Some business scandals and a growing awareness of the effects of climate change have piqued investors’ interest in sustainable investment

Main concerns, motivations and strategies of institutional and individual investors in terms of sustainable investment

From 2020, investors have accentuated their sustainable investment-oriented strategies and favoured the disruptive transition to electric mobility

Some business scandals and a growing awareness of the effects of climate change have piqued investors’ interest in sustainable investment

As we have seen, it was the initiatives developed by the UN aimed at sustainable development in the world at the turn of the millennium which have definitely placed the theme of sustainable investment on the agenda of the financial community.

These were simultaneously the impetus and construction of architecture, around ESG or environment, social and governance, which serves as the basis for the construction of sustainability our days.

But these themes were already coming from behind.

The theme of Governance was awakened by the major corporate scandals and major media impact of the 1980s in the US, such as the bankruptcies of Enron and Worldcom.

These scandals were at the root of the Sarbanes-Oxley Act of 2005 which aims to ensure the creation of reliable audit and security mechanisms in companies in order to mitigate business risks, prevent fraud, and ensure transparency in the management of companies.

The theme of the Environment and climate change moved from the scientific community to our daily life in the following decade, 1990, with the multiplying of a succession of natural disasters and other negative events that caused destruction and degradation of life around the world, including earthquakes, floods, droughts, contamination, pollution and noise.

The 2005 Katrina earthquake and the oil spill in the Gulf of Mexico by BP known as the Deepwater case of 2010 are just two examples.

With the intensificating of successive natural disasters, the Paris agreement emerged, the treaty under the United Nations Framework Convention on Climate Change (UNFCCC) which aims to govern greenhouse gas emission reduction measures from 2020 in order to contain global warming in a context of sustainable development, and which was negotiated and approved in 2015.

The theme of Social, or discrimination and equality, still comes from further afield. It has been more than a century old with racial problems in the U.S. and elsewhere, and the fight of women for equal treatment around the world.

Racial themes were on the political agenda during the 1955 Secession War, Hitler’s Nazism in Germany, and Martin Luther King’s 1955 civil rights activism.

The struggle for equal rights for women begins with the movements for the right to vote of the Suffragettes in the United Kingdom in the early 20th century founded by Emmeline Pankurst, having extended to other areas such as equal rights in education, salaries and careers, etc.

In recent years, the first surveys have been made on how sustainable investment is applied by institutional and individual investors.

These studies do not always reach those with the same results, either because the base of respondents is different, or because these matters are still very confusing and taking the first steps with investors and industry in general. However it is worth investigating, knowing and analyzing their results.

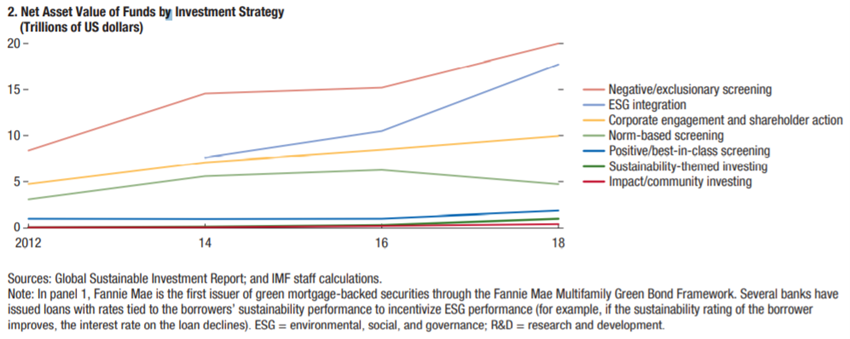

In a previous article we saw the sustainable investment strategies most used by the largest institutional investors are as follows:

The main strategies used are the exclusion of negative cases, followed by a growing ESG integration in investment processes, and later and more distant the more selective inclusion and activism of investors.

The CFA made one of the most robust surveys on these subjects in 2017, surveying nearly 50,000 associates and obtaining 1,588 valid responses.

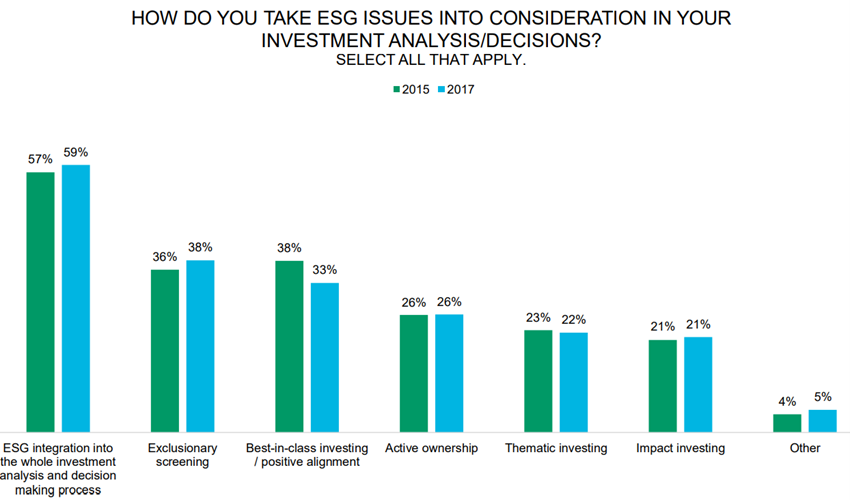

The same question about the strategies used had the following results:

First, the integration of the ESG arises, followed by negative exclusion and positive inclusion at the same level, and then by activism and thematic investment.

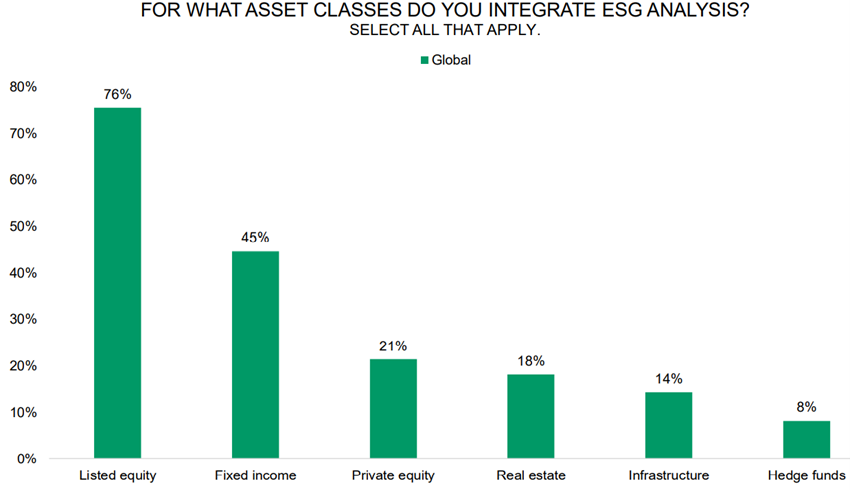

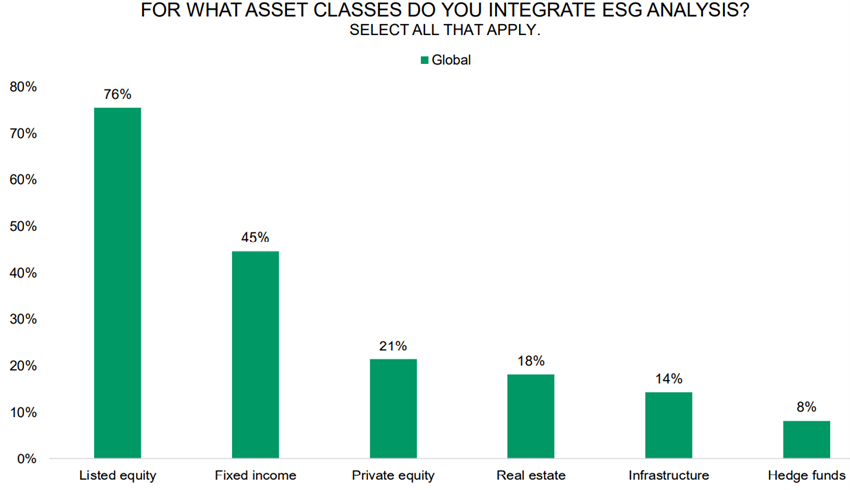

The asset classes in which there is greater integration of sustainable investment in ESG in the processes are:

The stocks dominate with 76%, followed by bonds with 74%. ESG’s percentages of incorporation into private equity, real estate, infrastructure and hedge funds are much lower.

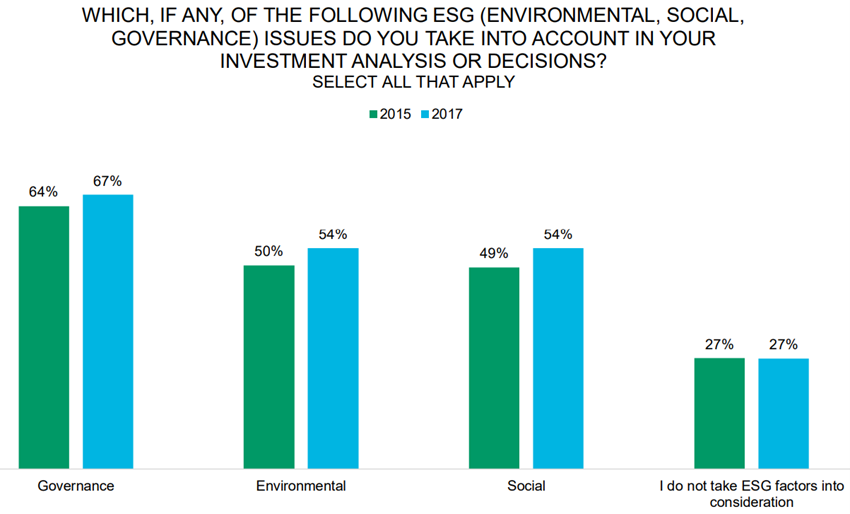

In terms of the degree of importance of the factors taken into account the answers were:

73% consider the aspects of ESG in their analysis and investment process, with governance being the most important with 67%, followed by the environment and the social with the same 54%.

On the issues that managers consider to have the most impact on financial markets:

Respondents focus on management responsibility (72%) and human capital (65%). The following are environmental degradation, demographic trends, resource scarcity, management compensation and climate change with between 53% and 62%. Finally, the supply chain and diversity of management with between 42% and 49%.

On the reasons that motivate them for sustainable investment:

65% of managers said the most important thing was to help manage investment risks, and 45% think they do so in response to investor demands.

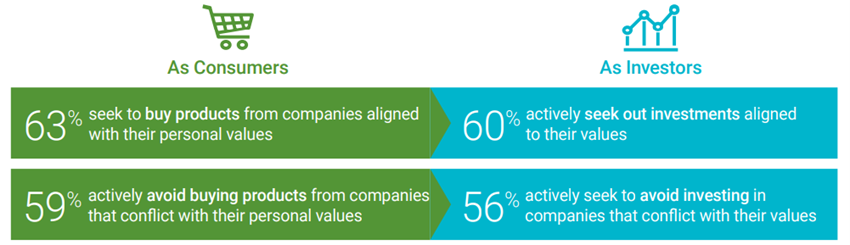

A 2018 study by Natixis with a wide range around the world, integrating results from 4 surveys of financial professionals, individual investors, institutional investors and professional investors in investment funds, covering a total of more than 10,000 respondents from more than 28 countries in North America, Latin America, Europe and the Middle East concluded that investors’ actions are confused with that of consumers:

Like consumers, investors engage in sustainable ESG investment to see personal values realized, while improving financial performance expectations.

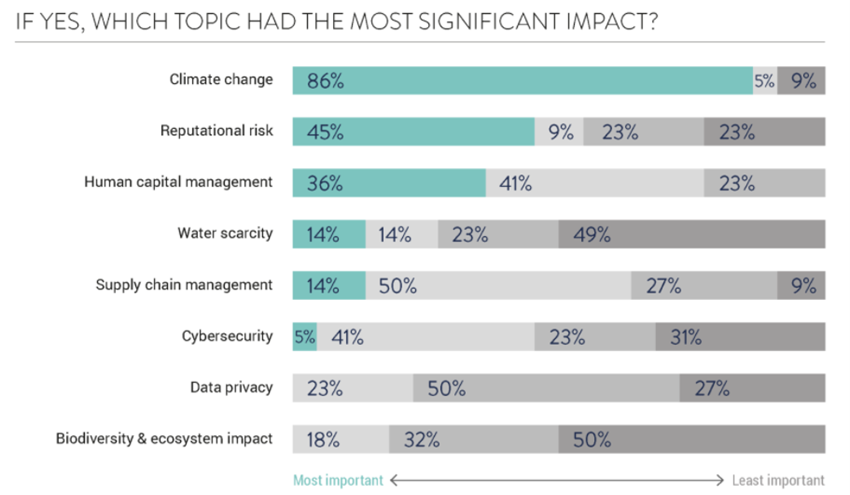

For the most important topics the results were:

Climate change is seen as the most important aspect with 86%, followed by reputational risk with 45% and management of human capital with 36%. In addition, the management of human capital has been the main aspect highlighted by the three largest managers in the world in the last two years.

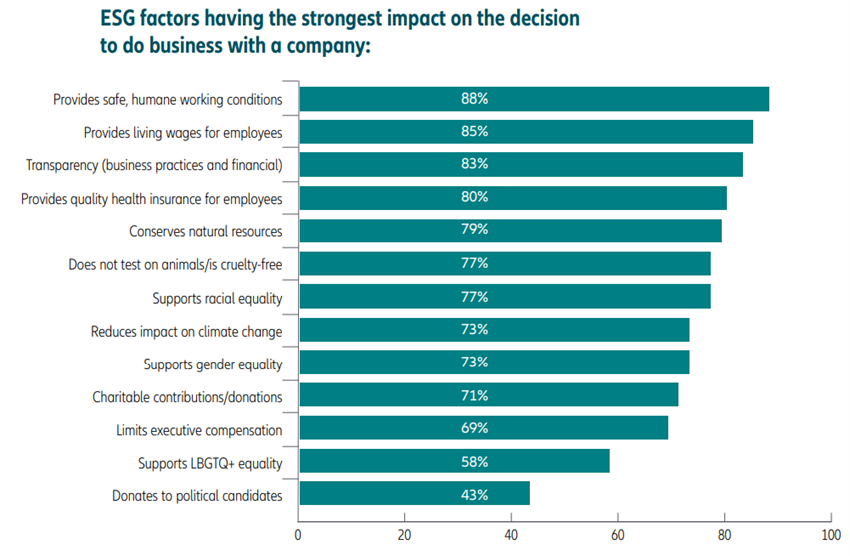

In December 2018, Allianz Life conducted a sentiment survey on ESG in the US of 1,000 people:

The factors most impacting the decision to do business with a company were human conditions in general, transparency and ethics, the conservation of natural resources.

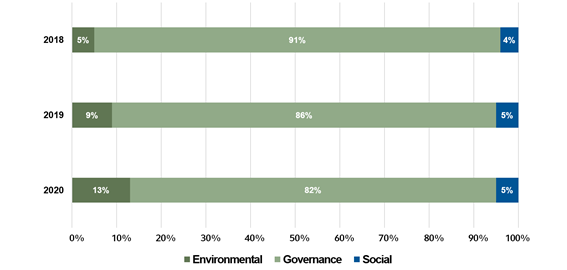

The latest survey of 400 of the world’s largest asset managers conducted by Russell Investments in 2020, with assets under management of less than €10 billion to more than €500 billion showed that the main pillars of ESG in the analysis and decision are:

Governance dominates 82%, followed by the environment with 13% and that has been growing, and the social with stable 5%.

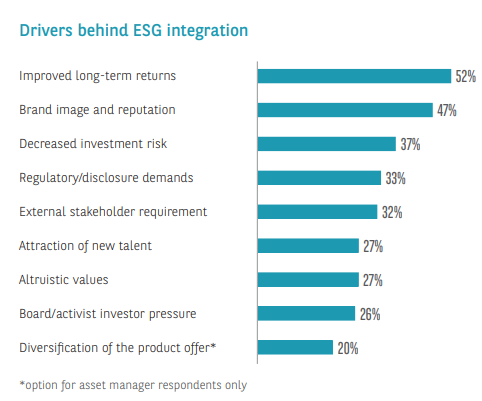

In 2019, a study conducted by BNP Paribas on asset managers and investors of 357 financial institutions, including pension fund managers, insurers, official institutions, sovereign wealth funds and foundations, concluded:

The two main reasons for pursuing sustainable investment are the demand for better long-term profitability and the image and reputation of the institution. This is followed by a decrease in investment risk and compliance with regulatory or other stakeholders requirements.

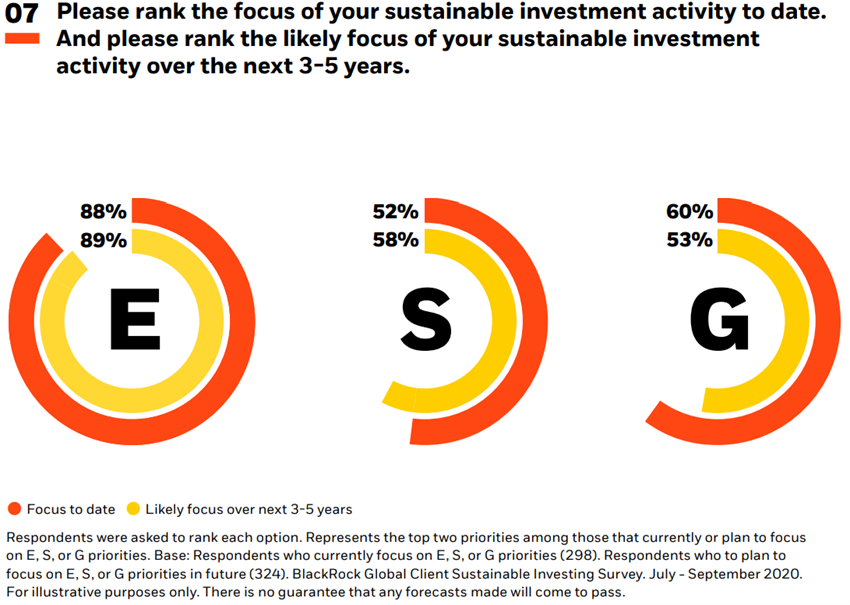

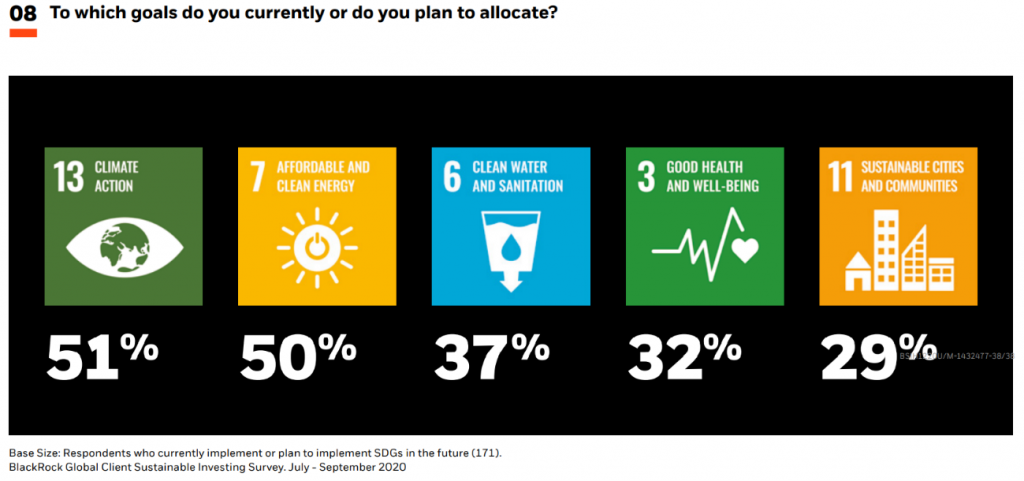

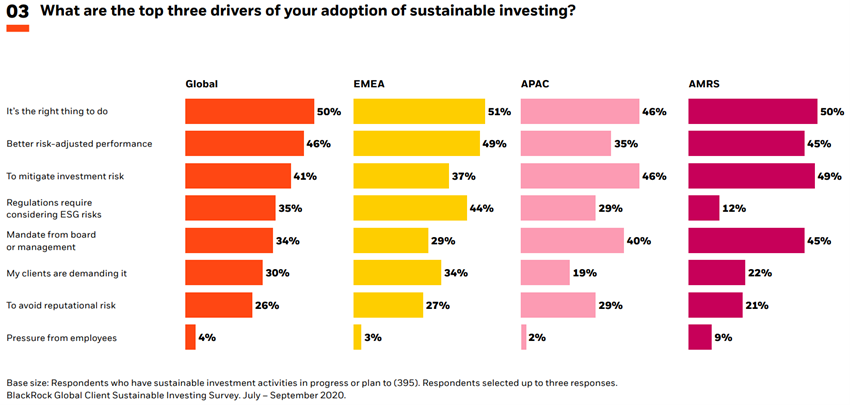

Finally, Blackrock conducted the Global Sustainable Investing Survey in September 2020, listening to 425 investors from 27 countries with a total of $25 billion of assets under management, with the following results:

The most followed strategy at global level is the integration of esg into the 75% process, followed by negative exclusion and thematic investment or inclusion with 65%.

The sustainability aspect that investors place the most is the 88% environment, followed by 60% governance. However, the social is growing from the current 52% to 58% predicted for 3 to 5 years from now.

In terms of sustainability, institutional investors guide the allocations of their investments to the sustainable development goals of climate action, clean energy, water and health treatment, health and well-being, and sustainable cities and communities.

The main motivations for the adoption of sustainable investment are the combination between doing what is right and achieving better risk-adjusted profitability.

From 2020, investors have accentuated their sustainable investment-oriented strategies and favoured the disruptive transition to electric mobility

But it has not only seen a growing investor’s support for sustainable investment, or a greater and more adjusted incorporation of ESG aspects into the investment process.

As or more important the last few years, in particular that of 2020, is marked by the explosion of sustainable investment and its manifestation in the financial performance of actions linked to renewable energy and electric mobility.

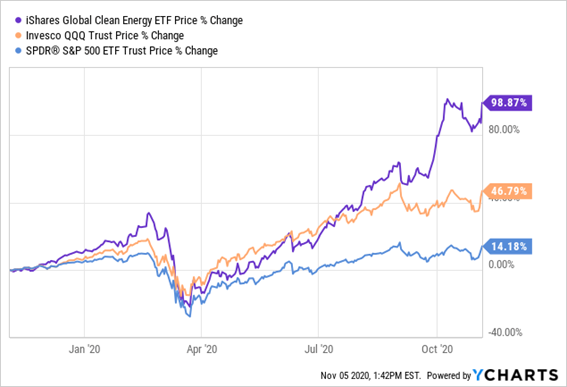

In the following chart we see the performance of clean energy stocks in the U.S., compared to the Nasdaq and S&P 500 indexes:

The clean energy sector gained 98.9%, versus 46.8% on the Nasdaq and 14.2% on the S&P 500.

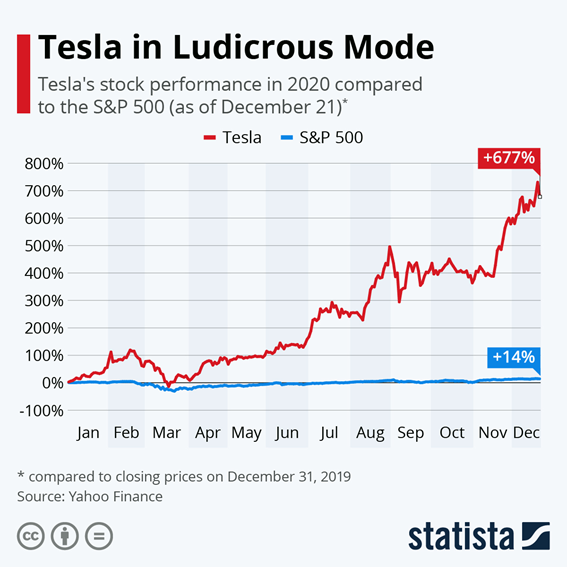

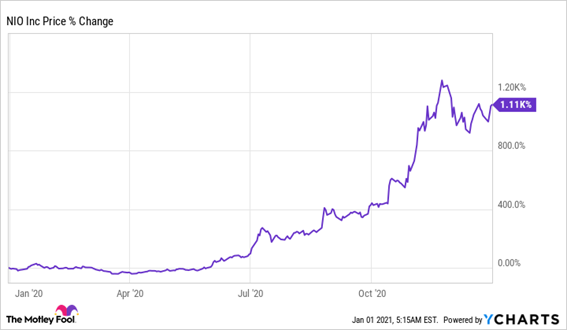

In terms of electric mobility were very significant the gains of two of the main protagonists, Tesla and NIO.

Tesla rose 677 percent for the year, compared with 14% in the S&P 500.

And NIO had a higher valuation of 1.110% in the year.