The main financial objectives are an emergencies fund, retirement, children tuition and financial capacity to maintain the standard of living

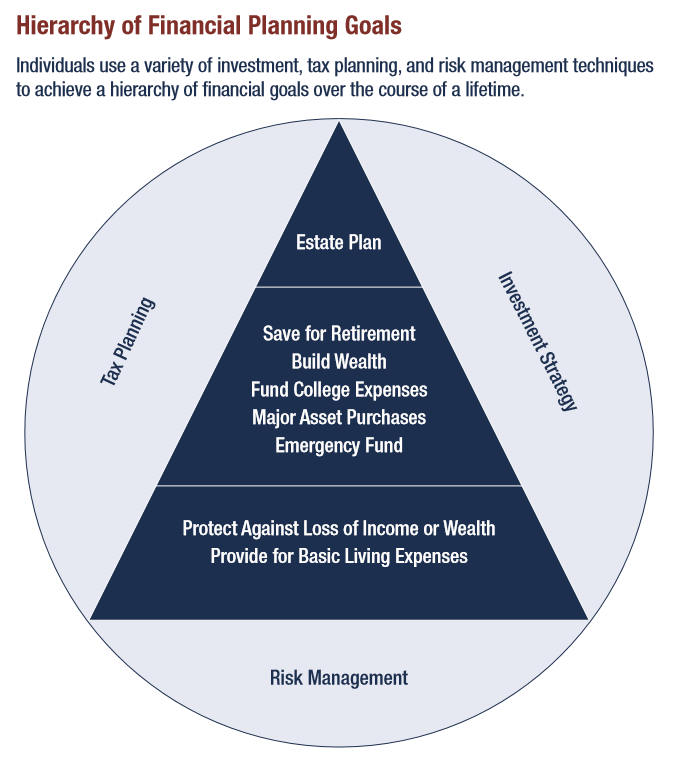

For the management of personal assets each of us has a hierarchy of planned financial objectives that determine investment strategies, risk management (or insurance) and tax planning

Retirement, holidays, emergencies, home and children education are the main people’s goals around the world

Our main objectives should be the direct reflection of our biggest financial concerns: not having money for retirement, for medical acts of illness or accidents, for current health care, to live the day-to-day with the same quality of life or pay for the children education

These objectives are common to all households, of different incomes, ages and situation or social status, although with some obvious nuances

For the management of personal assets each of us has a hierarchy of planned financial objectives that determine investment strategies, risk management (or insurance) and tax planning

Retirement, holidays, emergencies, home and children education are the main people’s goals around the world

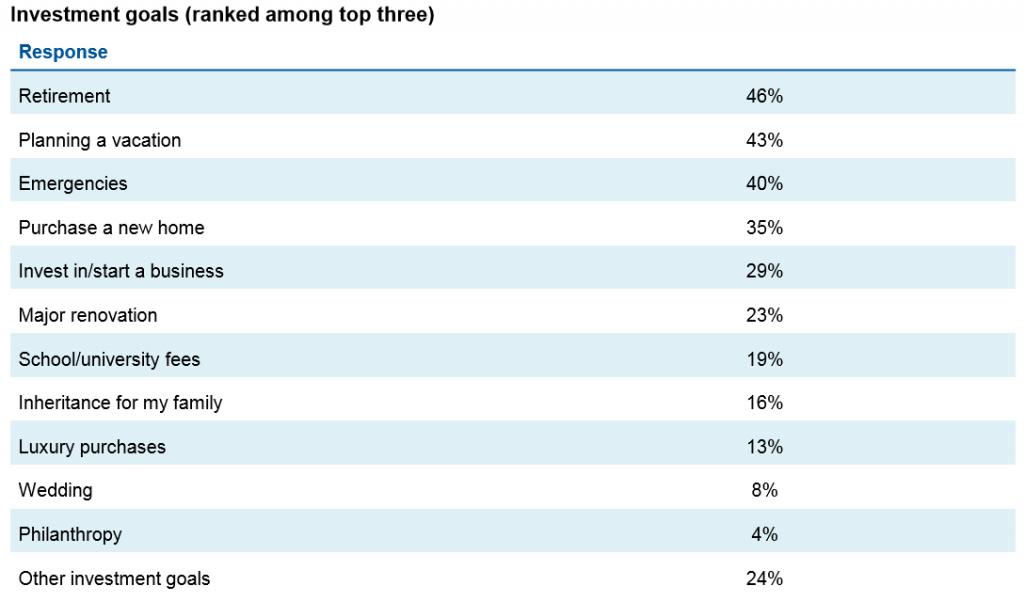

One of the most internationally regarded studies on the behaviour and sentiment of individual investors is the one conducted every five-years by Franklin Templeton, the Global Investor Sentiment Survey.

The latter was held in 2015, covering 11,500 respondents in 23 countries from all regions (Brazil, Chile and Mexico in Latin America; Australia, China, Hong Kong, India, Japan, Malaysia, Korea and Singapore in Asia Pacific; France, Germany, Greece, Poland, Spain Sweden and the United Kingdom in Europe, South Africa and the United Arab Emirates; Canada and the USA) aged between 25 and 65, highlighting the following results for the 3 main investment objectives:

Despite some diversity people choose as main investment objectives, retirement, vacation, emergencies, housing expenses (be it buying or remodelling), developing their own business and educating children.

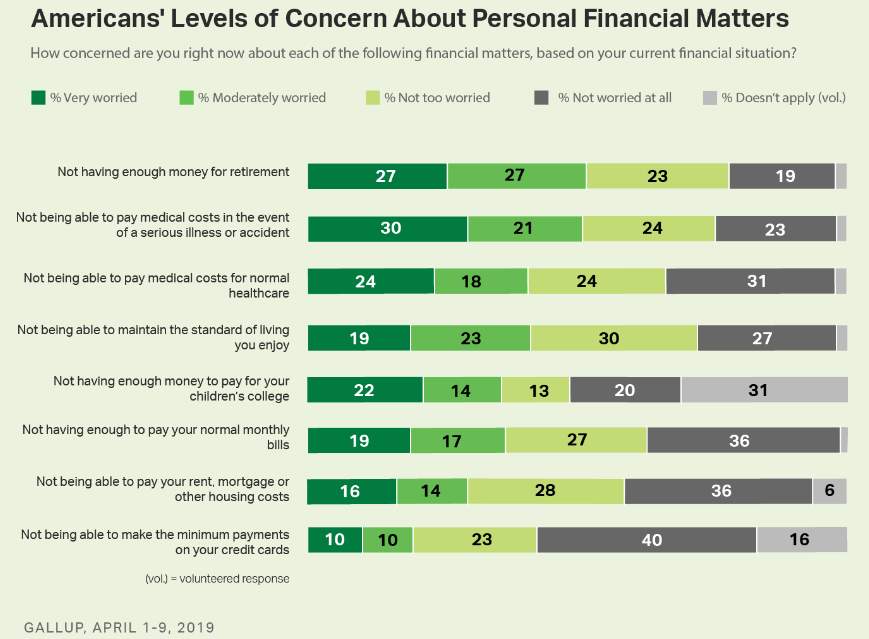

Our main objectives should be the direct reflection of our biggest financial concerns: not having money for retirement, for medical acts of illness or accidents, for current health care, to live the day-to-day with the same quality of life or pay for the children education

Our financial concerns should be the reverse of the coin of our main objectives.

Gallup conducts a study every year in the U.S. on the main financial concerns of families, and this in 2019 concluded in the following:

As you would expect there is a direct correspondence between the above-mentioned objectives and the concerns expressed in this study.

So, and once again, people choose retirement as the most important financial aspects, followed by unexpected or even current health care, the financial capacity to live day-to-day and their children’s education.

Guide to Retirement | J.P. Morgan Asset Management (jpmorgan.com)

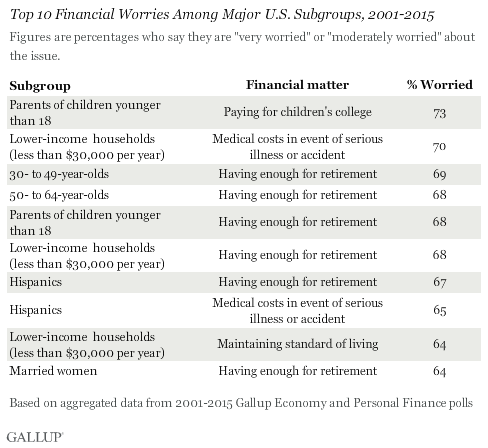

These objectives are common to all households, of different incomes, ages and situation or social status, although with some obvious nuances

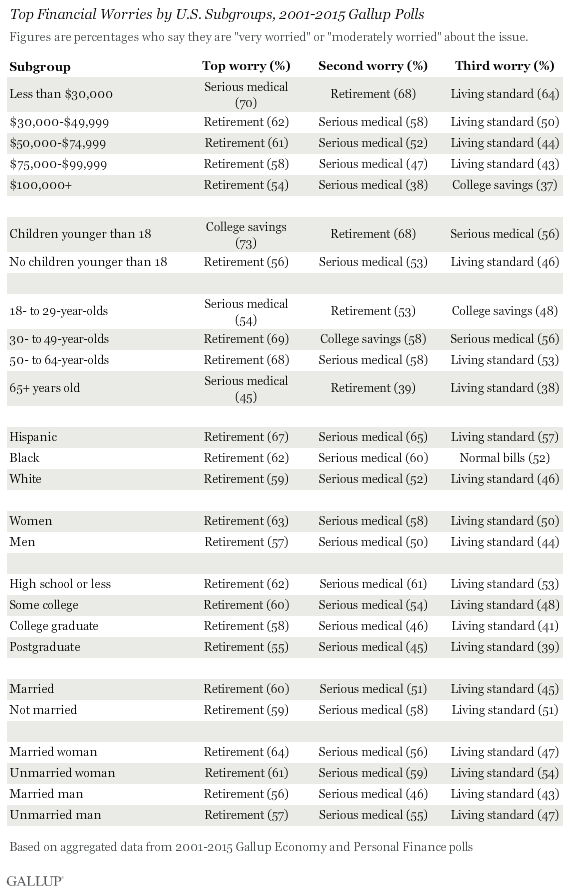

Gallup published in 2016 a study evaluating the priorities attributed to financial objectives over a long period between 2001 and 2015 by social classes:

Retirement is the main concern for all ages, with the exception of child education for couples with underage children, and the financial capacity to live on a day-to-day basis or bear unexpected health expenses for lower-income families.

Retirement, unexpected medical care and the financial capacity to live day-to-day are the main general concerns.

One can presume that concern about health care is less for families in countries where the social state confers protection and provision of these services by the public regime, as is the case in the generality of the most developed European countries.