Investing in the S&P 500 index (cap-weight) is the most common investment for private investors

The concentration of the S&P 500 is high due to the weight of the Magnificent 7

The equal-weighted S&P 500 index is the solution for investors who want to reduce concentration risk

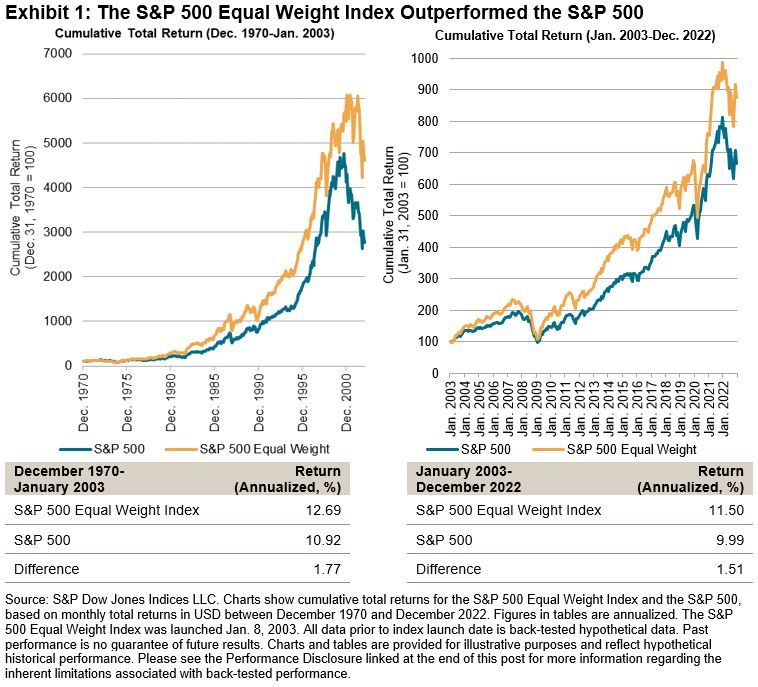

The performance of the two indices has been equivalent in the medium and long term, with a slight advantage for EWI

Market indices are important for several reasons.

First, because there are many funds or products that are directly indexed to many indices.

Second, because most investment funds have the main indices as a performance benchmark (profitability and risk).

Third, because indices are the benchmark for measuring the performance of individual companies, for example for evaluating performance and attributing benefits to the executive managers of the companies.

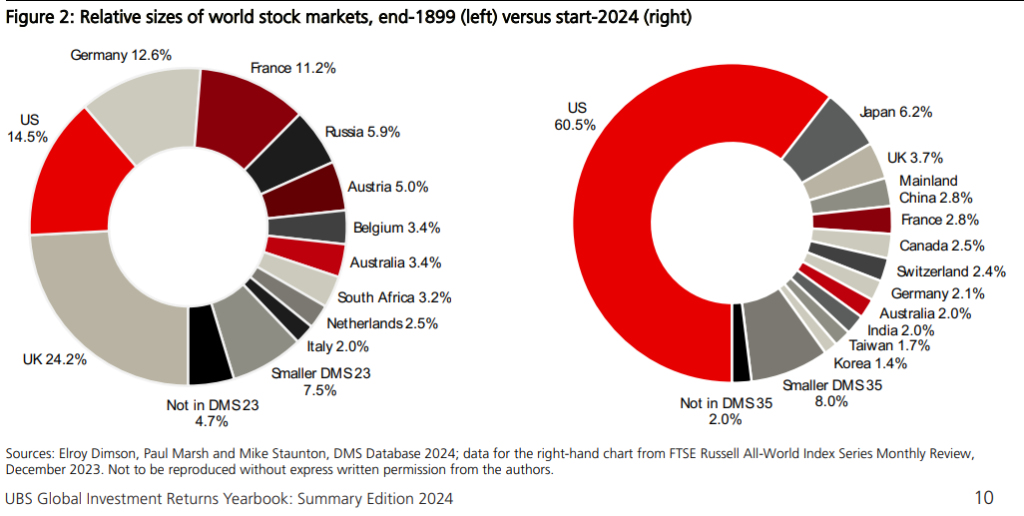

In this context, the S&P 500 index stands out as the main index of the world’s stock markets, as it is the main benchmark index of the world’s largest stock market, the USA.

