To understand cryptocurrencies begins by knowing a little of the history and role of money

How do cryptocurrencies appear and develop? From Bitcoin to our days

To understand cryptocurrencies begins by knowing a little of the history and role of money

In the history of the evolution of money, there has been an unceasing search for alternative coins to the currencies used as a generally accepted means of payment, namely that they comply with the required properties and can serve their various functions more efficiently.

It is not possible to understand what a cryptocurrency is without knowing and understanding what its core or its object is – money – and especially what has been the evolution of money.

So, we will make a synthetic description of what money is, and what has been its evolution since its inception. Synthetic, because the central objective in this article is different, and also because we will present a more developed version in another article in which we will address money as an investment.

It is considered that money is any good generally accepted for exchange or for the final payment of goods and services, and for the payment of debts, including taxes.

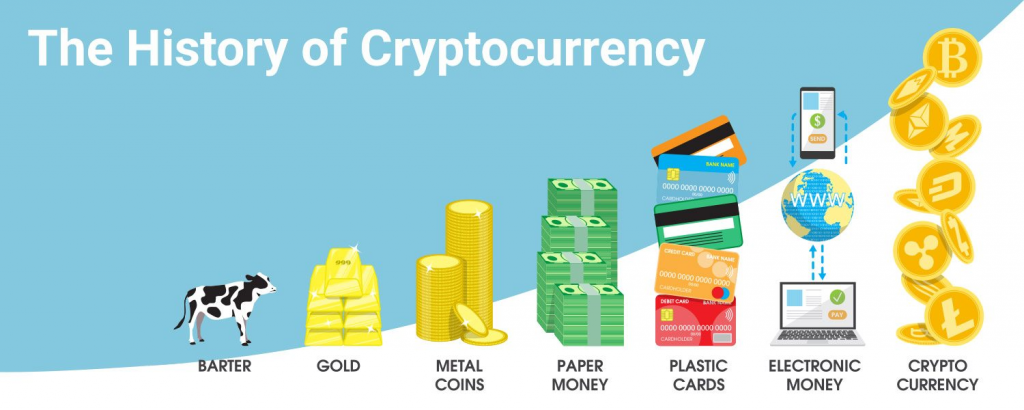

Since its inception, money has taken on countless forms. At first, shells, wheels, beads and even cows.

At the beginning of civilization, trade or payment of goods and services was made by direct exchange or payment in kind, in which one good was exchanged for another, such as a cow, a shelter, or a hunting spear or bow.

After more functional solutions have been tested to facilitate transactions over hundreds of years, such as the most frequently used and easiest to transport goods, including salt and shells in the Byzantine Empire (1,700 BC), precious metals such as gold, silver and bronze were eventually chosen as the means of payment.

From the precious metals came the concept of minted coins in the Roman Empire (600 BC) and the Dynasty … in China, where the stamp was the seal of quality assurance of the material used. We then evolved from coins into paper currency (1700), easier to transport and handle, and hence to plastic cards and electronic transactions (1950).

These days, coins and banknotes are a rare form of money. The total sum of the money in the world is about US$60 trillion, but the total of coins and banknotes is less than US$6 trillion. So more than 90% of all the money – more than $50 trillion that appears on our accounts – only exists on computer servers.

Money has thus gone through various forms or representations to this day.

In the beginning, the first forms of the money were the commodity money, money that had value because it was made of a substance that had value. Examples of commodity money are gold and silver coins. Gold coins were valuable because they could be used in exchange for other goods or services, but also because gold is valued in itself and had other uses.

The commodity money gave way to the representative money. The representative money is a certificate or symbol that can be exchanged for the underlying commodity. Instead of taking the gold commodity money with us, the gold was stored in a bank vault and we walked around with a paper certificate that represents and is supported by the gold that is in the safe. It was understood that the certificate could be refunded at any time for gold. Moreover, the certificate was easier and safer to carry than real gold. Over time, people grew to rely on both paper certificates and gold.

Finally, the representative money has led to the use of fiat money – used in today’s modern economies. Fiat money is money that has no intrinsic value and does not represent an asset in a vault somewhere. Its value comes to be declared to have “legal course”, an acceptable form of payment by the government of the issuing country. In this case, we accept the value of the money because the government tells us it has value and because other people value it enough to accept it as payment.

The history of the money is confused with that of the discovery and affirmation of its functions and its properties.

The four major functions of the money that have been present since its origin are medium of exchange or payment, unit of account, store of value and standard deferred payments.

- Money as a medium of exchange or payment. This means that money is widely accepted as a payment method.

- Money as a unit of account. We can think of money as a measure or device that we use to measure value in economic transactions.

- Money as a value reserve. We can keep money before we spend it because it will keep its value until tomorrow, next week, or even until next year, without deteriorating. Although money is an efficient value reserve, it is not perfect, as inflation slowly erodes the purchasing power of money over time.

- Money as a standard for deferred payments. A standard for deferred payment is considered one of the accepted methods of debt settlements.

Similarly, from its origins to the present times there has been an important evolution of money until we reach its 5 basic or necessary properties, which are the following: fungibility, durability, portability, recognizable and stability.

Fungibility. Refers to the ownership of money to have individual units that must be interchangeable with each other, and the units must be distinguishable from each other. If individual units of the same money came in different quantities, this means that this money would not be consistent when used in future transactions (counterpoint example: diamond)

Durability. Money must be durable enough to withstand repeated use and maintain its usefulness for use in future transactions. Money must remain functional without requiring frequent maintenance or repair over its useful life.

Portability. Money should be divisible in small quantities so that users can transport different quantities of the money with ease and minimal costs.

Recognizable. Money must be easily identifiable for users to agree on its authenticity and quantity. This facilitates transactions because both parties to the transaction agree to the terms of exchange without incurring additional payment costs to verify the authenticity of the goods by all parties in return.

Stability. The value attributed to the money against other assets with which it trades must be relatively stable. The value of the money should be consistent or gradually increase over time. Money whose value fluctuates is often inadequate, as it will create disparities in value when used as a measure of value and means of exchange.

It is in this context that cryptocurrencies have emerged.

But what are cryptocurrencies anyway?

According to Jan Lansky, a cryptocurrency is a system that meets six conditions:

- The system does not require a central authority; its state is maintained through a distributed consensus.

- The system keeps an overview of cryptocurrency units and their ownership.

- The system defines whether new cryptocurrency units can be created. If new cryptocurrency units can be created, the system defines the circumstances of their origin and how to determine ownership of these new units.

- Ownership of cryptocurrency units can be proven exclusively cryptographically.

- The system allows transactions to be carried out where ownership of cryptographic drives is changed. A transaction declaration can only be issued by an entity that proves the current ownership of these units.

- If two different statements are entered simultaneously to change ownership of the same cryptographic drives, the system performs a maximum of one of them.

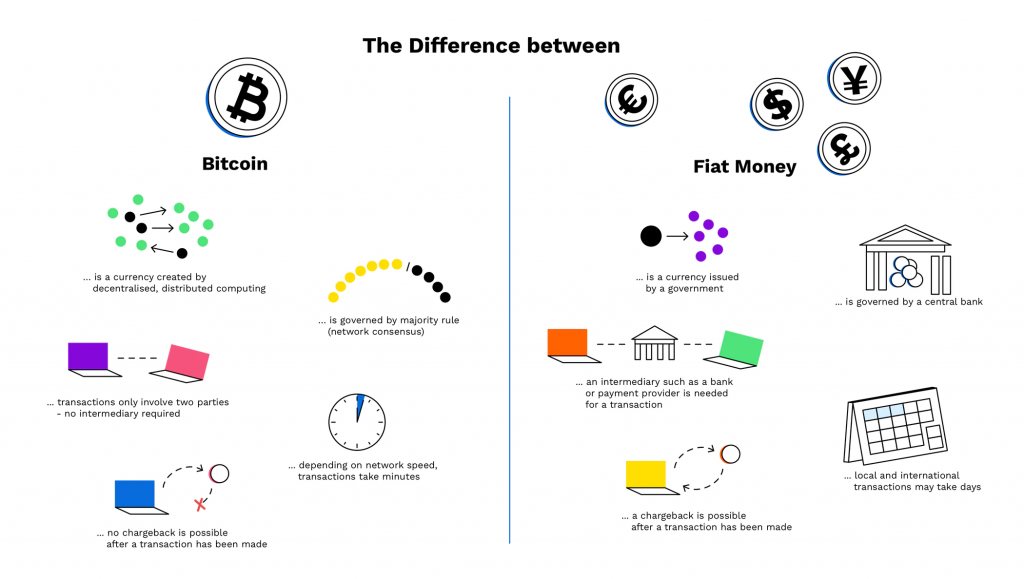

Thus, differences between fiat currency and cryptocurrencies are as follows:

Fiat currency is created by the government and cryptocurrency by a distributed and decentralized system of computers. Fiat money is managed by central banks while cryptocurrency is managed by a consensual network. Fiat money is traded through the financial system and the cryptocurrency is traded only between the two entities directly. Fiat money transactions can take 2 days and those of the cryptocurrency minutes. Once done, a fiat money transaction can be cancelled, but not that of cryptocurrencies.

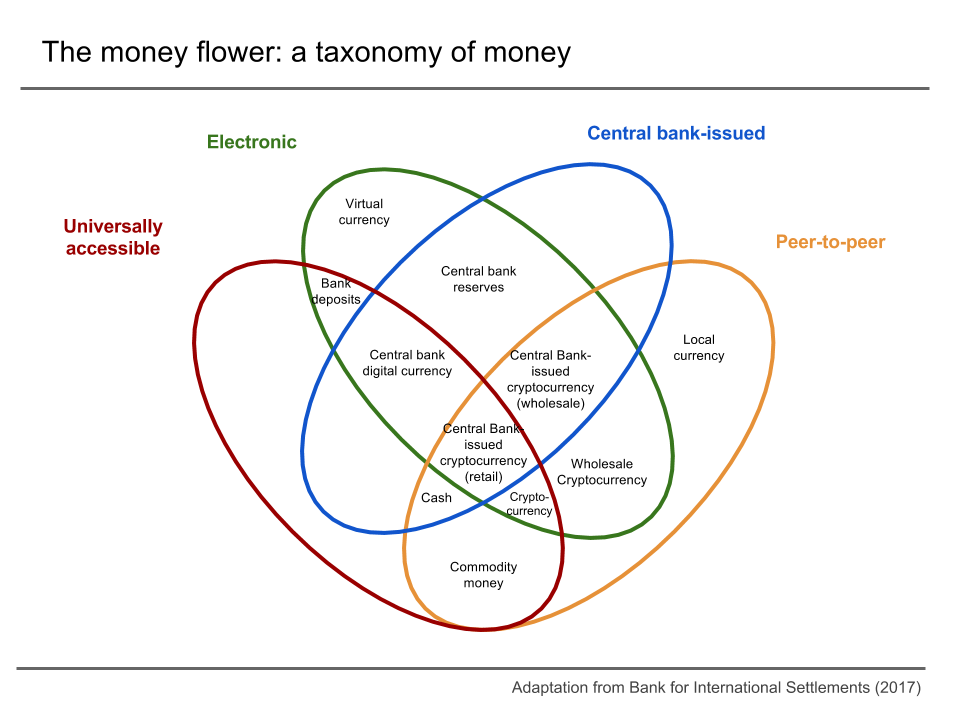

In these terms, money, in a broad sense, takes several forms that are organized according to the modes of transaction:

There is universally accepted money, money issued by central banks, electronic money and peer-to-peer money. Only cash or central bank digital retail money (or central bank cryptocurrencies) take on all these characteristics. Cryptocurrencies assume three, not filling only the issuance by a central bank.

How do cryptocurrencies appear and develop? From Bitcoin to our days

Although in the 80s there were already initiatives for the development of crypto currencies, these developed soon after the Great Financial Crisis, supported by the general responsibility and discrediting of the institutions resulting from the speculative responsibility of commercial banks in the subprime crisis, and also the subsequent rescue action of the banks and the intense activity monetary issuance by the central banks.

In 1983, American cryptographer David Chaum devised an anonymous cryptographic electronic currency. Later, in 1995, he implemented it through Digicash, an early form of cryptographic electronic payments that required user software to withdraw from a bank and designate specific encrypted keys before being sent to a recipient. This allowed the digital currency to be undetectable by the government-issuing bank or any third party.

In 1996, the National Security Agency published an article titled “How to Make a Mint: the Cryptography of Anonymous Electronic Cash”, describing a cryptocurrency system, first publishing it on an MIT mailing list and later in 1997 in the American Law Review.

In 1998, Wei Dai published a description of “b-money”, characterized as an anonymous and distributed ATM system.

Shortly after, Nick Szabo described the gold bit. Like bitcoin and other cryptocurrencies that would follow it, the gold bit (not to be confused with the subsequent gold-based exchange, BitGold) was described as an electronic money system that required users to complete a proof of working function with solutions being cryptographically assembled and published.

Bitcoin, first launched as open-source software in 2009, is the first decentralized cryptocurrency created by the programmer with opposition member Satoshi Nakamoto, still unknown.

Since the launch of Bitcoin, more than 6,000 altcoins (alternative variants of bitcoin, or other cryptocurrencies) have been created.

From 2008 to today, events were many and varied, especially with advances, but also some setbacks, and followed at a breakneck speed, with the following chronology.

2008 – The Mysterious Mr. Nakamoto

2009 – Bitcoin begins

The first decentralized cryptocurrency, bitcoin, was created in 2009 by presumably pseudonymous programmer Satoshi Nakamoto. He used sha-256, a cryptographic fingerprint function, in his proof-of-work scheme.

2010 – Bitcoin is valued for the first time

The first registered goods purchase was made with Bitcoin when Laszlo Hanyecz bought two pizzas for 10,000 BTC. This day is still celebrated to date as bitcoin Pizza Day.

After the birth of Bitcoin as the first cryptocurrency, solutions had to be found to exchange them. In March 2010, the first cryptocurrency exchange appeared in the name of bitcoinmarket.com (now extinct). In July of that year, Mt. Gox was also launched.

2011 – Bitcoin’s rival cryptocurrencies emerge

In April 2011, Namecoin was created as an attempt to form a decentralized DNS, which would make Internet censorship very difficult.

Shortly thereafter, in October 2011, Litecoin was launched. He used the deed as a fingerprint function instead of SHA-256. Another notable cryptocurrency, Peercoin used a hybrid with proof of work or concept.

Bitcoin managed to achieve parity with the US Dollar in February 2013. During this year, some rival cryptocurrencies have emerged. In May 2013, the cryptocurrency market had 10 digital assets, including Litecoin. Another large crypto asset joined in August under the name XRP (Ripple).

2013 – Bitcoin price drop

As the value of Bitcoin grew, the first hacks followed. In June 2011, Mt. Gox was first hacked and 2,000 BTC was stolen, worth about $30,000 at the time.

Mt.Gox became the largest cryptocurrency exchange in 2013, having reached 70% of all Bitcoin transactions at its peak movement.

2014 – Fraud and theft

In 2014, Mt.Gox became the first major cryptocurrency stock market hack, having been stolen from 850,000 BTC. This is the largest BTC theft in Bitcoin history, which was valued at $460 million at the time (the current date is worth about $9.5 billion).

After this unprecedented situation, bitcoin’s price fell 50% and only recovered to its initial value at the end of 2016. Cryptocurrency exchange hacks have always remained present ever since, though rarely of mt.gox’s caliber.

On 6 August 2014, the UK announced that its Treasury had commissioned a study on cryptocurrencies, and what role, if any, they can play in the UK economy. The study was also to inform about whether the regulation of cryptocurrencies should be considered.

2016 – Ethereum and ICOs

On July 30, 2015, the Ethereum network was launched. Currently the second crypto asset in terms of market capitalization, it has brought smart contracts to the world of cryptocurrencies. These allow the Ethereum blockchain to spin an entire ecosystem on its blockchain, while hosting its own native currency: Ether (ETH).

The arrival of Ethereum also marked the emergence of Initial Coin Offerings (ICO), fundraising platforms to offer investors the ability to trade shares of private companies or listed shares almost immediately after the public offering. This is despite warnings against ICOs in the US, by the SEC, the capital markets regulatory authority. The SEC has warned investors that due to lack of oversight, ICOs may well be fraudulent or Ponzi schemes. This did not stop people from embarking on an ICO madness. Unsurprisingly, the Chinese government banned them.

2016 was the year cryptocurrencies became increasingly mainstream. The number of Bitcoin ATMs reached about 900 that year. In the top news for the cryptocurrency world, Uber switched to bitcoin payments in Argentina to overcome a legal issue in the country – demonstrating the power of the framework and the confidence that people in technology have placed in it.

2017 and 2018 – Bitcoin’s boom and crash

The long-awaited “bitcoin money split” finally took place in 2017, dividing Bitcoin into two cryptocurrencies: BTC and Bitcoin Cash.

Japan has passed a law approving Bitcoin as a legally accepted payment method. Norwegian bank Skandiabanken integrated bitcoin accounts and recognized Bitcoin as an “investment asset” as well as a payment system.

With developments like these, 2017 was the busiest year for cryptocurrencies. The price of Bitcoin and most altcoins continued to rise, pulled by growing interest from individual investors. In June, it was worth $3,000. At the end of December, the price of Bitcoin peaked and a maximum ever, of $19,783 per Bitcoin.

More and more people and businesses flocked to the trend and chased it as the price continued to rise.

But this would not go on for long. 2018 was a difficult year, with big bitcoin price devaluations that made lows around $6,000.

Despite the dramatic drop in prices, cryptocurrencies and Bitcoin continue to pave the way for the future of financial transactions.

In 2018, Samsung confirmed that it was making computer chips for the sole purpose of extracting coins.

Many European governments have begun to cooperate with a regulation of cryptocurrency, and more are launching partnerships with cryptocurrency-based companies and organizations.

2019 to date: The institutionalization and bonanza of Bitcoin and other cryptocurrencies

Suddenly, some cryptocurrencies began to gain traction in early 2019.

Some positive news about the cryptocurrency market returned to the public interest, only this time the interest was based on more than speculation, as it was supported by a lot of institutional money.

The media began labelling the first quarter of 2019 as the “Cryptocurrency Spring”. People had predicted that an institutional uptake would boost the space of cryptocurrencies.

It all started with the adhesion of giant companies like eBay, PayPal, Visa and Square. Then came financial investors, especially hedge fund managers, such as Paul Tudor Jones. Mastercard and some banks such as Bank NY Mellon, Goldman and Citigroup then announced that they would develop business processes for cryptocurrencies. Finally, in early 2021 Tesla announced a major investment in Bitcoins and the possibility of accepting payment for its cars in that currency.

These institutional forays were accompanied by a rampant rush of many individual investors for fear of missing an opportunity, causing a bonanza in prices.

By this time, Bitcoin has already surpassed the $50,000 mark.

The future of cryptocurrencies will be covered in following articles, but for now there is a quote from Steve Jobs that seems appropriate: You cannot connect the dots looking forward; you can only turn them on by looking back. So, you have to trust that the dots will somehow connect…

https://coinmarketcap.com/charts/

https://www.amazon.com/Bitcoin-Standard-Decentralized-Alternative-Central/dp/1119473861