Size and weight of global bond markets

The main global bond markets indices: Bloomberg Barclays Global Aggregate Index, Bloomberg Barclays US Aggregate Index, Bloomberg Barclays Euro Aggregate Index, Bloomberg Barclays Asian-Pacific Aggregate Index and JP Morgan Emerging Market Bond Index

Historical performance of bond market indices

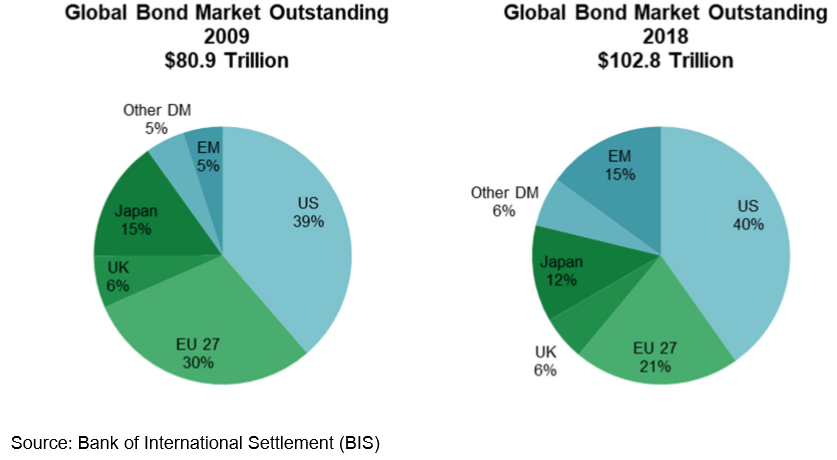

Size and weight of global bond markets

The size and weight of the different global bond markets measured by the value of all issues traded on financial markets in the various countries is as follows:

The US accounts for 40%, followed by the Eurozone with 27%, Japan with 6%, the UK with 6%, other developed markets with 6% and emerging markets with 15%.

In terms of credit rating more than 85% of the issues are investment grade and only the remaining 15% are speculative grade.

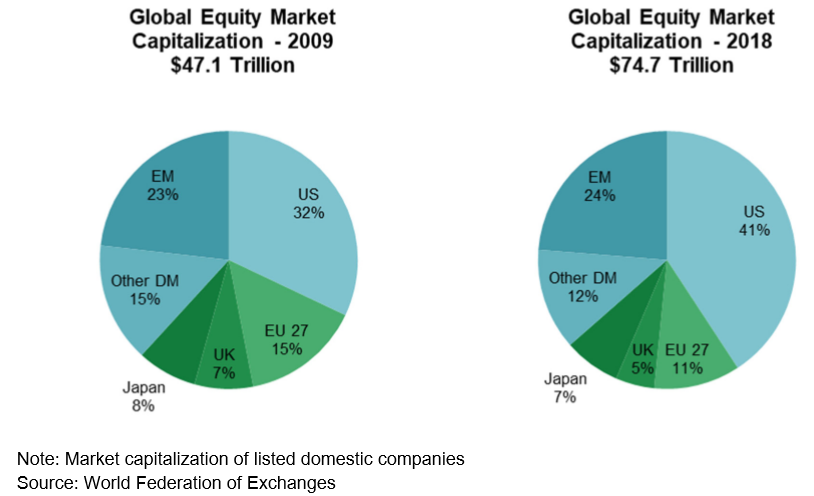

To get a feeling about the importance of this market, it should be stressed that the value of $102.3 trillion in the global bond market tradable issues exceeds the value of $74.7 trillion of the global stock market’s capitalization:

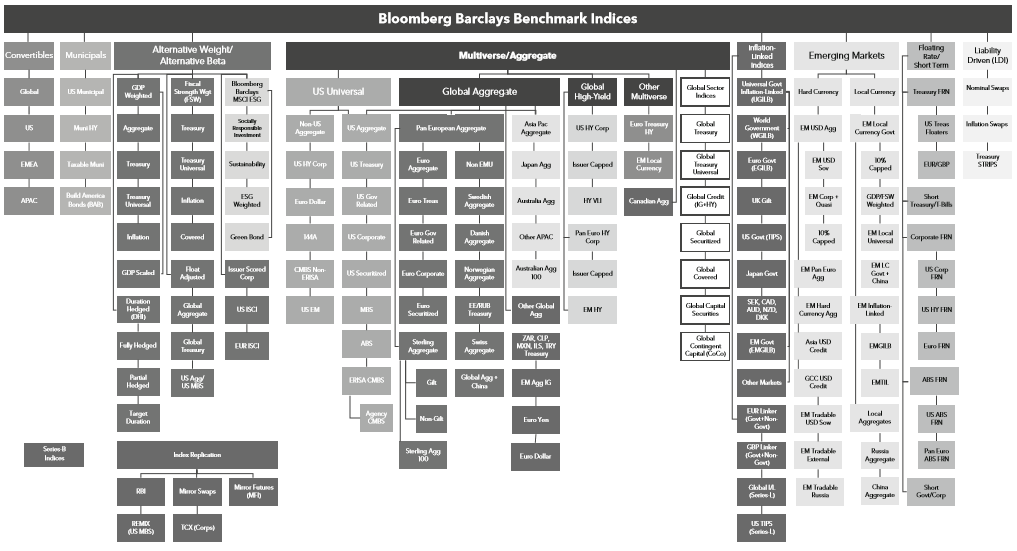

The traditional family and still one of the main references of bond markets indexes is the one from Bloomberg Barclays:

Before we see some of its main indices it is worth making a parenthesis to reaffirm two important aspects regarding the investment in bonds by the individual investor.

Firstly, the investor should invest predominantly in a set of bonds of his own treasury currency, to mitigate foreign exchange risk, contrary to what he must do while investing in stock markets. The reason is simple and will be exploited in other posts: the more conservative and defensive nature of the investment and the impact of exchange rate volatility in the total return do not advise exposure to foreign exchange risk.

Secondly, given that the average private investor has a lower risk profile and is less sophisticated than market participants in general, he should have greater exposure to investment grade, and speculative grade investments should be residual, not exceeding 3% or within the 5% limit.

The main global bond markets indices

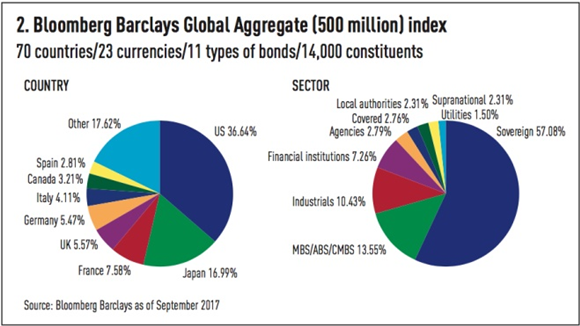

World: Bloomberg Barclays Global Aggregate index

The Bloomberg Barclays Global Aggregate Bond Index is the world bond market’s benchmark index.

It contains the global investment credit grade or rating debt of 70 countries and twenty-three currencies, integrating more than 5,000 issues of more than 2,000 issuers and with a 6 to 8 years average maturity.

This multi-currency benchmark index includes current (or “plain vanilla”) treasury bonds, bonds from other governmental entities (or agencies), supranational entities, banks, other non-financial companies, and securitized issues (such as mortgage bonds) from developed and emerging markets.

With respect to countries the US has a predominant weight of 37%, followed by Japan with 17%, France with 8%, UK 6%, Germany 5.5%, Italy 4%, Canada and Spain 3% each, and other countries 18%.

Regarding the distribution by types of issuers, the sovereign debt dominates with 57%, industrial companies with 10% and banks with 7%. Securitized or collateralized issues account for 14%.

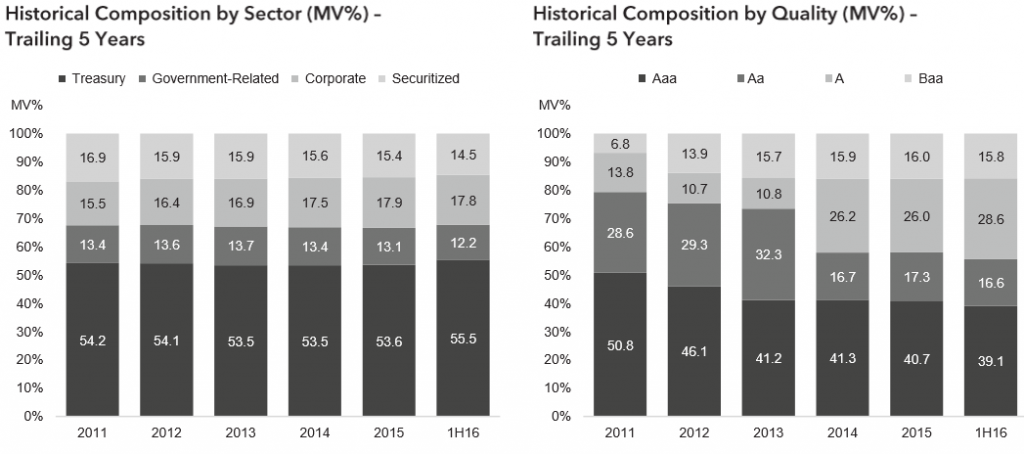

Its composition in terms of issue and issuer types and credit rating grades on the 5 years average prior to 2016 was as follows:

55% was sovereign debt, 12% other governmental entities, 18% from companies and 15% from securitizations.

40% of emissions had AAA rating, 17% AA, 28% A and 16% BBB rating.

The following link contains a brief description of the index in 2016:

https://data.bloomberglp.com/indices/sites/2/2016/08/Factsheet-Global-Aggregate.pdf

US: Bloomberg Barclays US Aggregate index

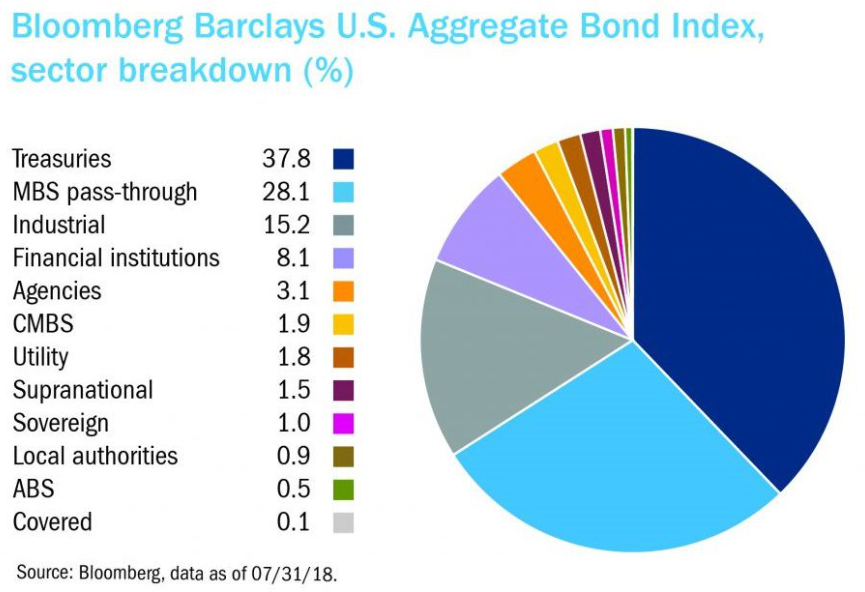

The Bloomberg Barclays US Aggregate Bond index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

In addition to investment grade corporate debt, the index tracks government debt, mortgage-backed securities (MBS) and asset-backed securities (ABS) to simulate the universe of investable bonds that meet certain criteria.

To be included in the index, bonds must be of investment grade or higher, have an outstanding par value of at least $100 million and have at least one year until maturity.

The index consists of approximately 3,000 bonds, giving rise to the name “total bond index funds” for those index funds that track it. Its duration is about 7 to 8 years.

Investors often use it as a reference to measure the performance of the US bond market.

Its sectoral composition was as follows

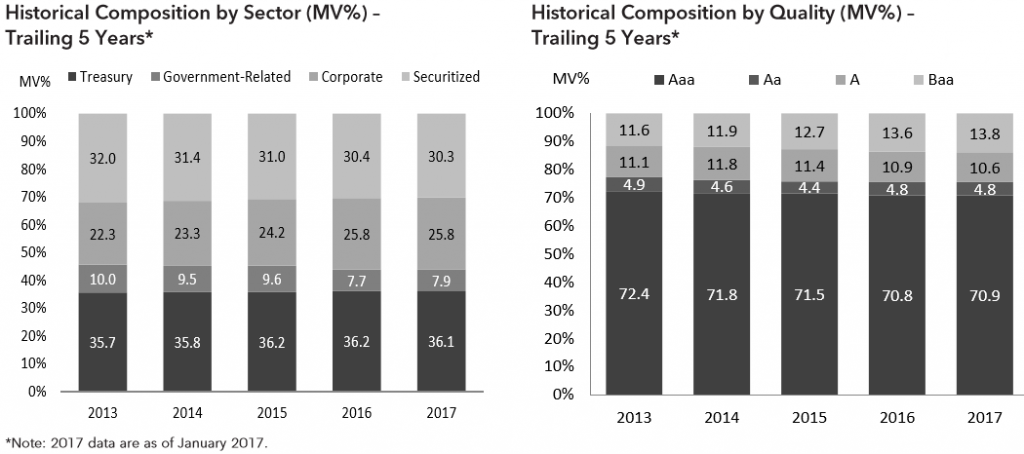

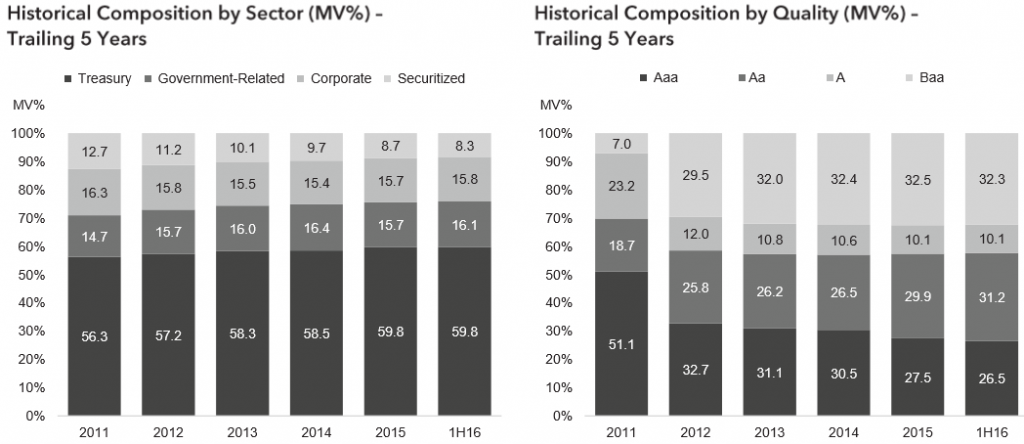

The evolution of its composition in the 5 years average prior to 2017 was as follows:

In relation to the issuer 36% was sovereign debt, 8% other government entities, 26% companies and 30% of securitized issues.

Concerning rating notations, 70% was AAA, 5% AA, 11% A and 14% BBB.

The following link contains a brief description of the index in 2017:

https://data.bloomberglp.com/indices/sites/2/2016/08/2017-02-08-Factsheet-US-Aggregate.pdf

Europe: Bloomberg Barclays Euro Aggregate index

The Bloomberg Barclays Euro Aggregate Bond index includes fixed-rate, investment-grade Euro denominated bonds. Inclusion is based on the currency of the issue, and not the domicile of the issuer. The principal sectors in the index are the Treasury, corporate, government-related and securitised.

Its composition in the 5 years average prior to 2016 was as follows:

With respect to the issuer 60% was sovereign debt, 16% bonds of government-related entities, 16% of companies and 8% of securitized emissions.

Regarding rating, 27% was AAA, 31% AA, 10% A and 33% BBB.

Currently the index is composed of more than 2,000 securities and has a duration of about 8 years.

The following link contains a brief description of the index in 2017:

https://data.bloomberglp.com/indices/sites/2/2016/08/Factsheet-Euro-Aggregate.pdf

Asia-Pacific: Bloomberg Barclays Asian-Pacific Aggregate index

The Bloomberg Barclays Asian-Pacific Aggregate index contains fixed-rate, investment-grade securities denominated in Japanese yen, Australian dollar, Hong Kong dollar, Malaysian ringgit, New Zealand dollar, Singapore dollar, South Korean won and Thai baht. Inclusion is based on currency of the issue and not the country of risk of the issuer.

