We don’t go far with deposits or savings accounts

The cases: Germany, United States, Japan, United Kingdom, the Eurozone and the G7 countries

We don’t go far with deposits or savings accounts

What income do we earn from deposits and other savings investments? We earn an interest rate, usually fixed and short-term.

We always think that the value of that interest rate is too low. This feeling has increased in recent years because lately interest rates have been very low for a long period.

But in order to make rational decisions we need to know or try to measure its value.

Contrary to financial investments, whether in stock or bond markets, information on deposits and other savings accounts is very scarce. The reason is simple: these placements are contracted directly with one of our banks, and there is still no systematic and consistent information that aggregates the data from all these numerous transactions.

However, although dispersed, we can find some information on this topic.

Germany

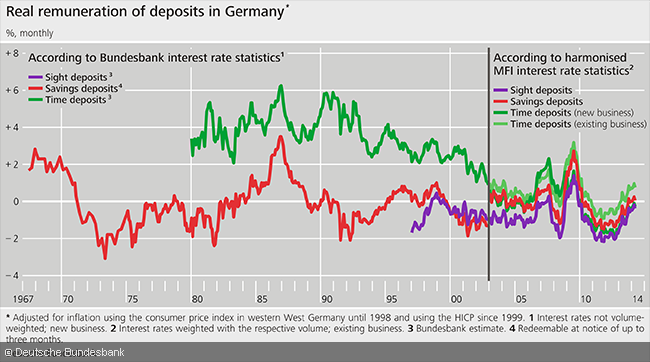

The German central bank published a study with the evolution of real interest rates (deducted from inflation) of deposits and other savings accounts in Germany between 1967 and 2015:

Interest rates on savings deposits (red) ranged from +2% to -2% per year, with their negative average or below 0% per year. Only the actual interest rates on time deposits were positive in the period between 1980 and 2003 of the order of 4% per year to 1995 and 2% from that year; since 2003 and with the exception of some spot peaks, these interest rates are on average zero or negative. Interest rates on sight deposits have almost always been negative since data are available, from 1997 to 2017.

United States

There is not such a series of long data on deposit and savings rates for the US.

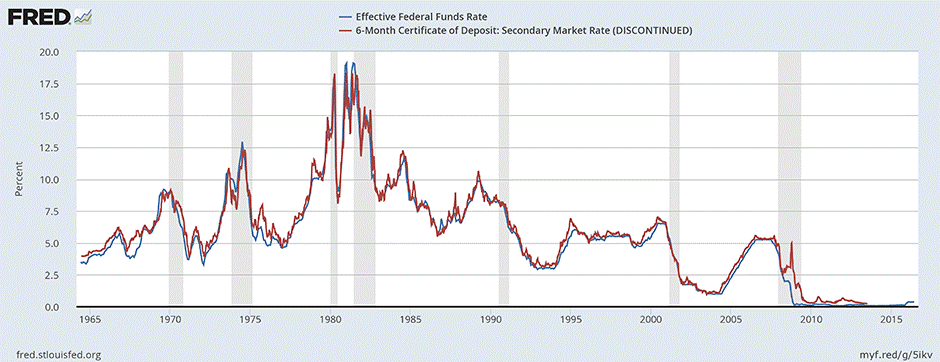

The following graph shows the evolution of Certificates of Deposit and the effective Fed funds rates in nominal terms and inflation rates between 1965 to were date (CD’s data was discontinued in mid-2013):

As we can see the Certificates of Deposit rates are almost identical to the central bank’s base interest rates. After all, these rates are those practiced for transactions between the various banks and the central bank, serving as such a reference for interest rates practiced in interbank transactions. In general, as banks finance themselves either with their customers or with other banks, these rates end up becoming the reference or basic rates practiced by the various banks.

The CD rates ranged mostly between 3% and 10% per year until 2009, with an average close to 5%. As the average inflation rate was about 3%, the average real interest rate will have been around 2%. Since then, CD interest rates are almost 0%.

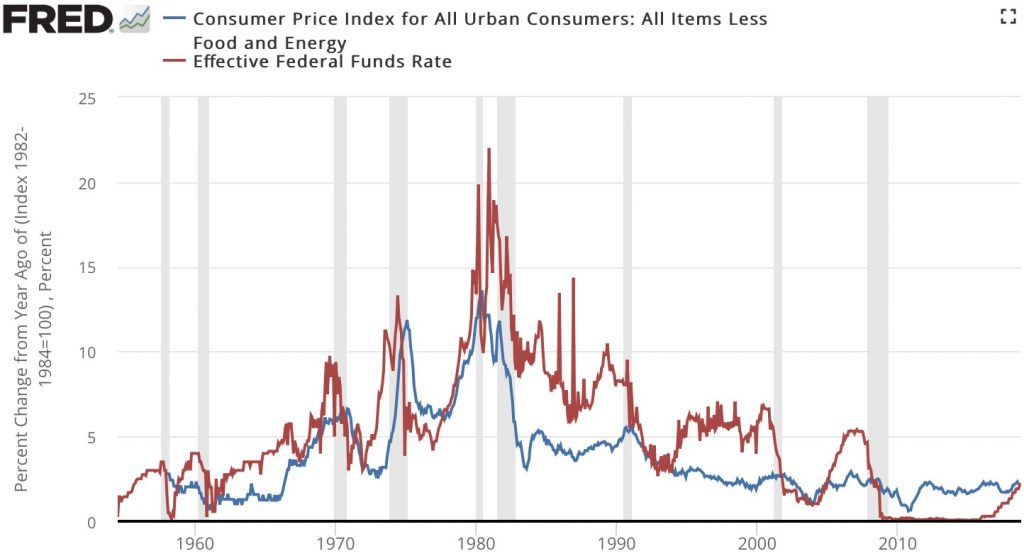

The following graphs show the more recent evolution of Fed funds rates:

From 2009 to 2016 the Fed funds interest rate was set at 0% starting to rise gradually since then to the current approximately 2.5%, below inflation rates.

Japan

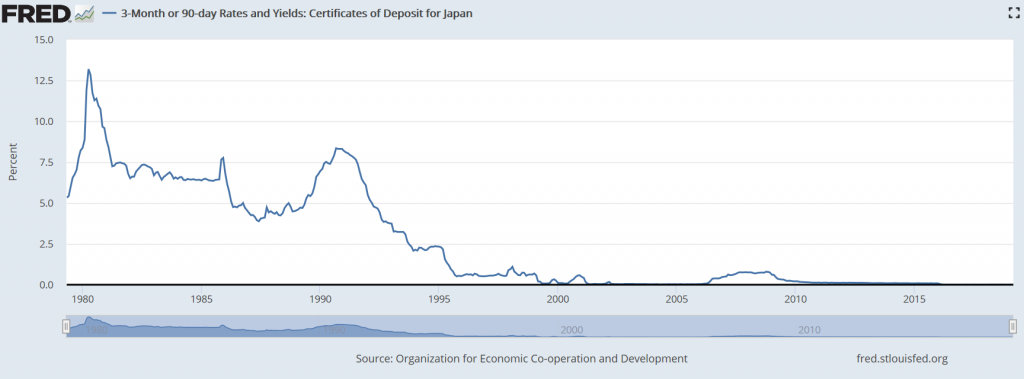

The following graph shows the evolution of nominal interest rates practiced in deposit certificates in Japan from 1980 to date

From 1995 to date Japan has lived a period of rates of 0% per year after a period of positive rates in the first fifteen years. The latter is Japan’s so-called “stagflation”, characterized by lack of economic growth and deflation, and associated with the strong demographic ageing, which the other developed countries of the old economies have been registering in the coming years.

United Kingdom

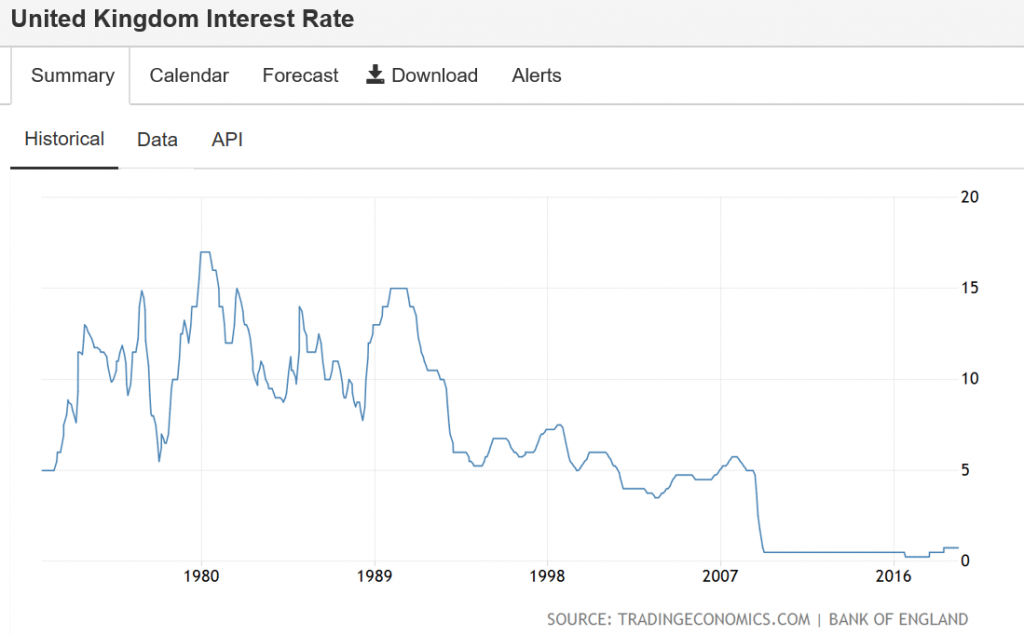

The following graph shows the situation of central bank interest rates in the UK since 1970:

In an initial period nominal interest rates were between 10% and 15% per year following high inflation, then falling to the level of 5% by 2009 and from then on have been close to 0%.

Eurozone

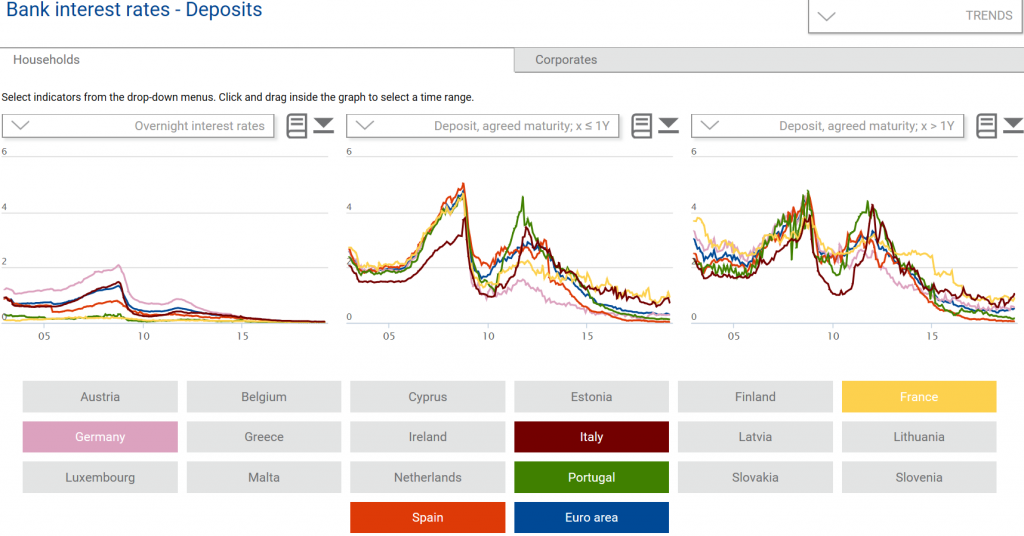

In Euro area countries we only have information on interest rates applied to deposits on time from 2000:

Between 2000 and 2010 nominal interest rates on term deposits were between 4% and 2% and from 2010 onwards they fall to close to 0% per year since 2015.

The G7 countries

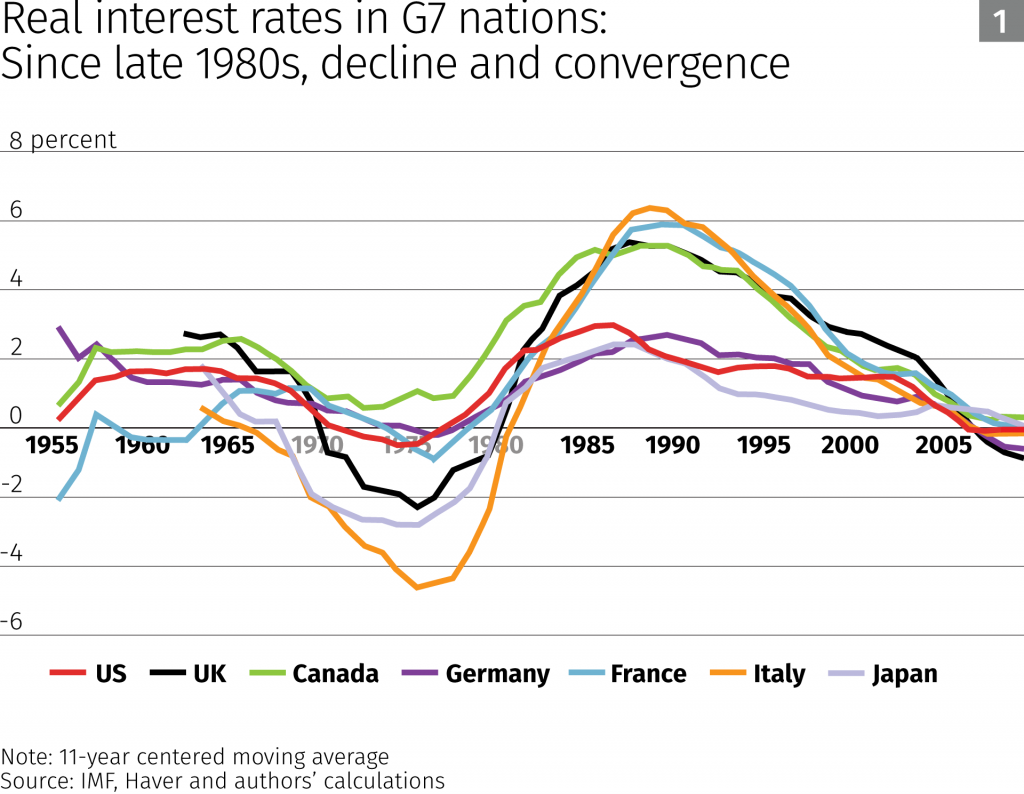

The following graph illustrates well the decline in real interest rates recorded in recent years in The G7 countries:

Source: Real Interest Rates over the Long Run, September 2016, Federal Reserve Bank of Minneapolis

In short:

- The actual interest rates on deposits and savings accounts (deducted from inflation) are marginally positive, not reaching 1% per year, except in abnormally high inflation periods as occurred between 1970 and 2000;

- In recent years, in most developed countries, interest rates for these accounts have been close to 0% for some years, with the recent exception being the US where this rate is close to the historical average of 2% per year, verified in normalised periods of inflation of about 2% to 3% per year;

- The interest rates of these placements will tend to be low due to moderate economic growth and demographic ageing, as is the case in Japan for about three decades.