Therefore, most of the articles on this site present data from the S&P 500, which is the most widely available and most widely used worldwide.

Now we will develop a variant of the S&P 500 index, which is the S&P 500 Equal-weight.

While the former is weighted by market capitalization, the latter assigns equal weight to all constituent companies. leading reference worldwide.

In the series of index funds, we have addressed the development of index-indexed investment funds, or liabilities, and the importance of comparison with the category benchmark for all types of funds.

In previous articles, we have addressed the issues of comparing active versus passive investment funds (or indexed to an index), as well as the selection criteria for the investment decision.

We have also presented in successive articles an overview of the subject of investment funds, the categories and types, the returns, the costs, the growth of indexed or passive funds, the criteria for choosing and selecting funds and the main fund management companies worldwide.

In a recent article, we developed the main features of the S&P 500 EWI index, and in an older one, those of the S&P 500 index.

Investing in the S&P 500 index (“cap-weighted”) is the most common investment for private investors

The S&P 500 is the dominant benchmark in the U.S. index fund market, accounting for more than $7 trillion of invested capital in 2022.

The return on this investment in the S&P 500 index has far outperformed most active mutual funds in the same category over many years

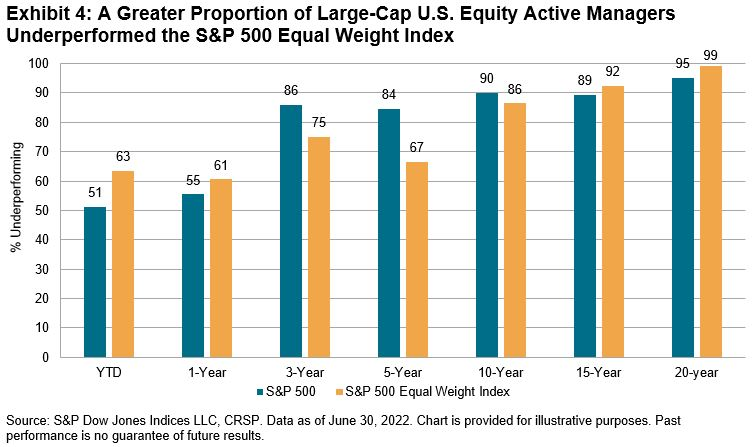

The S&P 500 and S&P 500 EWI indices have been hard for active managers to beat, with 99% of active large-cap equity managers underperforming the index over the past 20 years:

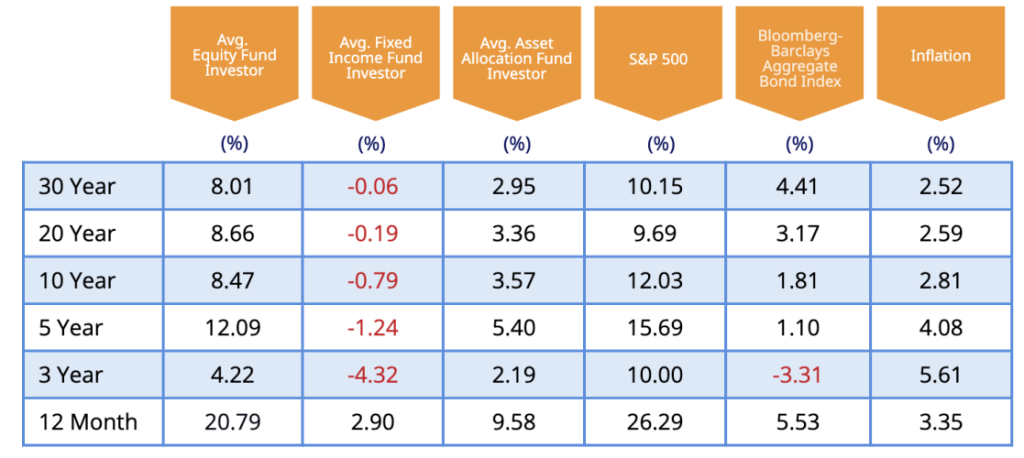

This is one of the main reasons why individual investors do not achieve the returns provided by the market, as we can conclude from the results of Dalbar’s analyses:

In the most recent study, for 2023, it is concluded that individual investors obtain returns between 8% and 9% for investment terms of more than 10 years, while the market (measured by the performance of the S&P 500 index) provides returns between 9.7% and 12%, that is, between 1% and 3% more.

The concentration of the S&P 500 is high due to the weight of the Magnificent 7

The concentration of market capitalization in the largest U.S. stocks is the highest in decades, led by the shares of the 7 magnificents:

The 10 largest U.S. stocks now account for 33 percent of the S&P 500 index’s market cap, up from 27 percent at the peak of the tech bubble in 2000

This concentration is also felt at the sectoral level, as most of these companies are in the technology sector:

The current concentration has contributed to a period of exceptionally strong returns in the U.S. market.

The S&P 500 has generated an annualized total return of 16% over the past five years, compared with a 30-year annual average of 10%.

The top 10 stocks accounted for more than a third of that gain.

There has been extensive discussion about where it is better to invest in the S&P 500 or its equal-weight version.

It is true that the largest stocks have shown a growth in revenues and results well above the average of the stocks that make up the index, which has determined their superior performance.

On the other hand, it is also true that these mega stocks are quoted at valuation multiples well above the average.

So, in essence, the question is whether we want more or less concentration of investment risk.

The equal-weighted S&P 500 index is the solution for investors who want to reduce concentration risk

Investing in equal-weight S&P 500 indexed or indexed funds is the solution to reducing concentration risk

As we said earlier, in another article we described and developed the main features of the S&P 500 EWI.

The performance of the two indices has been equivalent in the medium and long term, with a slight advantage for EWI

In the 20 years prior to 2022, the S&P 500 EWI was +425%, surpassing the +340% of the S&P 500 (weighted market cap).

There are several reasons why the S&P 500 EWI outperformed the S&P 500 during this period.

First, market analysis shows that, over long periods, there is modest outperformance of smaller stocks relative to larger stocks, and value stocks relative to growth stocks.

An index of equal weight would be favoured by those two factors.

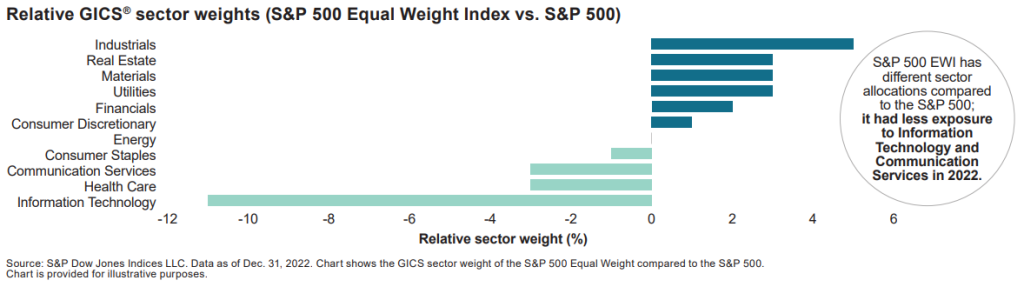

In addition, there is the sectoral exposure.

Technology stocks, which had an outsized market weight during the “dot.com” boom in the late 1990s, fell for much of the early 2000s, leading to underperformance for the market capitalization-weighted S&P.

And in 2022, low-market-cap sectors such as energy companies outperformed, while large-cap sectors such as technology underperformed, and obviously equal weight improved.

However, since 2023 the divergence has been unusually wide.

That’s what led to a lot of discussion that there might be something wrong with the market, but in our opinion, it’s not about that at all.

This change is simply the result of the effect of the reversion to the mean over market cycles, a phenomenon that occurs in the capital market very frequently.