This is the second part of the third article dedicated to the Retirement series, the main financial objective.

In the initial article we presented the program of the series and developed the base scenario and the alternative scenario that we will use throughout it.

In the second article, we looked at how much money we will need to live during our retirement.

In this article we analyze the importance of asset allocation in the accumulation of capital for reform, associating it with the effort we will have to make to reach those desired values.

In the first part we looked at the effect on the capital accumulated for retirement.

In this second part we will see the allocations preferred by experts and investors.

We assume that the investor selects index funds, indexed or ETF, under the main market indices, which allows us to use the past average returns as expected, considering the broad investment horizon of the reform.

This series on retirement follows on from other much earlier articles already published on this topic.

We felt it was important to develop a structured series on this topic, as it is the main objective of most people’s financial and investment plan.

In these scattered articles we have addressed the importance of retirement as a financial goal, the number of years we need to live in retirement, and the money we need to have a smooth retirement.

We have seen the degree of dependence on the public pensions of the current pensioners, the replacement rates of these pensions (ratio between the last salary and the first pension), the years of duration of these same pensions relating them to longevity, to conclude that we cannot live only on public pensions.

Therefore, we analyzed the need for retirement planning and the situation of how pensioners currently live.

In the Tools folder, we find very useful retirement calculators, including the retirement capital needs and disposable income assessment at Vanguard, as well as those from Bankrate, Marketwatch, and Flexible Planner.

What is the asset allocation recommended by the experts?

The traditional 60/40 portfolio, with 60% stocks and 40% bonds, is the most used by investors in retirement plans.

Using the historical very long-term rates of return this portfolio corresponds to a compound rate of 8.7%.

Looking at the previous table we see that the rate of 8% corresponds to a value of accumulated capital of 621 thousand dollars over 40 years.

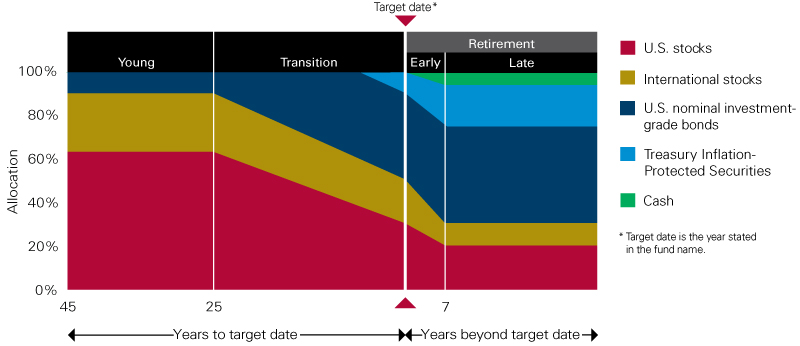

Retirement experts advocate for dynamic allocation over the working life by integrating it into their target retirement funds or target dated funds.

Also known as lifecycle funds, these funds are designed to offer a diversified portfolio that automatically rebalances to be more focused on yield over time:

In the first few years the allocation is 90% to stocks and 10% to bonds, starting to decline at the age of 25 towards the end of the reform towards 50% in each asset.

In these terms, the average percentage of allocation to equities is even higher, which corresponds to a historical return of almost 10%.

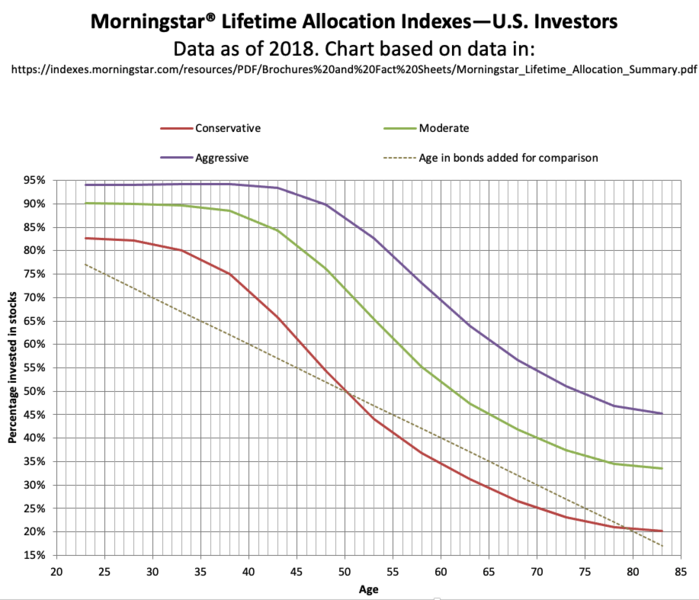

Morningstar has fine-tuned these target date allocations, adjusting them for the risk profile:

The allocation starts with 80% to 95% to equities in the first 10 years, then drops to between 65% and 75% in the following 20 years in the more conservative profiles, and ends at 30% to 60% at age 65.

