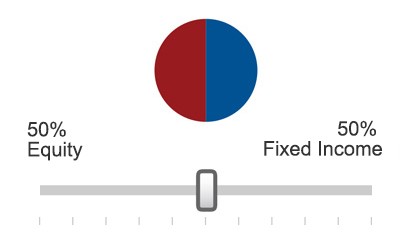

Our asset allocation – that is, how we divide our money between stocks, bonds and short-term reserves – may be the most important factor in determining our portfolio’s short- and long-term risks and returns.

Hence our first step, before we analyze and select any investments, is to determine the correct allocation to the various assets.

The investor questionnaire recommends an asset allocation based on answers to questions about the investor’s investment objectives and experience, as well as its time horizon, risk tolerance and financial situation.

If the investor’s personal objectives or circumstances change, it may be helpful to retake the questionnaire and reallocate portfolio investments.

Free

Access here: