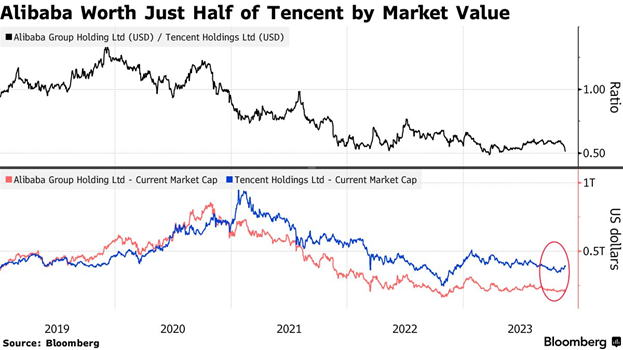

Many companies have seen deeper devaluations, including internet giants BAT – Baidu, Alibaba, Tencent – which were preferred by foreign investors, and have lost more than 50% of their value in the last 3 years

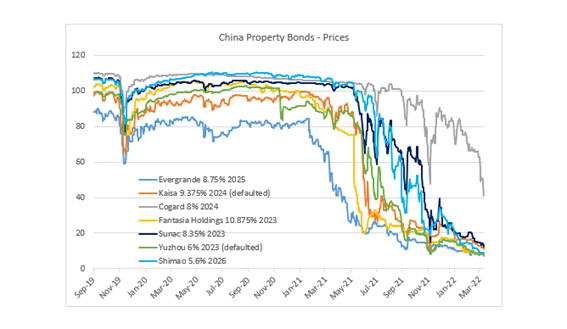

The first signs of economic problems have begun to manifest themselves in the international bond market of large Chinese construction companies

There is a lot of external misunderstanding of government actions, ranging from policies to support the stock market, financing foreign investment by private conglomerates, and arrests and prosecutions of some top managers

Xi Jinping’s reaffirmation of the Common Prosperity goal in 2021 and the need for market support, considering their dependence and importance for household wealth are the new policy benchmarks

The war in Ukraine has brought the risks of autocracies into the minds of foreign investors

In good times, with all the tailwinds, investors tend to forget that China is a socialist economy and its market is still nascent, while in times of upheaval, investors exaggerate worries and risks

This article is part of a series dedicated to investing in Chinese stocks.

In the first article, a general introduction to the topic was made,including a synthesis of the remarkable performance of economic growth and development in the last 4 decades, as well as the challenges it has faced especially since mid-2015.

In the second article, aspects of China’s strong economic growth over the past 4 decades were developed.

In the first part of this third article, the performance of the Chinese stock market in the last 4 decades was shown.

In this second part, we will provide an overview of the perspectives of understanding the economic reality and the markets by foreign investors, before moving on to the analysis of the current challenges.

In previous articles we have already developed the size and weight of the Chinese economy in global terms, its enrichment in recent years, as well as its convergence with the most developed countries.

Also in previous articles we have addressed the growth of investment in emerging equity markets, as well as their attractiveness, with emphasis on the Chinese market.

In another article, we also delved into the specifics of the structure, functioning and activity of the Chinese stock market.

Many companies have seen deeper devaluations, including internet giants BAT – Baidu, Alibaba, Tencent – which were preferred by foreign investors, and have lost more than 50% of their value in the last 3 years

Baidu, Alibaba and Tencent, jointly dubbed BAT as an anachronism of contrast to the US FAANGM, have lost 50% of their stock market value in the last 3 years:

The first signs of economic problems have begun to manifest themselves in the international bond market of large Chinese construction companies

Starting in 2018, some of the large Chinese construction companies are starting to have problems servicing debt on international obligations:

The Chinese government and banks have provided some support, but many of these companies end up going bankrupt.

And it must be borne in mind that the construction sector directly and indirectly accounts for almost 25% of China’s GDP.

There is a lot of external misunderstanding of government actions, ranging from policies to support the stock market, financing foreign investment by private conglomerates, and arrests and prosecutions of some top managers

These problems have been exacerbated by the difficulty of foreign investors in perceiving the orientations of government policies in relation to the economy and markets.

At the beginning of the last decade, the Chinese government encouraged its leading private entrepreneurs to grow overseas, either organically or through acquisitions, through financing by state-owned banks.

Since the 2015 crisis, caused by the financial excesses of previous years, and which required the intervention of the authorities, everything seems to have changed.

Press releases by major Chinese companies – “We have lost touch with our chairman.” – have become frequent.

The supervision and discipline of the markets by the Chinese authorities has been felt through arrests, charges and trials of managers and the largest shareholders of some large groups.

At the same time, greater regulatory pressure has been exerted on large private companies.