In a subsequent article we will look at target-dated funds in more detail.

What is the asset allocation chosen by investors?

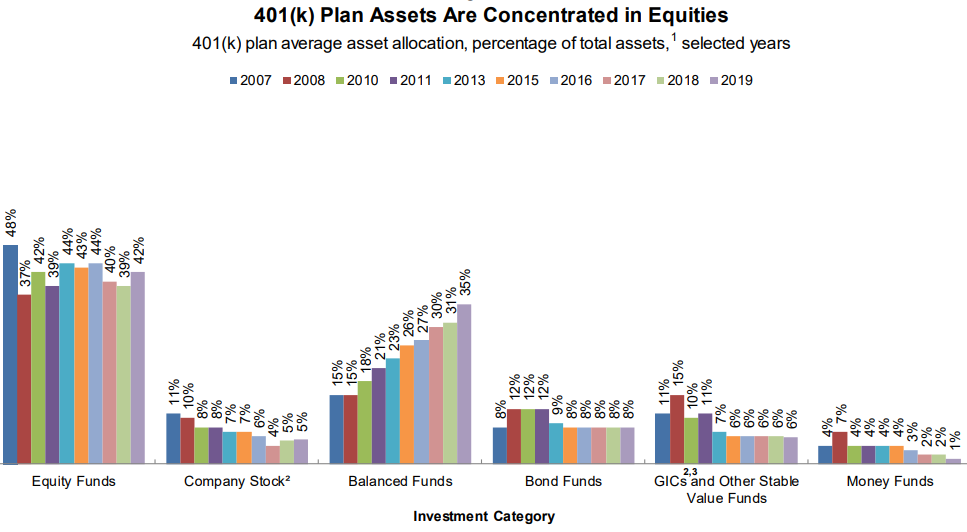

The Employee Benefit Research Institute’s (EBRI) most recent study of the top private pension plans in the U.S., the 401k plans, based on information from 73,312 plans with 0.9 trillion assets from 11.1 participants (401k plans are estimated to cover a total of 60 million participants and $6.3 trillion) shows that most of the 401k assets are invested in equities:

At the end of 2019, 68% of the assets of 401k plan participants were invested in equities, either through equity investment funds, mixed funds or stocks of the companies they work for.

And 29% of the assets were invested in bonds, whether in bond funds, stable funds, money market funds or mixed funds.

At the end of 2019, 31% of 401k plan assets were invested in target date funds and 60% of participants held target date funds:

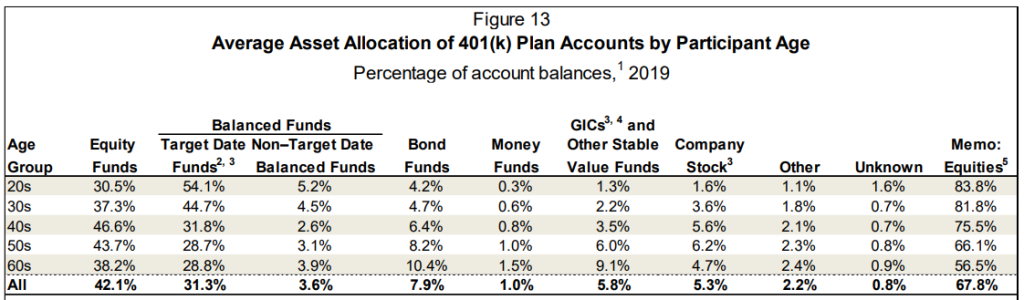

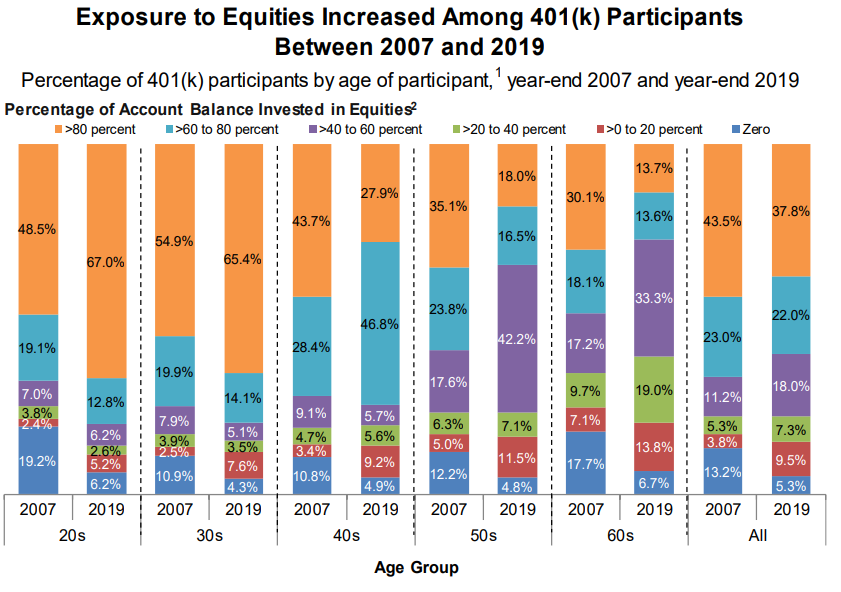

As expected, exposure to equities decreases with age, and has been increasing in younger groups:

The allocation to equities by the younger generations (from twenty to forty years of age) is in the order of 70%-80%, while investors from fifty to seventy have allocations of 50%-60%.

We also see that between 2007 and 2019 the younger generations significantly increased their exposure to equities and the older ones reduced somewhat.

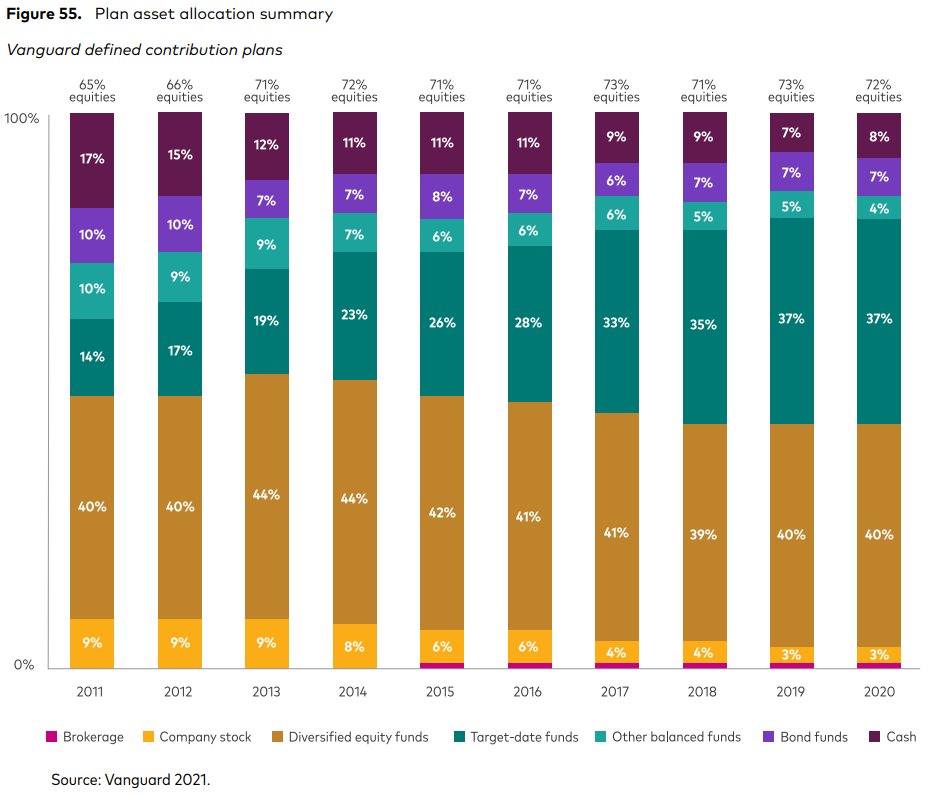

Vanguard’s 2021 How America Saves study, covering information from 4.7 million participants in defined-contribution pension plans, shows that the percentage of assets invested in equities in 2020 was 72%:

The allocation to equities includes equity investment funds, and the equity components of mixed funds and target date funds.

In 2011 the equity endowment was only 65% in 2011, so it grew by 7 percentage points, due to the performance of the equity markets and the improvement in the construction of portfolios of participants.

In 2020, investments in balanced strategies reached 41%, including 37% in target funds and 4% in other balanced options.

The growth of target date funds has been reshaping the investment patterns of the defined contribution plan, increasing the allocations between age-appropriate actions and obligations and reducing extreme allocations.

Eighty percent of all participants used target date funds.

And two-thirds of participants holding target date funds had their entire account invested in a single target date fund.

