The main types of mutual funds: by object, money market (or treasury), shares, bonds or balanced/blend; by management model, active or passive funds (on market indices)

Active investment funds and passive or indexed investment funds

ESG mutual funds

The essential information and data of mutual funds: the investment strategy or policy, and the factsheet, the information document and the issuing prospectus

In a previous article we saw the main characteristics and advantages of mutual funds.

We have also seen that mutual funds are the investment vehicle par excellence of individual investors in the financial markets arising from their advantages. To this extent, one of the most important investment decisions is the choice of mutual funds.

There are several factors and criteria that should guide this selection, which will be covered in the following articles.

The first factor is the type or category of the fund, because we want to choose the mutual funds that best fit the asset allocation defined by the investor, depending on their objectives and profile.

Thus, in this article we will address the main types or categories of mutual funds and investment policy as a core factor for defining the object of the fund’s investment.

This series is accompanied by the publication of articles containing information on the main mutual funds of each category in the Best of Mutual Funds Series in the Assets and Investments folder and a summary sheet of the information of the funds in the Tools folder.

The main types of mutual funds are defined by the subject of investment assets: money market (or treasury), shares, bonds or balanced funds, and management model of active or passive funds (on market indices)

Each mutual fund has an investment policy that defines the object and other rules or conditions of its investments which the management company has to observe, inter alia, the type and its composition in terms of assets and markets.

Mutual funds can be classified into different types or categories according to the investment object. We have money market funds, bond funds, equity funds, blend or balanced funds and stock index funds (and also bonds or other assets).

Money Market Funds

Money market funds invest in short-term fixed income securities. Examples of short-term fixed income securities are Treasury bonds, Treasury bills, commercial paper and certificates of deposit.

This type of funds are usually a safer investment, but with a lower potential return than other mutual funds.

Bond (or fixed income) funds

Bond or fixed income funds buy investments that pay a pre-defined and normally fixed rate of return.

This type of mutual fund focuses on obtaining profitability that enters the fund primarily through interest.

Equity Funds (or variable income)

Equity funds invest in stocks or variable income securities.

There are different types of equity funds, such as funds specializing in growth stocks, value stocks, large market capitalization, mid-cap, small-cap, or a combination of these stocks.

Balanced funds

Mixed or balanced funds invest in a combination of stocks and bonds – typically in a 40% bonds and 60% stocks ratio.

The purpose of these funds is to generate higher returns than bond funds, but also to mitigate the risk of stocks through fixed income securities.

Indexed funds

Index funds aim to track the performance of a specific market index, for example the S&P 500, or Bloomberg Barclays Bond.

Index funds follow the respective index to which they are associated, and rise when the index rises and fall when the index goes down.

Index funds are increasingly popular as they typically have a lower management commission compared to other funds (given that the manager doesn’t need to do as much research).

In addition to these, there is a wide variety of other categories.

Sector funds that focus on a particular sector of activity such as technology, energy, telecommunications, healthcare, biotechnology, industrial, etc.

Also notegoing thematic funds, which have gained some importance recently and which are associated with important topics such as major trends, including climate change, population ageing, the new technological revolution, biotechnology, innovation, etc.

Within each category of funds we have several sub-categories.

In stocks, the main subcategories are divided by geography, capitalization and strategy (in addition to currency), giving rise for example to large equity stocks and mixed strategy in the USA (in USD). In bonds, the main subcategories are organized by geography, issuer type, rating and term, e.g. long-term US treasury bonds.

These different types or categories of investment funds have different profitability, risk and even costs, as we will see in the following articles.