The index is composed primarily of local currency sovereign debt, but also includes government-related, corporate, and securitized bonds.

Its composition in the 5 years average prior to 2016 was as follows:

Regarding the issuer, 90% was sovereign debt, 8% government-related entities and 2% from companies.

In relation to rating, 6% was AAA, 7% AA, 87% A and 1% BBB.

The following link contains a brief description of the index in 2017:

https://data.bloomberglp.com/indices/sites/2/2016/08/Factsheet-Asian-Pacific-Aggregate.pdf

Emerging Markets: JP Morgan Emerging Market Bond index

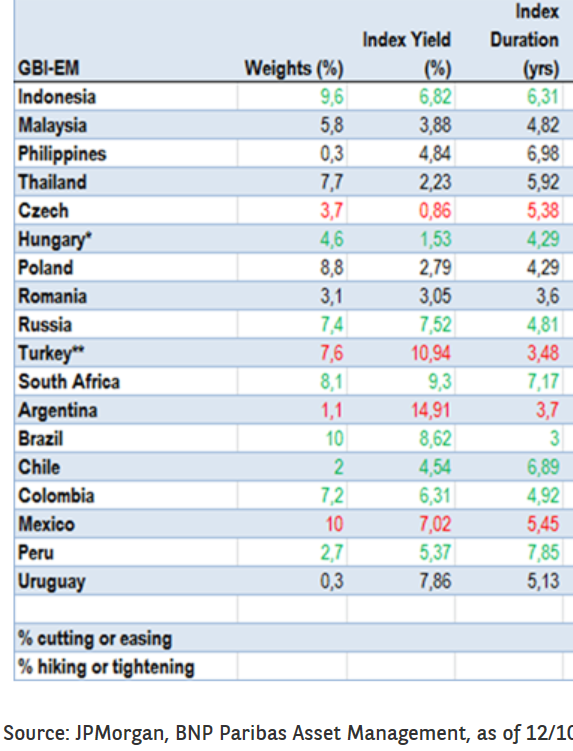

The JP Morgan Government Bond Index (GBI-EM) emerging market indices are comprehensive emerging market debt benchmarks that track local currency securities issued by emerging market governments.

GBI-EM Broad is the all-encompassing index. It includes all eligible countries regardless of capital controls and/or regulatory and tax hurdles for foreign investors. As of November 2013 the following 18 emerging market economies were part of the GBI-EM Broad index: Brazil, Chile, China, Colombia, Hungary, India, Indonesia, Malaysia, Mexico, Nigeria, Peru, Philippines, Poland, Romania, Russia, South Africa, Thailand, and Turkey.

GBI-EM Global is an investable benchmark that includes only those countries that are directly accessible by most of the international investor base. The GBI-EM Global is effectively the GBI-EM Broad excluding China and India.

In 2017 its geographical composition was as follows:

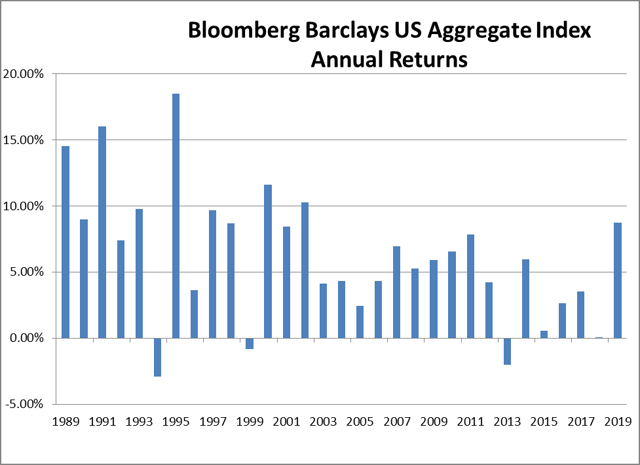

Historical performance of bond market indices

The following chart shows the returns of the Bloomberg Barclays US Aggregate index between 1989 and 2019: