What was the long bull market of bonds?

The long bull market of bonds resulted from monetary expansion

This is the first part of an article on the subject of the long bull market of bonds, a period in which bonds had very high yields and very low risk, and which lasted 40 years between 1980 and 2020.

The article relates to others previously published on monetary policy and bond investment.

On this investment we have seen what bonds are, the rationale for investing in bonds and how to invest in bonds.

“History has shown that this liquidity has to come out somewhere, and that with this we will not get a free lunch. I think, at the end of the day, who will suffer is the bondholder”, Jeremy Siegel, CNBC, 5/5/2020

“Forty years of a bull market in bonds. Is it very difficult to turn your head and say that this can be a turning point? But I think history will say yes. I see interest rates rising continuously over the next few years.”” Siegel, idem

“Bondholders will pay for the battle against coronavirus in terms of diminishing their purchasing power,” he said, alluding to a return to inflation that he believes will begin in 2021, Siegel, idem.

“The long bull market race in bonds has come to an end,” Scott Minerd, Guggenheim Partners.

Investors and managers have become accustomed to the idea of interest rates in a fall to zero or even negative levels in the last 40 years, in what has become known as the long bull market of bonds.

This context of falling interest rates has resulted in very interesting return on bond investment, and has also benefited from the return on stocks.

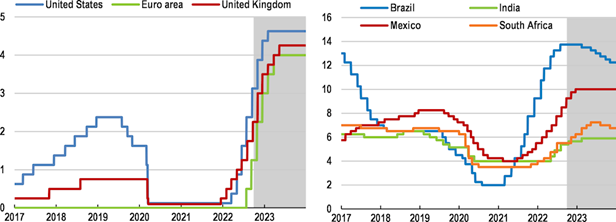

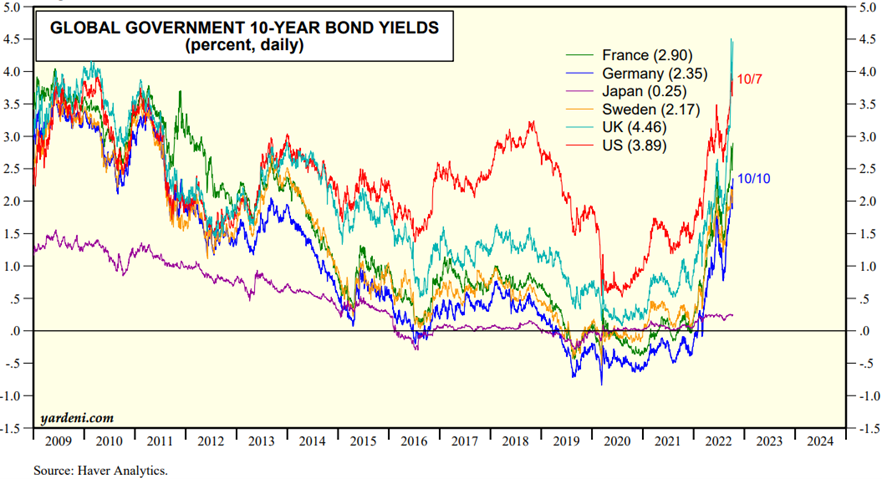

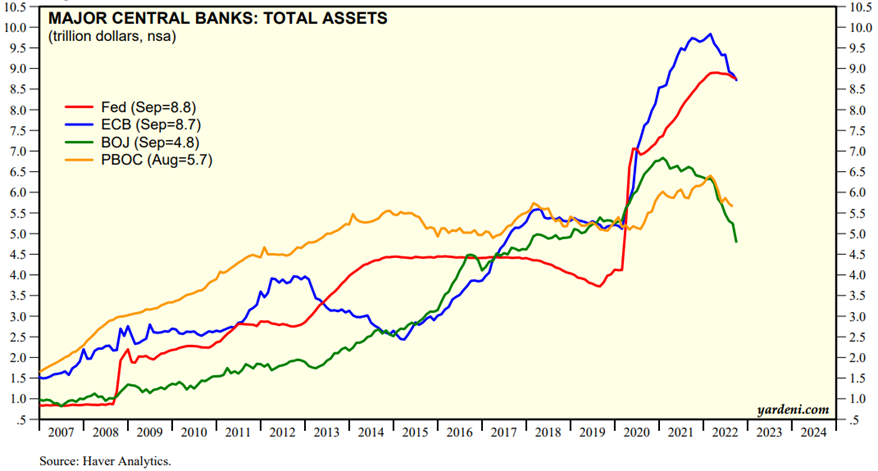

Since the beginning of 2021, rising inflation and its fight has led to the rise in official interest rates and the market, and the reduction in the huge balance sheet of central banks accumulated in recent years:

Source: OECD Economic Outlook, Paying the price of War, September, 2022

Source: Market Briefing: Global Interest Rates, October10th, Yardeni Research

Source: Central Banks:Monthly Balance Sheets, October,10th, Yardeni Research

This change in monetary policy is a new standard for the management of investments in bonds and stocks, and in essence for the management of assets.

So it’s easy to see that with the end of the bull market of bonds, the world has necessarily changed.

For many, individual and institutional investors, it is a completely new reality.

We all want to understand what’s coming, what its impacts on the financial markets, the expected return on assets, investment portfolios, and investor positioning.

Thus, it is important to know this reality better, to understand its implications and to see what we can expect for the future.

What was the long bull market of bonds?

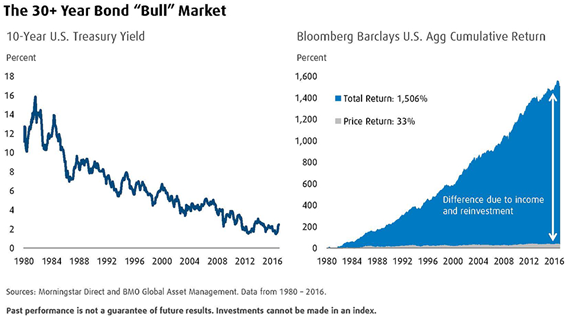

The long bull market of bonds has been a long period, of more than 4 decades, one way, one way for price movements and bond interest rates, and that ended very recently.

In fact, between 1980 and 2021, bond prices only rose, and correspondingly, bond interest rates only fell.

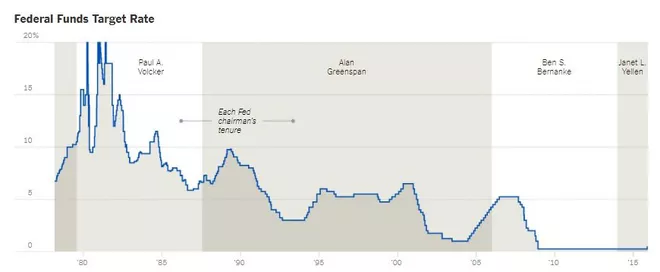

In the early 1980s, interest rates in the US and Europe were at levels of 10% to 20%, and have fallen continuously since then:

As bond prices are inversely related to interest rates, the yields on bond investments have been very high in this period.

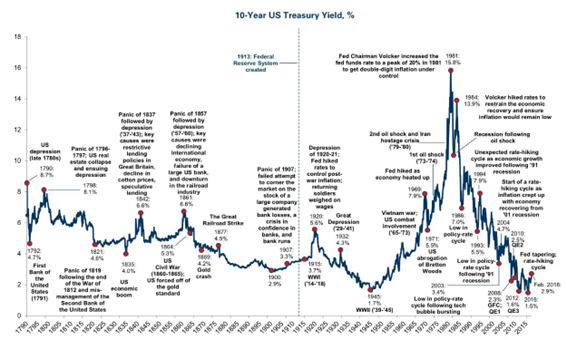

This bull market of bonds seems normal because it lasted a long time, but it was something truly surprising in historical terms.

The following graph, from the history of more than two centuries of 10-year U.S. treasury interest rates, gives us a very important historical perspective of the significance of what was the recent bull market of bonds:

The long bull market of bonds resulted from monetary expansion

Between the end of World War II and the beginning of the 1980s there is a very sharp rise in inflation from 2% to about 16%.

This increase is due to the expansionary fiscal and monetary policies developed after that war and the Vietnam war, rising commodity prices, increased protectionism, slowing productivity and increased uncertainty resulting from high real interest rates.

In the early 1980s, an aggressive policy to combat inflation by central banks began (which benefited from the strengthening of the independence of these banks and the establishment of price stability alongside low unemployment as their main mission).

After the positive experience of the 1980s in New Zealand, the FED adopted an inflation target level of 2% in 2012, which was most recently followed by the ECB.

This action is accompanied by a set of measures that promote the fall in inflation.

For example, the introduction of supply-side economic reforms (such as improvements in energy and transport infrastructure), increased globalisation and lower costs and increased competition associated with technology and digitisation.

At the same time, there is lower consumption and greater savings as a percentage of wealth, increased available capacity and reduced business power of workers, and increased demand for fixed income assets associated with an ageing population.

More recently, this situation has been driven by unconventional expansionary monetary policies developed after the Great Financial Crisis – known as quantitative easing programmes.

These programs brought interest rates on U.S. treasury bonds to near zero levels, and negative in European countries and Japan.

Given its importance and impact on financial markets, we will go a little deeper into this monetary policy management.