Disruptive technologies based on long-term positive cash-flow

The example of Cathie Wood’s ARK Innovation Fund

Astronomical price performance in 2020

Hard landing from mid-2021

Yo-yo or the extreme sensitivity of cryptocurrencies to market sentiment

A year ago, three articles were published on the recent democratization of investments in shareholder markets, especially in the USA.

The move was seen globally positive, though having flaws that time would probably correct.

This series of articles takes a view of the situation.

In the first, we looked at the increased participation of individual investors in the spot market and options.

We have shown that this is a trend that remains and we have reaffirmed that it is very positive for the market and for new investors.

In the second article we began to address the issues of the various excesses or market failures brought about by this democratization of the market.

We divide this theme into parts because there are several aspects to consider.

First, we dealt with the case of “meme” stocks, shares of companies that have been subject to excessive demand and consequent price eruption, due to a massive movement of a community of investors, mostly young and young.

Then we focus on the theme of SPAC’s initial public offerings, a fast track to the stock market introduction of companies that exploded in 2020.

Understanding these market situations is very important to know the land on which we invest.

In this last article, we see the excesses of the effects of fashion, taking as examples, the high growth stocks and cryptocurrencies.

Never mingle your speculative and investment operations in the same account nor in any part of your thinking. — Benjamin Graham

Disruptive technologies based on long-term positive cash-flow

The star stocks of the pandemic wave were growth, especially technological ones.

These companies have benefited from strong tax and monetary support at three levels.

The liquidity injection drove interest rates to very low levels, driving the value of those stocks up.

The liquidity received by investors was very directed to these companies, which promised great potential gains, reinforced by the increasing use of the products and services of these companies in a remote work environment.

Technology companies were clearly more favoured than those in the traditional sectors by new investors, more technological, more aggressive and more susceptible to social media.

The market experienced a period of euphoria in which risk-on was high.

The example of Cathie Wood’s ARK Innovation Fund

The most media-based example of this fashion was ark funds managed by Cathie Wood, especially the ARK Innovation Fund.

It is a family of actively managed and themed mutual funds, targeted at disruptive technological trends, in accordance with their investment policy.

The ARK Innovation Fund is geared to 5 major areas of disruptive technological innovation: energy storage, robotics, artificial intelligence, genome sequencing and blockchain technology.

The link to ARK Innovation Fund’s marketing prospectus is as follows:

https://medium.datadriveninvestor.com/cathie-woods-5-platforms-of-innovation-974913769efb

Astronomical price performance in 2020

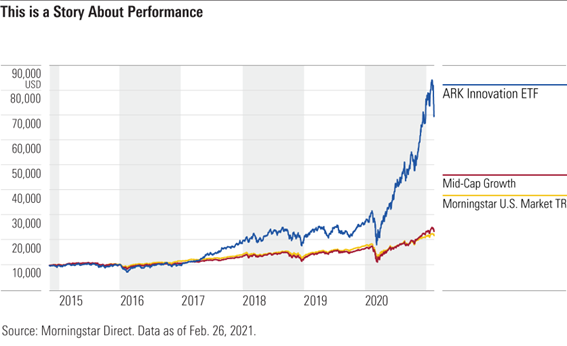

The strong recovery of the stock market following the pandemic that began in April was made astronomically felt in the invested shares of the fund and consequently in the performance of the ARK Innovation fund:

The ARK Innovation fund gained almost 400% in 2020.

Hard landing from mid-2021

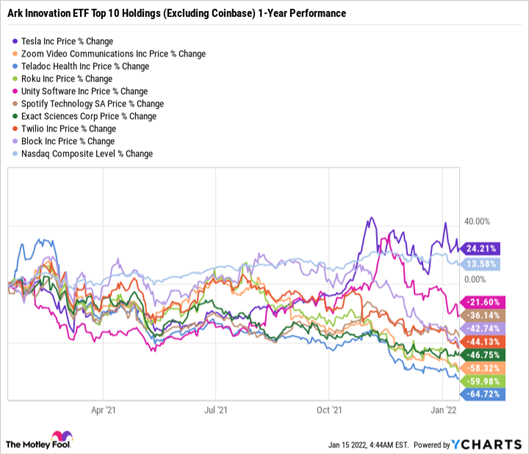

However, from the second quarter of 2021, with the signalling of the withdrawal of stimulus, the increase in inflation and the prospect of rising interest rates, the fund’s actions began to be achieved:

Most stocks have fallen since April 2021, with Tesla as one of the exceptions

Naturally, the fund reflected the devaluation of its components:

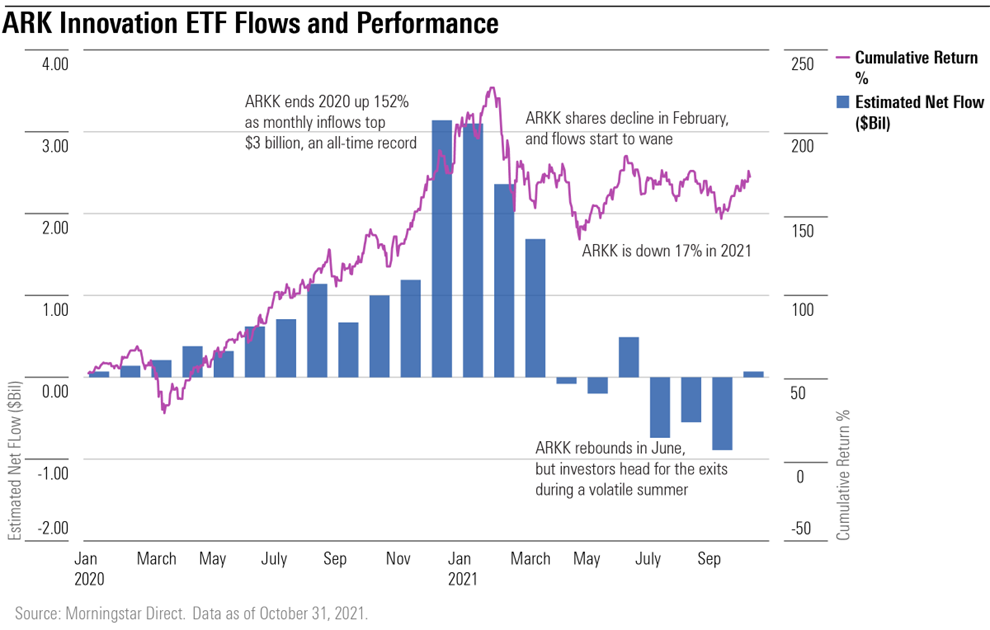

The fund reached its highest price in February 2021, having fallen since then.

As is usually the case with all investment funds, investors pursue valuations.

Especially in the funds that stand out for the higher valuations of the market.

Investments are made when the fund is up sharply and close to highs, as the fund flows show.

After last summer investors withdraw some of the money invested.

The devaluation of invested companies and the fund continued and continued in the first months of 2022 to the day:

The replacement of risk-on sentiment to risk-off of the market in general accelerated with rising inflation, rising interest rates, reversal of the asset purchase program and the Ukraine war.

The stock market was hit, the indexes had strong corrections and went into negative cycles (“bear markets”), with losses of 20% of the DOW and S&P 500 to 30% of the Nasdaq.

The technological stocks whose valuation is based on future cash-flows were the most affected.

ARK Innovation Fund stocks were the most affected, losing in some cases between 60% and 80% of their peak price.

Ark Innovation’s price has lost about 70% since its peak.

ARK Innovation traded back to 2018 levels, and its valuation since 2014 has been surpassed by the growth of the S&P 500 index.

This is a good example of the cycles of stocks, styles and fashions of the market, which we have already addressed in other articles and which we must take into mind.

Yo-yo or the extreme sensitivity of cryptocurrencies to market sentiment

We have a series of articles published on the topic of cryptocurrencies that seek to address their various aspects for medium-term investment.

This section takes a completely different perspective, much more immediate and conjunctural.

This is because another good example of fashion and the change of feeling or “risk-on” cycle to “risk-off” is that of the cryptocurrency market.

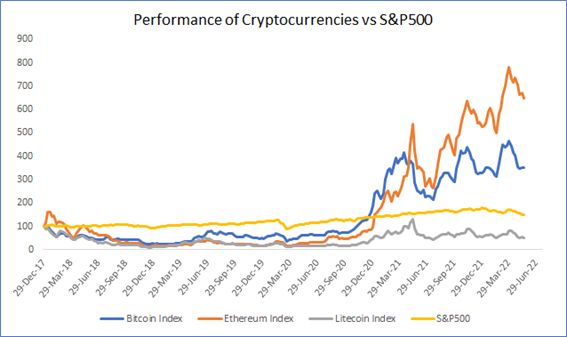

Bitcoin ended 2021 with a 70% appreciation, after gaining more than 300% in the pandemic year in 2020.

In early 2020 it quoted at $10,000, reached a maximum of $65,000 last November and currently quoted at $20,000.

This strong oscillation is typical of the cycles of euphoria and panic.

In addition to changes in the economic and financial context, cryptocurrencies in general, and Bitcoin in particular, are also affected by a new investment that trades in an incipient market.

There were events that aggravated the situation.

The decline in cryptocurrency quotes generated a real domino effect, which began with the bankruptcy of the Luna token and the (said) stable Terra associated currency.

Terra that was a stable cryptocurrency lost 95% and imploded in a couple of days.

As we saw in a previous article, stable cryptocurrencies are those that are linked or “pegged” to currencies, usually the dollar, quoting on a 1-to-1 basis. The best known is Tether which is the third in terms of market capitalization.

In the Terra system, the Luna token was used to maintain dollar replication. However, unlike Tether, Luna was in a computational algorithm.

The bankruptcy of Terra and Luna triggered the bankruptcy of the Three Arrows Capital fund, which was unable to settle a $650 million loan.

And things may not stick around because the tea of the cryptocurrency market may bring up other events of this order.

The market has low liquidity and is very leveraged.

The global capitalization of the cryptocurrency market is currently $900 million after it exceeded $2 billion last year.

This situation is not new. Between 2017 and 2018 Bitcoin lost more than 80% of its value.

The novelty is that there are now many more individual and above all institutional investors in the market.

In the last three years institutional investors have entered the cryptocurrency market such as Paul Tudor Jones, PayPal, Tesla, Block, and even the asset sectors Fidelity, Blackrok and Vanguard, acting on belight of their clients.

Despite this, the appreciation of major cryptocurrencies such as Bitcoin and Ethereum far outweighs that of the S&P 500: