Women want to invest more

Women’s main challenges in investing

The need for expert financial advice

The importance of financial investment literacy for women

Women also want lower costs and better communication in investments

In the series “How they invest” we address the characteristics of the main classes of individual and institutional investors, which we consider useful to guide the investments of most individual investors.

With regard to individual investors, we present the characteristics and differences of investors from various regions or countries, from different levels of wealth, and above all from different generations and women.

In the initial article of this series on women’s investment, we saw that women already control 1/3 of the financial wealth in these countries, that in the next 10 years they could exceed 50%, and that they invest more and more, but still less than men (“investment gap”).

In the second article, we showed that women have the same or even better results than men, but with significant differences in the way and style of investment management.

In the third, we develop the 5 women’s investment gaps, comprising the wage, wealth, retirement needs, retail investment and institutional investment gaps.

In this article we will address what women need to invest more, and achieve one of the goals of financial management

Women want to invest more

Studies show that women want to invest more.

Fidelity’s 2021 Women and Investing Study found that 9 out of 10 U.S. women plan to make decisions to increase investment in the next 12 months:

These decisions include increasing knowledge about financial planning and investments, creating a plan, hiring a consultant, and increasing the investment percentage of your savings.

Women’s main challenges in investing

However, women believe that there are challenges to overcome.

BNY Mellon’s study “The Pathway to Inclusive Investment: How Increasing Women’s Participation Can Change the World,” based on a survey of 16,000 women and men in 16 countries, found that there are three key barriers to higher levels of female participation in investing:

– The crisis of commitment. Globally, only 28% of women feel confident in investing some of their money.

– The capital bar: On average and globally, women think they need $4,092 of disposable income per month (or, almost $50,000 per year) to start investing some of their money.

– The high-risk myth: Nearly half of women (45%) say investing in the stock market, either directly or in a fund, is too risky.

9% of women report that they have a high or very high level of risk tolerance when it comes to investing, 49% have a moderate risk tolerance, and 42% have a low risk tolerance.

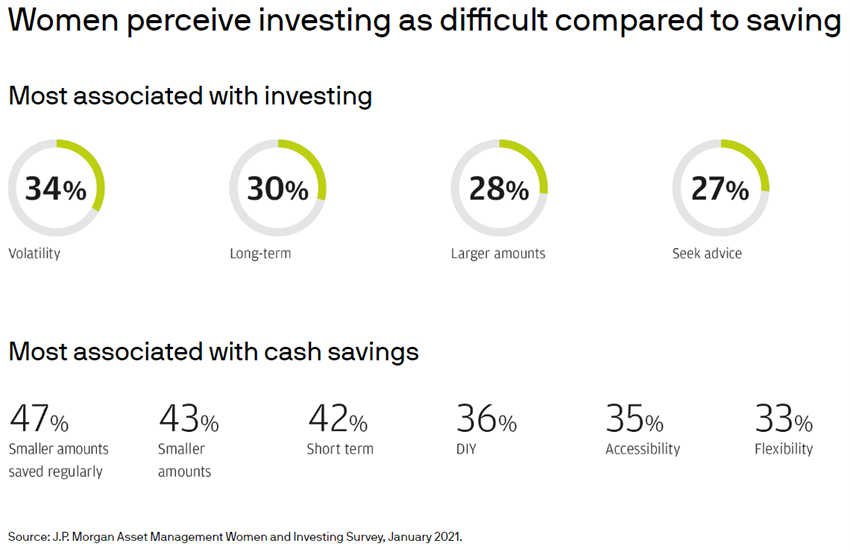

According to JP Morgan’s “Women and Investing Survey 2021”, European women understand that making investments is much more difficult than savings:

Women understand that investing is a more demanding and long-term commitment. For their part, they see savings as an easier decision, given their affordability and flexibility.

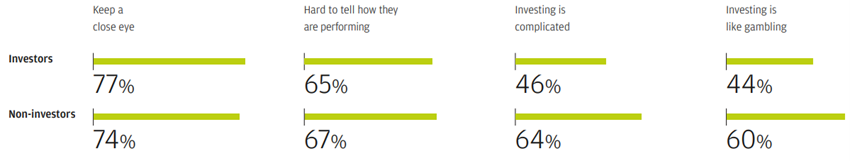

In the same study, they state that investment has many challenges:

They consider that in order to invest it is necessary to do a permanent monitoring and that it is not difficult for them to know how they are performing. In addition, they consider that investing is complicated and that it is like a game, especially women who do not invest.

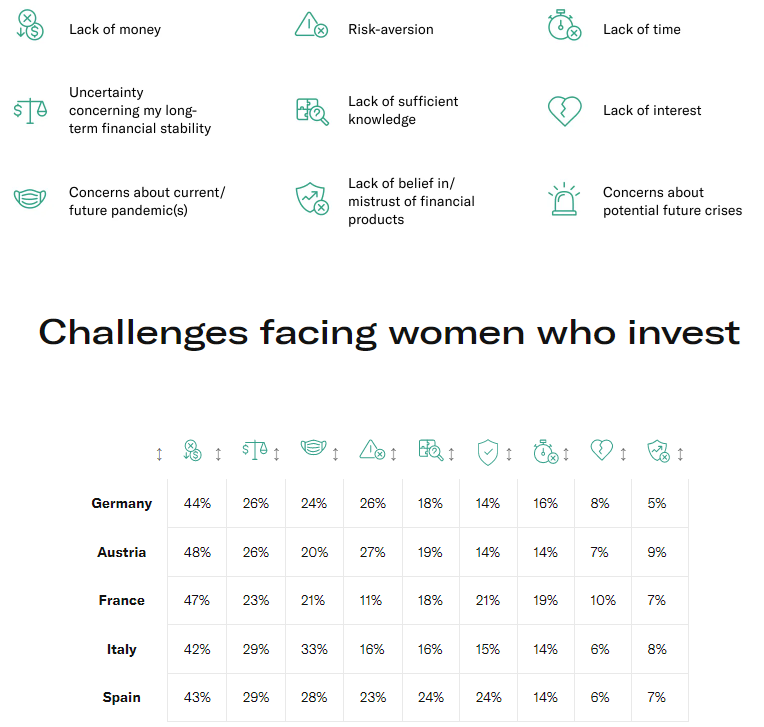

The N26 study also found that European women who invest consider themselves to have some important challenges:

The main challenges are, in addition to lack of money, risk aversion, lack of time, uncertainty about long-term stability and lack of sufficient knowledge.

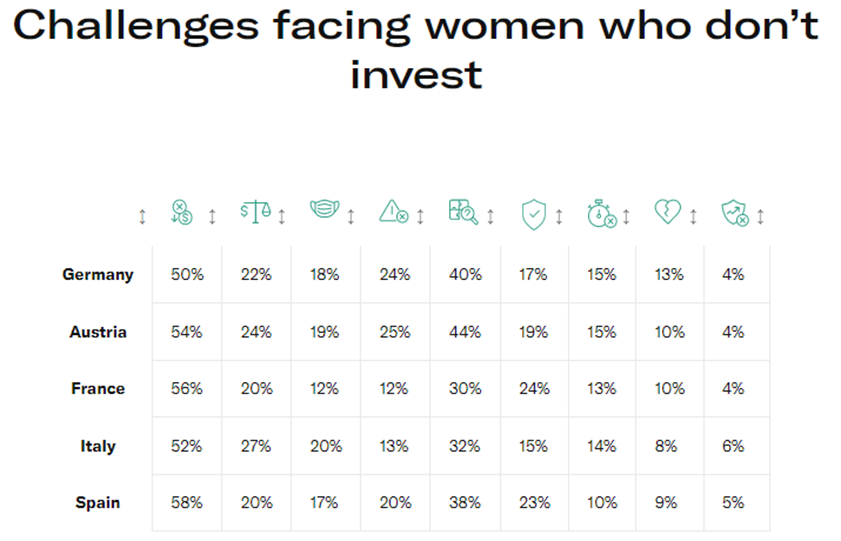

For women who don’t invest, there are also investment challenges, but they are a little different:

Of course, the lack of money becomes even more important, as does the lack of knowledge and uncertainty about the future.

The Need for Expert Financial Advice

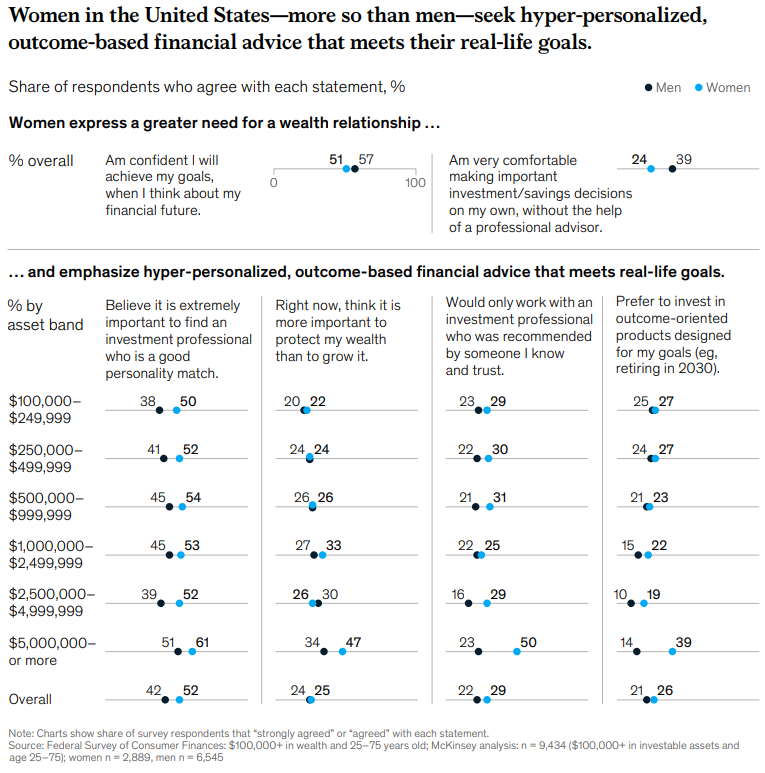

Affluent U.S. women use specialized financial advisors more than men, according to McKinsey’s “Women as the next wave of growth in U.S. wealth management” study, published in July 2020:

This study also found that women are more willing to pay the commission for face-to-face financial advisors, which can cost 1% or more, compared to 0.1% for digital services.

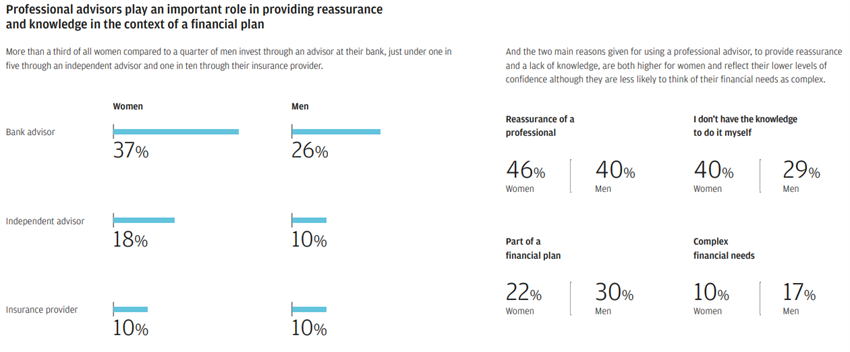

Regarding European women, according to the study “Wake up and see the women: Wealth management’s underserved segment”, also by McKinsey, published in June 2022, more than a third invest through a banking advisor, compared to a quarter of men, less than one in five through an independent consultant and one in ten through their insurance provider:

The two main reasons given for using a professional advisor – to provide peace of mind and address a lack of knowledge – are both higher for women and reflect their lower levels of confidence.

The Importance of Financial Investment Literacy for Women

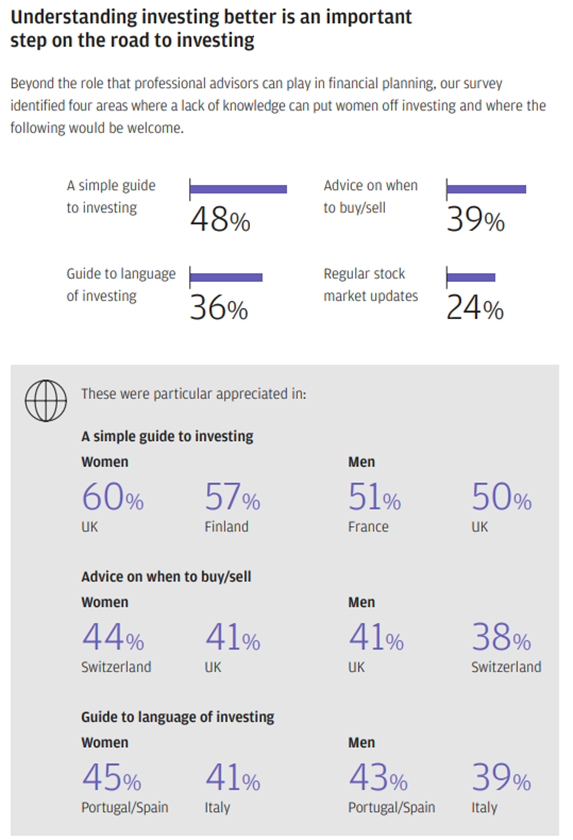

In addition to the role that professional advisers can play in financial planning, JP Morgan’s survey conducted in Europe identified four areas where a lack of knowledge can drive women away from investing and where the following initiatives would be welcome:

Affluent European women value a simple investment guide, easy and accessible investment language, advice on what and when to buy, and regular monitoring of investments.

The investment guide is especially valued in the UK and Finland, while the easier and more accessible language is more sought after in Portugal, Spain and Italy, and advice on what and when to invest in is most sought after in Switzerland and the UK.

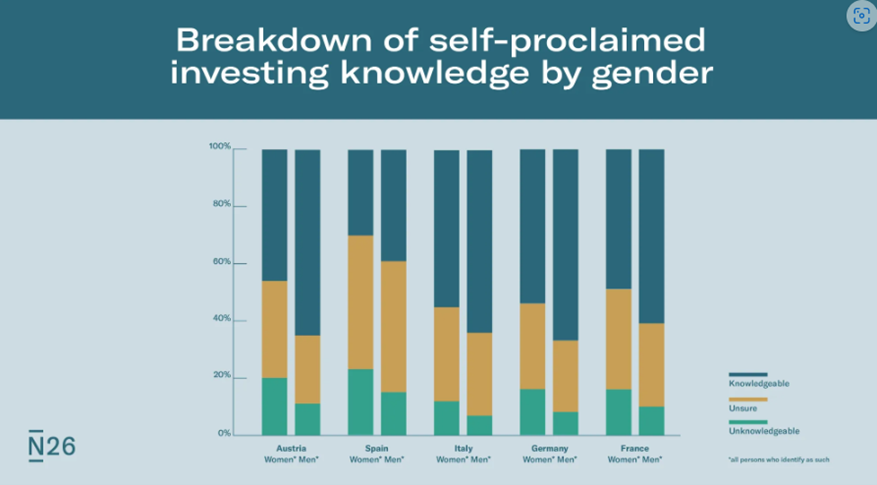

According to N26, less than half (48%) of European women consider that they have enough knowledge to invest, compared to 59% of men:

Italian women are the most confident investors at 55%, while only 30% of Spanish women say they have investment knowledge.

Women who don’t invest also indicate that lack of knowledge is a blocker, ranking it as the second most common reason for not investing.

Possible causes include lack of access to educational resources and under-representation in the wider investment community.

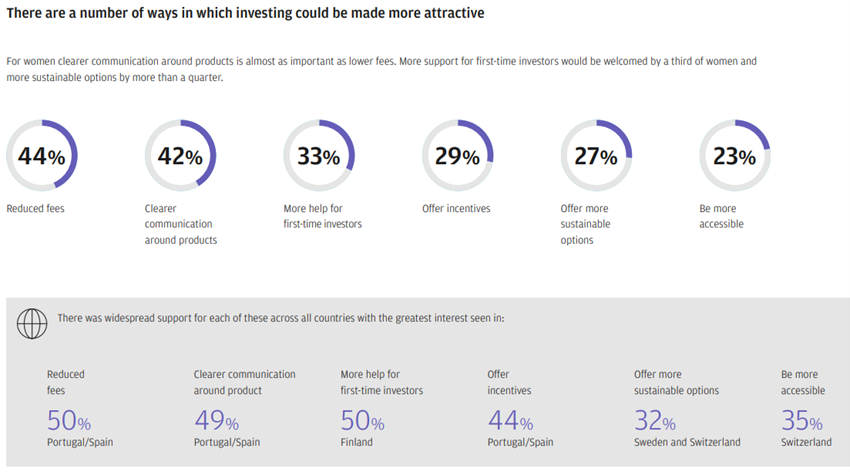

Women also want lower costs and better communication in investments

According to JP Morgan’s study, European women want lower commissions and clearer communication about products:

These two aspects are particularly important in Portugal and Spain.