The Series program

The set of assumptions of the Base Scenario and Alternative Scenarios

How can we apply the results to our personal case?

This is the first article in a series on the most important financial objective of all, retirement.

Here we will make an introduction and summary development of the various aspects that this topic involves.

The key idea is that in order to know how to plan and live in retirement well, we must look at it backwards, from the end to the beginning, contrary to what is customary to do in the other matters of our lives.

By this what we mean is that we must start from the capital that we must accumulate for retirement in the future to know what we have to do now to get there.

We know that our capital accumulated in retirement depends on our longevity, the income secured such as pensions, estimated expenditures, periodic and/or one-off savings and contributions made at the level of the supplementary and personal retirement plan, and the returns on the investments of these savings before and after retirement.

To this end we will adopt a structured approach that will allow us to know:

#1 How much money we need to live through retirement

Let us start by knowing how much money we will need to live through our retirement, that is, what expenses will have to be covered by income.

#2 What is the allocation of assets we have selected for the investment of the capital of the personal retirement plan.

We must understand the “trade-offs” we take in terms of deciding the allocation of assets of our investments throughout the retirement savings cycle which depend on the investment term and the investor profile.

#3 How much we should save in our active life to achieve income or supplementary retirement capital

We should know how to assess the periodic contributions required (annually) to generate a given set of capital amounts and/or income complementary to our guaranteed income, such as pensions and others (e.g. royalties), which should be the basis of our personal retirement savings plan.

#4 What is the value of capital invested on time in data moments (or deadlines) of our working life

We will know how to evaluate the capital and/or accumulated income for the retirement resulting from a given set of one-off capital values invested at various times that may be combined with the periodic contribution plan mentioned above.

We must understand what capital we should have accumulated in data moments throughout our working life depending on the income and expenses provided.

#6 What is the value of saving early for retirement

We will assess the differences in the savings effort to achieve the same capital values in retirement between different moments of start of savings

#7 What are the main risks of retirement capital, the options we have and how we should manage them

We should understand the trade-offs and specific risks we run in the years near retirement, by the critical importance of the sequence of returns at times when the accumulated capital for retirement will be close to the maximum values.

#8 How should we use capital during the retirement period

We must know how and how much we can mobilize the accumulated capital over the retirement period, depending on the observed capital appreciation (dynamic management).

The set of assumptions of the Base Scenario and Alternative Scenarios

We want these articles to be of the greatest use. To do that, they have to be as concrete as possible.

However, since we cannot cover all individual cases we will have to assume assumptions of values for the main variables.

These assumptions will be chosen as the mean or reference values, so that they can be suitable for most people.

In addition, we will establish value assumptions for a base scenario and for alternative scenarios.

In other words, we will analyze sensitivity to the variables that have the greatest impact on accumulated capital, in order to have simulations that predict the most likely cases.

These assumptions include, among others, the number of years, the value of contributions and the returns on investments made for retirement, as well as the number of years, the value of expenditures and the returns on investments in retirement.

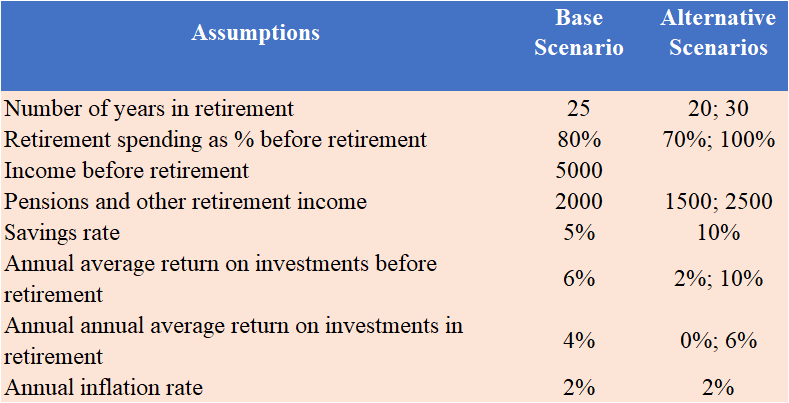

The assumptions used in the different scenarios are as follows:

In each article we will also present other data and even references to other studies that allow us to move between the values of the assumptions used.

#1 Longevity and retirement age

Of all the main variables used, that of longevity and the number of years towards and during retirement, are probably the most common or the least divergent to all people.

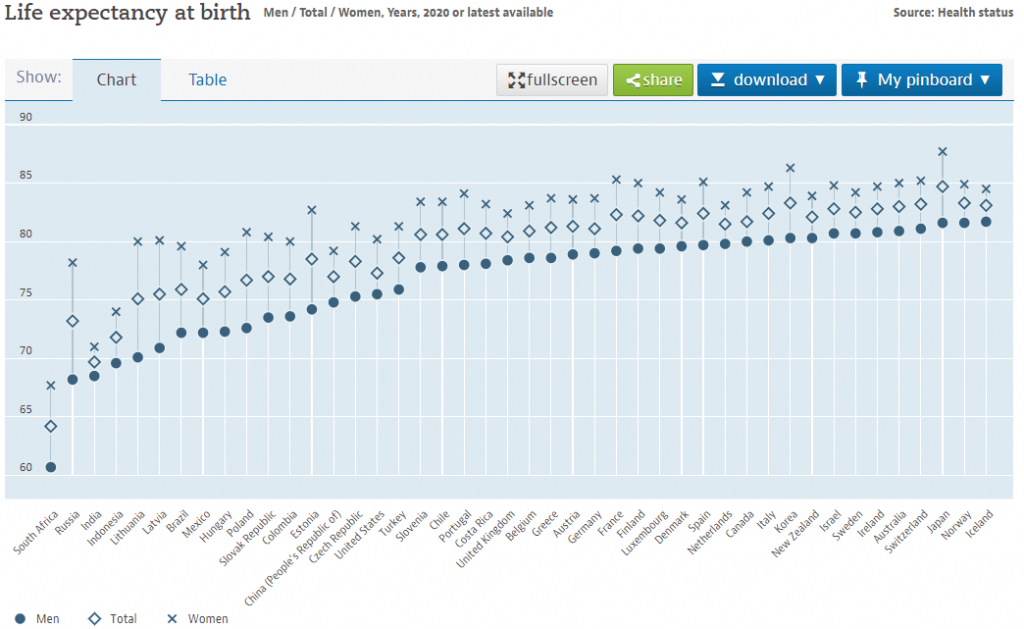

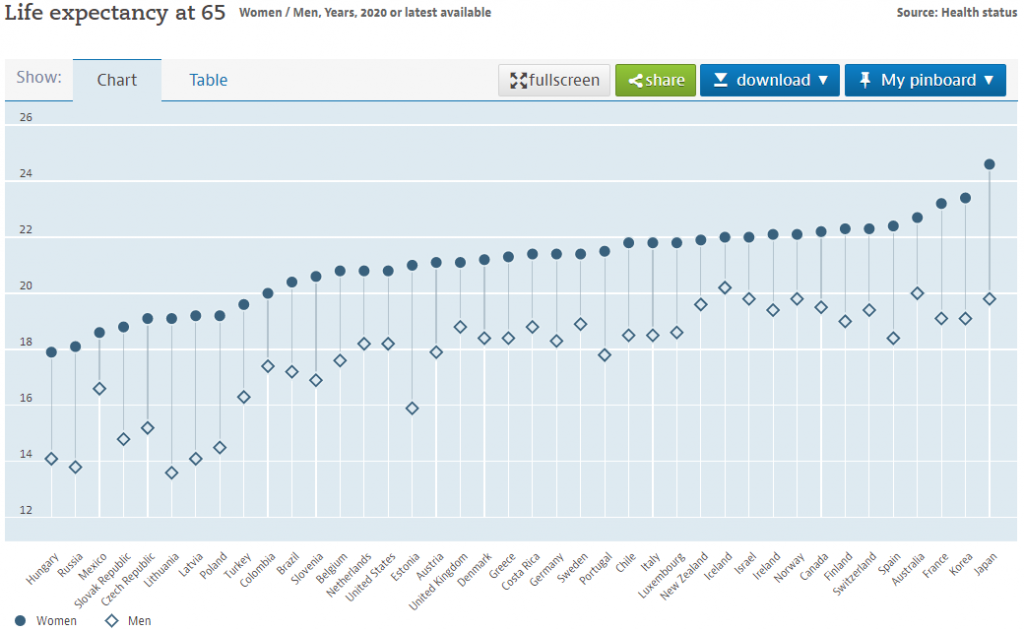

The latest OECD data for longevity at birth and at age 65 are:

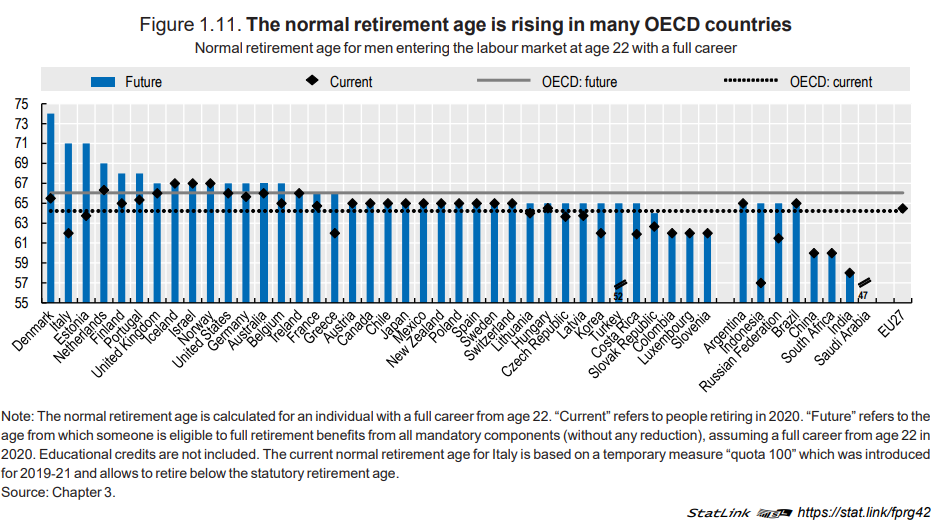

The official retirement age in the various OECD countries is as follows:

#2 Retirement spending

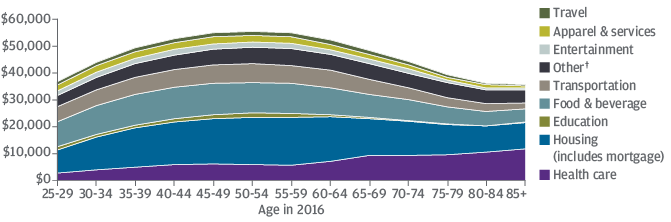

In terms of spending on retirement there are several studies, especially in the USA, which indicate that spending on retirement is 80% of spending before retirement:

#3 Upper-middle class or affluent average wages in developed countries

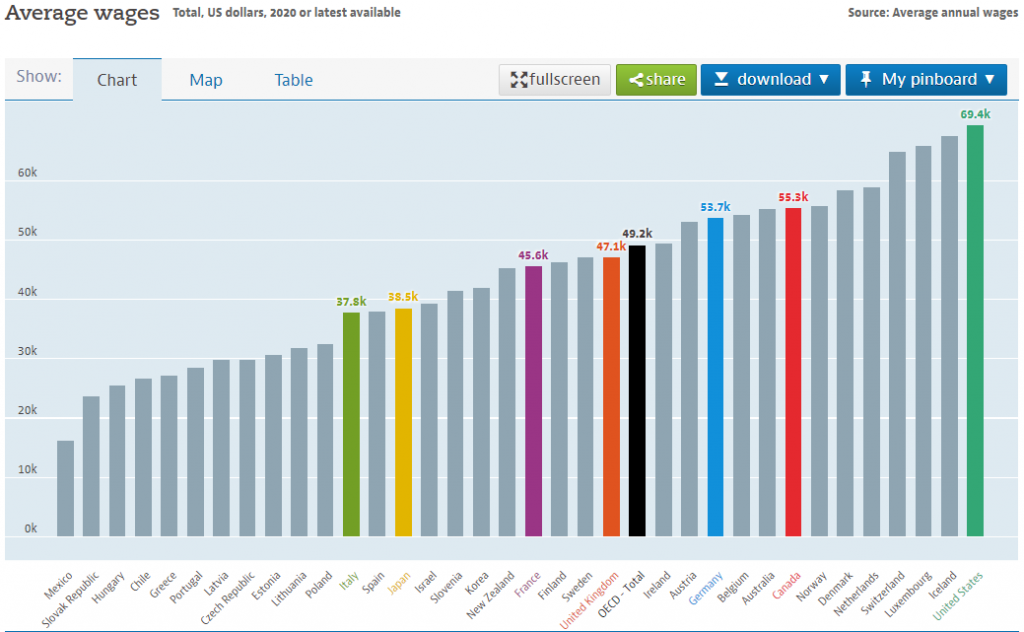

The average salaries in OECD countries are as follows:

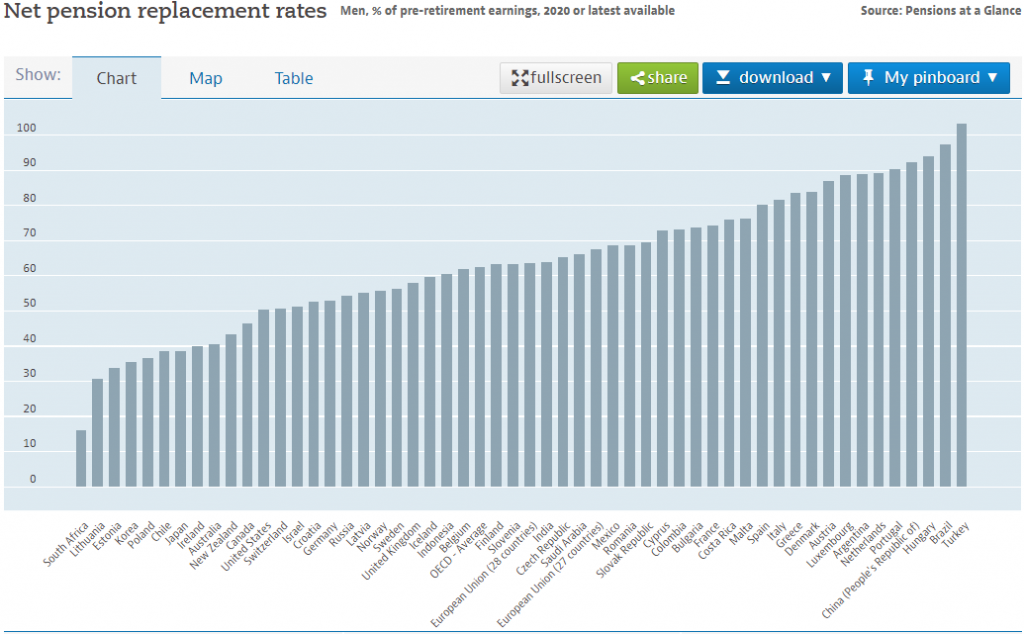

#4 Average pensions in developed countries for the upper middle class (net rate of replacement of pensions)

The net pension replacement rates, i.e. the value of the pension as a percentage of the last tax-adjusted income from work, in OECD countries are as follows:

#5 Investment rates of return before and during retirement

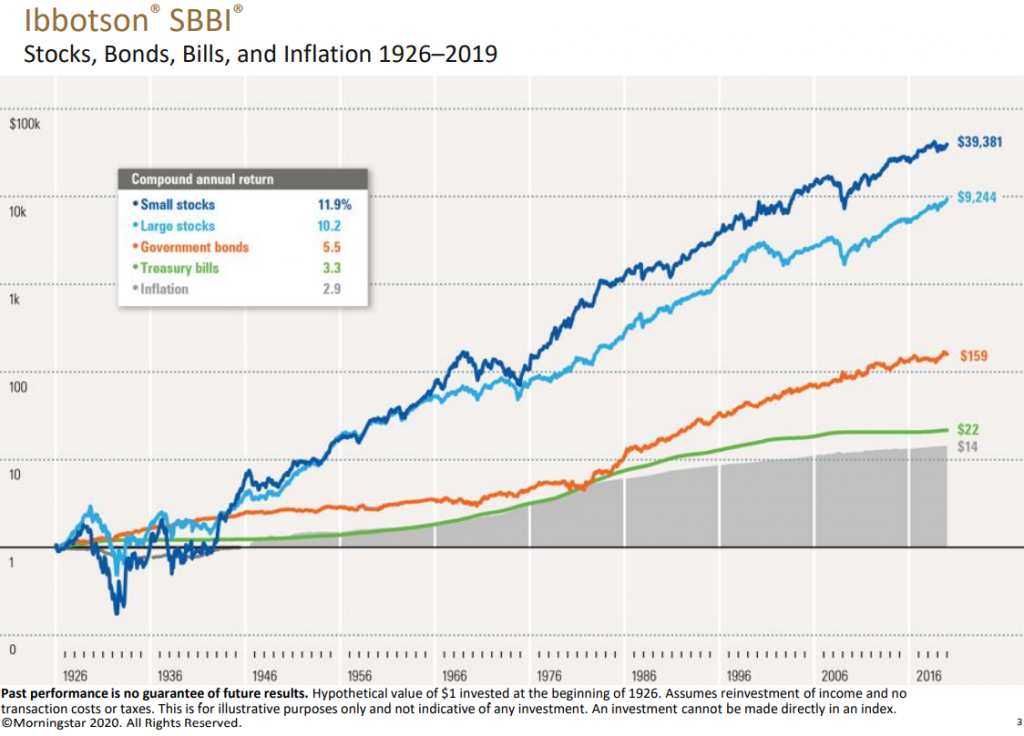

The return on investments considered are directly related to asset allocation, as proven by academia and financial history.

According to Morningstar/Ibbotson associates’ annual publication, the average annual return rates of stocks, treasury bonds and treasury bills (reference remuneration of deposit certificates and proxy for term deposits) in the US between 1926 and 2019 were as follows:

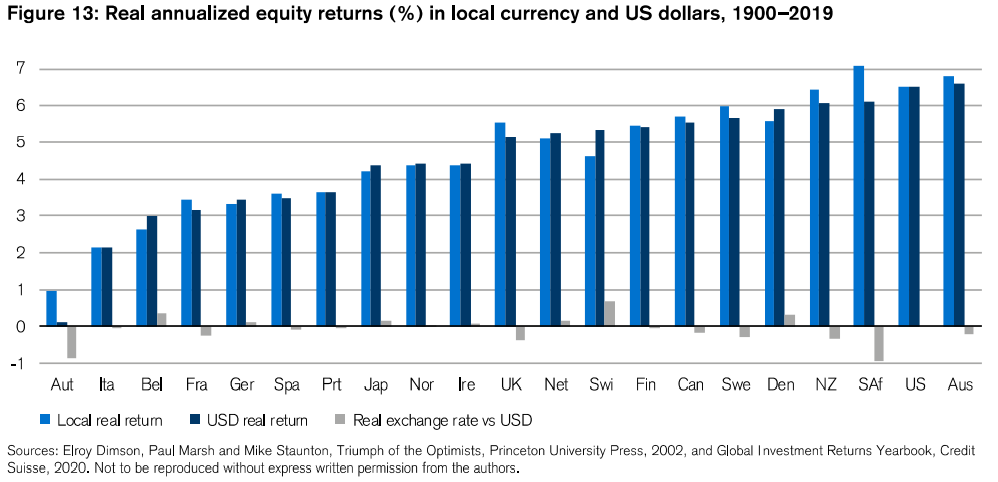

According to Credit Suisse’s annual publication, the average real annual rates of return (deducted from inflation) of equities in developed countries between 1900 and 2019 were as follows:

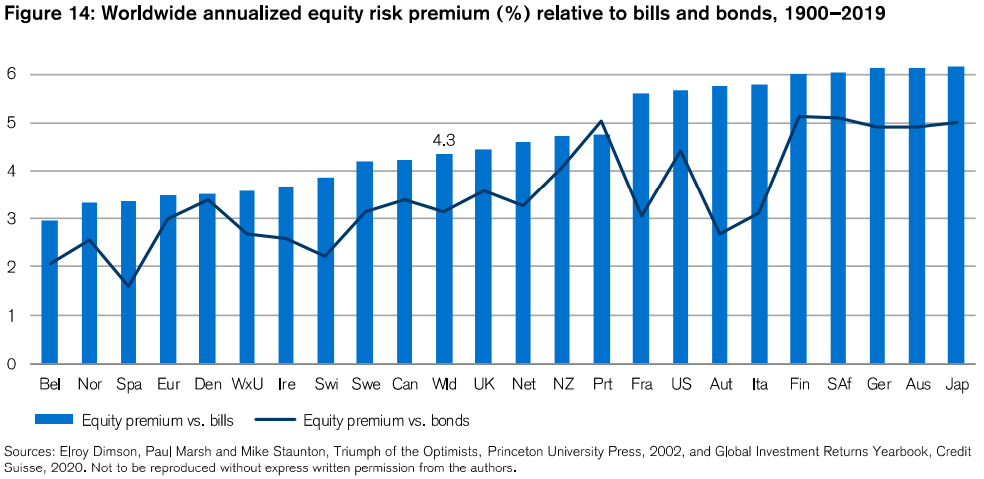

In the same publication, the risk premiums of equities are presented against the bonds and treasury bills, which by the difference allows us to obtain the rates of return of these:

In the case of capital values, savings and income and even pensions, we have taken by reference the average values of the upper-middle class (the so-called affluents) for the developed countries.

How can we apply the results to our personal case?

Guaranteed retirement income, whether from compulsory pensions or other income such as royalties, should not be assumed, but rather an important fact in the analysis of each case.

It makes no sense to assume them in that these incomes vary widely from case to case and each of us knows better than anyone what we will be entitled to.

Compulsory pension systems are very different in the various countries.

However, in many countries, it is possible to know the individual pension provided by consulting the pension systems, which we recommend to be done.

In order to adapt the results and conclusions to our situation, in some variables we can apply the proportionality rule in others not.

For example, we can use proportionality, for the amounts of income, expenses, savings and invested capital. In these cases just use the multiples for the individual concrete case.

However, the same is no longer possible for rates of return or savings rates as the effect of capitalisation impacts results in an non-linear way.