Focusing on investments in government bonds and investment grade rating companies

Diversifying by geographies but focusing on investing in our own currency

In the form of diversified and low-cost investments

We need to invest in bonds to have income stability and wealth preservation in a diversified portfolio

We need to invest in bonds to:

- Diversify an investment portfolio and associate the stability of bond returns with the capital appreciation provided by the stocks.

- If we want to have a part of our wealth in a more conservative, stable and safe ground and with some return.

Often, our bond investments boil down to buying some treasury bonds and/or some bonds of the best-known companies or companies we think we know well. Sometimes we decide for the lowest risk, others for the highest implied yield to maturity.

This post aims to answer the question of how we should invest in bonds according to a model of reasoning and structured thinking.

We should invest in bond or fixed income funds rather than a small number of individual bonds to have a diversified portfolio

Buying a bond or just a few bonds is not only risky but also has great costs.

Bonds prices fluctuate with credit risk or default probability on the debt service payments, and have market risk or changes in market interest rates.

The credit risk stems from the possibility that issuing companies may not comply with the payment of interest and above all from the capital reimbursement. This is the case when the company goes into financial difficulties, financial restructuring, bankruptcy, or liquidation.

Market risk stems from the fact that the price and value of bonds vary inversely with movements in market interest rate. Most bond issues are fixed interest rate. At each time the price of bond issues is determined by the market interest rate and by the credit margin or spread.

For the same credit spread, a rise in market interest rates means that new issues have to pay a higher interest rate, which devalues the price of bonds equivalent to lower rates.

The best way to avoid these risks is to diversify by investing in a broad set of bonds.

Furthermore, studies show that investing in a small set of securities has given bad results to the average private investor:

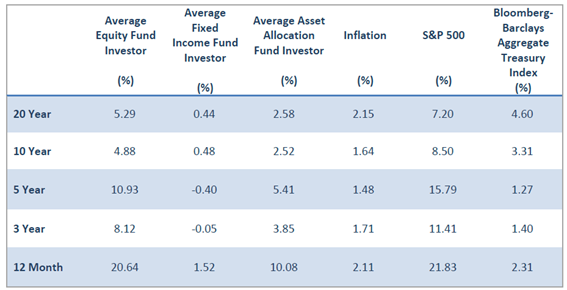

Bond investments made by individual investors have had much lower returns than the market (measured by the performance of the main U.S. index, Barclays Aggregate Treasury Index) in the medium and long term, with a difference of about 1.5% to 4% per year in terms of 3 and up to 20 years. The compounding effect makes these differences large amounts.

The active fund manager has not had much better results also:

