“The investor’s main problem – and even his worst enemy – is likely to be himself.”

This poor performance arises because we let our emotions take over on our logical thinking

There is a small set of 6 very basic rules to invest well that can be learned from successful investors practices

“The investor’s main problem – and even his worst enemy – is likely to be himself.”

Benjamin Graham, Warren Buffet’s mentor, once said that “the investor’s main problem – and even his worst enemy – is likely to be himself. In the end, how your investments behave is much less important than how you behave.”

Self-control is one of the main human qualities and social competences. Being patient, persevering and knowing how to wait for gratification is another. We know from our own experience that being impulsive and untimely has a cost.

The “Marshmallow” experiment was a study conducted for children, at the end of 60s and the beginning of the 70s, on the importance of deferred or delayed rewards, which evaluates the influence of self-control capacity in the determination of success in life, in terms of school performance, body mass and other indicators. It is well applicable to the success of adults in relation to investments.

Self-control, rules and discipline also apply to personal finances and investments.

Individual investors have investment returns that are very inferior to those of the financial markets, in all assets and time horizons

Studies prove that individual investors, on average, have much lower annual returns than financial markets.

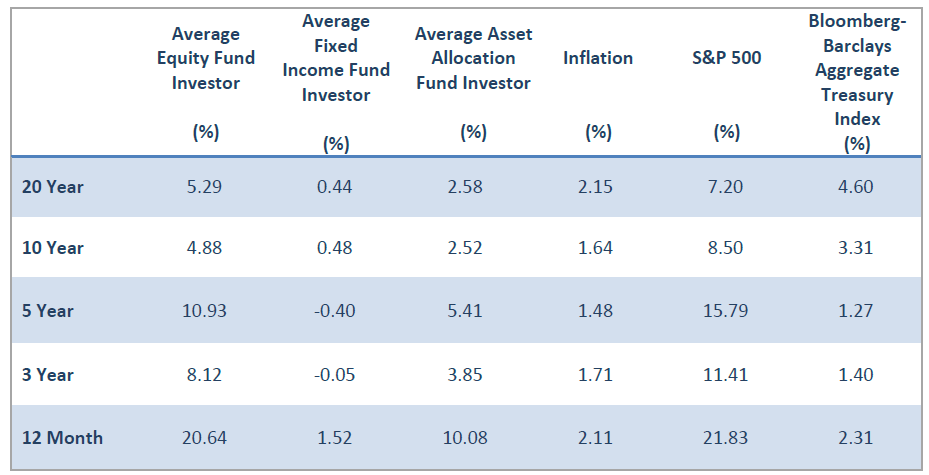

Source: Quantitative Analysis of Investor Behaviour, 2018, Dalbar

This table shows that the annual returns obtained by individual investors are, in many cases, far below the ones afforded by the stock and bond markets, for short, medium, and long-term investments!

And this is valid both for investments in stocks and in bonds and the differences are higher for the longer time horizons, over 5 years.

For 10-year periods onwards, the investor is well below inflation in investing in bonds (fixed income), and he gets only almost half the market return in stocks.

This poor performance arises because we let our emotions take over on our logical thinking

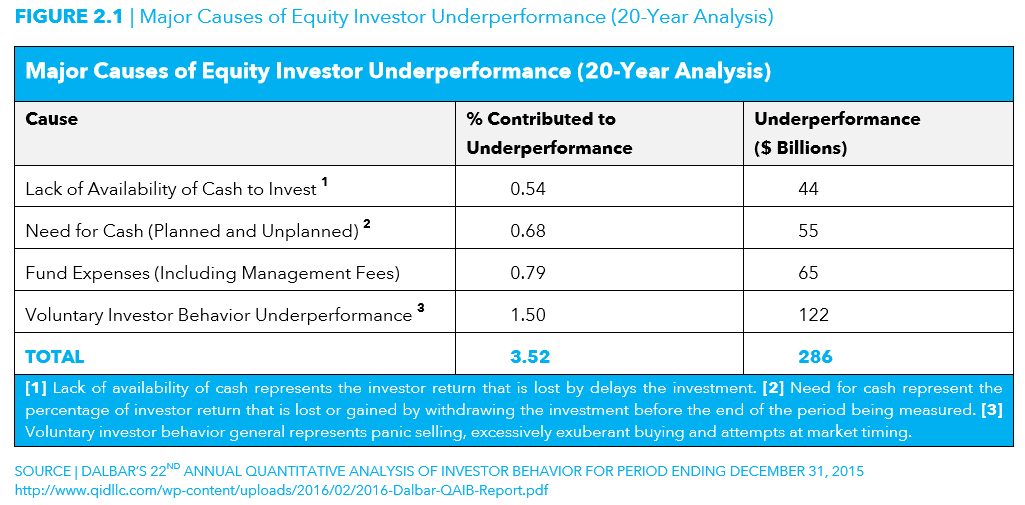

The main causes for this poor performance of investors in general are controllable by themselves, which makes this issue even more serious.

There are several studies evaluating the factors that explain the poor results of individual investors. One of the most referenced came to the following results:

It is concluded that:

- The factors not controllable by the investor, such as lack of capital to invest (delays in investment) or the need for cash (for planned or unexpected causes before the period considered), represent only 1/3 of the gap;

- The costs of the investment funds chosen, including the management fees, account for more than 20% of that gap;

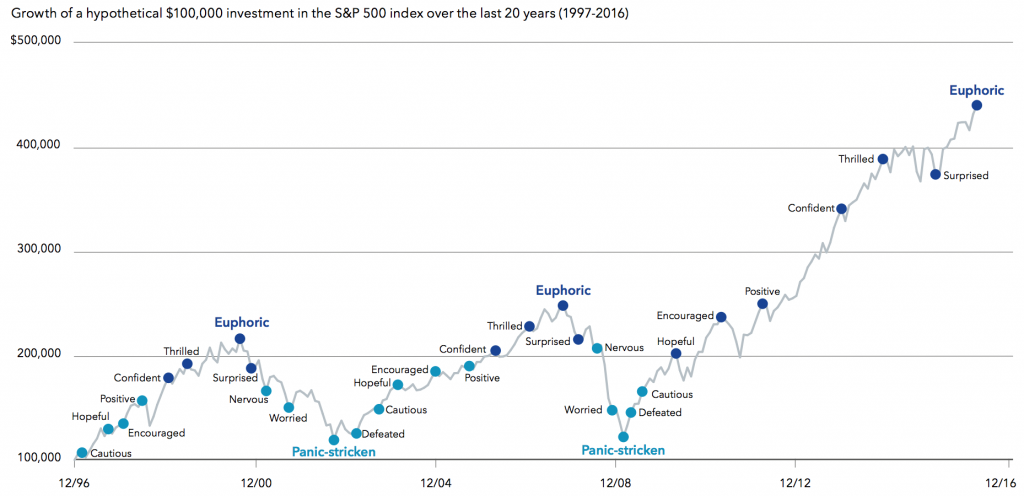

- The main factor for poor performance results from voluntary investor behaviour, which represent almost 50% of the gap, and include panic selling, excessive exuberant buying Euphoria, and in the background, attempts to market timing.

https://www.streamfinancial.com.au/wp-content/uploads/2020/05/real-investment-advice.pdf

https://wealthwatchadvisors.com/wp-content/uploads/2020/03/QAIB_PremiumEdition2020_WWA.pdf

It is critical to be patient, rational, know to stay on course and to avoid the excessive market noises

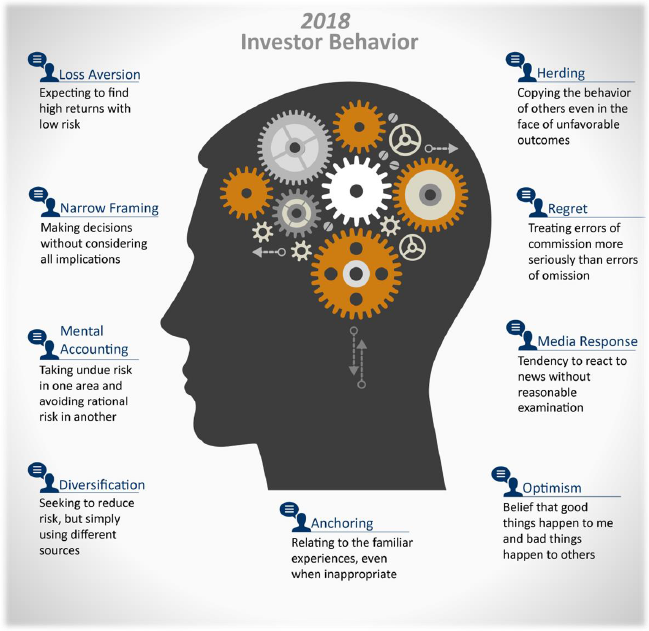

There are countless behavioural economics studies that show that in many situations we are not rational, and we let ourselves be carried away by our emotions.

Today we know that we are subject to making mistakes derived from behavioural biases and that they are very difficult to overcome. We can only achieve it with understanding, rationalization, rules and discipline.

The greatest behavioural biases that causes the biggest mistakes in the management of personal investments are well studied, including misunderstanding of loss aversion, narrow framing of decisions, mental accounting without logic, deficient diversification, anchoring only for successes, the herding effect, poor evaluation of regrets, too much media response and excessive optimism.

Source: Quantitative Analysis of Investor Behaviour, 2018, Dalbar

There is a small set of very basic rules to invest well that can be learned from successful investor’s practices

Diversification is key but it is not enough. There is a small set of simple behavioural rules that we must adopt to succeed in investing:

- Being patient and think long term (investments should be aligned with our biggest financial goals that are distant);

- Control your emotions (do not lose the head because almost always not everything is as good nor as bad as it seems);

- Avoid the short-term forecasts noise (there are opinions for all tastes and pretences gurus chasing their few minutes of fame);

- Do not try to time the market (because it is impossible);

- The markets fluctuate and we cannot anything else but stay the course (if we are unstable in moments of volatility, we have an explosive combination);

- A market correction is an opportunity (we can buy cheaper).

https://www.amazon.com/Thinking-Fast-Slow-Daniel-Kahneman/dp/0374533555

https://www.amazon.com/Misbehaving-Behavioral-Economics-Richard-Thaler/dp/039335279X