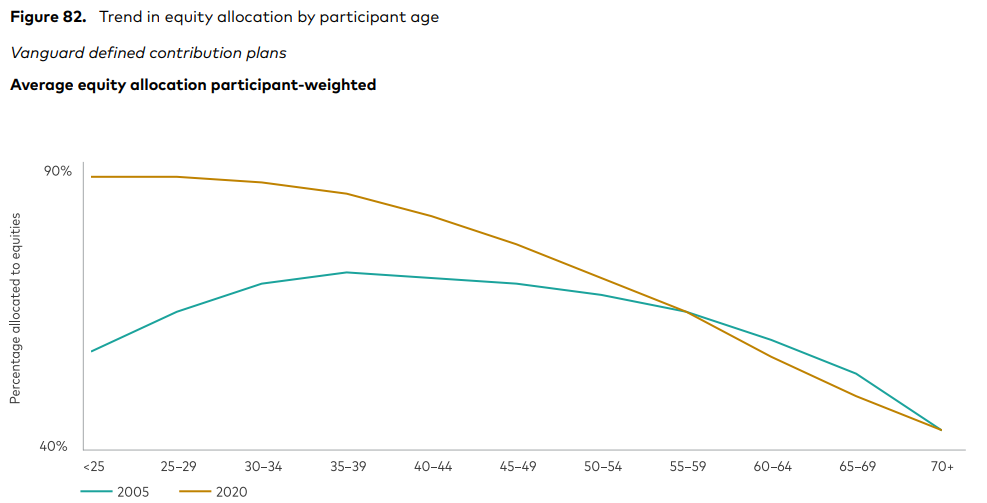

The average allocation to equities by participants of different ages was as follows:

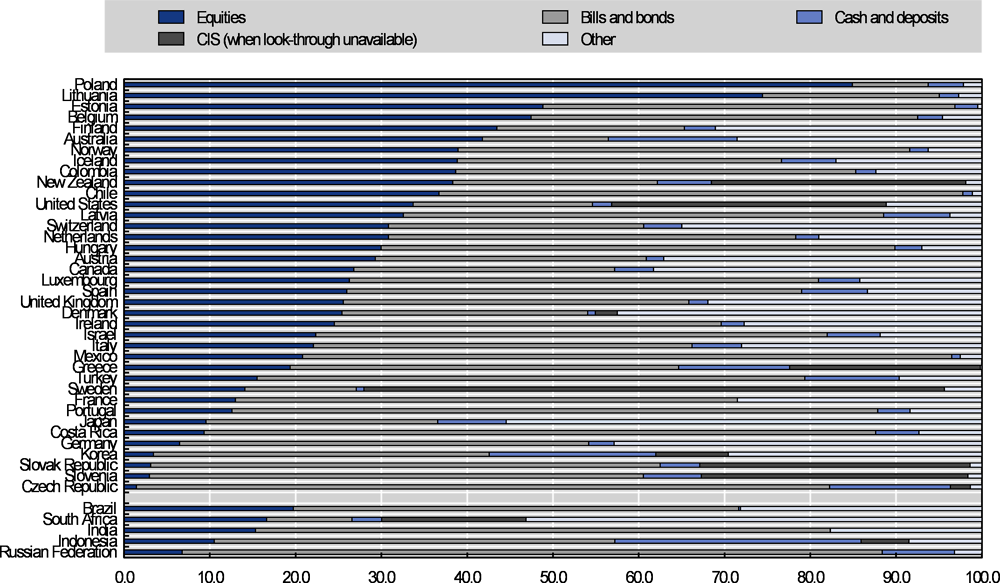

For other countries, information is scarcer.

The OECD publishes an annual report on the situation of the largest private pension funds and public pension funds.

In the 2020 edition the allocation of the largest public funds was as follows:

The proportion of equities and bonds varied considerably between countries at the end of 2020.

While there was a greater preference for bonds, overall, the reverse was true in 11 OECD countries and South Africa, where equities outpaced bonds (e.g., 41.8% to 14.7% in Australia, 74.4% to 20.6% in Lithuania).

Bonds and equities were also the predominant asset classes in the portfolios of public funds.

The 22 funds they reported invested 46.2% of their assets in bonds and 30.2% in equities.

There has been a greater appetite for equities in some public funds, which likely reflects their greater investment autonomy and long-term investment prospects.

The biggest examples are Norway’s pension fund, New Zealand’s Superannuation Fund and Japan’s pension investment fund

By contrast, public pension funds in Chile, Poland and Portugal, for example, have invested much more in bonds than in listed stocks.

The extreme case is that of U.S. public funds, which by law are fully invested in government bonds.