The effects of the increase in official and long-term interest rates on the stock markets

However, studies do not show a correlation between the performance of the stock market and the rise in interest rates

The effects of inflation on stock markets

Studies show that there is a positive relationship between real interest rates and market multiples

The stock market is at multiples well above the historical average, the main justification being the low level of real interest rates

The FED’s credibility has been called into question by some

The key question is whether the inevitable adjustment of the stock market to monetary policy change will be smoothly and gradually

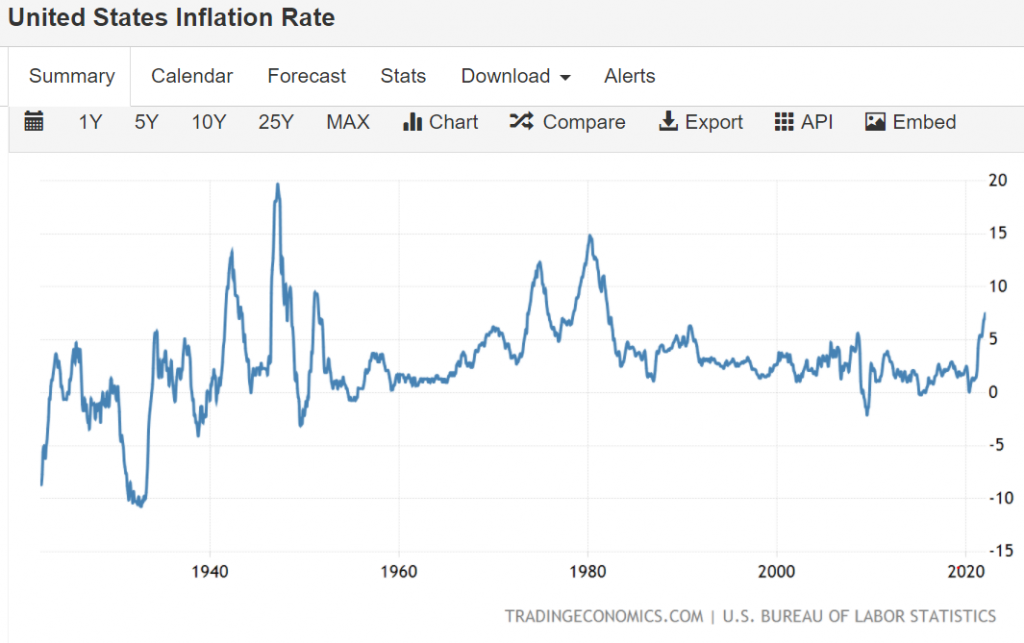

The annual inflation rate in the US continues to rise to 7.5% in January, at highs over the past 40 years.

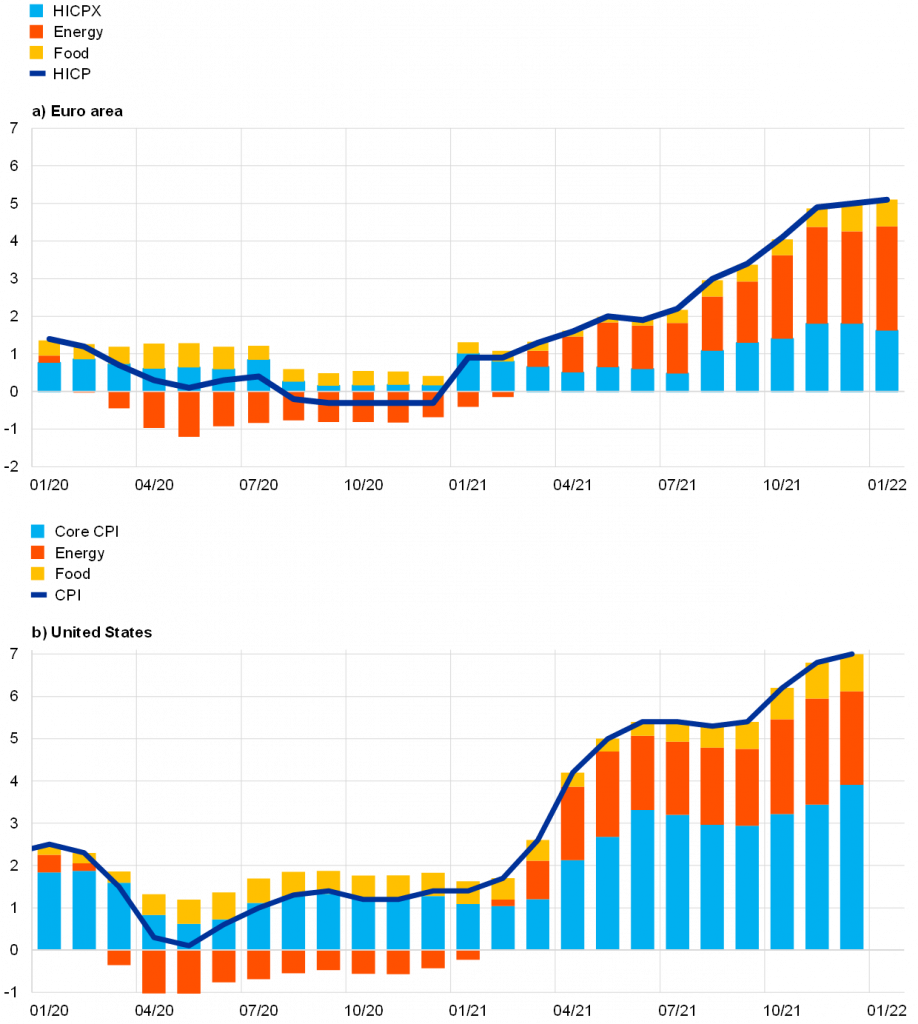

This increase in inflation in the USA is also observed in Europe:

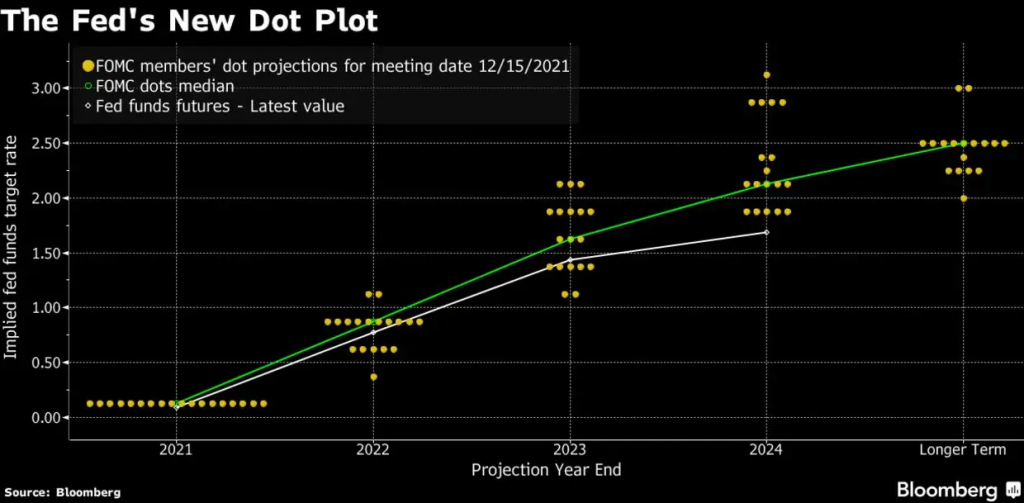

In response to this rise in inflation and considering favourable economic and labour market growth conditions, the FED projected a 3-level official interest rate rise in 2022 (movements of 0.25% each) at its mid-December meeting.

This increase follows the reduction of the asset program started in November and is expected to be reversed from March.

According to the FED minutes published on 16 February on the January meeting, the FED reinforced these ideas by admitting that it could accelerate the reversal of the asset purchase programme, which will adopt a gradual rise in interest rates, and is aware of concerns about inflation and financial stability.

However, given the continued worsening inflation, market analysts anticipate further increases in the official U.S. interest rate over the course of this year:

Analysts predict at least 4 interest increases, most between 5 and 6 increases, and some up to 7 increases.

This market forecast stems from a paradigm shift from the FED in early 2022, admitting that inflation was more persistent than it had been in the previous year, and justifying a more prompt and deeper monetary policy action.

This change in speech and policy has been at the heart of the correction and increased volatility of the stock market.

In these terms, it is important to know what we can expect from the increase in official interest rates in a context of high inflation.

The effects of the increase in official and long-term interest rates on the stock markets

In principle, an increase in official interest rates results in a decrease in the valuation of the stock markets.

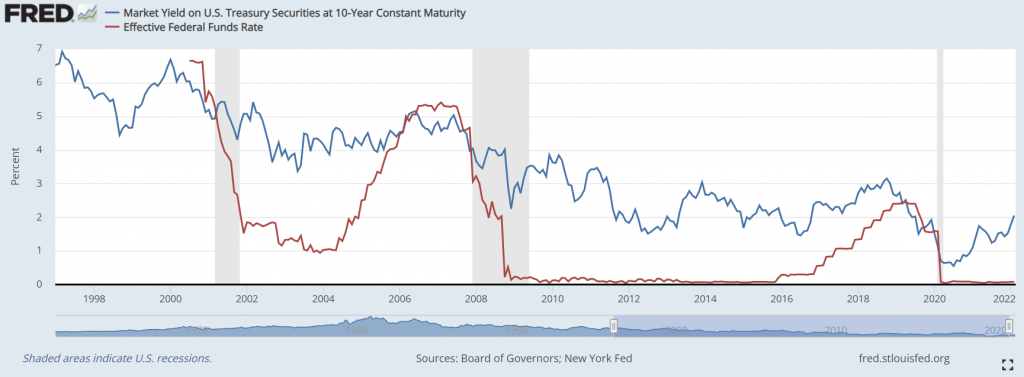

An increase in official interest rates is immediately accompanied by the rise in all interest rates, including long-term ones.

In financial terms the expected effect is negative.

The intrinsic value of stocks is determined by the value of discounted cash-flows. The discount rate used is the shareholder’s intended rate which of course is all the higher the higher the cost of money.

In addition, the increase in interest rates may also lead to a movement of movement or rotation of investment flows, from stocks to bonds, also penalising the former.

In macroeconomic terms, the expected effects are also negative.

A higher interest rate reduces the disposable income of households, in particular due to the higher financial burden sands of their debts.

Additionally, a higher interest rate also represents higher costs for companies and consequently lower profits.

Moreover, governments as debt issuers also have to bear greater burdens, reducing budgetary room for manoeuvre.

Finally, bond investors lose, creating a negative wealth effect.

It is obvious that not all sectors or companies are affected in the same way. For example, the financial sector typically benefits, and the most indebted or higher valuation multiples sectors (typically more dependent on future cash-flows) are the most affected.

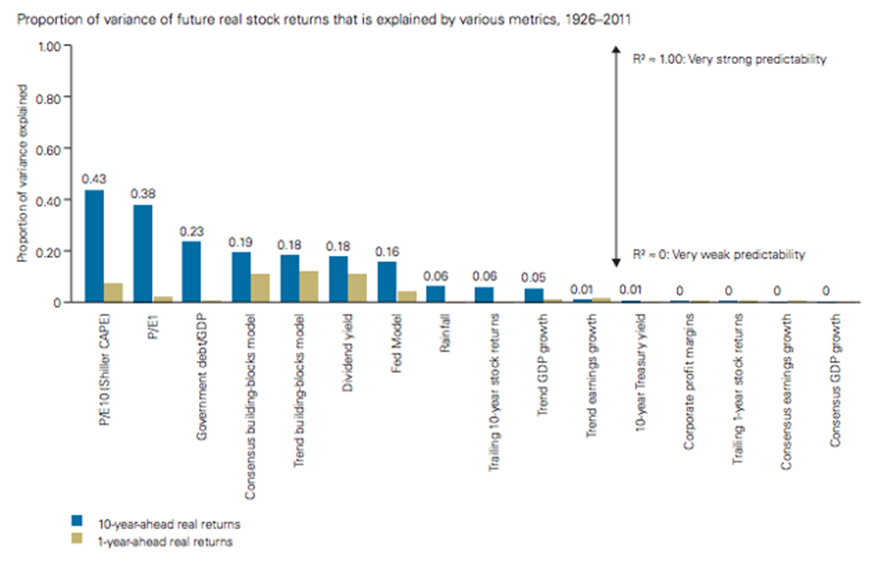

However, studies on the determinants of stock market performance in general do not show a correlation between interest rate movements in long-term stock yields.

In another article, we saw that the main determinants of these profitability are the evaluation multiples, namely Shiller’s PER, the PER and The P/B.

There are even some studies that suggest the existence of a positive correlation between these variables, contrary to what would be expected in terms of economic and financial theory.

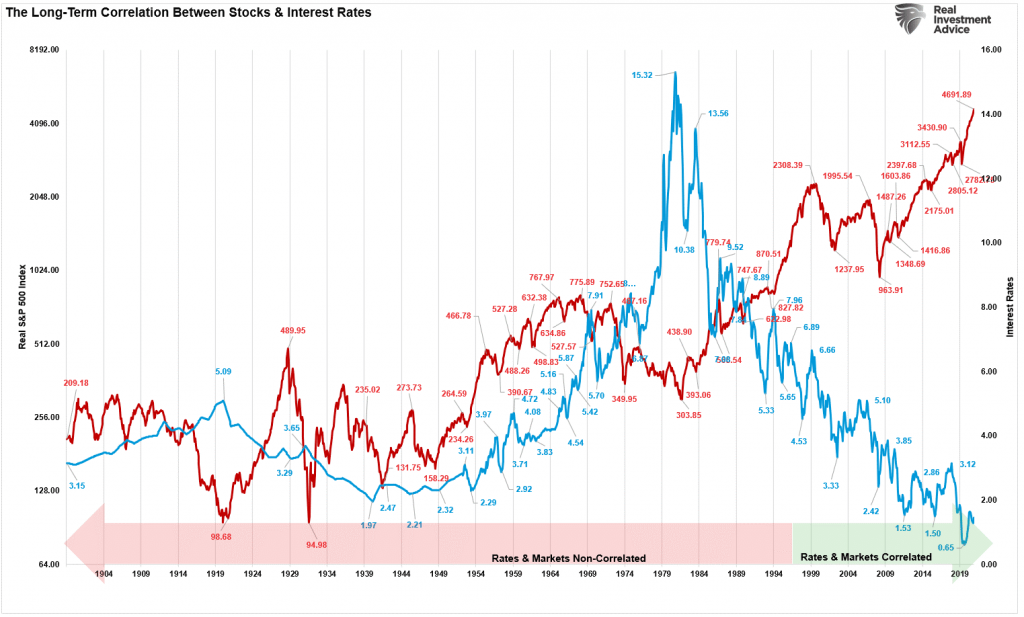

The following chart shows the evolution of the S&P 500 and interest rates on 10-year U.S. Treasury bonds from 1900 to date:

Between 1900 and 1980, stock markets and interest rates were not correlated. But from 1980, markets and interest rates show a negative correlation. The only explanation for this phenomenon is only the action of the FED that we will deepen further ahead.

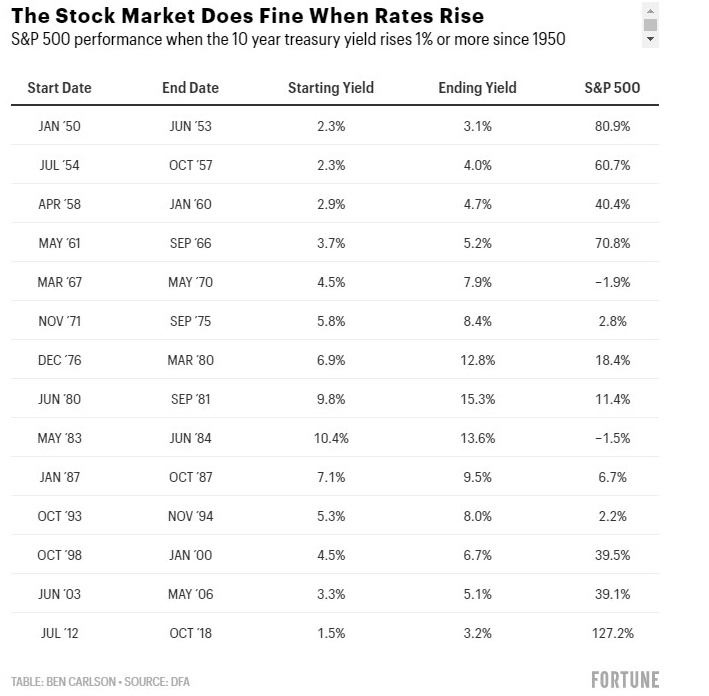

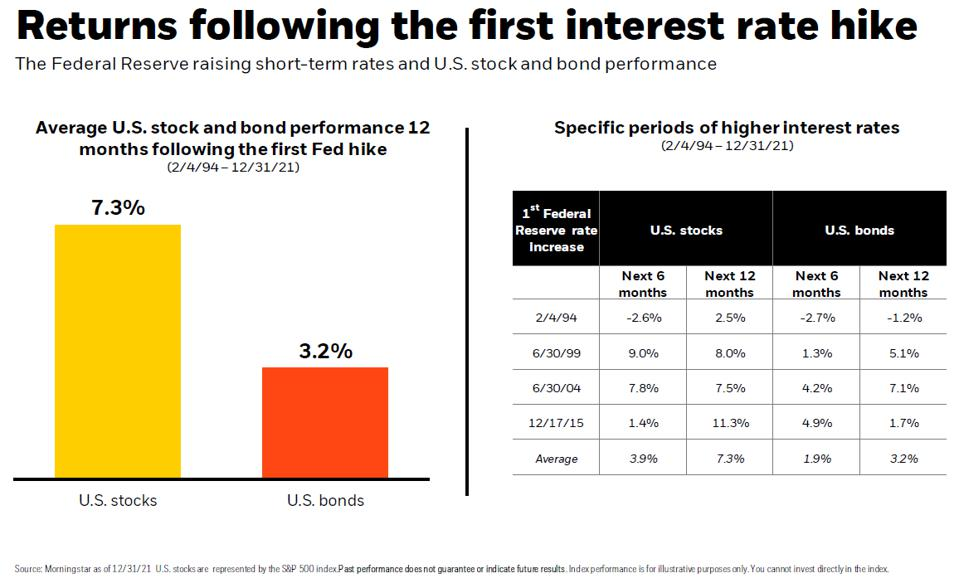

The following table shows the behavior of stock markets in the periods following interest rate hikes since 1950:

Over these 14 periods of interest rate hikes the stock market had a positive behavior except in 1967-1970 and 1983-84 in which it was marginally negative. However, we know that after many of these most recent periods there have been crises, such as the two oil companies, the technology bubble and the GFC.

We see that the increase in official interest rates is positive for stocks. What is at stake is that rates rise due to better economic growth and this is beneficial for businesses.

This indetermination is largely due to the phases of the cycle and the context in which interest rate movements occur.

The effects of inflation on stock markets

In theory, stocks provide some protection against inflation, as corporate revenues and profits are expected to grow with inflation after an initial adjustment period.

However, the impact of inflation on stocks tends to increase capital market volatility and the risk premium.

Moreover, in macroeconomic terms, the increase in the cost of living reduces the purchasing power of households, retracts demand and can lead to wage increases.

On the contrary, deflation is the regime most feared by the stock markets. Under this regime companies are forced to lower prices by reducing sales, margins and profits, since there are several production factors that are not adjustable in the low, such as work.

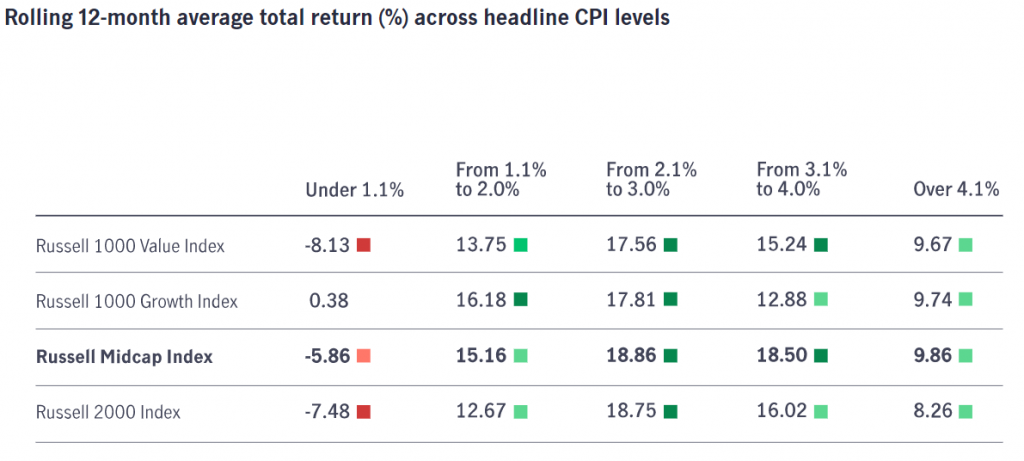

A very recent study by John Hancock Investment Management using data between 1970 and 2021 evaluated the behavior of stocks in various inflationary contexts:

The study concluded that stocks perform well in periods of high inflation, as opposed to deflation.

Stocks had average annual returns of 13% to 18% when inflation was between 2% and 4%, in line with the more moderate inflation of between 1% and 2%. With inflation above 4%, returns were around 10%. In deflation, returns were negative between -5% and -8%

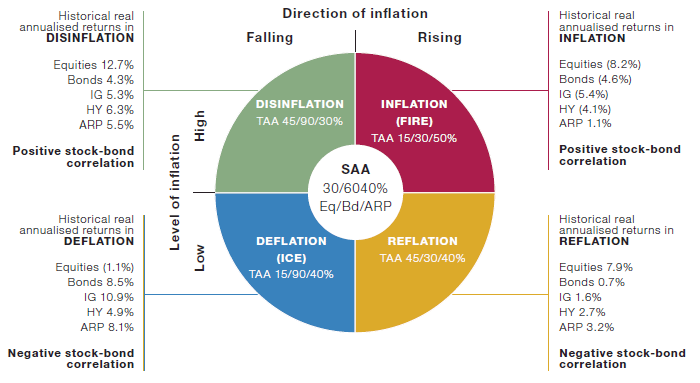

A very interesting recent study by the Man Institute using data between 1926 and 2020 shows the real profitability of the various assets in various inflationary contexts that integrate not only the level of inflation but also its direction:

The most unfavorable scenario for financial assets, and especially for stocks, is high and rising inflation rates. In this scenario, the annual and real equities returns are negative of -8.2%, and those of the bonds of -4.6%.

This scenario of an inflationary spiral is what is currently being fearsome (it should be noted that the period under analysis encompasses very different phases, such as the Great Depression, World War II and oil shocks).

On the other hand, if inflation is high, but its meaning is downward, the situation changes dramatically. Equities provided annual and real returns of +12.7% and bonds +4.3%.

The context of deflation, i.e. low and declining inflation, is positive for bonds and negative for stocks, while the reflation framework, i.e. low but rising inflation, is favorable for stocks and neutral for bonds.

The conclusion is that the global context is important to perceive the movements. There are positive interest rates and inflation increases for the market and other negative ones.

Studies show that there is a positive relationship between real interest rates and market multiples

We have seen that studies show that the effect of rising interest rates and inflation on the stock markets is low and dubious, contrary to what is core of economic and financial theory.

And what is the combined effect of interest rates and inflation on markets?

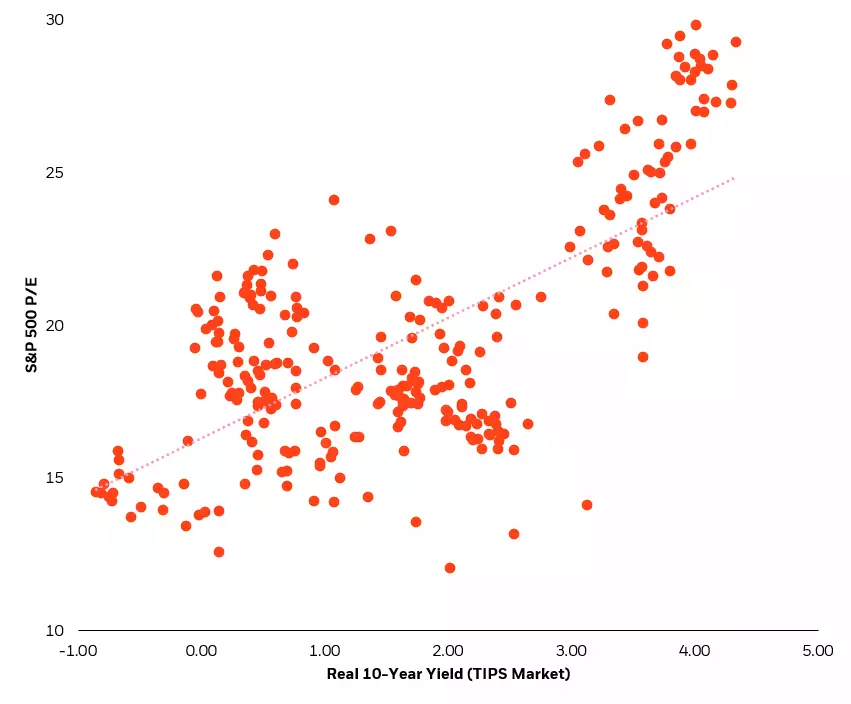

When analysing real interest rates the relationship with markets is stronger.

A study with data from the launch of the inflation-indexed bond market in 1997 to 2020 concluded that there is a positive correlation between real interest rates (nominal rates deducted from inflation) and market valuation multiples:

Higher real interest rates are associated with higher valuation multiples.

Therefore, this is not why fears of rising interest rates are justified.

It is necessary to deepen and understand the dynamics of cause and effect relationships and the main variables concerned.

The current questions are:

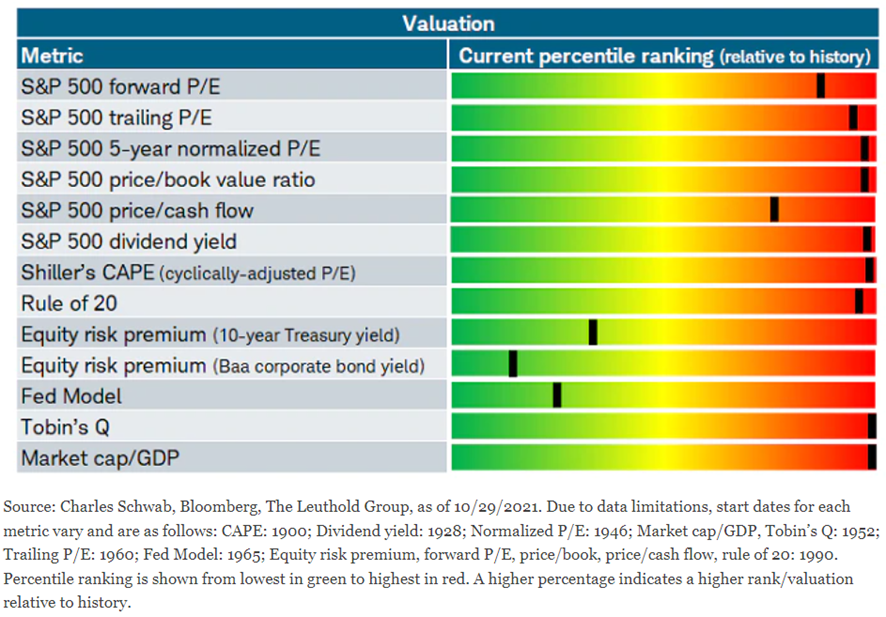

- The market is quoting at high multiples and real interest rates are negative;

- The market has reached these levels due to the ultra expansionist monetary policy programmes that have been experienced in the last 10 years, to which the market has become accustomed, and now a change and even reversal of it;

- The rise in interest rates is to halt economic overheating, in a context of good indicators of growth and employment.

The market has become accustomed to the QE programme for more than 10 years since the GFC and the existence of FED protection (the so-called FED put), which now ends

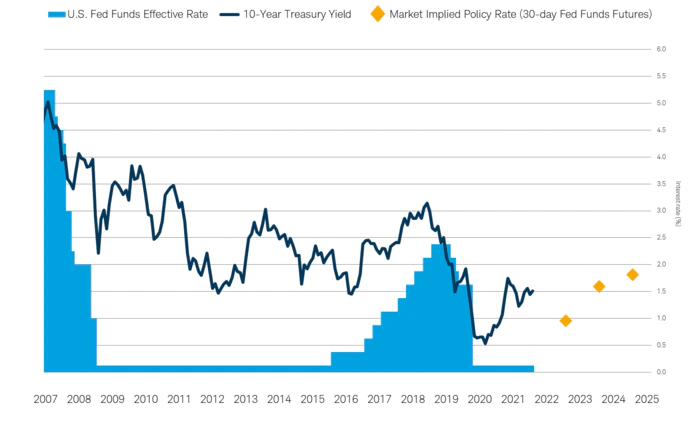

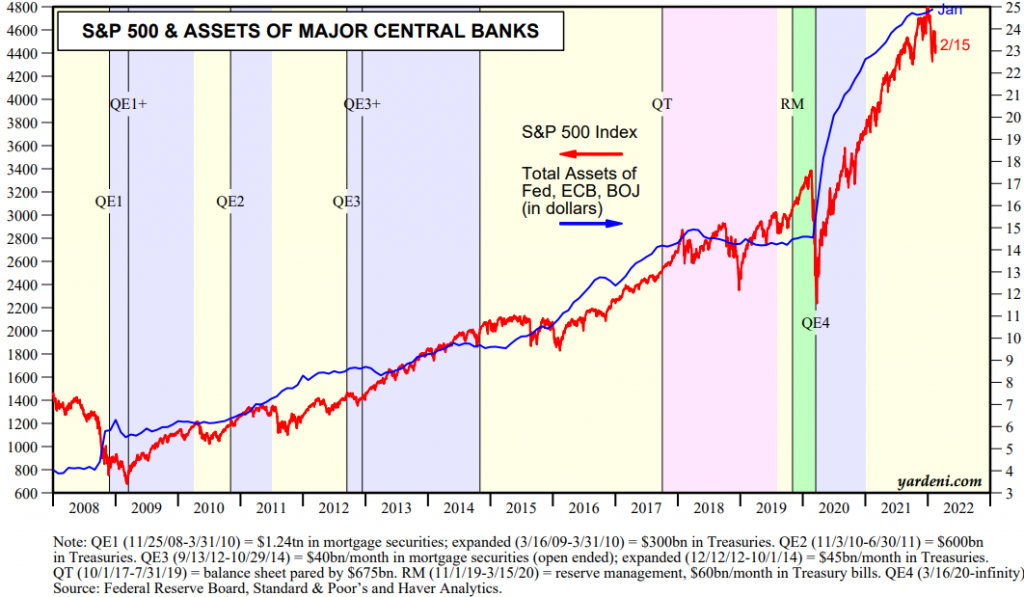

Since the GFC in 2008, the stock market has become accustomed and has benefited from the FED’s accommodative policies aimed at economic recovery, comprising asset purchases and low official interest rates.

There is a very direct relationship between the total assets of central banks and the performance of the stock market.

Between 2008 and 2014, there were three asset purchase programs in the U.S., also called “Quantitative Easing” for GFC exit. In 2020, a fourth programme was initiated, now to combat the pandemic.

In other periods there have been other interventions made by the FED in other periods, in particular to maintain favourable financial conditions for the sustainability of economic growth.

As many of these moments occurred in market correction situations were dubbed FED protection or FED put).

Weaning from this situation is the main source of uncertainty.

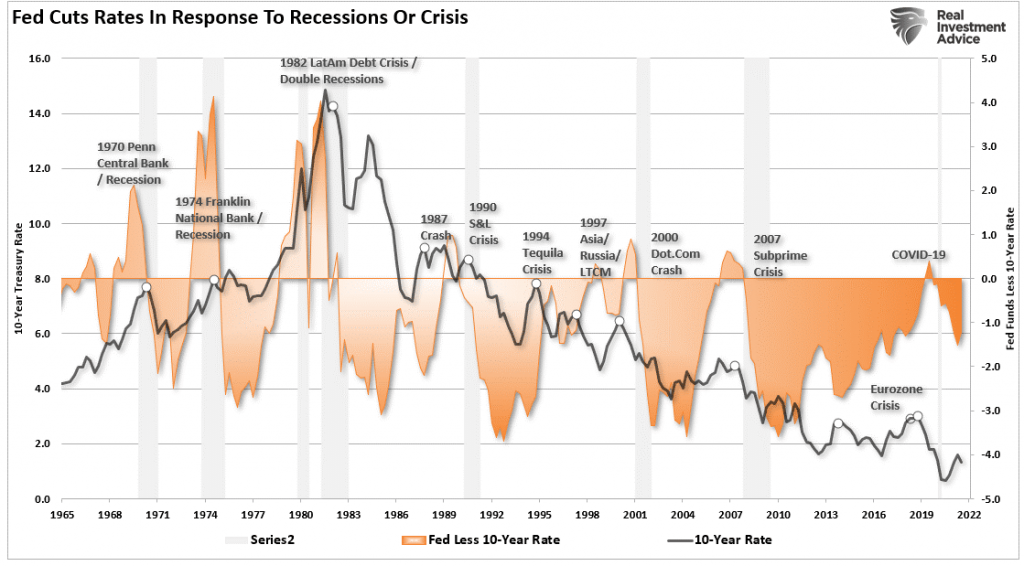

Reinforcing this idea, the following graph shows the effects of the FED’s interest rate declines from 1965 to today:

Returning to the point mentioned above, what introduced the negative correlation from 1980 was the change in the performance of the FED.

This change began with Alan Greenspan in the bailout of long-term capital management bankruptcy, was used in the exit of the tech bubble crisis and more recently in qe programs in the Great Financial Crisis. And it gave rise to the expression that the FED is not worth fighting.

Investors have become accustomed to buying stocks and selling bonds for the accommodative stock of monetary policy.

The problem is that this will now be reversed to fight inflation.

The stock market is quoting at high multiples, the main justification being the low level of interest rates:

Rising interest rates reduce the historical attractiveness of the market, both in terms of risk premium and the FED model. As a result, the market is in the adjustment phase for new valuation levels.

The credibility of the FED has been called into question by some

An important issue for the market is that the credibility of the FED may have been called into question.

Inflation began to accelerate in the first quarter of 2021, when it rose from 1.7% in February to 4.2% in April.

The speech by the FED and the other central banks was that the event was transitory and not persistent due to the breakdown of supply chains, the imbalance in demand and supply caused by the pandemic, and the rise in commodity and energy prices.

However, it was not temporary. On the contrary, inflation rose from 4% in early 2021 to the current 7.5%.

Critics say the FED did not act as early as it should, allowing rising commodity prices to spread to the labour market, as recent wage increases suggest.

This situation of some uncontrol may make inflation more persistent and more difficult to fight. To that extent, the costs in terms of economic growth may be higher. Thus, the different estimates of interest rates increases are perceived.

The theme is not only that of the movement of interest itself, but the uncertainty as to the magnitude and speed of it, and also the reversal of the asset purchase program.

Inflation and uncontrolled interest rates, along with the sale of assets by the FED, are undoubtedly the main fear of the financial market.

Contrary to the more simplistic market narrative there is much more to be concerned than the effect of inflation and the FED’s rising interest rate.

The market is close to historic highs, has had annual returns above 20% in the last 3 years, comes from a positive long cycle of more than 10 years (suspended by the pandemic but quickly exceeded), is quoting to high multiples at very high based on zero interest rates, and has become accustomed to a very favorable monetary policy.

To this extent, the key question is to look at how the inevitable adjustment of the stock market will be made to this paradigm shift in monetary policy.