Usually, especially in equities, we invest almost everything in our country instead of investing around the world, which is a set of several serious mistakes

If we are doing well in our equity investments, we should not change …, but if that is not the case, it is better to think and take a different way

The most frequent, important, and unknown or forgotten mistakes (in fact there are at least 3 errors), are to accumulate various risks on our country without realizing the implications

Error #1: Loss of the value of international diversification in the investment portfolio

Error #2: Myopia or limitation of the options for better investments

Error #3: We already have enough country risk in our lives – home, employment, children, pension, etc. – we will still want more?

Usually, especially in equities, we invest almost everything in our country instead of investing around the world, which is a set of several serious mistakes

Usually, we suffer from what is called “home bias”, a skewed preference for national investments, that is, we invest most of our financial assets in our country, which means that we invest mainly in domestic financial investments, whether stocks or bonds.

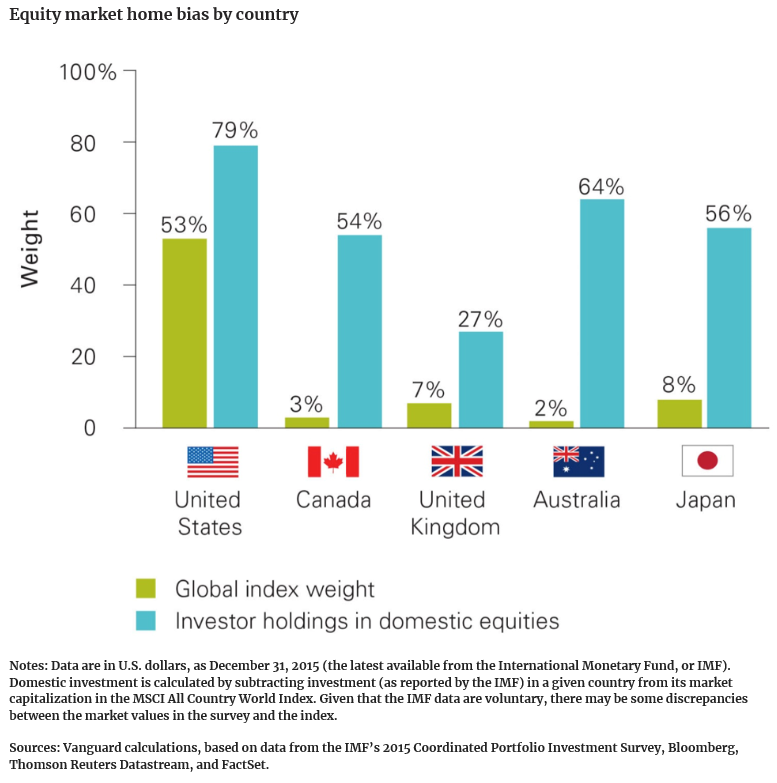

This reality can be proven in the following chart comparing the weight of the stock markets of several countries in the global market with the weight of investments in these geographies in the portfolios of investors in those countries.

This situation leads to several management errors, some technically proven and others of mere common sense, which we will talk about further.

.

The US investor invests 79% in his country’s shares when the market’s global weight is 53%. This even turns out to be the least extreme or more balanced case.

Canadian investors allocate 54% of their investments in the stock market to their country when the weight of that market in the global economy is only 3%. The British invest 27% in their market, which only accounts for 7% globally. The Japanese invest 56% in Nikkei or Topix when their weight in terms of global market capitalization is only 7%. Australians invest 64% for a weight of 2%.

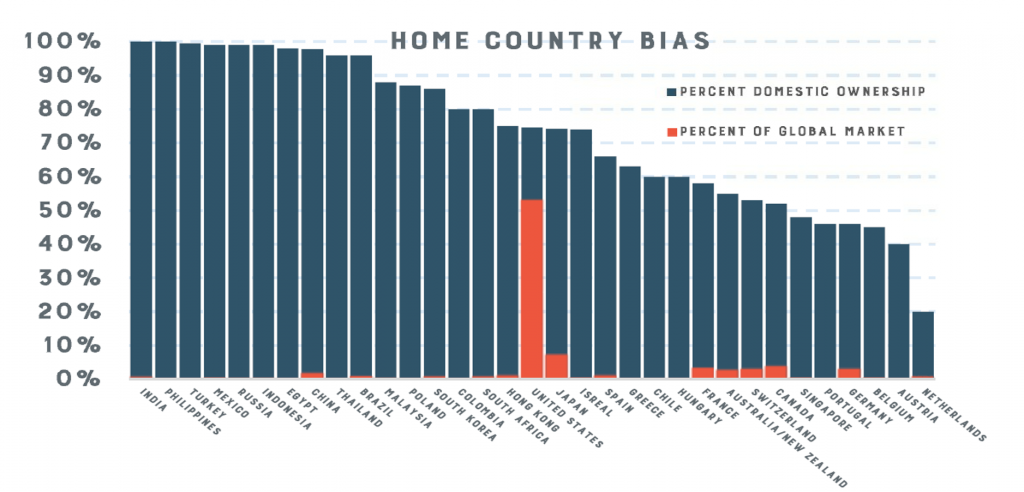

The following graph shows the extent of this bias in relation to shareholder markets at the level of several countries in the world:

It is quite clear that the stock markets are mostly held by domestic investors, and that except for the US, this share or national ownership is far greater than the country’s weight in the world stock markets.

If we are doing well in our equity investments, we should not change …, but if that is not the case, it is better to think and take a different way

This is a reality that always arises in the conversations on this topic that we have either with family, friends or clients.

When we ask why the answer is invariably always the same: because we know better what the companies of our country are, or at least it is like we view it.

In fact, when we go a little deeper into this conversation, we see that in this answer there are two distinct versions:

- There are a number of people, especially older generations, who did not have much information about what was going on outside the country when they started investing (or even the means and forms of access to international investment) and have become accustomed to investing only in domestic assets;

- There is another group of other people who, even though they have or know that they have the same information or easy and equal access, prefer to invest in their country’s assets because they consider that they know the situation better and therefore are able to better evaluate the opportunities and risks.

In these situations, the conversation can go two ways:

- We may ask if the investor is happy with the results of his investments, show him the returns and risks of investments in comparable international assets, and reassess together, the response to satisfaction with their investments.

- Or we can present the arguments in favour of international diversification, not only the most common of the technical benefits of this diversification on the investment portfolio itself, but also the following two that are often forgotten.

First, the low relevance of the domestic market in the context of global financial markets and, on second, the accumulation of home country risk by joining the risks of the financial investment portfolio with the exposure to risk of many other aspects of our lives that have little to do with investments.

In the end, if people are happy with the performance with their investments, they deserve to be congratulated on the achievements because it is not normal for the choice of investments to consistently beat a diversified portfolio in a medium and long term horizon. In this case, people should not change their strategy and should even consider whether they do not want to embrace the profession of investment manager or financial advisor.

Basically, we believe that what is at stake is the feeling of comfort zone: but it is usually a false or delusion comfort zone.

The most frequent, important, and unknown or forgotten mistakes (in fact there are at least 3 errors), are to accumulate various risks on our home country without realizing the implications

Error #1: Loss of the value of international diversification in the investment portfolio

The financial theory on assets and investment management demonstrated the benefits of investment diversification, asset classes, geographies, securities, companies, etc.

The common sense idea is not to put all the eggs in the same basket.

The technical rationale is to increase returns to a given level of risk or vice versa.

This has been proven by Harry Markovitz in his Modern Theory of Portfolio Management in 1952. We can improve the expected return for a given level of risk or decrease the risk for a given expected return of an investment portfolio if we combine multiple assets with different returns and risk distribution profiles. Portfolio diversification reduces investment risk.

.

Error #2: Myopia or limitation of the options for better investments

The composition of world financial markets should be the starting point for any investor anywhere in the world, as it reflects the importance, weight, and degree of development of each market from a global perspective.

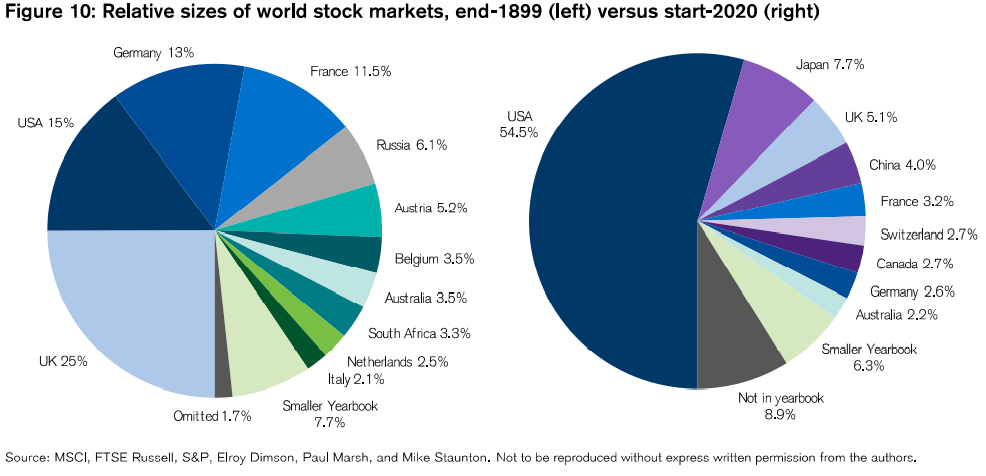

Looking only at the stock markets the composition was as follows in 2020:

We conclude that no country, except for the USA, has a relevant weight in the world capital market, whether in the equities or the bond segments. Japan is the second largest country and is only 8.6%, followed by the United Kingdom with 6.1%, France, Germany, China, and Canada with about 3% and so on.

The Portuguese market is totally insignificant. The country is a small economy and listed companies are very small worldwide. Portugal has a GDP that places it in 48th position globally, about 0.003 % of world GDP, and the weight of its capital market is no higher. Thus, the probability of finding the best investments in Portugal is also very low.

In theory, the distribution of investments by the weight of the stock market capitalization of each stock market is an optimal passive portfolio from the point of view of market efficiency. The theory is that market capitalization weights reflect the valuation and perspectives of all market participants at each moment.

From this point of view, only Americans can afford to allow themselves to invest only in their country. Even for them at the expense of optimal diversification because even for Americans it theoretically makes sense to invest something abroad. The US stock market has size and diversity. It represents more than 50% of the global stock market, in terms of market capitalization and volume of transactions. It has the largest companies in the world, from all sectors and many of them are truly global.

Individual investors from all other geographies, from European countries, Japan, Australia, Canada and emerging economies, should allocate most stocks investments to international markets. Thus, all countries, except for the US, must have a large international investment weight. In Portugal we must increase substantially the international stocks investments.

There are still those who might try to argue that, despite all this, it makes sense to invest more in markets where returns have proven to be higher. Although it has no technical rationale, the truth, too, is that the US is one of the markets that has best performed from the medium to the very long term (from 1900 to date, as we saw in another post).

Moreover, this relative performance of the markets is reflected in the change in the composition of the markets themselves since 1899.

Error #3 (the most forgotten): We already have enough country risk in our lives – home, employment, children, pension, etc. – do we still want more?

The watchword for investors in all countries is to distribute their investments internationally, whether in stocks or bonds.

The technical, economic, and financial reason is primarily to reap the benefits of diversification. Reduce the financial risk of investments.

But there is another reason that is not less important, especially for those from medium or small and weaker or fragile economies. The risk we add or accumulate is enormous.

We have our work here and its future always depends on the future of the country, whether we are employees or entrepreneurs on behalf of individuals. We also have the house where we live, the value of which also depends on the situation of the country as we have experienced, for example in the case Portuguese and others, in the period of the subprime and sovereign debt crises, and that we cannot sell easily at a fair price in case we need to do it.

We have the bear in mind our children living in the country who depend on what is going on here and that we will not fail to help them in case of need.

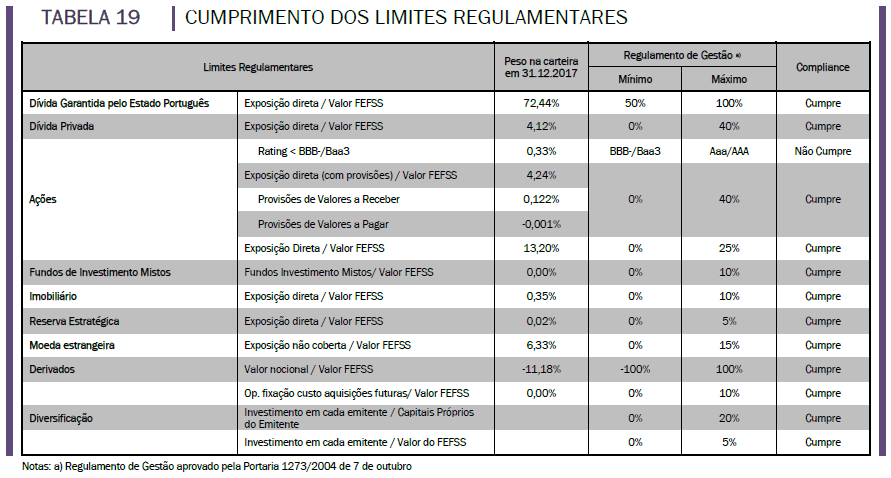

Finally, the pension we have or are entitled depends of the country’s present and future. The entity that manages our pension also invests too much in our country (in the case Portuguese, currently about 72% are national public debt with a minimum limit of 50%).

Source: Relatório e Contas FEFSS 2017

Thus, if we add up all these risks, work, home, children, pension, etc., why should we add up the financial risk of the country? It is not enough?

If our country were the US, it could be understood. In all other cases, it is a set of serious, important, and unknown or forgotten errors.

Getting out of the shell is gaining financial independence, and with new wings

We want to leave home to gain our independence. Winning a world perspective only does us good… and the same applies also to our portfolio.

https://www.vanguardinvestments.se/documents/strategic-asset-allocation-brief-tlor.pdf