Rising GDP per capita has lifted China from a low-income economy to an upper-middle-income economy

The economic performance in terms of international comparisons can be even more impressive

The reasons for the miracle of economic growth

The problems of the last 6 years

This article is part of a series dedicated to investing in Chinese stocks.

In the first article, a general introduction to the topic was made,including a synthesis of the remarkable performance of economic growth and development in the last 4 decades, as well as the challenges it has faced especially since mid-2015.

In this second article we will develop the aspects of China’s strong economic growth over the past 4 decades.

In previous articles we have already developed the size and weight of the Chinese economy in global terms, its enrichment in recent years, as well as its convergence with the most developed countries.

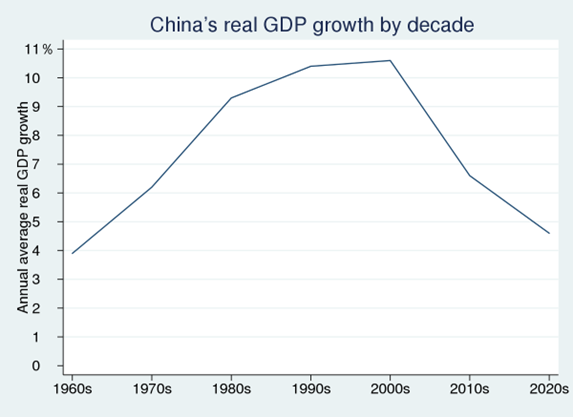

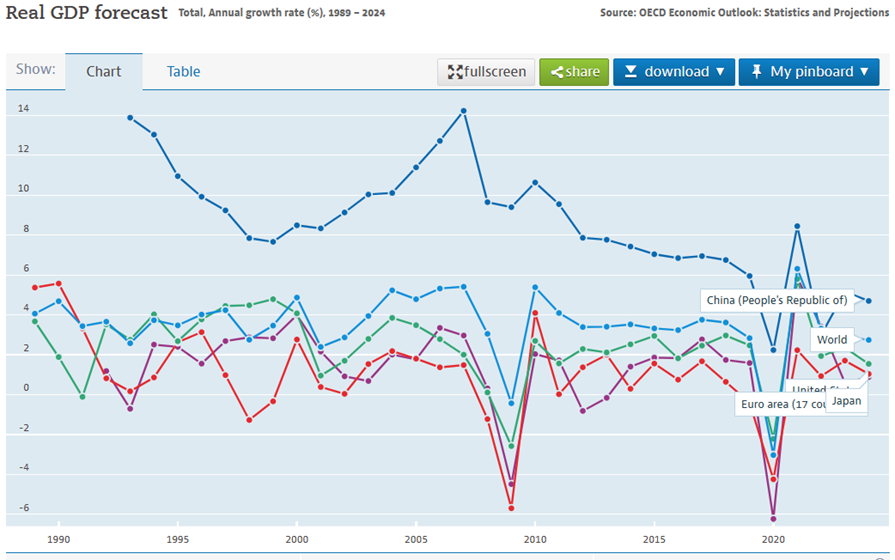

China’s economic growth has been 9% a year for the past four decades, despite the slowdown in recent years

China’s economic performance has been exceptional over the past three decades, with remarkable and persistent high growth.

This growth has lifted the economy from a low-income position to an upper-middle-income one.

China’s GDP was $18.3 trillion in 2022, 73% of the United States’ GDP and 10 times more than the 7% of American GDP recorded in 1990.

China’s per capita income is now about $13,000, roughly 17 percent of U.S. per capita income, which compares with less than 2 percent in 1990.

Over the past decade and a half, China has been the main driver of global economic growth, accounting for 35% of global nominal GDP growth, while the United States accounts for 27%.

For decades, since China reopened to the world in 1978, it has been one of the fastest-growing major economies on the planet:

Between 1991 and 2011, it grew by 10.5% per year.

Expansion slowed during Chinese leader Xi Jinping’s rule, but was still averaging 6.7% in the decade to 2021.

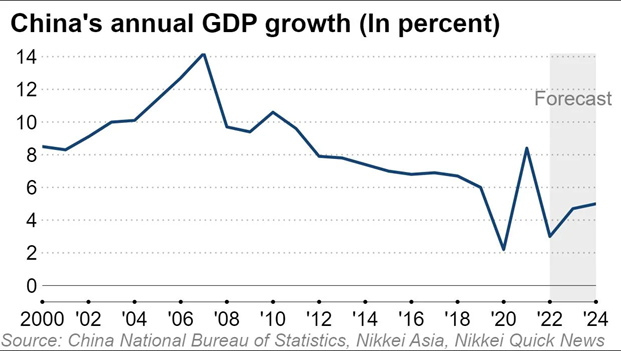

The downward trajectory of growth begins with the Great Financial Crisis and is accentuated from 2016 onwards:

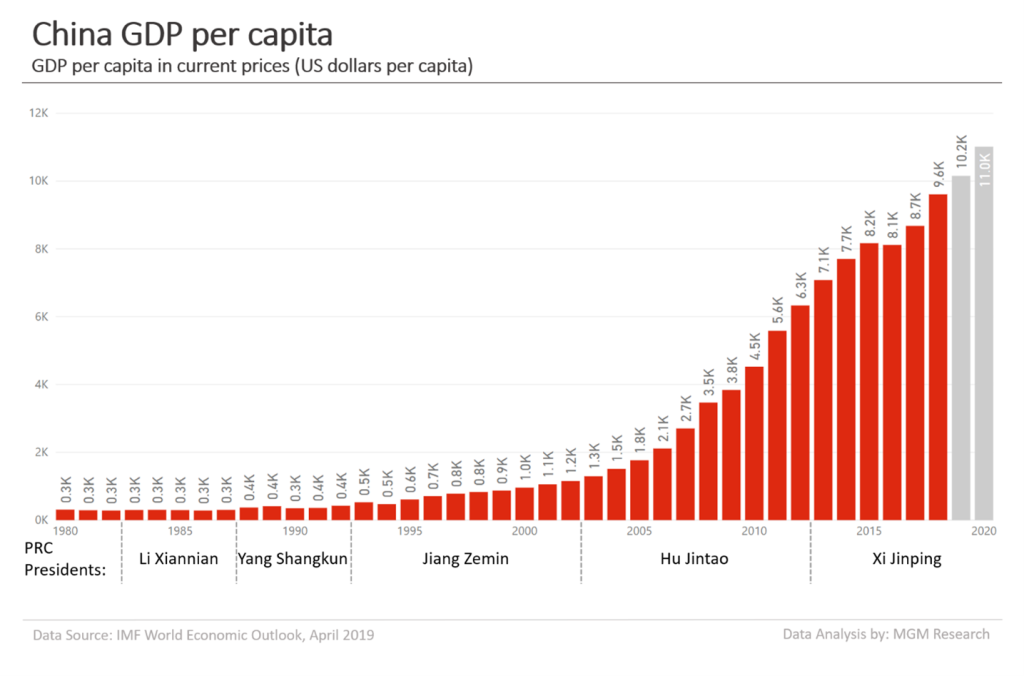

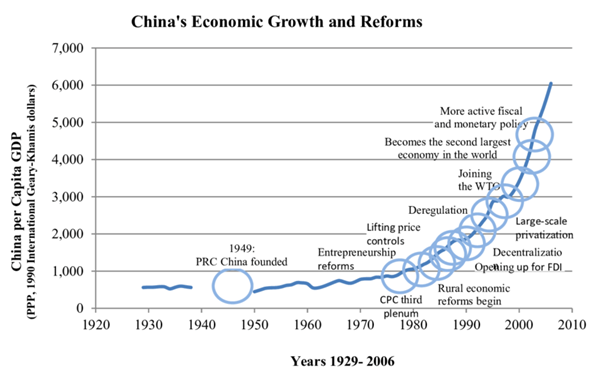

Rising GDP per capita has lifted China from a low-income economy to an upper-middle-income economy

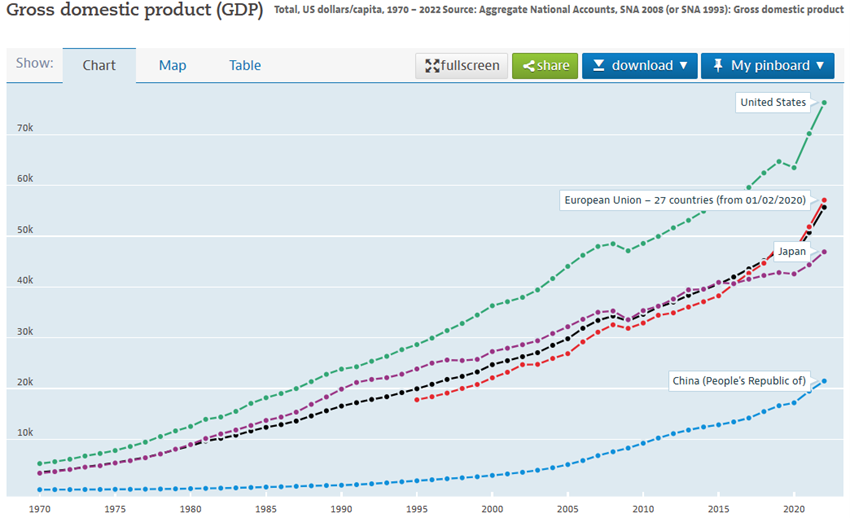

This pace of economic growth was also reflected in terms of the enrichment of the population, or the increase in per capita output:

China has reached a GDP per capita close to $13,000 in 2023, which compares with $7,051 a decade earlier and $163.9 in 1962.

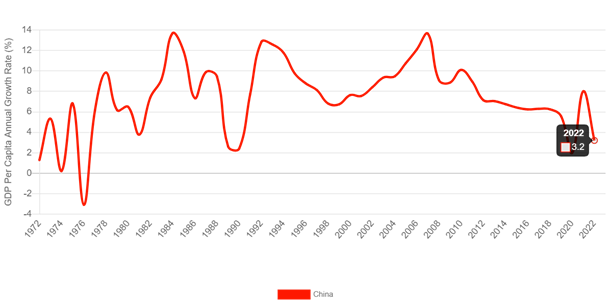

The annual growth rate of GDP per capita was above 6% between 1980 and 2010 and is now at 3.2%:

The economic performance in terms of international comparisons can be even more impressive

China’s economic growth is even more remarkable when compared to other countries:

Since 1992, China has recorded an average annual GDP growth rate of 9%, compared with a rate of 2% in the US, just over 1% in the Eurozone and 0% in Japan.

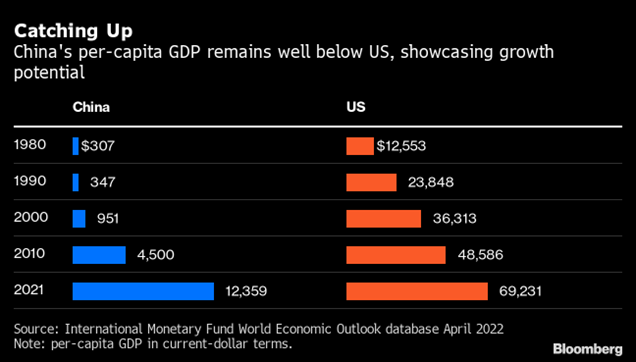

In terms of per capita income, progress is also very strong on a comparative basis:

China’s evolution over the past 40 years is formidable when compared to the US, although its level is still a long way off, which may be indicative of its potential:

China has gone from a per capita income of $307 in 1980 to $12,359 in 2021, 40 times more (and this progress has been mostly concentrated in the last 30 years alone)

In the same period, U.S. per capita income went from $12,553 to $69,231, just over 5 times.

China’s per capita income was only 2.4 percent of the U.S. in 1980 (and only 1.4 percent in 1990!), and today it is 18 percent (still a long way off, admittedly).

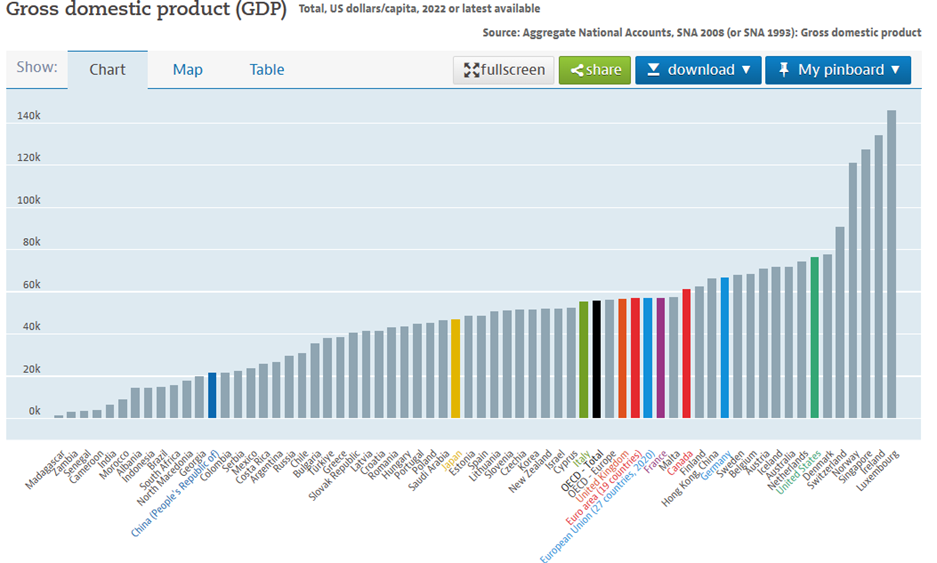

China’s per capita income is very low relative to the vast majority of OECD countries:

China’s per capita income stands at $13,000, while the OECD average stands at over $43,000.

The reasons for the miracle of economic growth

This economic growth was due to a series of reforms developed after the fall of Mao Zedong, initiated by Deng Xiaoping and pursued by his subsequent leaders:

China is a socialist, developing, upper-middle-income market economy that incorporates industrial policies and five-year strategic plans.

It is an economy that has public sector enterprises, state-owned enterprises (SOEs) and mixed-ownership enterprises, as well as a large domestic private sector and openness to foreign enterprises.

Investment – public and private – and exports are the main drivers of economic growth in China, but the Chinese government has also emphasized domestic consumption.

It is the world’s largest trading partner.

China has sustained growth due to exports, its industrial sector, and low-wage workforce.

China has become an industrial powerhouse, moving beyond initial successes in low-wage sectors such as apparel and footwear to the increasingly sophisticated production of computers, pharmaceuticals and automobiles.

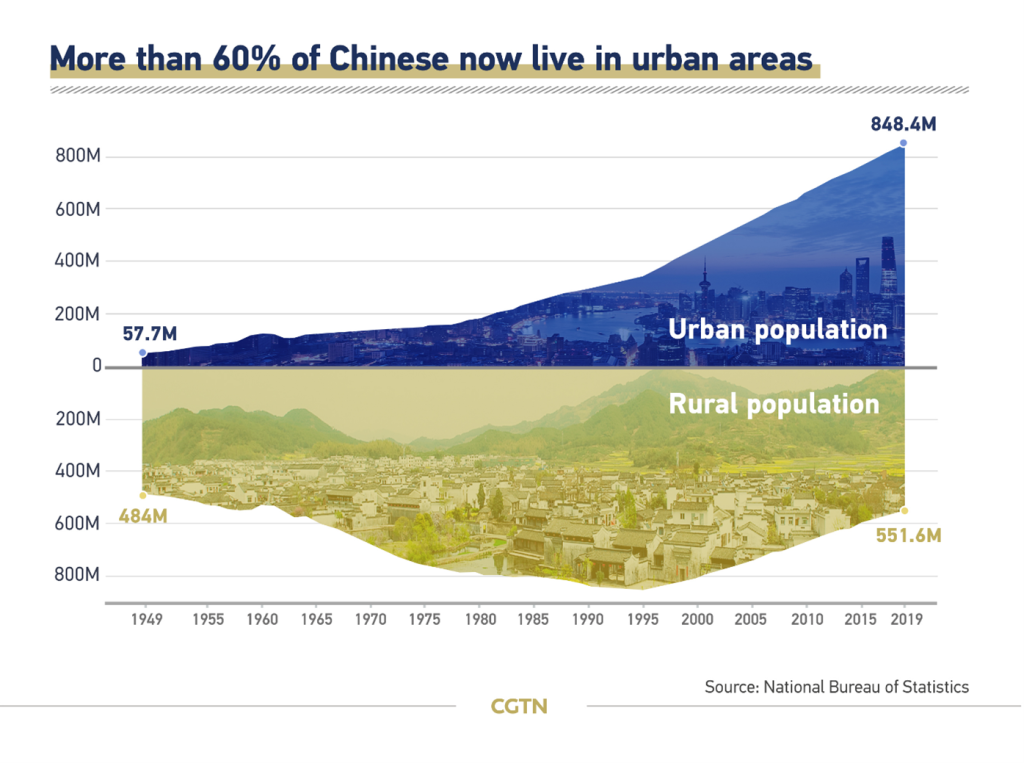

This process of growth was accompanied by an intense phenomenon of urbanization, with a huge movement of the Chinese population from the countryside to the cities:

In 1980, the urban population did not reach 200 million people. Today, this population is approaching one billion people.

China has lifted more people out of extreme poverty than any other country in history. Between 1978 and 2018, China reduced extreme poverty by 800 million people.

The problems of the last 6 years

In the last 4 decades we have had very high economic growth rates, a strong increase in GDP per capita, urbanization, wealth, savings and investment.

Perhaps even more impressive than pace was the length of this very high growth cycle.

We all know that it would be very difficult to maintain it for a long time, because of the base effect, the diminishing returns and, above all, the challenges of the necessary changes in the development model.

In the last 7 years, growth has slowed significantly.

At first, it was thought that this slowdown would be due to the 2020 pandemic, but today it is admitted that it is more structural.

Some fractures, weaknesses and vulnerabilities in the economic development model began to emerge, such as the inefficiencies and low productivity of public investment and SOEs (which manifested themselves in the bankruptcies of the construction sector, among others), demographic ageing, and the effects of the setback of globalisation.

In the following articles we will dissect each of these aspects and the consequences regarding the interest of the Chinese stock market for foreign investors.

This central question of the attractiveness of the Chinese market is very pertinent because, as we know, investing well means diversifying risks, doing so, above all, in the world’s largest economies and companies, and privileging those that are world leaders and consumer goods, in order to put the economy to work for us.