Active investment funds and passive or indexed investment funds

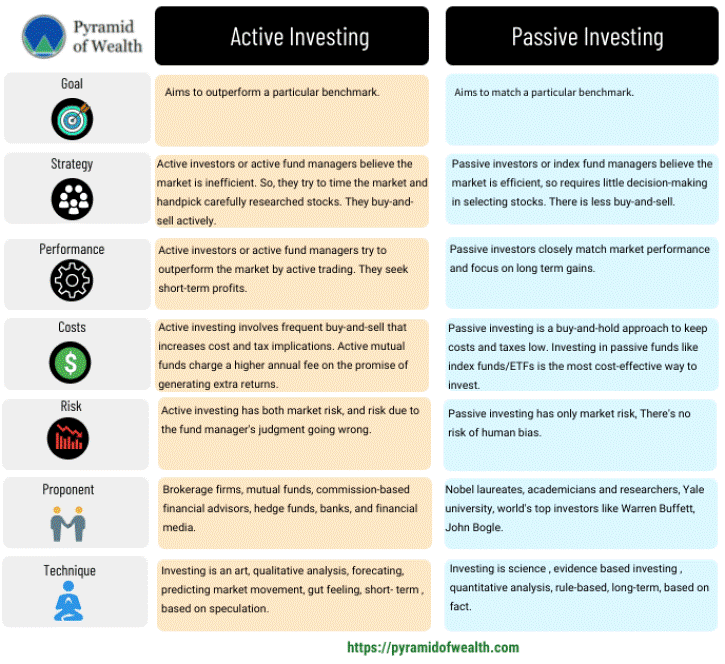

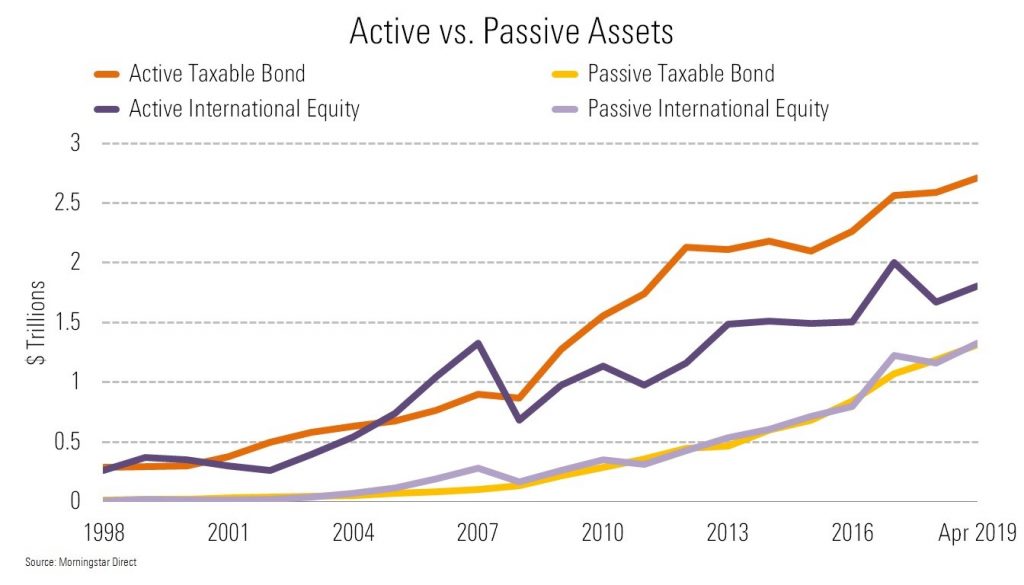

As for the management model there are two groups of mutual funds: active funds or active management funds and indexed funds, liabilities or passive management.

Most mutual funds are actively managed in the sense that managers analyze, select and make investment decisions in assets and securities according to their preferences and choices, naturally observing the fund’s investment policy.

Therefore, these funds are also called active or active management. Thus, the objective of managers is to beat the benchmark or the benchmark market index established as an objective or comparison of fund valuation.

The indexed mutual funds, which have emerged more recently, are passively managed investment funds, where they typically replicate or follow a specific market index.

Therefore, these funds are also called passive funds or passive management funds. Thus, the objective of the managers of these funds is to replicate or follow their market index as accurately as possible.

Typically, active funds have higher commissions and total costs (“Total Expense Ratios” or TER) than indexed funds, seeking to reflect the higher costs associated with active management (prospecting, analysis and selection of assets and securities, as well as investment market times).

However, as we will see in other articles, the vast majority of active funds cannot beat their benchmarks or indices, and above all they cannot do so consistently, as is deduced from the low success rates of these funds compared to passive funds.

As we will see in another article, this situation results not only from the difficulty of managers in beating the market, but also from the fact that they practice higher commissions.

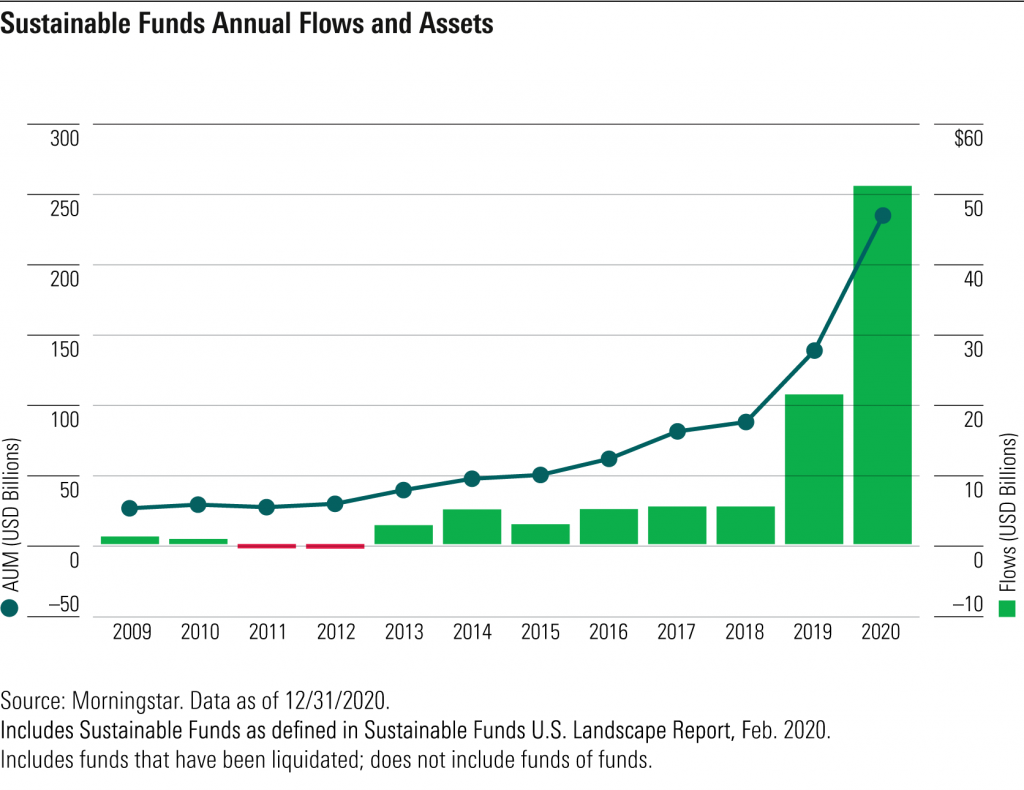

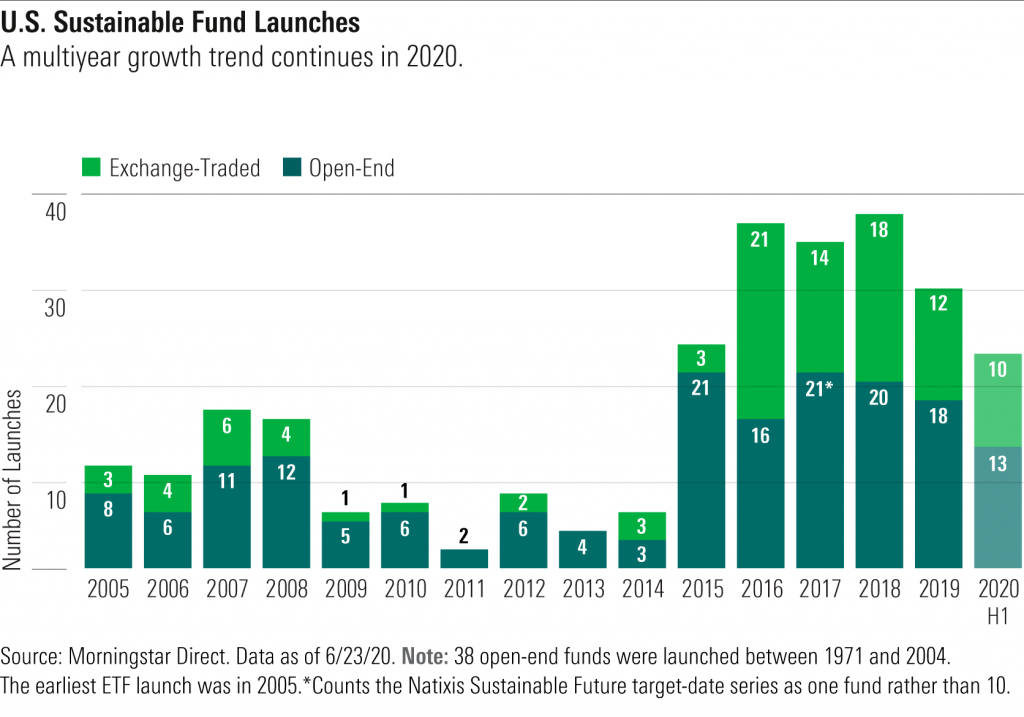

The growing concern for the most relevant social issues has increased investors’ interest in sustainable investment, giving rise to funds specialized in the three main themes of sustainability, the Environment, Social and Governance or ESG.

To this extent we have equity, bond and mixed funds, whether active management or index, specializing in sustainable investments or ESG.

The essential information on mutual funds is their investment strategy and policy, as we have seen in other articles the allocation of assets determines the performance of investments by more than 90 % in terms of profitability and risk.

This information is contained in the following documents published by the management company and compulsorily accessible and available to investors by the marketing entity: the factsheet, the information sheet (KID or IFI) and the prospectus for issuing the fund.

Given its importance, we recommend that the factsheet and information document be seen and analysed when deciding the choice of investment funds, to ensure the best alignment and adequacy with the interests of each investor.

The prospectus is the document containing all the information of a legal nature.

There are a number of entities that maintain a database of key information elements of market mutual funds, such as Morningstar, Mutual Funds and Justetf accessible from the following links:

https://www.morningstar.com/large-blend-funds

https://mutualfunds.com/screener/

https://www.justetf.com/en/find-etf.html

For example, the following are links to the factsheets and information documents of some of the major and largest mutual funds, the funds on US stockmarket:

https://investor.vanguard.com/etf/profile/VTI

https://www.ssga.com/nl/en_gb/institutional/etfs/funds/spdr-sp-500-ucits-etf-dist-spy5-gy

https://fundresearch.fidelity.com/mutual-funds/summary/315911750

https://www.schwabassetmanagement.com/products/swppx

https://am.jpmorgan.com/us/en/asset-management/adv/products/jpmorgan-equity-index-fund-a-4812c1520

https://fundsus.dws.com/us/en-us/products/mutual-funds/dws-core-equity-fund.html/A?&

https://www.amundi.com/usinvestors/Local-Content/Product-Pages/Pioneer-Fund/Pioneer-Fund

https://www.im.natixis.com/us/mutual-funds/natixis-us-equity-opportunities-fund/NESYX