Index funds versus active managed funds

Main advantages of index investment products, mutual funds or passive management (Pros)

Main disadvantages of index investment products, mutual funds or passive management (Cons)

Index funds versus active managed funds

Indexing is a form of passive fund management.

Instead of a fund portfolio manager actively stock picking and market timing—that is, choosing securities to invest in and strategizing when to buy and sell them—the fund manager builds a portfolio whose holdings mirror the securities of a particular index.

The idea is that by mimicking the profile of the index—the stock market as a whole, or a broad segment of it—the fund will match its performance as well.

We can look at index investment like a driving style in cruise speed mode or automatic gear, while active investment resembles more rally driving style.

Portfolios of index funds substantially only change when their benchmark indexes change.

If the fund is following a weighted index, its managers may periodically rebalance the percentage of different securities, to reflect the weight of their presence in the benchmark.

Weighting is a method used to balance out the influence of any single holding in an index or a portfolio.

Index funds seek to match the risk and return of the market, on the theory that long-term, the market will outperform the majority of other investments, as has been demonstrated in several studies.

Main advantages of index investment products, mutual funds or passive management (Pros)

The advantages of indexed products or funds are as follows:

Excellent diversification

The main benchmark market indices, whether from stocks or bonds, are usually composed of hundreds and in some cases up to thousands of securities, which provides wide diversification (it is recalled that we have seen earlier that studies show that from 30 securities we eliminate market risk).

In addition, these indices, in particular those of the stock markets, but also the bond markets, are composed of the stocks or bonds of the largest companies of that market or segment, in terms of size (stock market capitalisation or sales), which means that they are composed by the largest companies in the world.

Moreover, almost all of these indices are weighed by the company’s capitalization, which means that the largest companies have higher weights, but prevents a company from having an excessive influence.

Thus, the indices are not only composed of the largest companies in the markets they represent but the companies that integrate them go through a periodic process of natural selection associated with the review of the indices, several times a year: they survive, maintain and grow in weight the best companies and the worst companies are excluded or lose weight.

Strong long-term returns

As we saw in the Morningstar study presented in another post, the vast majority of market index investment products or funds show better returns than active funds for several investment periods, be it 1, 3, 5, 10, 15 , and 20 years.

Only 20% of active funds beat the market returns, it means that 80% of passive or indexed funds beat the active managed funds.

In addition, it is very difficult to select the active funds that will beat the market.

Studies show that there is a great variability of the few funds that are able to beat the market, that is, those who make it aren’t for long periods, have little consistency, usually because the style of the manager cannot adapt to the market changes.

Low investment costs

Typically, index investment products and funds have, on average, lower costs for the investor, whether on management commissions or other charges.

Ideal for long-term investors, buy-and-hold investors

These products, in addition to not choosing the securities, also do not choose to pick the market timing.

The advantage of this characteristic is to help the investor to look at an investment in financial markets as a medium- and long-term process, correcting deviations and behavioural biases to which he is exposed by the short-term fluctuations of markets, as should be the case to be successful in our investments.

In addition, they do not require the investor knowledge, experience, time and dedication to analyse markets, professional fund managers or securities.

Main disadvantages of index investment products, mutual funds or passive management (Cons)

Vulnerable to market swings, crashes

The index investment products or mutual funds when replicating the index are evidently exposed to fluctuations and major financial corrections or crises, which are more pronounced in the stock markets.

However, we have seen that stock markets have a positive growth story evolution over the medium and long term, exceeding highs years after years despite more violent crises and showing average annual real returns of more than 6% per year.

Moreover, it is not proven that most managers of active products and mutual funds anticipate these periods of crisis and beat the market.