Xi Jinping’s reaffirmation of the Common Prosperity goal in 2021 and the need for market support, considering their dependence and importance for household wealth are the new policy benchmarks

The policy of “Common Prosperity” as the new stage of Chinese development, recalled and accentuated by Xi Jinping in 2021, has reshaped this balance between public and private interests, subordinating the latter to the former.

The political reshuffle in the Communist Party of China in 2021, announced at its 20th party congress, provoked a major reaction in the markets as it implied a hard-line approach to the country’s zero-COVID program, more opaque future government policies, and greater uncertainty and risk.

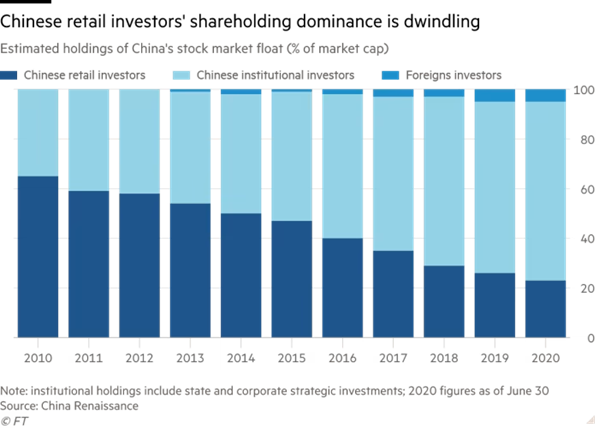

From time to time, this principle is balanced with direct and more robust intervention by market authorities, not only to supervise, but also to promote it in order to attract greater institutional and foreign investment:

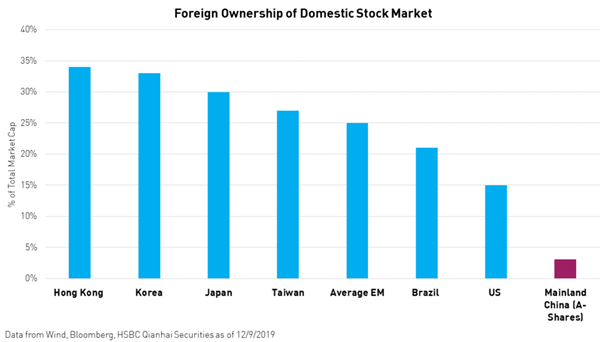

The share of foreign investors rose from 2 percent of market capitalization to 3.1 percent and from 3 percent of free-float to 8 percent, making foreign institutional investors the largest group of institutional investors in China’s stock market.

The current level of foreign ownership remains well below the 30% threshold set for mainland equities and is far lower than other major Asian markets.

Currently, foreign ownership levels in Hong Kong and Korea are at 34% and 33%, respectively.

This greater international participation has aggravated the problems, as in 2023, foreign investors sold 90% of what they bought that year.

The war in Ukraine has brought the risks of autocracies into the minds of foreign investors

First, it was the market’s reaction to Russia’s invasion of Ukraine in early 2022. Then there was the latest market reaction around geopolitical tensions between China and the US.

In good times, with all the tailwinds, investors tend to forget that China is a socialist economy and its market is still nascent, while in times of upheaval, investors exaggerate worries and risks

As we know and have seen before, investors are subject to a lot of behavioral biases.

When times are good and all the winds are blowing, investors make money, become too optimistic, the market spirals into euphoria and rises sharply, as happened with China between mid-2014 and mid-2015.

Herd behavior biases and overconfidence or optimism are very present.

When times are bad and the winds are headwinds, investors lose money, become overly pessimistic, and the market goes into a risk-averse spiral and goes down sharply, as happened with China in the summer of 2015 and in the last 3 years.

Loss aversion and herd behavior biases are very active.

In both cases, investors are also influenced by current or recent memory biases, familiarity or home bias, and media noise.

Investors forget that China is a socialist, planned and dirigiste market economy and that, despite remarkable progress in recent years, it has an incipient economic development model.

It is an economy still in transformation, which has gone from an underdeveloped country to an emerging one, but has not yet reached the stature of a developed one.

Chinese capital markets are also nascent, very new and with structures and operating rules that are more fragile and vulnerable than the developed markets of Western economies.

In the following articles, we will delve into the structural problems of the Chinese economy and markets, which include the slowdown in economic growth and the exhaustion of the development model of the past, as well as geopolitical and institutional issues.

All this, with a view to analysing the interest of the Chinese stock market for foreign investors.

This central question of the attractiveness of the Chinese market is very pertinent because, as we know, investing well means diversifying risks, doing so, above all, in the world’s largest economies and companies, and privileging those that are world leaders and consumer goods, in order to put the economy to work for us.