Governance, comprising corporate governance, ethics and corporate culture, is the dominant concern of sustainable investment in ESG

The importance of good corporate governance, and more generally, also of the ethics and culture of companies, is a matter that is usually only perceived, felt and seen when its missing results in financial losses.

The history of financial markets is fraught with corporate scandals that have stemmed from bad corporate governance and result in billions of dollars of financial losses to shareholders, thousands of jobs and losses for suppliers and other “stakeholders” of companies.

In recent years, regulators around the world have developed several legislative and regulatory initiatives to mitigate this problem. Despite this, given the complexity of the subject, there are new major corporate scandals every year.

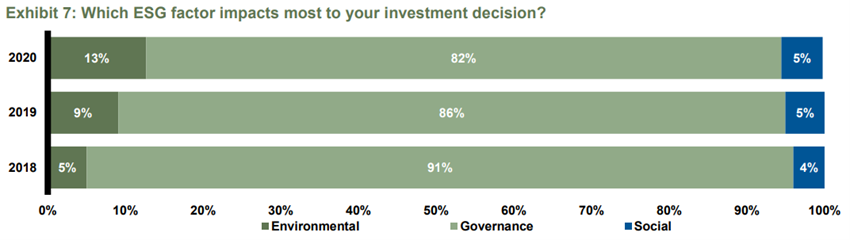

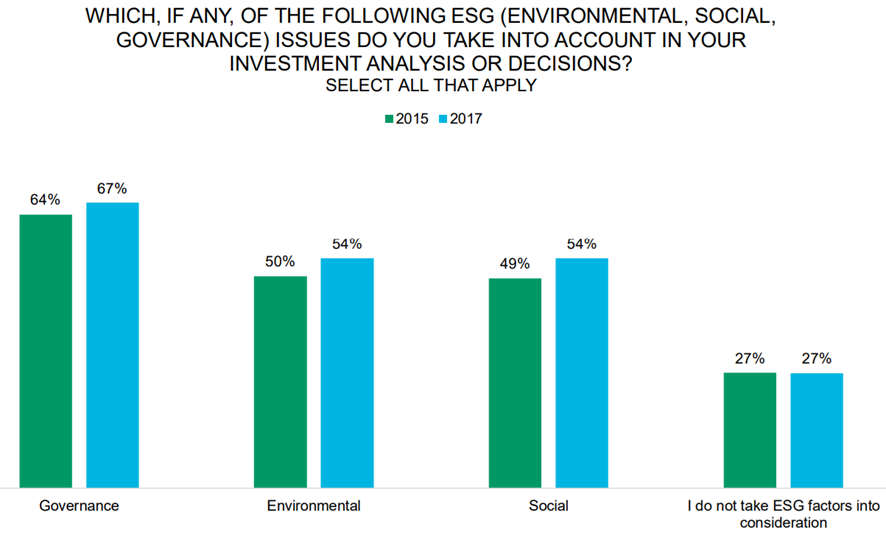

Corporate governance is the matter of sustainable investment that most concerns investors, which of course is perceived in view of the seriousness of the risks and losses associated with it:

The aspects that focus investors’ attention on governance are several, the most important being the accountability of executive directors, financial compensation and diversity, bribery and corruption, transparency, business ethics and shareholder rights

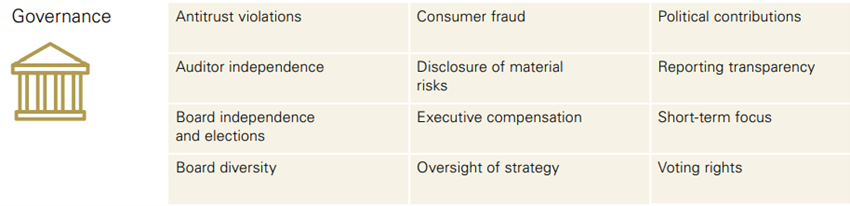

Regarding corporate governance, institutional investor concerns include competition violations, consumer fraud, political donations, auditor independence, disclosure of material risks, transparency of information reporting, appointment and independence of boards, board remuneration, short-term focus, board diversity, policy oversight and shareholder participation.

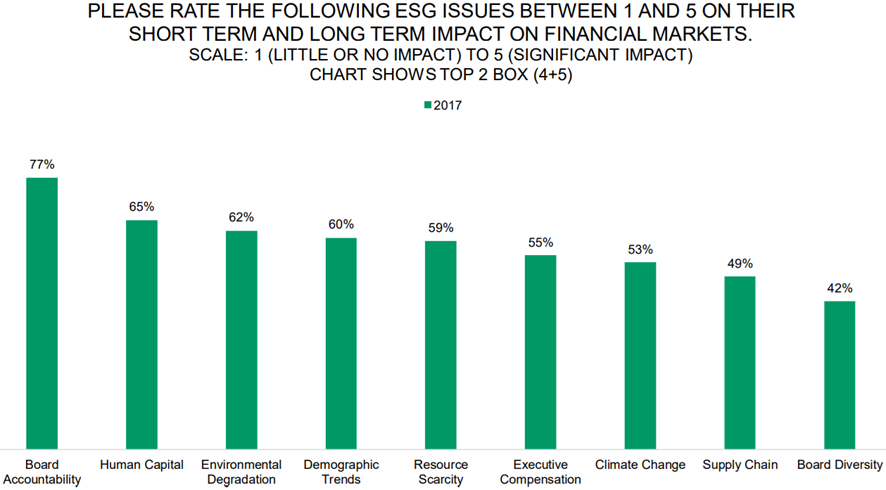

The accountability of the boards, their financial compensation, as well as their diversity are the most important issues for institutional investors in terms of corporate governance:

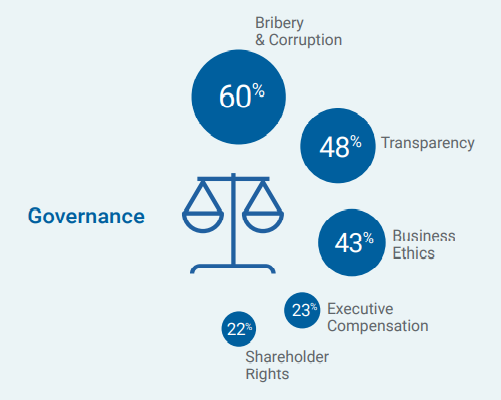

Bribery and corruption, transparency, business ethics, financial compensation of executive directors and shareholder rights are the focus of corporate governance issues by investors:

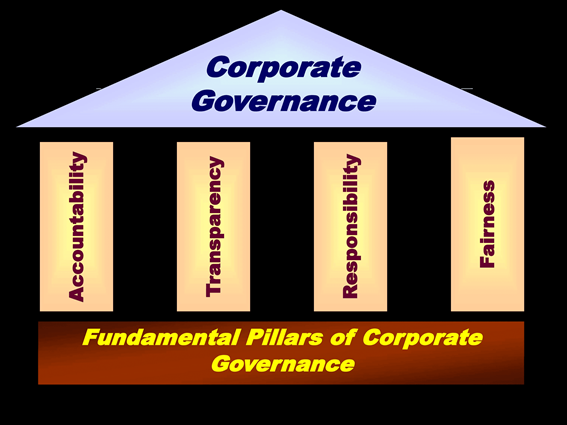

Corporate governance is the structure of rules, practices and processes used to run, manage and control a company

Corporate governance essentially involves balancing the interests of many of a company’s stakeholders, such as shareholders, executive management, customers, suppliers, funders, government, and the community.

Corporate governance is also the framework in which the company develops its objectives, so it covers virtually all spheres of management, from action plans and internal controls to performance measurement and corporate disclosure.

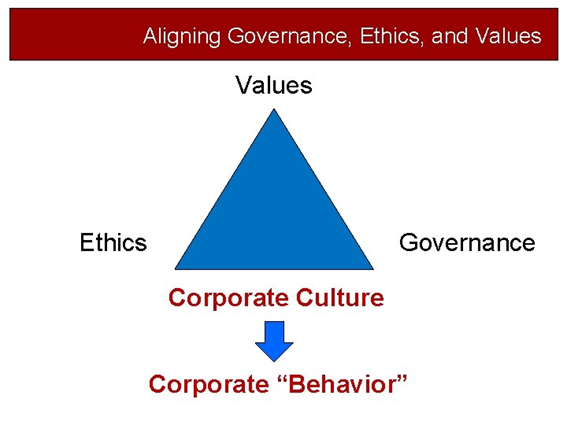

The alignment of values, ethics and corporate governance model determines the company’s culture and behaviour, which aim at honesty, transparency and accountability

The alignment of values and moral integrity, ethics, and compliance with the law, regulations, and codes of conduct, determine and integrate the culture and behaviours of the company.

The objectives of corporate governance are to build an environment of honesty/trust, transparency, responsibility and accountability, necessary to foster long-term investment, financial stability and business integrity, thereby supporting stronger growth and more inclusive societies.

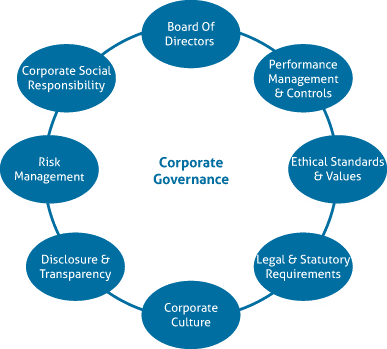

The main aspects of corporate governance and the importance of the board of directors as the main force that influences it

The main aspects of corporate governance are the board of directors, management assessment and controls, ethical values and standards, legal and statutory requirements, company culture, transparency and disclosure, risk management and corporate responsibility.

The board of directors is the main direct player that influences the government of companies. The directors are elected by the shareholders or appointed by other members of the board of directors and represent the shareholders of the company. The board is responsible for making important decisions such as appointments of executive directors, executive compensation, and dividend policy.

Boards are often composed of insiders and independents. Insiders represent the big shareholders, founders, and executives. Independent directors do not share the ties of insiders but are chosen for their experience in managing other large companies. Independents are considered useful for governance because they dilute the concentration of power and help align shareholder interest with insiders.

At the root of corporate governance themes are, among others, the agency’s theory and the stakeholders theory

The theory of corporate governance concludes that there are two important factors that affect the functioning of organizations:

- The agency’s theory leads to shareholder pressure and shareholder activism.

- Stakeholder theory leads to stakeholder influence and concerns about social responsibility.

The agency’s theory is used to understand the relationships between agents or executive managers, and principals or shareholders. The managing agent represents the principal shareholder in the management of the company and is expected to represent the best interests of the capital without considering its own interest.

The different interests of managers and shareholders may become a source of conflict, as some managers may not act perfectly in the interests of shareholders.

Companies should seek to minimise these situations through a sound corporate policy. These conflicts test the ethical behaviour of individuals in situations of moral hazard. Incentives are usually used to redirect the behaviour of the managing agent and realign its interests with the main shareholder’s concerns.

On the other hand, stakeholder theory describes the composition of organizations as a set of several individual groups with different interests, such as workers, suppliers, local communities, creditors, among others. These interests together represent the will of the organization. Business decisions should take into account, as far as possible, the interests of this collective group, and promote global cooperation.

This theory addresses morals and values in the management of an organization, such as those related to corporate social responsibility, the market economy and the theory of social contracts.

Corporate government developments are like a ping-pong between corporate scandals and regulatory initiatives

Public and government concern about corporate governance tends to fade and decrease over time.

However, highly publicized revelations of corporate failure often emerge that revive interest in the subject. For example, corporate governance became a pressing issue in the United States at the turn of the 21st century, after fraudulent practices bankrupted large companies such as Enron and WorldCom.

This resulted in the passage in 2002 of the Sarbanes-Oxley Act, which imposed stricter requirements on companies, as well as severe criminal penalties for violating these and other securities laws. The goal was to restore public confidence in listed companies and their way of operating.

Poor corporate governance can call into question the reliability, integrity and transparency of a company, which can have an impact on its financial health

Tolerance or support for illegal activities could create scandals such as the one that rocked Volkswagen AG in September 2015. The development of the details of the “Dieselgate” (as the case came to be known) revealed that, for years, the car manufacturer had deliberately and systematically manipulated engine emission equipment in its cars to manipulate the results of pollution tests in America and Europe. Volkswagen saw its shares fall to nearly half their value in the days following the scandal began, and its global sales in the first full month after the news fell 4.5%.

Other types of poor corporate governance practices include:

- Companies do not cooperate sufficiently with auditors or do not select auditors with the appropriate capacity, resulting in the publication of false or non-compliant financial documents.

- Poorly designed, misaligned, and excessive executive management compensation packages do not create an ideal incentive for company managers.

- Poorly structured boards of directors make it difficult for shareholders to be expelled from ineffective incumbent managers.

https://www.cfainstitute.org/-/media/documents/survey/esg-survey-report-2017.pdf

Podcast: Play in new window | Download