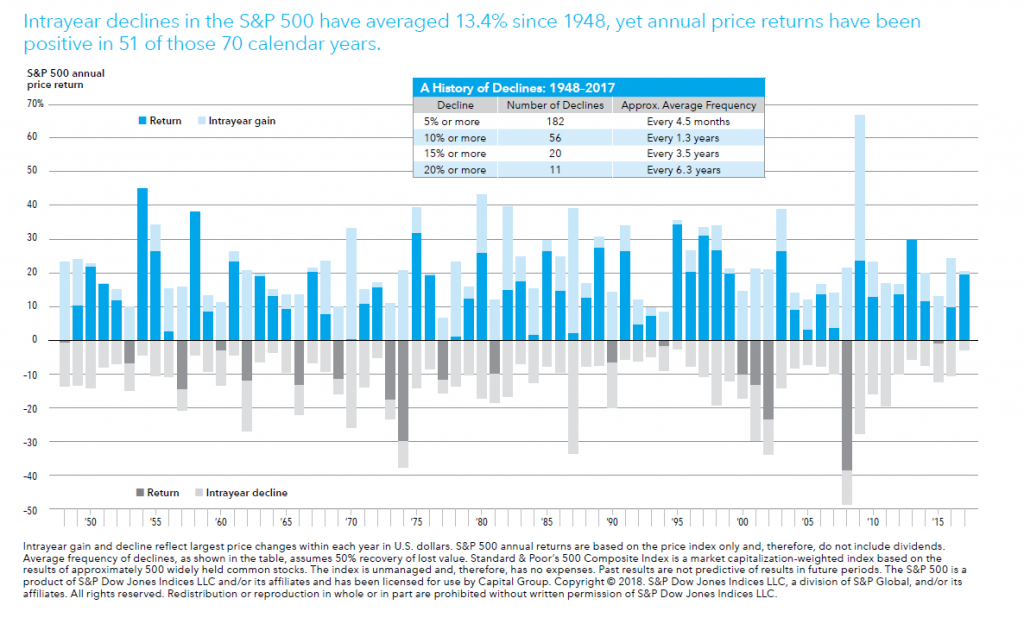

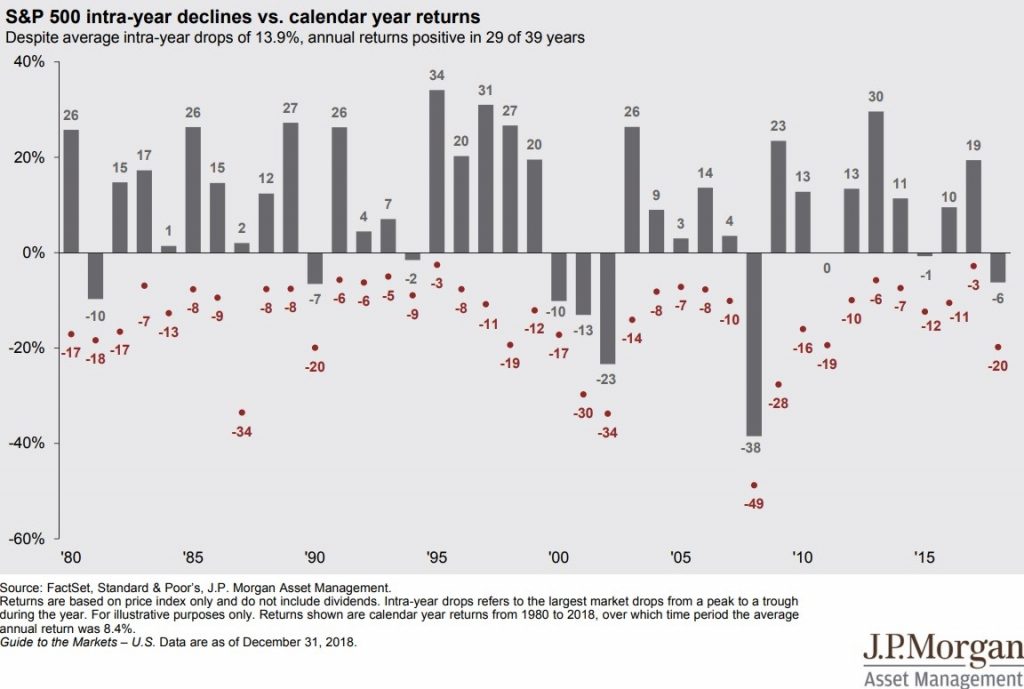

It is necessary to take into account that in more than 2/3 of the years the stock markets indices have provided positive returns and that in the vast majority of years when the indices have these positive returns, there are several periods of correction, days, weeks or months, in which the indices suffer corrections in many cases greater than 10%, called technical corrections.

We must also not forget that if we are not invested in the market in some few, of their best days, profitability is greatly affected.

Moreover, even if some fund managers could anticipate a crisis they would still have to know when to return to the market in the post-crisis, in order to take advantage of its recovery.

If it’s hard enough to be right once, it’s even more like doing it twice.

In another article, we will see that trying to get it right in the best moments in the market (“market timing”) is difficult, if not impossible, for these reasons, and has great costs.

Lack of flexibility

It’s indisputable.

At the root of index investment products and mutual funds is precisely the discipline of alignment with market developments, which determines and has as a consequence the lack of flexibility.

But as we have seen flexibility is not always good, because it exposes us to biased behaviours and attitudes that can be more harmful to us than beneficial.

No human element

Once again, the very definition and nature of indexing eliminates human behaviour and intervention.

But as we have seen before, will this discipline keep track regardless of market noise, will it be good or bad?

Limited gains

It is true that we “only” have the market gains. But isn’t that more than enough?

Earning between 8% and 10% per year in nominal terms, which has been the rate of returns of main indices of the stock markets in the medium and long term not good enough?

Earning 6% a year in real terms is not enough to be satisfied? As we saw in another article, Dalbar’s studies on the rates of return achieved by the individual investor are much lower than those of the market, whether in stocks or in bonds.

In short, the index investment products and mutual funds on the main indices have, in addition to the wide diversification, two other major advantages:

- More than 80% perform better in terms of rates of return than active investment managed products or funds in stock markets, and 65% in bond markets;

- On average, they are cheaper than active products or funds and we know that costs have a very important impact on the final outcome in terms of growth of the accumulated capital, especially for long periods.

Its disadvantages stem from its nature of market tracking and are interconnected: exposure to strong oscillations, rigidity for adjustment and lack of human intervention in management.

In our opinion, these elements, presented by their critics, are more advantages than disadvantages, because they eliminate the main risk of the investor: himself, limiting impulsive behaviours and attitudes that penalize him.

In addition, and as we will see in another article, the investment strategy we recommend alongside making investments in index and passive management products is the periodic (annual) rebalancing of investment portfolios to maintain alignment with the risk profile of the investor.

This periodic rebalancing, or adjustment of the weights of the asset subclasses in the portfolios, allows the introduction of an automatic buffer or stabilizer that mitigates the effects of a major crisis or devaluation of a subclass in the portfolios, as a whole, in the medium and long term and allows us to buy low/cheap and sell high/expensive.

https://www.morningstar.com/lp/active-passive-barometer

https://www.morningstar.com/articles/1055229/how-low-can-fund-fees-go

https://www.amazon.com/Little-Book-Common-Sense-Investing/dp/0470102101

Low-cost main markets index funds proved they are one of the best investments for the average investor as most active managers professionals can´t beat them.

Economists and even all-time great investors agree, like Paul Samuelson, Eugene Fama, Benjamin Graham, and Warren Buffett.

https://www.onedayinjuly.com/who-supports-indexing