After 4 decades of strong economic growth and good stock market valuation in China, the last 5 years have been disappointing

Since the 2009 financial crisis, the Chinese economy has become more dependent on domestic demand, favoring public investment and the development of the residential real estate sector

In 2020, problems began to emerge in the construction sector

The weight of the construction and real estate sector in GDP is more than 20%

This article is part of a series dedicated to investing in Chinese stocks.

In the first article, a general introduction to the topic was made,including a synthesis of the remarkable performance of economic growth and development in the last 4 decades, as well as the challenges it has faced especially since mid-2015.

In the second article, aspects of China’s strong economic growth over the past 4 decades were developed.

The third article was divided into two parts, the first addressing the performance of the Chinese stock market in the last 4 decades, while the second provided a framework for the prospects of foreign investors’ understanding of the economic reality and the markets.

In previous articles we have already developed the size and weight of the Chinese economy in global terms, its enrichment in recent years, as well as its convergence with the most developed countries.

Also in previous articles we have addressed the growth of investment in emerging equity markets, as well as their attractiveness, with emphasis on the Chinese market.

In another article, we also delved into the specifics of the structure, functioning and activity of the Chinese stock market.

This article begins to develop the main challenges of the Chinese economy.

In it we will analyze how it all began, the crisis in the construction sector. It was thought to be the core problem, coupled with the draconian Covid response policy.

The crisis in the construction and real estate sector is serious because it has direct and indirect effects of great impact.

But it’s not the most serious problem. Appearances are often deceiving.

The problem is deeper and more structural, as we will see in subsequent articles.

After 4 decades of strong economic growth and good stock market valuation in China, the last 5 years have been disappointing

The past five years have been a frustrating period for investors and participants in the Chinese stock market.

Currently, China trades at depressed valuation multiples and with very low allocations from international investment funds.

The world’s second-largest economy is hostage to a host of problems, including a record slowdown in the housing sector, deflation, debt, a falling birth rate and a shrinking workforce, as well as a shift to ideological policies that have rattled the private sector and spooked foreign companies.

The stock slide has caused Chinese markets to be one of the worst performers in the world, losing 50% since 2018.

All of this comes against the backdrop of a sharp global rally in stock markets, led by the US and Japan.

In the next articles we will analyze the reasons behind this poor performance.

Since the 2009 financial crisis, the Chinese economy has become more dependent on domestic demand, favoring public investment and the development of the residential real estate sector

Since the global financial crisis of 2009, the Chinese economy has increasingly orientou.se to domestic demand.

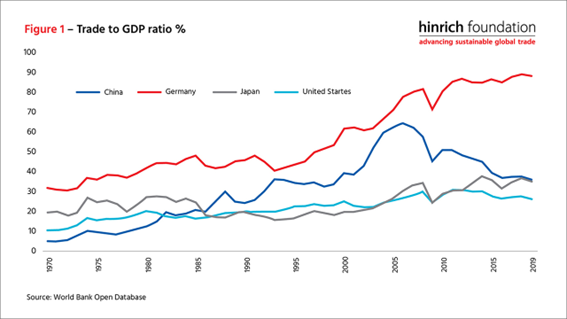

The ratio of international trade to GDP has been steadily declining, a trend that is likely to continue:

China’s exports and imports increased more slowly than GDP growth, due to the state-led investment model and the boom in residential real estate development that boosted the country’s GDP growth in the following years.

China’s strong export dominance also makes further market share gains more difficult.

In 2020, problems began to emerge in the construction sector

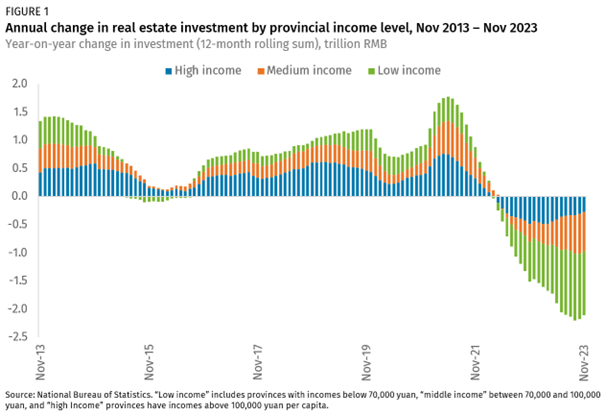

Since Beijing unleashed a regulatory maelstrom in the real estate sector in 2020 that aimed to deleverage the sector, real estate has been in the doldrums despite some subsequent pushbacks by authorities.

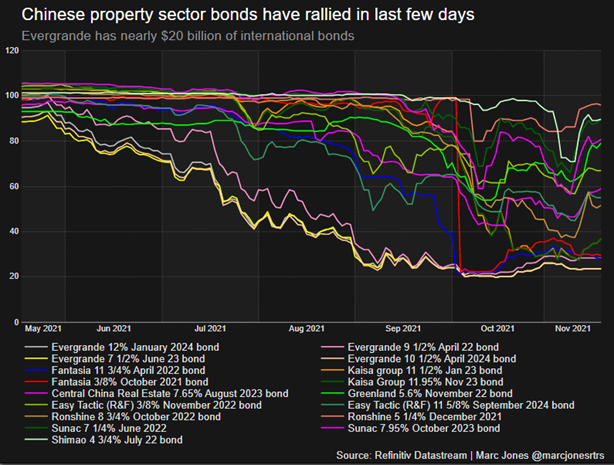

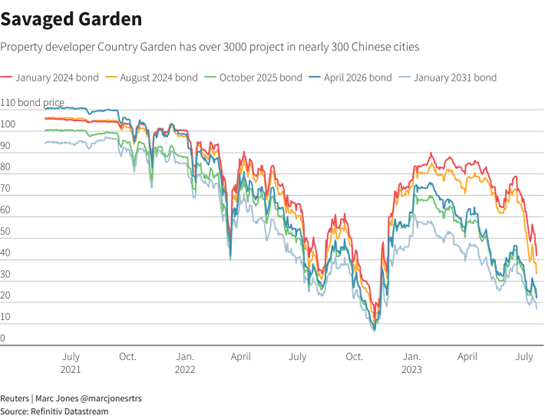

The construction sector’s problems began to be visible in mid-2021, when the Financial Times announced that some of China’s largest construction companies – first Evergrande, and then Country Garden – were struggling to pay contractors, and a little later, to service the debt of international bond issuances.

Evergrande was China’s second-largest construction company, had liabilities of $300 billion, and had deposits from 1.5 million customers to build their homes. Country Garden was China’s sixth-largest construction company

Immediately, the international bonds of these companies suffered significant devaluations:

And they dragged along other large construction companies that had the same problems of illiquidity and high debt.

As of September 2023, 34 of China’s top 50 builders have defaulted on their debt payments.

In 2024, Evergrande declared bankruptcy.

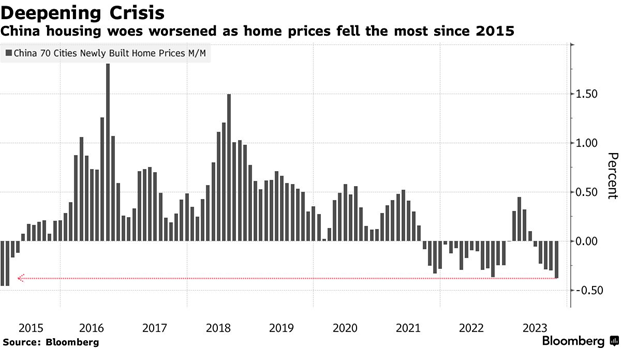

The problems of the construction companies were accompanied by the sharp fall in real estate prices:

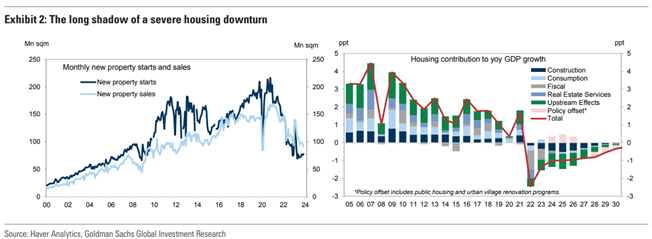

And the pace of new housing construction has also dropped significantly from mid-2021:

The weight of the construction and real estate sector in GDP is over 20%

China’s real estate market has been one of the main drivers of the economy since the country began opening its markets in the 1980s.

As of 2010, China’s real estate market has become the largest in the world.

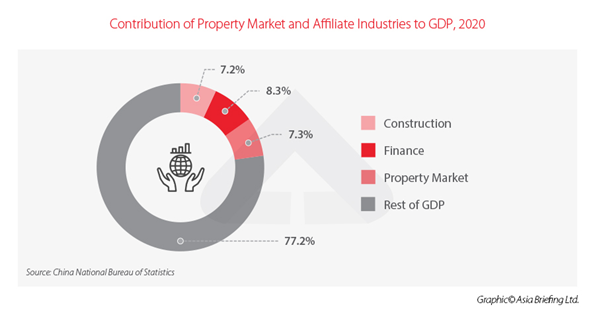

Today, the real estate market is still a major contributor to the economy, with estimates ranging from 17% to 29% of GDP, depending on the scope of industries included.

According to the People’s Bank of China (PBOC), direct investment in real estate in 2020 reached about RMB 7.5 trillion (USD 1.18 billion), a contribution of about 7.4% to GDP.

Data from the National Bureau of Statistics (NBS) shows that the construction industry, which is based on the real estate sector, contributed another RMB 7.3 billion (USD 1.15 billion), or 7.2% of that year’s GDP.

According to Bloomberg estimates, the sector contributed about 20% of China’s GDP in 2023, down from a peak of 24% in 2018.

Therefore, this crisis has contributed significantly to the slowdown in GDP growth:

These are the direct and most visible effects of the crisis in the construction and real estate sector.

But this crisis has other, indirect, perhaps even more impactful effects.

This topic will be addressed in the second part of this article.

In the following articles, we will continue to delve into each of these aspects and the consequences regarding the interest of the Chinese stock market for foreign investors.

This central question of the attractiveness of the Chinese market is very pertinent because, as we know, investing well means diversifying risks, doing so, above all, in the world’s largest economies and companies, and privileging those that are world leaders and consumer goods, in order to put the economy to work for us.