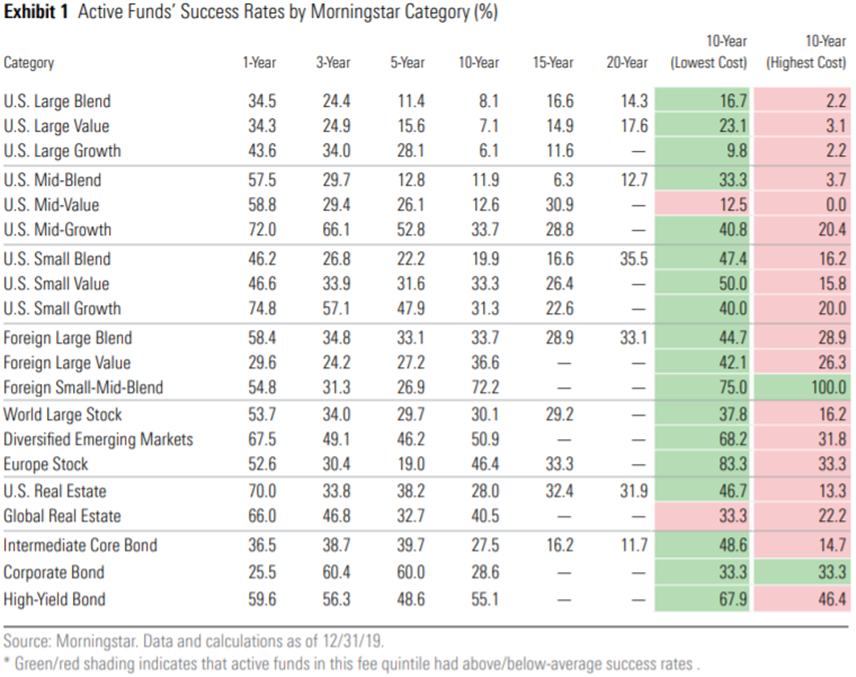

Only between 11.7% and 27.5% of them beat the market in investments in intermediate core bond (medium-term Treasury bond), in periods of 10 to 20 years. The figures improve slightly for the corporate bonds with investment grade rating, to 28.6% for a 10-year period. And because they are professionals, they charge commissions. The surprising thing is that the more they charge, the worse the results.

Neither individual investors nor even professional managers achieve better returns than the overall market.

In addition, the direct holding of bonds also has very high costs because most bonds trade through financial intermediaries (financial institutions and brokers), instead of being traded on the stock exchange: there are purchase and sale commissions, spread or difference between buy and sell price, bond custody fees, interest payment fees, etc.

This makes it preferable to invest in bond or fixed income funds than in some individual bonds directly. Funds also have commissions, but the value of diversification more than compensates. In addition, bond funds are managed by professionals.

The solution is then to invest in investment products that replicate market indices and are low cost. So-called index mutual funds that are not traded or are traded on the exchange exchange (like “Exchange Traded Funds” or ETF).

Focusing on investments in government bonds and investment grade rating companies

To do this we must start by knowing what type or class of bonds we want to invest in. We will analyse only the simple and straight bonds, by contrast to the structured ones (which include financial derivatives or are issued by special vehicles in pooling or “repackaging” of debts). We will also focus on fixed-rate issues because they are the ones that predominate; in addition, variable-rate issues, because they are indexed to the money market, are more like monetary or short-term investments.

We saw in another post that bonds have as main characteristics:

- Nature or type of the issuer, sovereign or corporate.

- Geography.

- Credit quality or risk rating.

- Currency denomination.

We have also seen that bonds, particularly Treasury bonds, provide low returns but also have a low level of risk. It is recalled that in the USA, between 1926 and 2019, the real return on investment in 10-year Treasury bonds (after inflation and taxes) was 0.6% per year, which caused that over 90 years, capital only doubled in real terms. Once again, its main attraction is to add stability to the wealth investment.

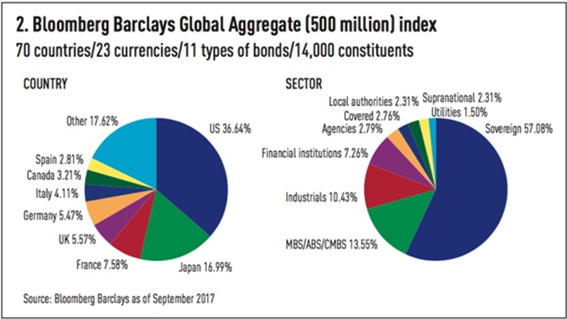

In a previous post we saw that the composition of the global bond market is approximately as follows:

Due to its nature and characteristics of stable and low returns when we invest in bonds we should not risk too much. It takes many years and it is very difficult to recover from a significant loss of capital even if it is partial.

So, for the most part, our bond investments should be made with a high level of security.

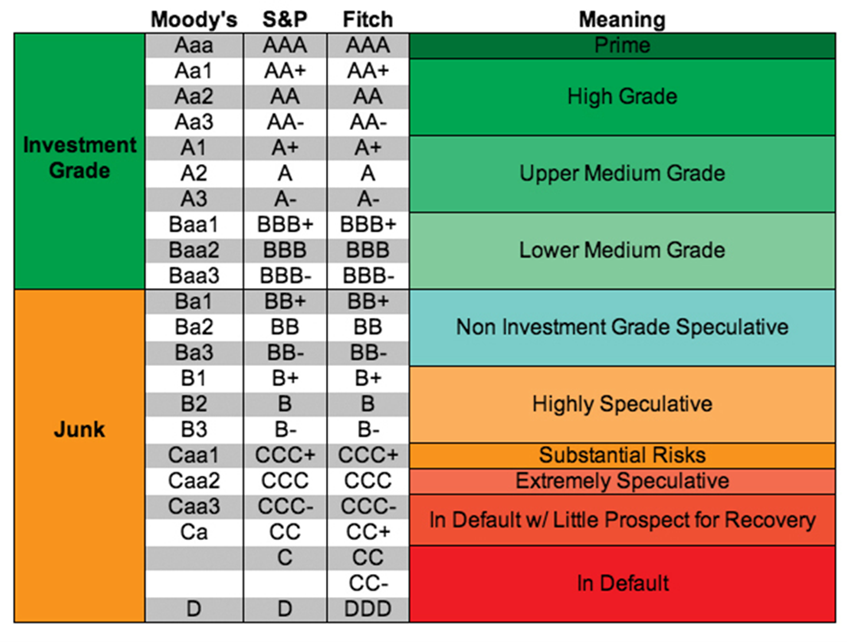

Remember the following chart on the scale of credit rating ratings:

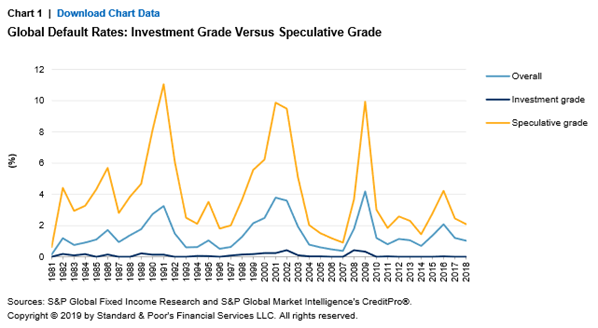

The following graph shows the probability of default between 1981 and 2018 for the world market:

The following chart shows Standard & Poor’s rating on sovereign debt of the various countries in March 2019:

We see that most developed countries have sovereign investment grade rating and even higher than A (North America, Western Europe, and Oceania).

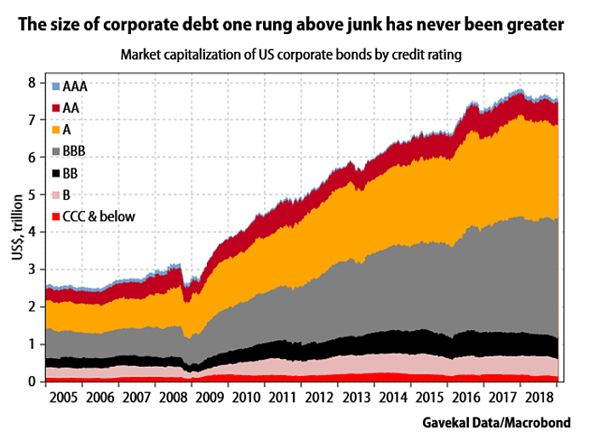

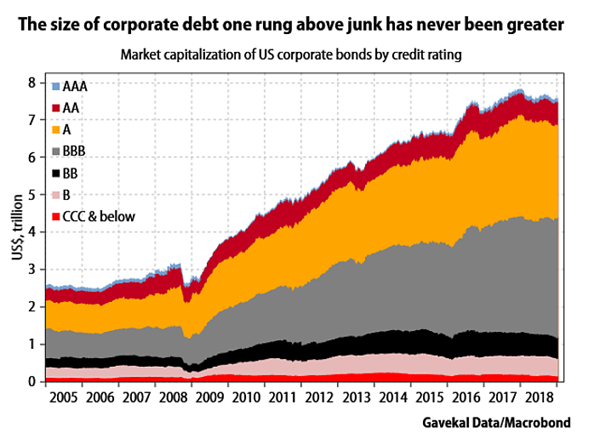

The following chart contains the distribution of the US corporate bond market by rating grades:

The investment grade rating category, i.e. equal to or greater than BBB represents almost $7 trillion.

The following graph shows the evolution of credit spreads in the U.S. between 1997 and 2017 for issues between 5 and 10 years:

Recently, investment grade rating spreads have been around 1.5% to 2.5% (150 to 250 basis points) and speculative grade spreads at about 4% to 6% (400 to 600 basis points).

Having said that, we should focus exclusively on sovereign and investment grade debt, and not invest in speculative risks (“Speculative Grade” or “Junk”) for the following reasons:

- The interest rates offered, or the credit spreads charged do not pay the risk of default of interest payment and repayment.

- The investment grade market has a considerably larger dimension than the speculative grade and naturally higher liquidity.

Even within the investment credit grade, most of our investments must be in the ratings of A or higher, with BBB being the remainder.

Diversifying by geographies but focusing on investing in our own currency

Diversification once again leads us to disperse our geographical investments.

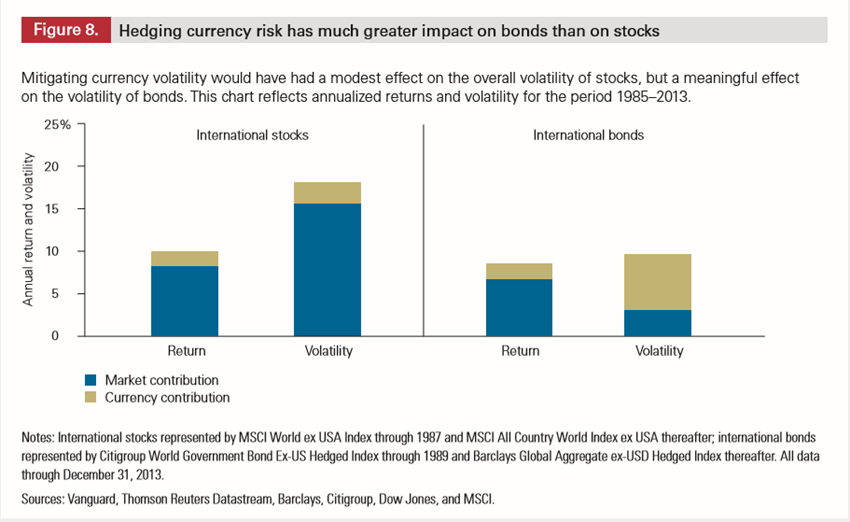

The following chart shows the currency volatility of foreign exchange risk in stocks and bonds investments:

It is concluded that unlike stocks, exchange rate volatility has a major impact on bond volatility, which makes it clearly preferable to invest in the currency of the country of origin.

Thus, we should invest mostly in denominated issues in the world’s currencies more aligned with our own and domestic currency, i.e. dollars for the US and all countries with dollar-linked currencies, euros for eurozone countries, yens for Japan, British pounds for the UK, etc.

In other words, we should minimize foreign exchange risk in bond investments.

As mentioned, this situation contrasts with what we should do in our stocks investments: in bonds we must invest in the domestic currency or of the country of origin of the investor and not on the currency of destination of the investment.

In the form of diversified and low-cost investments

Again, the most diversified and lower cost investment products, which leads us to mutual funds and equivalents, whether index funds or other products with similar investment policy, in any case aligned with the desired asset classes.

Among the various hypotheses we have the funds of Blackrock, Vanguard, Fidelity, Dimensional, State Street, etc:

In another post we develop in more detail these investment products.

Morningstar is a company specialized in the evaluation and comparison of mutual funds, assigning ratings to each fund according to performance, profitability, risk, among other factors. Its ratings cover most indexed investment funds. In this sense, it is a useful source of information for their selection:

https://www.morningstar.pt/pt/fundquickrankLegacy/default.aspx

https://screen.morningstar.com/fundselectoraol.html

In another post, we will deepen the information contained therein.