This is the third article dedicated to the Retirement series, the main financial objective.

In the initial article we presented the program of the series and developed the base scenario and the alternative scenario that we will use throughout it.

In the second article, we saw how much money we will need to live during our retirement, that is, how much we must accumulate capital in our personal retirement plan to have a pension associated with investments.

In this article we will analyze the effort we will have to make to reach those desired values, and the importance of asset allocation in capital accumulation for retirement.

In this first part we will analyze the effect on the capital accumulated for retirement.

In the second, we will see the allocations preferred by experts and investors.

Let’s assume that the investor selects index funds, indexed or ETF, under the main market indices, which allows us to use the past average returns as expected, considering the large investment horizon of retirement.

This series on reform follows on from other much earlier articles already published on this topic.

We felt it was important to develop a structured series on this topic, as it is the main objective of most people’s financial and investment plan.

In these scattered articles we have addressed the importance of retirement as a financial goal, the number of years we need to live in retirement, and the money we need to have a smooth retirement.

We have seen the degree of dependence on the public pensions of the current pensioners, the replacement rates of these pensions (ratio between the last salary and the first pension), the years of duration of these same pensions relating them to longevity, to conclude that we cannot live only on public pensions.

Therefore, we analyzed the need for retirement planning and the situation of how pensioners currently live.

In the Tools folder, we find very useful retirement calculators, including the retirementcapital needs and disposable income assessment at Vanguard, as well as those from Bankrate, Marketwatch, and Flexible Planner.

The importance of asset allocation in the accumulation of retirement capital

In a previous article, we saw that asset allocation – the combination of stocks and bonds – determines the performance of the investment portfolio by more than 90%.

In another article, we also saw that the allocation chosen by each investor should be the one that considers the term of the financial objective, as well as their financial situation and risk tolerance.

This is because the longer the investment term, the lower the risk of the impact of short-term stock market fluctuations, clearly more volatile, but at the same time providing higher returns in the medium and long term.

The following charts show the higher returns, but also the higher risk (volatility or loss), of stocks compared to bonds.

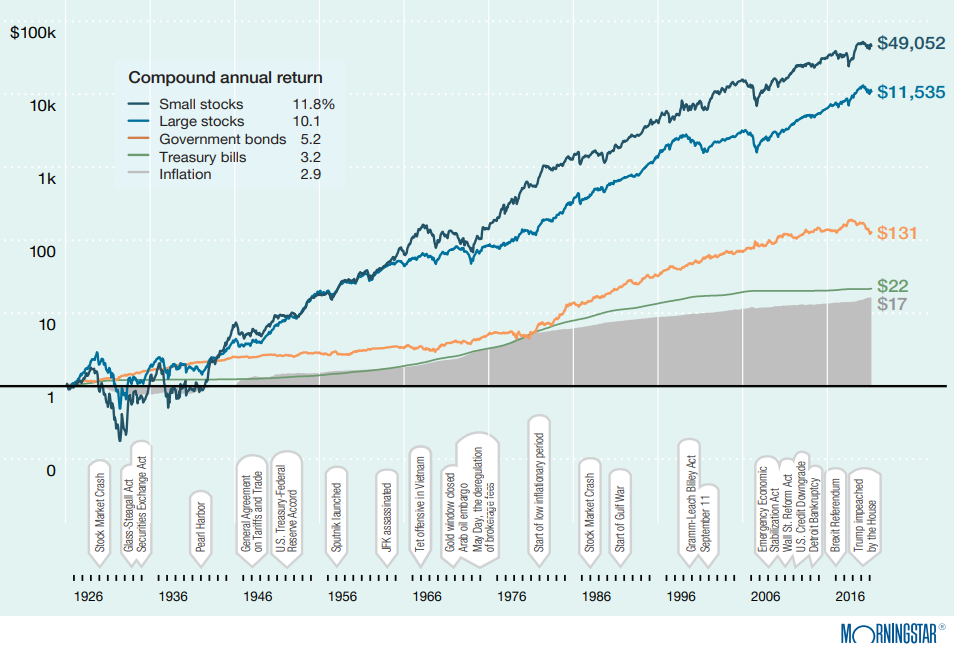

The first chart shows the annual rates of return on investments in small companies, large companies, 10-year government bonds and 6-month treasury bills in the U.S. between 1926 and 2022 (as measured by the respective market indices):

Investment in small company stocks is what provides the highest annual rates of return, at 11.8 percent, followed by investment in large company stocks, at 10.1 percent. Then come the 5.1% of returns on 10-year government bonds and 3.2% of 6-month treasury bills.

In this chart it is also worth noting the strong impact of compounding, well visible in this very long-term information, in which apparently small differences in returns result in large differences in capital accumulation.

The most obvious case – even by the order of magnitude of the values – is the comparison between the returns of stocks of small and large companies.

Less than 2 percentage points of annual difference (or 20%) results in accumulated capital after 97 years of $49k and $11.5k, i.e. 4 times more, for a starting investment of $1.

But the difference in investment in treasury securities is also very significant, for much lower values.

The 3 percentage points of annual difference (equivalent to 2.5 times) results in capital of $131 and $22, a difference of more than 6 times, for the same $1 invested at the beginning.

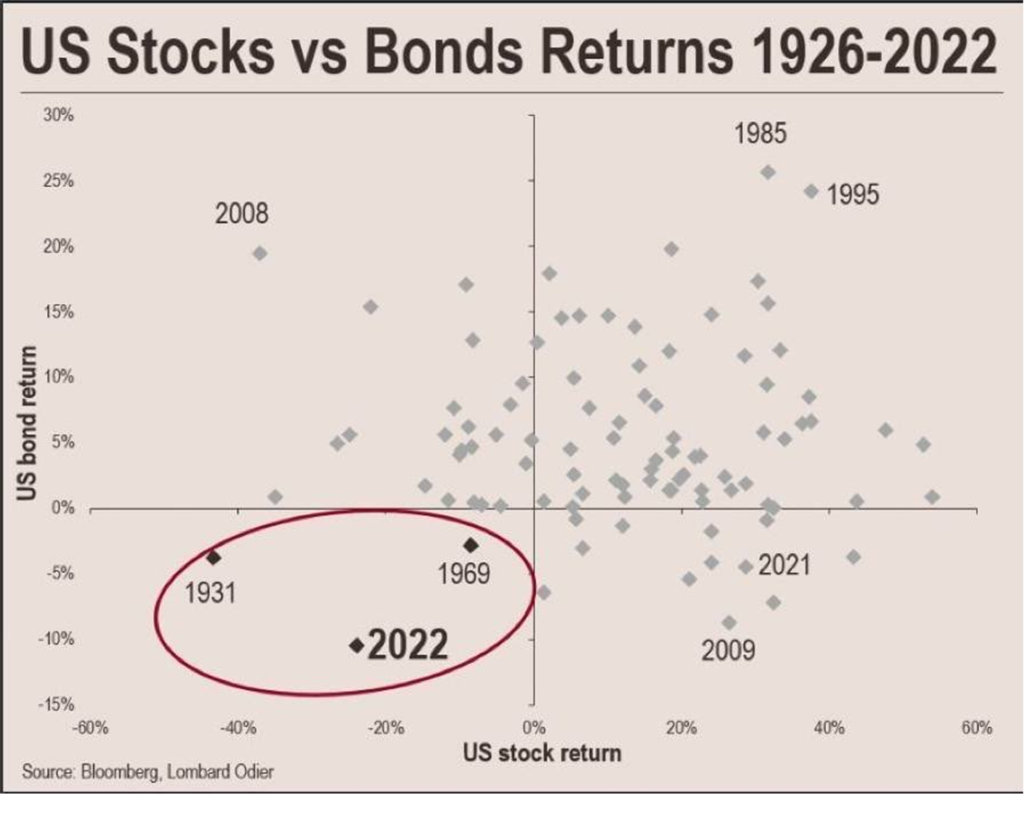

The second chart shows the distribution of annual returns on U.S. stocks and bonds (given by the S&P 500 index and 10-year government bonds between 1926 and 2022):

This presentation allows us to observe the dispersion of returns.

In most years, there were positive returns on stocks and bonds (upper right quadrant).

There have been a few years when stock and bond returns have diverged in opposite directions (upper left and lower right quadrant).

Finally, there were only negative returns on stocks and bonds in 3 years (lower left quadrant).

It’s also easy to notice that stock returns are much more volatile than bond returns.

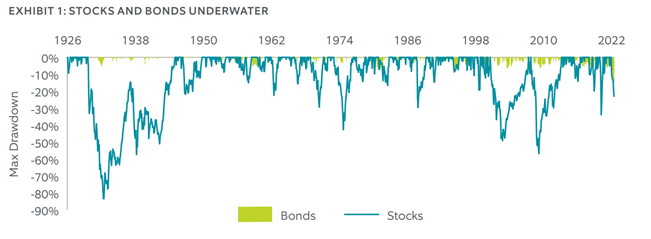

The third chart shows the largest negative fluctuations (or “drawdown”) of investments in U.S. stocks and bonds, using the same references as the previous one:

It’s easy to see that stocks are subject to much steeper declines or falls than bonds

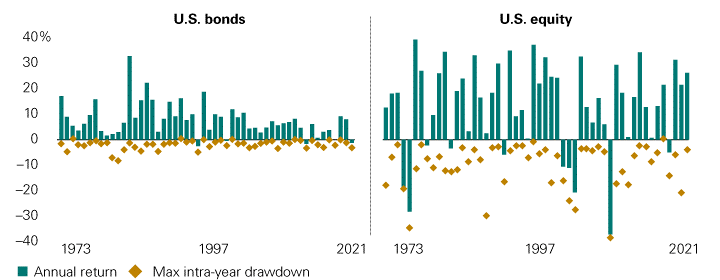

The fourth and final chart shows the distribution of returns and the largest annual declines of these two assets (again, using, respectively, the S&P 500 index and 10-year government bonds) in the U.S. between 1973 and 2021:

In this shorter period of 50 years, it is once again evident the higher returns of stocks, and also their greater risk, measured by the sharpest falls.

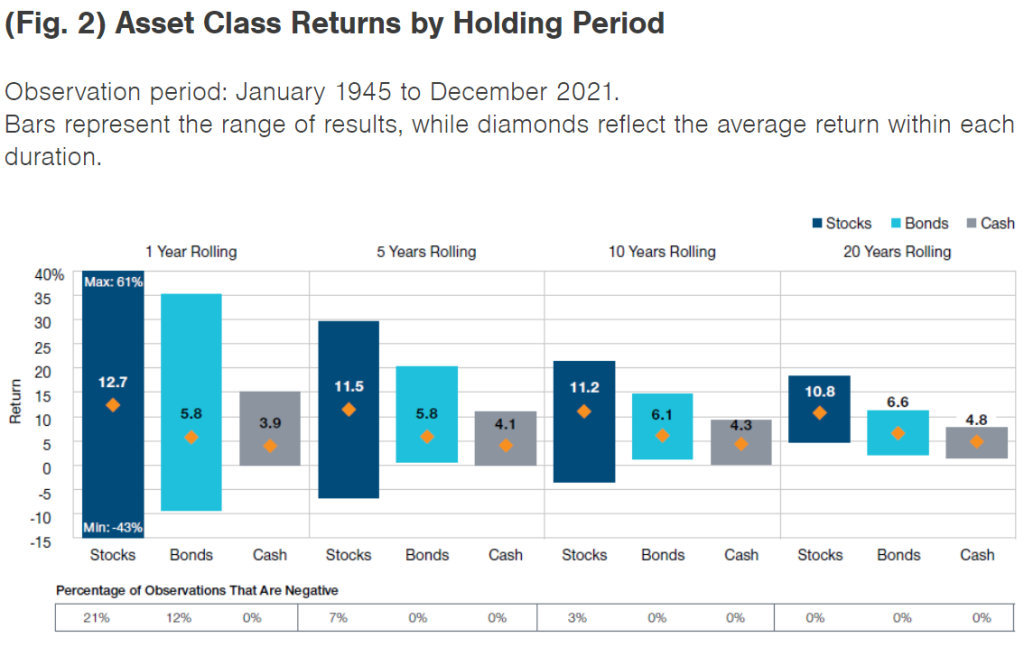

The following chart is useful to illustrate the advantages of stock investments in the medium and long term.

This chart positions the distribution of investment returns on stocks, bonds, and cash over investment periods of 1, 5, 10, and 20 years, for the U.S. between 1945 and 2021 (using the same references as before, and the 6-month treasury bills as a cash proxy):

It is clear that over 10 years, stocks are the most interesting financial asset, providing more attractive returns with moderate risk.

However, the investment period for retirement is one of the longest among the various financial objectives of investors.

Generally speaking, we start working around the age of 20 and reach retirement at the age of 65. That is, from the perspective of those who start working now, the total term for retirement is 45 years.

Only the general financial objective of valuing the heritage in order to pass it on to future generations, by inheritance, has a longer term.

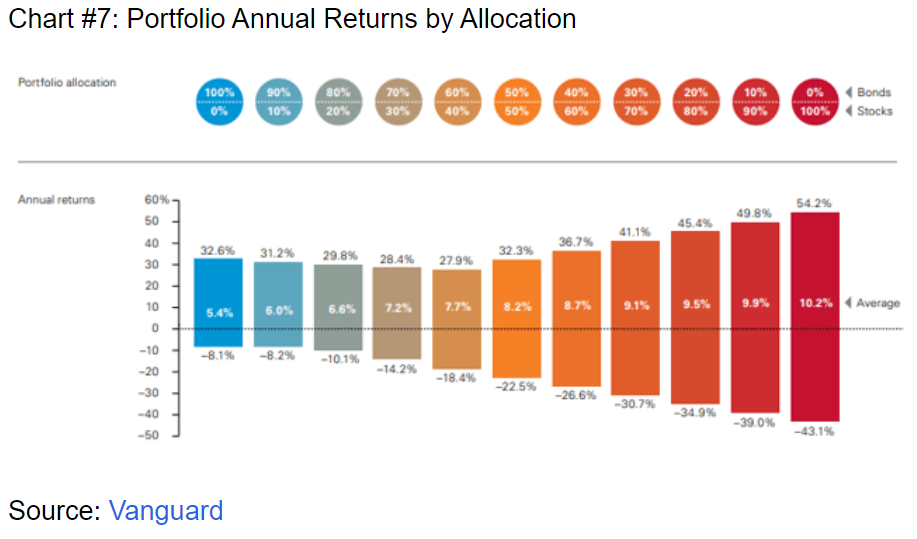

This very long term allows us to assume an asset allocation with higher expected returns and higher financial risk:

In addition to the time horizon, we must also consider the risk profile of the investor, because the investor has to know how to live with the expected fluctuations of the market.

Over the long term of investment for retirement, there will be ups and downs, and it is very important that the investor stays the course.

There are investors who in periods of greater volatility stop investing and give up, harming the accumulation of capital for retirement.

The risk profile of the investor is also influenced by his situation or financial capacity, in that the higher the investor’s effort rate, the more averse he will be to loss.

In this article we will calculate the impact of asset allocation, both on the capital accumulated for retirement and on the annual pensions associated with this capital.

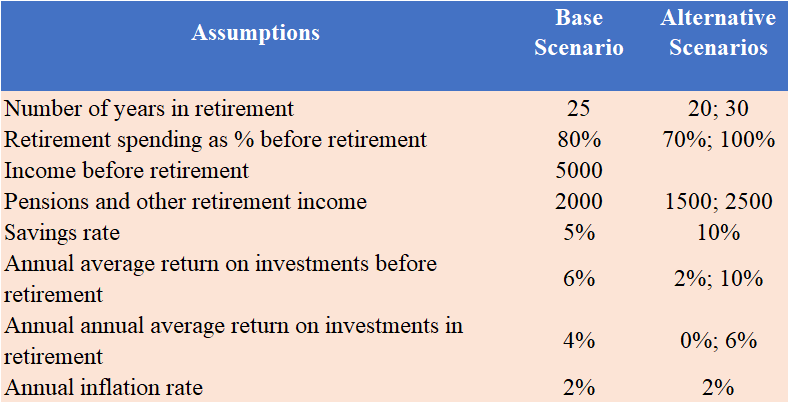

Reminder: Assumptions

As we did in the previous article, we begin by recalling the main assumptions we established in the initial article of the series.

In the following table we summarize the assumptions used:

We will use average annual returns of 0% to 12% per annum over the working life, which as we have seen are a reasonable assumption given the long-term historical returns on stocks and bonds in major developed countries.

And we assume that the inflation rate is 2% per year.

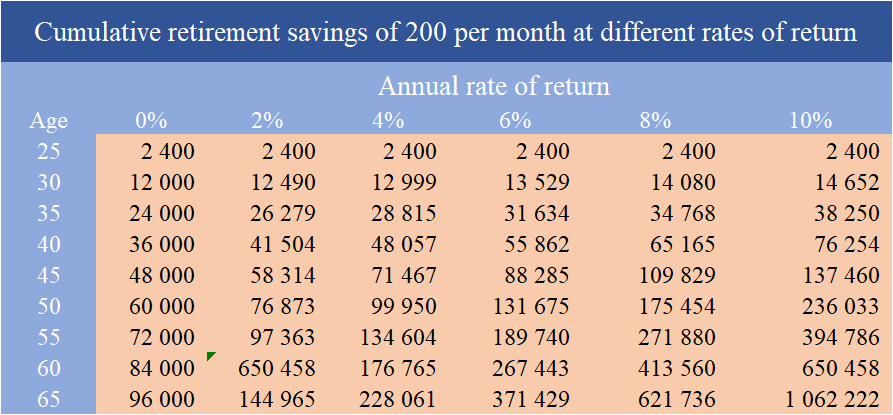

Capital accumulated with investment of 200 per month for 40 years for rates of return of 0% to 10%

To analyze the effect of asset allocation we need to establish the investment period, the value of the capital invested and the rates of return on the assets.

In this article we will consider an investment period up to 40 years, for many the normal working term for retirement.

We will also consider the investment of a constant capital value of 200 euros per month over that period.

200 euros per month corresponds to a savings rate of 10% or 5% for monthly salaries of 2,000 and 4,000 respectively.

In the U.S., there are studies that point to an objective level of higher savings rate, between 10% and 15%.

If we want to know what would result with different values of capitals just apply the respective multiples.

The values of the capital accumulated in retirement for the different nominal rates of return are as follows:

If we needed to save 300 per month instead of 200, just multiply those values by the factor of 1.5x.

We are aware that this situation is an approximation and that reality results in many cases from the financial life cycle.

Very few families save the same amount and on a steady basis.

Usually, they don’t start investing anytime soon.

It is also frequent that there is not a regular and constant investment, but rather times when greater contributions and smaller ones are made.

Generally, the values of invested capital are lower in the first years and grow over the period of accumulation, increasing with the growth of income.

People can set and allocate a percentage of their income as savings for retirement investments.

That table allows us to extract the information for a wide variety of other situations.

If we want to know what capital we would accumulate if we started saving for retirement later, we just have to adjust the timing of the investment.

For example, if we start at the age of 30, the applicable capitals are those on the 55-year line, 10 years before the end of the term.

For an annual rate of return of 6%, if we start saving at age 20 we accumulate $371,000, but if we start 10 years later, we only accumulate $189,000.

In other articles we will cover many of these situations.

We’ll look at the differences between starting early or late, in more detail.

And we will also present the results of savings as a percentage of income.

In the second part of this article we will see which asset allocations are recommended by experts, as well as those chosen by most individual investors in their retirement plans.