Not all our money is always the same to us

Mental Accounting in personal finance makes us mistakenly think that not all money is the same

We lose money irrationally when we use credit balances and we have money in deposits

There are very good and useful money management and savings apps

Mental Accounting in personal finance makes us mistakenly think that not all money is the same

Mental Accounting consists of taking undue risks in one area and avoiding rational risk in another.

It was developed by economist and Nobel laureate Richard H. Thaler.

According to the theory of mental accounting, people treat money differently depending on factors such as the origin of money and intended use, rather than thinking of it in terms of “a whole or a (common) basis”, as is the case in formal accounting.

Thus, they are prone to irrational decisions in their spending and investment behaviour.

A very important concept underlying the theory is fungibility, is the fact that all money is fungible and has no tags or labels. In mental accounting, people treat assets as less fungible than they really are.

Even experienced investors are susceptible to this bias when they see recent gains as disposable “free” money, which can be used in high-risk investments. In doing so, they make decisions about each mental account separately, losing the portfolio overview.

In personal finance these errors usually arise when we receive tax refunds, birthday gift money, bonuses, lottery prizes, or we think of “money we can afford to lose”, in “capital that we can’t afford to lose anything”, money that we think we have already spent or when we make identical purchases for confusion.

We lose money irrationally when we use credit balances and we have money in deposits

Mental accounting often leads people to make irrational investment decisions and behave in financially counterproductive or harmful ways, such as applying to a low-interest savings account and having large high-interest credit card balances at the same time.

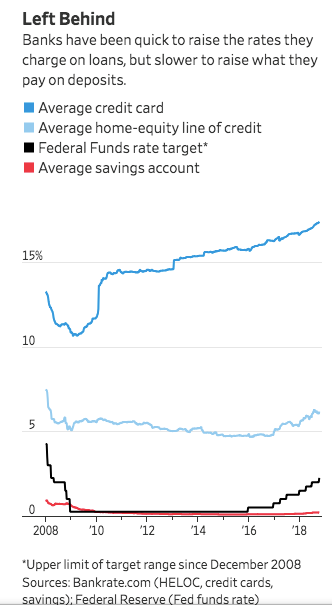

The following chart shows the average interest rates of credit cards and savings accounts in the US between 2008 and 2018:

The rates of return of deposits or savings accounts do not reach 1% per year and those of credit cards exceed 17% per year in 2018. Despite this difference, many people keep balances in both accounts, which means that they are paying loans to the banks with their own money, losing 17% a year.

There are very good and useful money management and savings apps

To avoid bias in mental accounting, individuals should treat money as perfectly fungible when allocating it to different accounts, be it a budget account (daily living expenses), a discretionary expense account, or a wealth account (savings and investments).

Why doing mental accounting when we already have great tools available today that can help us?

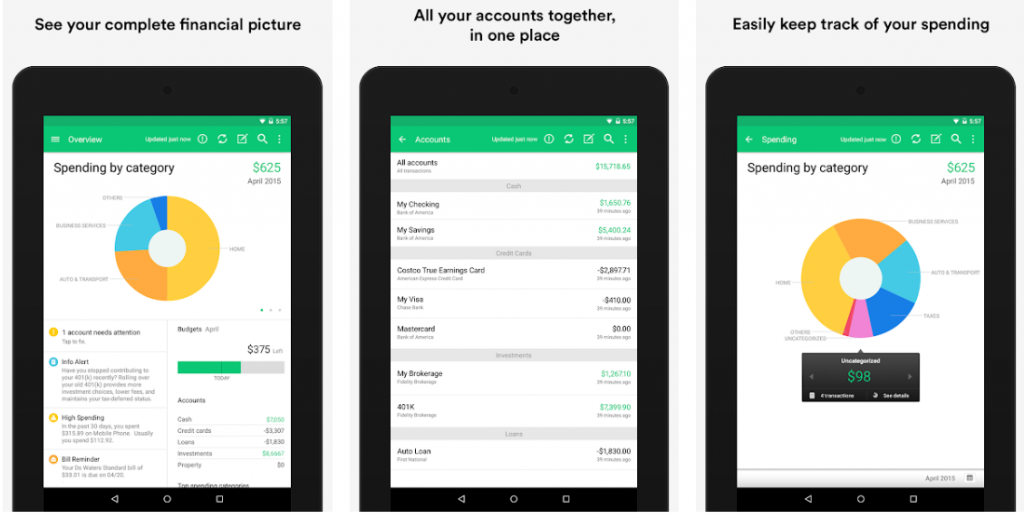

We are talking about personal finance apps, being one of the main references to Mint (there are also YNAB, Quicken, among others):

These apps are precious helpers in managing our money. They allow us to see consolidated assets on a single screen, from accounts to order, savings, investments, but also credit cards and loans, and help us rationalise our decisions in terms of better financial management of funds. That is why we must use them in our daily lives.

Money is all the same and has equal value: there is neither free money that we can lose nor sacred money that we cannot invest to build wealth

In investments, the two main manifestations of this bias, with very pernicious effects, are the money that we think we can lose, that is, the increase in the risk profile with potential or unexpected gains, associated called the effect of free money, or its opposite, of the money that we consider we cannot lose anything and that should be locked in a safe.

On the one hand: free money or what we come to think we can lose and that leads us to lose everything and something else (including the head)

This bias means that when we receive or make money unexpectedly or faster than we expected (feeling like easy money), we risk more, either by keeping investments too risky for longer or to strengthen investments and increase the downtime.

In most cases, we sell late to lose everything we have been gaining and still lose a substantial part of the capital. There are many examples of people losing fortunes after winning the lottery or being millionaire professionals, not so much for spending, but more for the greed of high-risk investments.

In many cases, this behaviour is more like playing in the casino than financial investing.

On the opposite side: money that we can’t risk anything (“safety capital”) and that blocks us from the most appropriate investment options

We usually associate this money with priority and/or very important objectives.

It is obvious and therefore correct that we cannot lose and risk the money we need to live in the very short term or to meet inevitable and certain goals.

Our individual pension plans and other medium and long-term investments should have investments in stocks and bonds, more like what happens in the US than in Europe

We often believe that we cannot risk the investments of savings for retirement, for children’s tuition fees, purchase of the house, other planned expenses, etc., because they are very important.

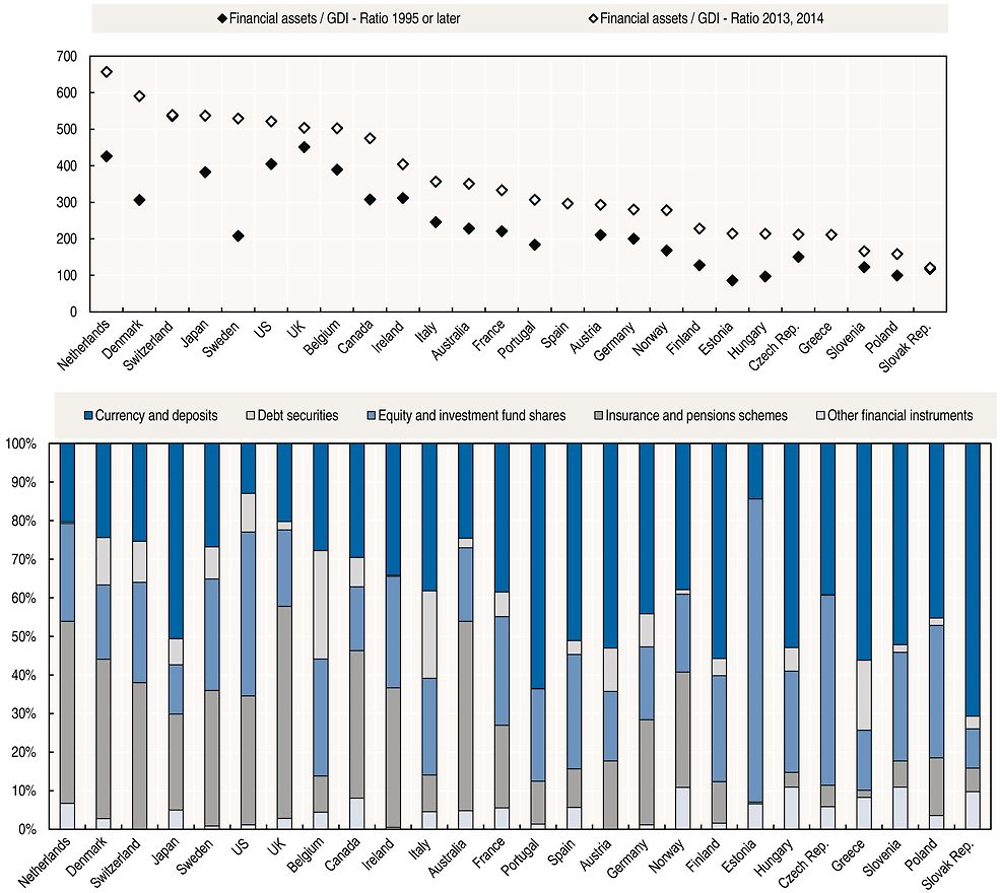

As a result, the allocation of assets to investments in stocks and bonds is very low in most countries:

Investments in stocks and bonds account for about 20 to 30% of household assets in almost all countries, and in particular in Europe. In the US alone, these investments account for 50% of total assets.

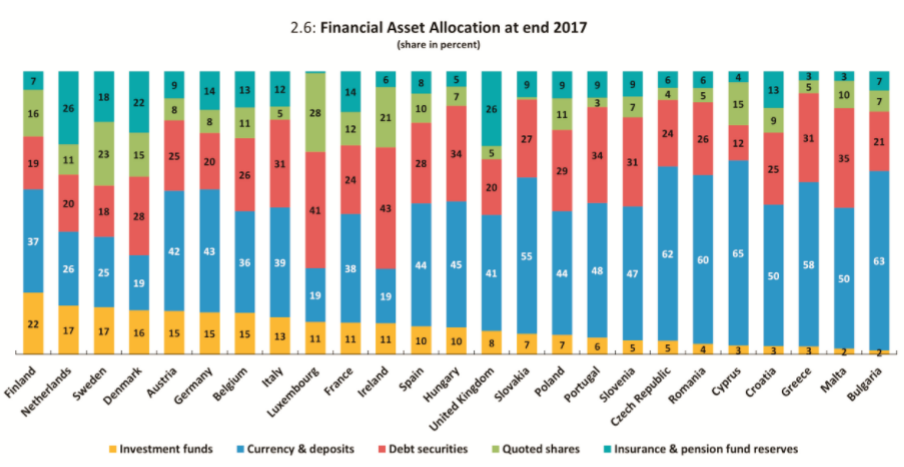

The most recent EFAMA study conducted in 2017 confirmed the low allocation of assets to equity and bond investments by households in various European countries:

That idea of thinking that we cannot risk, that leads us to seek security in investments and to these low allocations to stocks and bonds could not be more wrong.

Because these are medium-term or even long-term objectives, for which we can have some degree of flexibility, we have the time on our side and working for us, allowing us to withstand the possible market fluctuations of more risk and more profitability investments and benefit more from the compounding effect.

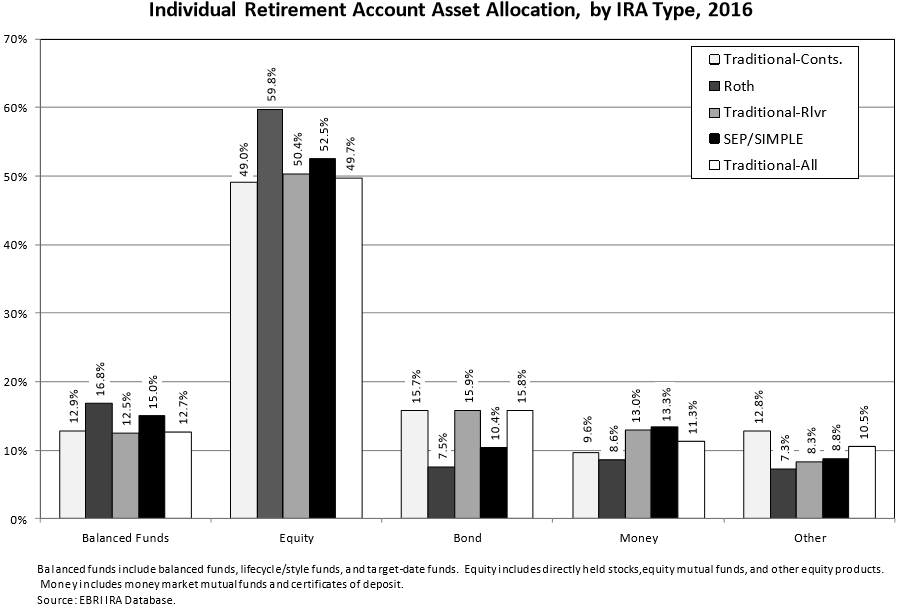

This attitude is very different from what happens in individual retirement plans in the US. In this country, people choose a strong allocation in their private pension plans, be it IRA or 401k, and at all ages:

For to IRA (individual retirement accounts), equities represent well over 50% if we consider that part of the balanced funds also contain shares.

For 401 k companies private plans the percentage of equities is even higher:

![PDF] 401(k) plan asset allocation, account balances, and loan ...](https://investorpolis.com/wp-content/uploads/2020/07/401k-Asset-allocation-3-1024x681.png)

The average of all participants in these plans invests more than 65% of the savings in equities. This percentage is naturally higher in younger people, from more than 70% to 50 years of age, dropping to 64% to 60, and to 54% from over 60.

https://thedecisionlab.com/biases/mental-accounting/

https://www.behavioraleconomics.com/resources/mini-encyclopedia-of-be/mental-accounting/