Age Wave estimated that the wealth gap could reach $1 million:

This estimate was based on the average wages of men and women and assumed that women took three breaks from work to take care of their children, parents and spouse.

Considering the impacts of the wage gap and these three career breaks on a lifetime’s savings, a wealth gap is generated that can represent less than $1 million of total financial resources, including income from work, investments, retirement savings, and real estate.

The retirement needs gap

As for retirement capital, the issue is not just one of parity.

In developed countries, women, on average, live five years longer than men, having less capital to finance what can often be a longer and more expensive retirement.

At age 85, women outnumber men by a ratio of two to one and 81% of centenarians are women.

More than three-quarters of widows are women, which means that many women will be on their own and financially for themselves in their later years.

On average, women enter retirement two years earlier than men, often to join an older spouse in retirement — or to care for him.

But when women end up needing help, they are often alone and require long-term health care, which is very expensive.

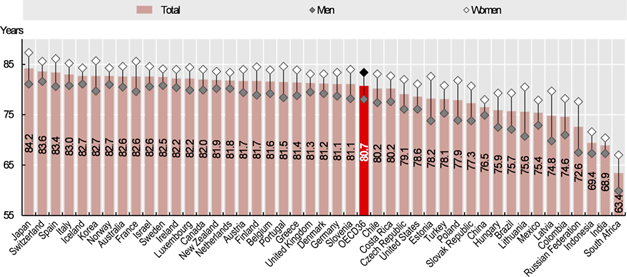

In the OECD, the average life expectancy at birth of women and men is as follows:

This gender gap stood at 5.3 years in OECD countries in 2017 – life expectancy at birth for women was 83.4 years, compared to 78.1 years for men.

In 2017, life expectancy at birth for men in OECD countries ranged from around 70 years in Latvia and Lithuania to 81 years or more in Switzerland, Japan, Iceland and Norway.

In the case of women, life expectancy reached 87.3 years in Japan, but was less than 80 years in Mexico, Hungary and Latvia.

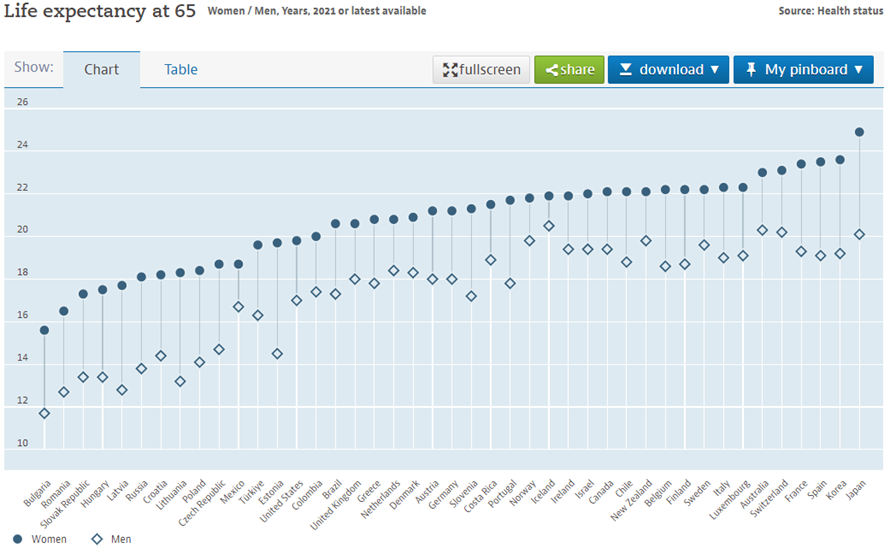

More important for assessing retirement needs is the average life expectancy at 65 (the official retirement age in many countries), which is as follows according to OECD data:

On average, in OECD countries, people aged 65 can expect to live another 19.7 years.

Life expectancy at age 65 is higher for women than for men of the same age, by more than 2.5 years.

Life expectancy at age 65 is highest for women in Japan (24.4 years) and for men in Switzerland (20 years).

Among OECD countries, life expectancy at age 65 in 2017 was the lowest for women in Hungary (18.4 years) and for men in Latvia (14.1 years).

In addition, women usually enter retirement age earlier, either when their husband retires or to take care of the family, usually their parents.

In conclusion, women live longer, live longer in retirement and have less capital accumulated for retirement than men.

Mercer recently conducted a study for the United States, in which a 65-year-old woman must support herself for an additional 20.6 years on average, compared to an additional 18 years for a 65-year-old man.

In the United States, on average, a family in retirement spends more than $3,800 a month, so a 65-year-old woman needs to have earned, saved, and increased her wealth by nearly $120,000 more than a man on comparable terms to maintain her lifestyle.

The retail investment gap

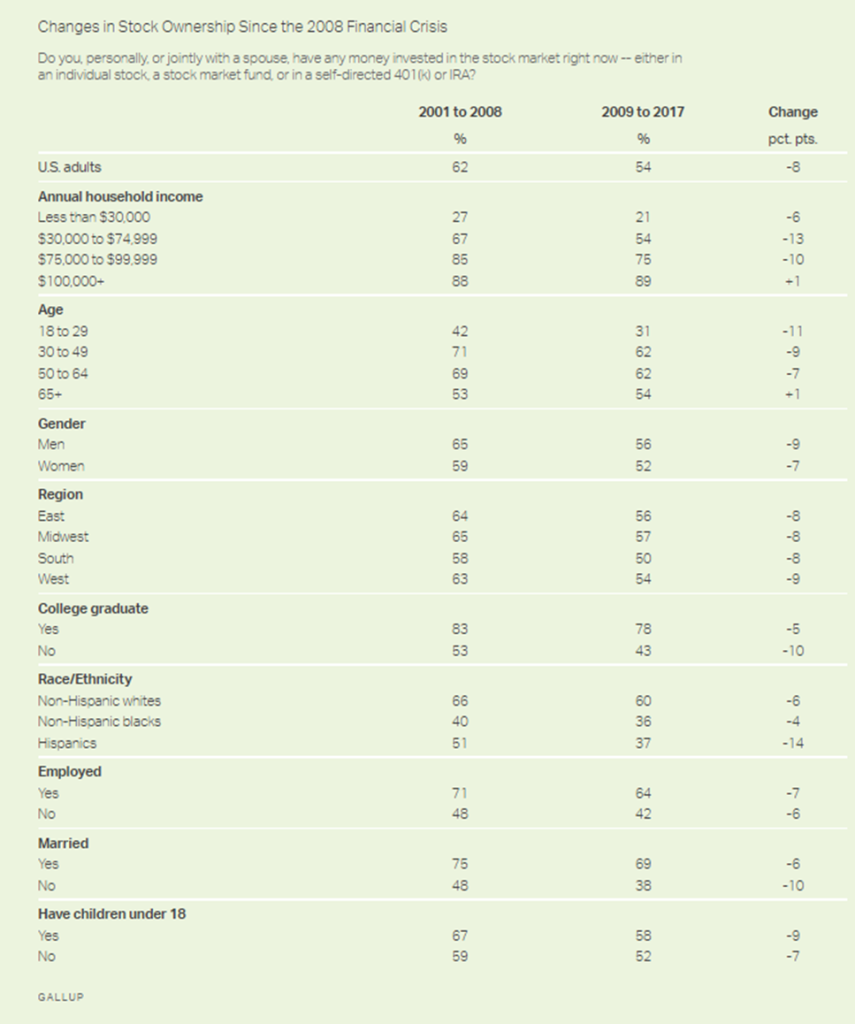

We saw in the previous article that according to Gallup studies, women invest less in stocks than men.

Many years ago, 60% of men invested in stocks and only 40% of women.

This gap of 20 percentage points was already only 6% between 2001 and 2008 (65% for men and 59% for women).

Today, the gap is reduced to 4% (56% for men and 52% for women).

The institutional investment gap

The wealth and asset management industry is predominantly male-driven.

According to Morningstar’s most recent data for the U.S., 10 percent fewer asset managers are women, versus 37 percent of doctors, 33 percent of lawyers, and 63 percent of auditors and accounts.

This “gap” has been an obstacle to women’s investment, since at least some women prefer to work with other women.